Abstract

The importance of staying close to the customer in ‘interesting times’ has increased. Recent evidence shows not only the extent of use of the Internet and its perceived importance, but also the extent of use of Web 2.0. Comparison sites or aggregators have flourished. The effect of their arrival and of the practices of the most advanced web businesses in other sectors is likely to change the requirements of consumers as to how their relationships with suppliers should be managed – by both suppliers and customers. This paper summarises research carried out for SAP on the use of Web 2.0 techniques in financial services. It shows clearly that aggregators have taken the lead on the road to CRM 2.0 and Customer 2.0. However, they are followed by the banks, with one or two insurers on their tails. By focusing on the customer and kind of dialogue and information they feel customer wants, some companies are making good progress in real-time customer management.

Similar content being viewed by others

SCOPE OF THE PAPER

This paper documents the outcome of the first in a series of customer relationship management (CRM) research projects sponsored by SAP. It focuses on

-

1

The impact of the effect of the global upheavals in financial services markets on customer management in financial services.

-

2

How far companies are using, or considering using, strategies in which customers provide input about their requirements (for propositions and how they want to be managed in a relationship or manage the relationship with the supplier) and the associated techniques that enable customers to customise their relationship with financial services institutions more completely.

-

3

How these strategies and techniques are used, where appropriate, with agents/resellers.

-

4

Whether these strategies or techniques are used with their own staff, for example in contact centres or in branches. We use as working names for these approaches Customer 2.0, Agent 2.0 and Worker 2.0, borrowing from the now almost universal use of the term Web 2.0 to describe the evolution of the web into a phenomenon where independent users rather than large companies determine how the web is used (even though they may be using an infrastructure provided by larger companies, such as MySpace).

-

5

The relationship between the first point and the other points, that is, could a closer mutual relationship between financial institutions and their customers have prevented some of the problems of 2008, and could it do so in the future.

THE COLLAPSE OF TRUST

It is not ‘new news’ to say that there has been a collapse of trust in financial services following the events of 2008. This has been well documented in the national and trade press.1 It has sadly come at a time when we are beginning to understand the relationship between trust and the adoption of electronic banking, and the role of electronic channels in building that trust or putting that trust at risk.2 Certainly, consumers have responded quickly to the upheavals, shifting money away from banks where trust had fallen towards banks that had come through the 2008 events unscathed. I asked CACI whether they could analyse their closed UK user-group banking data to identify whether there had been significant shifts in savings market share (savings being easily shiftable and also being an area where consumers are highly sensitive to possible loss). The answer was that significant shifts had already occurred before the crisis entered its final stage, with some companies more than doubling their share of the short-term savings market, and others losing more than a third of their market share. In addition, CACI confirmed that UK consumers initially took a very short-term approach to saving, focusing on instant access accounts and fixed term (the latter to get the highest possible rate). Behaviour patterns, as interest rates collapsed towards zero, have yet to be understood. Meanwhile, globally, trust in the UK's banking system has fallen sharply.3

Of course, the insurance sector came through these events relatively unscathed, with only two companies with strong insurance businesses being in the (bad) news. The life and pensions side has been deeply affected – albeit indirectly – by the collapse in the value of the shares that they hold, particularly – but not exclusively – in banking shares. Throughout the world, the very large number of ‘baby-boomers’ looking forward to a retirement funded by steady saving throughout their post-war working lives are having to re-evaluate their retirement plans following what could have been a reduction of a third in their value, unless they are fortunate enough to have a final salary-based pension scheme. Only those who had the sense to move their funds to cash will not be affected.

For general insurers, one risk relates to the return on investment achieved by investment of premium contributions received from customers, and with interest rates falling fast and stock market returns looking weak, they need to re-evaluate their strategies. Some are exposed to property-related losses (whether via investments or customers insuring property with them), while others are still suffering from weather-related claims. They all need to work hard to convince consumers coming under increasing pressure globally not to compromise when it comes to insuring their assets.

However, they should know how to do this. In financial services marketing techniques, the United Kingdom has in my view long been considered a world leader, along with the North Americans, the Dutch, Scandinavians, South Africans and Australians. This applies to branding, CRM (for example processes, systems, data), direct marketing, web marketing and customer service. The rebuilding of governance and trust is, however, not only a question of technique, but also one of culture and motivation. Customer engagement and (where appropriate) staff engagement are critical components of this.

The turmoil of the past 2 years is clearly having its effect on customers' perceptions of the treatment they are receiving at the hands of financial services call centres. I asked Harding and Yorke to supply Empathy Index ratings figures for 2008, and this showed large movements in trust-related factors among different financial services companies. Anonymised data provided to me by CACI, from their very large closed user-group of financial services companies, showed the massive shifts in savings balances from what they considered to be the less trusted to the more trusted brands, even before the debacle of October 2008.

Corporate governance relates to how a corporation is directed and how its different stakeholders – particularly owners, managers and directors – work together to achieve corporate goals. In financial services, corporate governance and political governance that relates to governance of state economic policy are increasingly closely related because of the extent to which governments rely on broadly monetary rather than fiscal or Keynesian measures to manage economies. This puts the financial system at the heart of economic governance. However, as we have seen, governments are behind the pace. The modern financial services industry works very differently from how it used to work, due to the speed and pervasiveness of information and communications technology. This has not always worked to create transparency – indeed it worked to create opaqueness, due to the increased speed with which new instruments can be created and marketed. It also increased the speed with which the consequences of failures are felt.

The extent to which governments are behind the pace on this is shown, in my view, by the failure of Sarbanes–Oxley. Introduced in the United States in 2002, it was the largest comprehensive law focused primarily on financial governance – and it has failed the test. But that is another story.

THE IDEA OF A CUSTOMER-MANAGED APPROACH TO FINANCIAL SERVICES

The idea of a customer-managed approach is not new. The idea of a customer-managed relationship has been under discussion for several years, as the supposed antithesis of customer relationship management. The term ‘vendor relationship management’ is now being used in the same way.4 My own research into the topic started several years ago through a survey in which I identified whether companies were allowing customers to tell them about their plans, and how they would like the company to meet their needs in the future.5 The research showed that this approach was rare, and that most companies were working hard to make Web 1.0 work, and to integrate it with their more classically based direct and database marketing approaches.

However, so far, it seems that these ideas have been a bit like ‘a voice in the wilderness’, particularly where it involves the financial services sector. The contrast with other sectors is clear. Led by Amazon and e-Bay, other sectors such as holidays and retailing have focused on trying to create a strong dialogue with customers, in which customers start to form the proposition, and orchestrate suppliers’ dialogue with them. How they have achieved this and the benefits they have received I shall be covering later in this paper.

WHAT CUSTOMERS WANT AND HOW THEIR NEEDS ARE CHANGING

Research into customers’ needs for relationships with financial services suppliers usually asks customers to articulate their need (or otherwise) for a relationship along a spectrum, which ranges

-

— from an arms-length relationship, in which the customer buys a product in a single transaction, with a minimal relationship and exchanging only the minimum information needed to complete the transaction

-

— to a close relationship, in which the customer specifies the kind of communication they want from the financial institution.

Rarely are customers asked what information they would like to give in order for the relationship to be managed so as to meet their needs. Of course, the information needed varies dramatically by product type. For example, choosing the appropriate insurance for an asset (car, house, boat, pet) in theory requires information on how the asset is used, particular risks it is likely to be subject to, anticipated changes in these and the likelihood that the insured party will be able to replace the asset from their own reserves. Life insurers are well aware of this, as the risks are much greater. However, the possibility of fraudulent declarations seems to have made insurers conservative about what they ask from customers. Life insurers have a nice escape clause – if someone dies, it is not too hard to find out whether the customer has lied about their health, and therefore whether the policy should be paid (different from the US situation, where a life insurer is required to establish up front the terms of the contract and to verify the customer's condition – when the customer dies, the policy is always paid).

The information also varies by its purpose. One set of information is required to ensure that the customer gets the right product to meet their needs as identified in the present. Another set of information is needed to ensure that the customer's future needs are met at the product level (by additional – or fewer – products or by changes to existing products). Yet another set of information must be exchanged to ensure that the customers’ emotional needs are met, so that the customer feels secure because they feel that they have made the right decision, and that they trust the supplier.

However, in a world in which customers’ relationship needs have not been too well met, it could be argued that for any one supplier, relatively low standards of relationship management could be observed. As long as no one did well, everyone could do poorly.

However, things are changing. In my view, four things have changed:

-

— Clear water has emerged between the leaders and followers in deploying CRM, so that customers who are managed by financial institutions that have deployed fully and carefully their CRM approaches do perceive that they are being managed better and respond by giving increased value to these suppliers. This is visible in the growth in market share and profitability of companies that have used CRM best.

-

— The aggregators have arrived, playing the role of the customer-advocate, and using information gathered form customers to help them make better choices. Aggregators have had a big impact on the way customers buy the simpler financial services.

-

— Web-based businesses in all sectors have continued to innovate, stimulating the customers’ appetite for individualisation, personalisation, enhanced and relevant information, and feedback from other buyers.

-

— One vital component of successful relationships has, in the wake of the global financial debacle, weakened for some suppliers – trust.

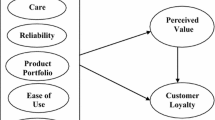

In this situation, the importance of staying close to the customer in ‘interesting times’ has increased. This involves several different components that have been talked about for a long time, long before the age of Web 2.0, and belonging in spirit to the world of ‘Successful; CRM 1.0’. These include

-

— Understanding the needs of current and target future customers – not only their needs for products, but also for value and relationships.

-

— Having a customer-oriented approach that is understood, agreed and managed at board level, so that the board can exercise effective governance in managing it.

-

— Achieving the right balance between success with products (having enough products with a good bottom-line and well-managed risk) and success with customers (having a portfolio of customers with the right mix of profitable and loyal – in the behavioural sense – clients).

-

— Understanding how to manage a customer portfolio, for example having a large number of customers with low but steady profit as well as a smaller number of high profitability customers, and to manage it well so that customers agree that their needs are being well met by the supplier.

HOW CUSTOMERS ARE CHANGING THEIR BEHAVIOUR

We used to talk about the rise of the Internet generation. Today, we talk about the iPod generation, who grew up in an age of personal computing and for whom the Internet is a fact of life. Recent evidence shows not only the extent of use of the Internet and its perceived importance, but also the extent of use of Web 2.0. For example, research by YouGov in autumn 2008 showed that 67 per cent of people in the United Kingdom thought that Internet access was more important than a car, and that more would rather shop online than go High Street shopping at Christmas or see friends, while three quarters had uploaded photos and watched YouTube videos. Research by comScore showed that in August 2008, over 14 million people in the United Kingdom had visited a blog site.6

Internet approaches have already had a great effect on financial services markets. For example, Mintel's research7 shows that nearly a quarter of people aged 25–34 bought their last contents and motor policy online. This figure is lower for older age groups, for example one-tenth of those aged 55–64. However, despite this, many customers are very receptive to buying insurance from incumbent suppliers of other categories, notably banking and retailing. In banking, upgraded, fee-charging current accounts often come with discounted or free travel insurance and/or insurance for other minor categories (for example home emergency, mobile), and possibly discounted general insurance in other categories, for example automobile, contents, buildings, though the ICOB rules governing household insurance selling prevent banks offering cover without advice as part of a current account package. Interestingly, the new ease of buying and the strength of the price comparison approach of aggregators have produced commoditisation, by a strong focus on price. Still, call centre and branch selling have remained strong, perhaps partly because many consumers prefer to deal with people where money matters are concerned. Interestingly, this is not just a question of age, as Mintel's research shows that younger or less experienced consumers behave in this way.

However, in my view, this could be because Internet and other electronic channels are perceived not to allow consumers to express their needs or discuss things. Despite this, comparison sites have flourished. Initially, there was a strong focus on price, but some aggregators realised that if they just attracted price-sensitive customers, they were also likely to be switchers, so that aggregation would be seen as a poor channel by product suppliers. Increasingly, they are using quality indicators and introducing ways for customers to design the level of coverage they require. Meanwhile, high street marketing in financial services, whether through banks or through amalgamation of brokers, continues to prosper. Larger companies can invest in branding, and in the technology needed to service customers in branches, and can negotiate the margins or commissions they need from the product suppliers. Nonetheless, remote sales via telephone and Internet are still growing at the expense of face-to-face sales. Interestingly, the telephone proportion has kept up, though a large proportion of buyers first research online before calling.

THE IMPACT OF CUSTOMER-TO-CUSTOMER

However, the effect of the arrival of the aggregators and the practices of the most advanced web businesses in other sectors is, in my view, likely to change the requirements of consumers. This is because of the significant change caused by social networking and similar developments that help customers to obtain insights from other customers. You may think that this is bad news – after all, we know that financial services markets are well known for the ignorance of customers. Many customers do make wrong decisions, and advise others to do so. Most research I have seen on who customers receive advice from is dominated by ‘members of family’, ‘friends’ and ‘neighbours’, with formal financial services providers – whether financial advisors or product suppliers – taking second place. Today, in most areas of the economy, customers can readily receive advice from other customers on the standing of a supplier or the quality of the product. In some cases, these are formally offered by the web, as per e-Bay supplier ratings or Amazon product ratings. In other cases, the savvy customer only has to key in a product or brand name and the word ‘sucks’ to see whether any customers are seriously dissatisfied.

WHERE DOES THE AGENT FIT?

Let us not forget the intermediary. How have agents been served by customer management technology, whether to help them to manage customers or suppliers? The answer to this question is a very mixed one. Generally, agents have suffered by being regarded as ‘channels’, not as human beings (individuals or groups), who are at least partly customers for products, propositions and relationships, or as businesses with their own propositions. In some parts of the financial services market – particularly those where ‘simple’ financial products dominate – for example property and casualty/general insurance, loans, credit cards – the nature of intermediation has changed very rapidly, from ‘real’ businesses with offices to ‘virtual’ businesses or aggregators, with very different financial models. This is not the place to discuss these models in detail, but what is clear is that the emergence of the aggregators has transformed the way we think about managing customers through intermediaries.

THE BENEFITS AND RISKS OF A MORE CUSTOMER-MANAGED APPROACH

In some ways, marketing thinking is lagging behind customers. It is definitely possible to have a more even balance between supplier and customer, in which each engages in a useful dialogue about their future plans. Some companies are gathering customer intention data, often from their financial advice divisions. The best move it to their operational customer management divisions, where it is used to manage customers. However, this is still early stage. That's because most marketers believe that they can do better than customers. Their credo is ‘We, the clever marketers, gather data from you, the customers. We analyse it, profile you, and tell you what you want next.’ In its most advanced form, it's trigger marketing, but the triggers are based on data about what the customer has just done (enquired, transacted, bought), not what they plan to do. However, this doesn’t work for many customers, who could be excused for thinking that what drives marketers is ‘We surprise you with our incompetence at guessing what you want next, because we don’t ask you what you want, or use this information to manage you in every channel, in every interaction’. Many customers won’t give intentions data to large organisations because they know the latter will not use them well – failing to store it, or using it as an excuse to sell the wrong product.

The essence of the way a business should relate to Customer 2.0 is that businesses provide ways for customers to express more about who they are, their actions, thoughts and intentions. The business translates information from sensing into a statement of targeting – which customers to deal with, a statement of customer requirements – what customers need, when they need it and so on. They respond by giving customers what they want, and will want, when they want it, at the right value – now and for the future – through the right channels, customised where appropriate, while making profit. They keep checking what customers are saying in order to identify whether they have really achieved what customers want. How might customers behave in this world? They identify businesses that are likely – now and in the future – to offer products and relationships that meet their needs, that can use information about their needs properly, and that provide the right information details about the propositions they offer, the channels through which they are available, their value, the pre- and post-sale service and so on. They use the information they gather to enquire, buy, give information, develop relationships – where they want them – and obtain service. This contrasts with current practice, where most businesses use data about past customer behaviour and needs to predict the future. They are often responding to past needs, or poorly predicted future needs, based upon simplistic generalisations. Thus, customers talk about large companies in disparaging terms – they know nothing, can’t be trusted with anything and visibly talk down to us.

Moving to a Customer 2.0 version of marketing and sales requires faster, smarter use of customer information to produce much faster, smarter response to customers, not just in day-to-day interaction, but also in attunement of marketing budgets (marketing resource management) and adjustment of total proposition (enterprise marketing management). In businesses where customer events (business, professional or personal/family lifecycle) determine value, customers will tell suppliers what they are planning next and will supply this data routinely, while suppliers will respond to customers, and will add data arising from dialogue to existing customer data to plan what offers or propositions to market. Offers and propositions will be notified to customers in ways and at times determined by customers. Customer benefits include taking less time and energy to get what they want, and receiving relevant offers more often. Supplier benefits include more cost-effective marketing, higher market share and more profit.

However, in my view, none of this will work without empathy and trust between customer and supplier. Customers are generally less happy to engage in the kind of dialogue described above in the absence of empathy and trust. Let's consider what this means in practice. Empathising means responding to customers’ signals in relation to their mental state, feelings, intentions and so on, and then reflecting where the customer is and wants to be, perhaps helping the customer articulate needs because the supplier has knowledge about customers in similar situations, and what products and propositions can do to improve it. This is the essence of real-time marketing, but with a focus on empathy.

This empathy is important because customers change. New customers appear, and old customers move out of category. Economic change causes customers to re-evaluate needs, whereas new laws and regulations often compel them. New competitors and channels materialise to offer more service or better price, whereas existing competitors retool to retain old customers and attract new ones.

What would it take to make all this happen? Here is my list of what financial services companies would need to do:

-

— Redefine their view of customer insight to include not just buying history, but intent: Combined, these two data sets would paint an accurate picture regarding what products customers want and from whom, as well as how likely they are to move from intent to reality. Purchasing and research data, for example, determine whether previous intentions were actualised; the stated plans of a customer who rarely fulfils his intentions are then treated with scepticism.

-

— Develop new and different approaches to analysing data: New applications and skill sets will be required to squeeze reliable data from purchasing history, attitudes, behaviour, lifestyle information and intent.

-

— Take channel management to a higher level: Customers often prefer different communication channels at different stages of their personal and professional lives, and may even combine channels for maximum effect. Getting the right mix could mean the difference between an ongoing customer conversation and extended silence.

-

— Develop more sophisticated CRM techniques: Financial services need to take into account the many and diverse ways customers are influenced during their personal and professional experiences.

-

— Implement responsive information systems: These are required to help to carry on the customer–supplier dialogue, and then process the resulting data quickly and efficiently enough to permit the offering of a relevant product or service. This means that constantly updated customer data run through powerful, integrated IT systems, using predictive applications that can be mined quickly for information required to compile an offer – the right offer, at the right time, and through the right channel. The customer, in fact, is invited to influence how and when the offer is presented.

All of that may sound more difficult than it really is. In fact, when it comes to systems and processes, this approach to marketing and selling is based partly on what some companies do already. The chief differences are

-

— A greatly enhanced data set, and a system that works more quickly, has the capacity to handle deep analytics, and is integrated across the banking enterprise to accommodate CRM activities in every line of business. The goal is a single customer view, processes to extend that view across channels and contact points, and an information system that supports ongoing, real-time dialogue with customers.

-

— Integration with Web 2.0 toolsets, to allow customers to manage their relationship with suppliers, and for the data from this relationship management to be fed to the systems and processes that create marketing and sales focus.

The returns delivered by this approach could be substantial. They are of two kinds:

-

— Increased response and customer conversion rates mean marketing resources can be saved.

-

— Reputation and positive brand awareness rise as customers begin to rate companies more highly and trust them more for their willingness to listen, empathise and respond relevantly.

The main risk of this approach is loss of control. However, I consider that this is more a perception than a reality. Control of customers has always been weaker than suppliers perceive. Just because a customer responds as expected to, say, an outbound marketing initiative does not mean that the customer is in any way under the control of the supplier. It just means that the supplier understood enough about the customer to offer the right proposition at the right time, expressed in the right way. However, there would be many other customers who did not respond.

Perceived loss of control may be experienced under classic CRM because the number of responders is much more or less than expected. The same can happen in this new form of marketing, of course. However, as a supplier learns to deal with the new information sets arising from Customer 2.0, it can make itself comfortable again with managing relationships with customers using these new sets. A small cultural transition is all that is required.

WHAT ARE THE CENTRAL TECHNOLOGICAL IDEAS OF CUSTOMER 2.0?

This paper does not review all the components of Web 2.0. In fact, the idea of customer-managed relationships predates most of what we call Web 2.0, but it is the latter's tools that make Customer 2.0 a real possibility. The main relevant characteristics of Web 2.0 are a much richer user experience and strong user participation and control. Content is dynamic, in the sense that it is adjusted to the characteristics of individual users. Because standards exist for this approach to using the web, it becomes much easier for any supplier to provide customers with the ability to manage relationships. The high scalability of the approach means that a company can apply it to a large number of customers. The openness of the approach allows for improved partnering and greater commercial and consumer freedom, aggregating and merging content (mashups) from different sources (whether online or offline), syndication of data, while collective intelligence is developed and used to help both customers and suppliers achieve their objectives. In this world, customers can run software-applications entirely through a browser, own and exercise control over their data, set up their own communication with all other customers (for example using weblog publishing tools) and add value to an application as they use it (for example through using forum or wiki software). Of increasing importance are folksonomies – collaborative tagging, social classification, social indexing and social tagging. Meanwhile, users have extended power to manage their own privacy in cloaking or deleting their own user content or profiles.

A good blog example

Bryan Inch, General Manager of RaboPlus, the Australian Internet arm of Dutch co-operative Rabobank, ran an executive blog for over a year. In September 2008, he announced that he would be moving back to New Zealand and leaving the bank. He also introduced his successor, Greg McAweeny. Greg posted his first entry to address customers’ concerns about the safety of their money deposited with the bank.8 Much has been written about the different business models that can be set up in Web 2.0 (for example Tapscott and Williams9). They argue that companies can design and even assemble products together with customers, with the customers’ share of value creation being possibly quite high. They suggest that in this world, large numbers of consumers, employees, suppliers, business partners and even competitors can co-create value without direct managerial control.

MOVING FROM 1.0 TO 2.0

Despite all these wonderful ideas, CRM in financial services is on the whole firmly lodged in the world of Web 1.0, which can broadly be described as a customer-controlled contact centre, in the sense that the scripts followed and data exchanged are managed much more effectively than in a contact centre (no agent cost), at the customer's leisure and timing. Web 1.0 allows much more efficient delivery of complex information sets, which the customer can browse through and choose. There is no doubt that Web 1.0 has been a massive advance for customers, as evidenced by their preference for doing business in this way in certain sectors, and the rise of businesses using this model. However, many of the leading Web 1.0 businesses have made a rapid transition to Web 2.0 for some of their activities, even if their business model is still broadly Web 1.0. For example, many of them allow commentary by customers.

Moving from Web 1.0 to Web 2.0 is not just a matter of allowing a bit more customer feedback, a bit more customer control of data, and indeed a bit more customer control of any of the attributes of customer management. In its most extreme form, it means developing a new proposition – indeed a new business – in which customers decide what kinds of service they want to buy and in what combinations, and in which they control the process by which they are sold the product.

This is quite hard to imagine in practice, so here is an example.

Mrs Smith, a relatively well-off customer, is reconsidering the approach to insuring all her physical assets – first and second car, caravan, boat, house buildings and contents (for main home and country cottage). Mrs Smith is a little fed up, because she has five policies at the moment. She is a very careful customer, always buying the best security devices for her assets. Both her houses have monitored alarms and new, high-quality double-glazing. She has some works of art, individually alarmed, and some valuable jewellery that she keeps in a safe. She needs these separately covered. Both her cars are new, not of the kind targeted by thieves, with the highest-quality security systems, and have tracker devices fitted. She keeps most of her valuables in a safe deposit at her bank, and the rest in a fireproof and waterproof safe bolted to the concrete floor of her cellar. Her houses are conventionally built and located well away from areas of flood risk. In other words, she is a safe customer. She wants an insurance company to make her an offer for insuring all these assets, each with an individual excess and an excess covering them all. She is not looking for the lowest price, but the best value for money, taking into account customer service and reduced administration for her. Most important of all, she wants to be able to give all this information via the web, anonymously initially, to a company she trusts, so that the company responds with a proposal, and if she accepts it, she wants to be able to record planned or actual changes in her asset holdings via the web, so that she can investigate the costs of insuring certain additional assets. In addition, she wants to modify terms and conditions of any proposition so that it suits her, and to see the effect on price. She wants to be able to verify the claims of any supplier regarding customer service quality and ease of administration (whether buying or claiming), by accessing the experience of other customers. In short, she wants to buy using a Web 2.0 approach. As a start, she wants to be able to identify companies that are prepared to take this approach with her, and see how it has worked for other customers.

Of course, customers like Mrs Smith are not that common, but one of the reasons for this is that customer requirements are partly determined by their experience, Before Amazon, eBay and Skype, customers were used to the world of contact centre-based Customer 1.0. Now they are getting used to small snippets of Customer 2.0 – big snippets if they are active eBay or Amazon buyers. Once companies start to offer them more than snippets, I believe they will respond.

The same will be true of agents, who, as I have said, are customers. In my discussions with aggregators, it has often been mentioned that product suppliers are unwilling to manage the aggregators as if they are business-to-business customers in the full sense. The relationship is characterised by opaqueness, with aggregators receiving the minimum information from suppliers that they need to do business. In particular, product suppliers’ processes for measuring credit or insurance risk are often opaque, so that it is hard to promise to a customer a particular interest rate for a loan or a particular premium for insurance. Final consumers require from aggregators clarity and accuracy – of product information, process, quotes, fees (where appropriate), penalties and other charges, and of coverage. They want explanation of where and why coverage is limited. They want to know about commercial relationships between aggregators and product providers, generally and in the context of league tables, and of any special choices or selections. For this to happen, product suppliers and aggregators need to be much more willing to disclose details. More importantly, aggregators would like greater transparency in the strategies of their suppliers, so that they can formulate their strategies accordingly. However, the relationship between product suppliers and aggregators is still firmly CRM 1.0.

Insurance agents would benefit from major product providers providing the facilities for them to set up blogs and dedicated social networking sites, for them to create a closer relationship with their customers. The idea is that customers would prefer to do business not with a stranger they have never met, have not heard of and don’t know, but with an agent whose podcasts or vodcasts they have heard or watched.

Other kinds of agents may have different needs. For example, at the moment, banks selling insurance tend to be content to take a very simplistic view – we’ll sell the business, you deliver it and give us our commissions. But this world is changing, as the separation between product supplier and final customer creates problems for the product supplier, caused by opaqueness about risk. In a Web 2.0 world, a customer buying insurance via a bank might be much more visible to the product supplier, and vice versa, unless the bank were bearing the risk. The reasons for the customer buying through the bank and for the bank choosing the insurer would be transparent to all parties.

Of course, much of this is speculation – but based on a fundamental idea – that in the age of Web 2.0, customers of all kinds want to be much better informed and in much more control. What are the feasible migration paths, and which are best in which situations? Some of the central ideas of Customer 2.0 are end-user product customisations, contextual help (whether by live agent chat/VoIP or content customised to the issue faced by the customer) and product service comparisons (across brands, end-user recommendations). Inter-customer collaboration is also important, whether through collective intelligence or collaborative product customisations or content creation, or even just bookmark-sharing. Additional elements are ease of new-user participation, user-assigned news item rankings, search results showing end usage, end-user content upload and chat.

Getting from Customer 1.0 to Customer 2.0 in financial services should be easy, because the path is being mapped out all the time by businesses in other sectors. The technology is there, and it is pretty stable. The operational business processes are not radically different, because the main change relates to where data are coming from, and not to the kind of data. For example, data forecasting the number of customers likely to do anything or want anything currently come from analysis of past and present patterns of behaviour (including today's response to real-time marketing) and from market research – often being inferred. In the Customer 2.0 world, it would come directly from customers – whether as intentions, requests or inferences.

The big difference in operational marketing would be in how a company encourages dialogue between and with customers, to yield the data that are needed to ensure that customers get what they want.

At a higher level, the big difference would be in marketing culture.

WHAT DO THEY MEAN TO AN INSURANCE COMPANY OR A BANKs?

Insurance companies and banks have slightly different interests in Customer 2.0 because of the issue of risk.

At the moment, the most common features of Web 2.0 that have been adopted by financial services companies are RSS feeds, podcasts and vodcasts. Some companies are using Static Mashups and rich user experiences. Sadly, very few have moved towards blogs and user-generated content.

The most visible characteristic of Web 2.0 is collaboration and social networking, in which users who generate content have control, as evidenced by the growth of blogs and wikis. In the insurance industry, the main relevant development is in portals to disseminate and share information with clients and agents. However, the main use of these technologies is one-way communication from service providers or insurers to clients (‘download’ only). Few use these applications for two-way communication, even though the software is designed for this, including document collaboration and exchange of structured data online. There are few wikis in the insurance industry and no major initiatives to create an open forum community. Two recent initiatives include the RiskWiki, an online glossary of risk management terms created by RIMS, and the Riskipedia, created by Risk Management Reports. Blogging allows anyone with Internet access to comment online, providing opinion on any issue, while RSS feeds allows blog comments to be shared. There are few insurance industry or risk management blogs. However, the general blogging activity on insurance is surprisingly high, as it is for other financial products.

In the insurance industry, ownership of data has long been an issue. Access to a greater depth of risk data is seen as a pricing differentiator for insurers and anyone who can supply it. This leads to reluctance in sharing data and conflicts over who actually owns it. The industry has spawned a few information organisations, such as Insurance Services Office, Inc. (ISO), and National Council on Compensation Insurance (NCCI), which act as data repositories and sources for the industry. One new Internet-based information company is Advisen, which has modelled itself as the Bloomberg of the insurance industry. A characteristic of the Web 2.0 data models is a structure that automatically builds the database through usage of the application. None of the current information-based companies in the insurance industry have been able to achieve this yet. Expect this to change with more Web-based software applications offered at a low cost as a means to capture data.

In banking, the data issue is different. Banking data are much richer than insurance data – covering all of a customer's banking transactions and interactions. One reason why banks have focused so strongly on using this data for ‘one-way’ targeting, that is, outbound communication, is that it is a ‘heroic task’ to bring it all together and make sense of it just for targeting. Opening the door to even more data – from customers providing information about their needs and intentions – has not been welcome for most banks, perhaps even not practically possible. Web 2.0 technology is starting to change this.

We are still at the early stages of Web 2.0 in the financial services industry. The signs are that we are just beginning to see adoption of some of the technologies. The softening market for insurance may help to fuel interest as insurers and brokers look to improve efficiency and competition increases. The low returns from borrowing and lending will put banking efficiency under the microscope, and therefore banks will need to explore innovative and cost-effective ways of managing customers. However, expect adoption to be slow. The financial services industry is very entrenched and in some sectors quite heavily concentrated. This makes new ways of doing business, particularly those that embrace participation and transparency, difficult. The reliance on legacy systems will act as a barrier to the adoption of some Web 2.0 concepts, such as software as a service. Conversely, it might benefit others, such as Web services. For Web 2.0 technologies to really take hold, the industry must want to embrace them. The industry is still wary of the Internet and the potential disruption it could create for parts of the distribution channel. While Web 2.0 technologies appear less disruptive than earlier Internet business models, the industry is likely to approach the new generation of Internet technologies with caution.

WILL 2.0 BE REPLACED BY 3.0? WHAT IS 3.0 ANYWAY?

The term ‘Web 3.0’ was coined by John Markoff of the New York Times in 2006. It refers to a possible next generation of Internet-based services. These comprise ‘the intelligent Web’, using semantic web, microformats, natural language search, data-mining, machine learning, recommendation agents and artificial intelligence technologies. These technologies emphasise machine-facilitated understanding of information to provide a more productive and intuitive user experience. Web 3.0 seems to be an open, intelligent, seamless, interoperable, access-anywhere by-any-channel, distributed system where software is a service. Identities would be open and portable.

HOW ARE INSURERS AND BANKS AFFECTED BY HOW NEW GENERATIONS OF CUSTOMERS ARE USING TECHNOLOGY?

Interestingly, after a period when take-up was affected by age and demography, in the United Kingdom the relative ubiquity of broadband now means that suppliers should not assume any bias in uptake. In fact, in many ways, the features of Web 2.0 meet the needs of the older generation, who might be thought to reject some of the ideas of Web 1.0, because they are more concerned than younger people about issues such as privacy and intrusion, and value very strongly the interaction with similar people making similar decisions. This has clearly been evidenced in the way the web is used by older consumers to discuss issues that are important to them, namely health and wealth. The proliferation of wireless broadband also means that simultaneous use by several users in one household has removed one of the barriers to access, in which one access point is monopolised by one person in the household – often the young. Today, wireless access is commonplace, as is the ownership of several PCs per household.

ISSUES WITH NEW TECHNOLOGY

The many different access channels that have opened up on Web 1.0 are flowering into Web 2.0, in the sense that customers can use these channels to manage relationships with suppliers. This has created issues relating to compliance, identity security and database protection. However, in my view, new channels and new marketing policies always pose problems for compliance, risk management and privacy. In some cases, these problems are overcome by the use of portals, which can be seen as acting as means of filtering and security control – whether for customers, staff or agents. The beauty of a portal approach is that it opens up access for all parties – whether partner suppliers or agents of customers. This approach has made it much easier to induct the different parties into new ways of managing relationships, with the portal itself being the central channel for training, particularly for agents and staff, but also for customers.

An important component of the new approach is its real-time nature. Real-time marketing, in the CRM 1.0 sense of real-time offer management, is only just becoming widely diffused, with the leaders being in mobile telephony, media and pure-play web businesses, and a few financial services companies. In some way, this is a phase companies must go through before aspiring to Web 2.0. If a customer interacts with a financial services company in a Web 2.0 context and then is faced by a lack of real-time approach in a particular channel, in the sense that an offer is made that is unresponsive to the latest information provided during the dialogue, then there is a clear divergence of experience.

To make these new approaches work, a cultural change is often needed – one in which marketing and service staff are led towards a nirvana that involves interaction with customers in a trusted environment, not one of control and targeting.

THE RESEARCH

In order to investigate some of the issues covered in this paper, I decided to carry out some qualitative research with UK-based financial services providers. I designed an e-mail questionnaire, and mailed it to some of my closest contacts in financial services companies, providing them with assurances that their names would be confidential and that their replies would be edited to ensure that they were not identifiable.

I considered how to present the responses. With several qualitative interviews, I considered that the best response was to present the information as a series of case studies, edited carefully to preserve confidentiality and to ensure intelligibility, but not so much as to lose the sense of the quick response. The conclusions are presented afterwards. At the end of this paper, I present the responses, which consisted of three aggregators, two banks, five insurers and one provider of services to financial advisors. In my experience, this number is entirely adequate to provide a picture of what is going on among the more innovative companies, who tend to be the ones that maintain contact with me and respond to my research requests.

It should be noted that this research was carried out in the middle of the financial crisis, so I felt happy that I had received any responses at all. Many of the respondents indicated that they were under severe pressure at the time, and four companies that promised responses did not manage to send them.

The questionnaire was presented as a Word table, which respondents simply completed. It is shown at the end of this paper, after the case studies.

CONCLUSIONS

The research shows clearly that aggregators have taken the lead on the road to CRM 2.0 and Customer 2.0. However, they are followed by the banks, and one or two insurers are on their tails. By focusing on the customer and the kind of dialogue and information they feel customers want, some companies are making good progress in real-time customer management.

In the short term, the approach is easier with simple transactional products such as general/property and casualty insurance, credit cards, and short-term savings and loan accounts, and the risk of being left behind is greater, particularly with the competition for value-added coming from the aggregators. However, my view is that in terms of the consumers’ long-term financial health, the move to Customer 2.0 is more important for life and pensions, mortgages and long-term savings, as this is where failure to understand the customers’ needs and perspectives can be most damaging.

In my view, in the long run, the progress made by the innovators will be visible in higher market share and profitability (depending of course on the contenders’ business objectives). However, one thing is certain – within a few years, the ‘buzz’ on the web and market shares, in particular the share of valuable customers, will make it clear which companies are regarded by consumers as truly responsive to their needs, and which are still trying to force products on customers.

There has been some progress with use of Web 2.0 techniques with staff, but less than I expected. Staff are important for several reasons. For many companies, they are the prime interface with customers, and they have access to the same systems used by management. They afford a great opportunity for less risky experimentation with Web 2.0 techniques, and the feedback they provide about how customers are feeling is very valuable. Because they manage customers, if they are not feeling comfortable about the situation in which they find themselves, this will be communicated inadvertently to customers. Web 2.0 techniques provided much more open-ended ways of gathering feedback – ways that are much more likely to accurately pick up sensitive issues relating to ethics and governance.

RECOMMENDATIONS

My recommendations for financial services companies are that they create a stronger focus on

-

1

Listening to customers, by combining classical CRM approach and Web 2.0: This means allowing customers who are represented on the CRM system to provide input in ways that are not pre-structured by the CRM system, and – just as importantly – to discuss issues with other customers, and to receive input from the company about these issues.

-

2

Retention throughout the customer journey: This means developing a deeper understanding of why customers decide to leave or stay, at different stages of the customer journey, and, if they decide to leave, what process they go through, and finding ways for customers to signal their intentions and concerns, and finding ways to listen to what customers are saying to each other about leaving or staying.

-

3

Trust, empathy, engagement and recommendation: This means finding ways to engage customers in a dialogue about their problems, being more open, honest and empathetic with them about issues that both parties may face, thereby building trust.

-

4

Engagement of staff: Helping staff engage customers and build trust and empathy by engaging staff more closely in the customer management process and by using Web 2.0 techniques to allow staff to express their concerns with that process and associated marketing, sales and service policies and to listen to other members of staff and customers.

-

5

Developing a customer management business strategy at Board level: All of the above will be helped by stronger, more insightful involvement of the Board, to support the required customer-focused innovation in both services and go-to-market strategies, and to develop stronger and more focused governance of new customer management processes.

THE CASE STUDIES

Case study 1: Bank

How far customers want individualisation, personalisation and enhanced, relevant information

‘Being treated as an individual’ is one of the core wants for our customers. Given the nature of banking and financial services, much of what we provide has to be ‘individual and personalised’ or customers believe that it is simply blanket marketing and are turned off. On the other hand, banking in the United Kingdom is largely expected to be free and customers are very happy to get ‘extras’, though when asked whether they would pay for enhanced relevant information, they are generally not willing to pay for it.

Plans to investigate and exploit the tendency of customers to use web-based methods to buy or recommend the kind of products and services your company supplies, or collaborate with each other in making decisions about them

To buy: our Internet banking already provides an ability for our existing customers to buy; for non-customers the challenges of money laundering, identification and very low profitability mean that this is of limited interest. The requirements for our next generation of Internet banking capability are very broad and incorporate this sort of idea of ‘recommendation’ groups and so on – though it is yet to get to the business case stage, so who knows. In practice, we know that recommendation is and always has been incredibly important, though still behind convenient location. The vast majority of our business still comes from having a vast local presence and recommendation from family, friends and work mates. Presumably one day Facebook and so forth will have an impact, but who knows when these will be substantive on the core day to day for recruitment. We are fully aware and track Facebook and other blogs as a source of feedback on what we do and how we are doing. We are also fully cognizant of ‘reputational risk’ and the emerging potential for collective action from these new sources.

How your company's intermediated business will be affected by the above-mentioned methods

Not relevant – as contacts with customers are handled primarily by staff in our branches and call centres.

The benefits of web-based and similar methods

Buying online is great for existing customers and commodity products like car/home insurance. If you are talking about acquiring customers via recommendation – that's very important, though the web is not so important to us, and yes those who came because of recommendation tend to be ‘better’ on many of the measures you mention. But it is only one aspect of recruitment.

The risks of these methods

The real question is ‘what does a company need to do to be recommended’, and the channel is less relevant. We are a multi-product multi-channel business whose customer base reflects the British population – so all the things mentioned in the question will be challenges – though the biggest will be dealing with the resultant complexity, and our understanding of how to manage through the sequence of changes required and how to make the business case which isn’t just a ‘leap of faith’.

How these developments affect how customers are managed across different channels

Interestingly, our focus on ‘wanting to be recommended’ is creating an internal dynamic to help us to align the business behind ‘managing individual customers seamlessly across products and channels’. I’m not saying we are there yet – but that we (top management) all know that's where we want to go – the challenge is getting there – along with everything else (particularly at the moment).

The difference between how different generations of customers use these methods

‘Early adopters’ are not really simply segmentable simply by age. We are able to identify early adopters by all sorts of transactional/payment information as well use of our own channels. What has been interesting to us over the past 10 years or so is that more people use more channels as we make them available – but this does not stop them from using other channels. A few years ago some of us thought ‘branches’ would die and everything would move to phone or more recently the ‘net’ – in truth it now looks like we will need all of these channels, which are not substitutional, but rather additive.

Use of such methods in managing staff

All of our rulebooks, training materials, MI, rewards and so on have moved onto web-based intranet systems. We are trailing intranet pages for personal blogs and Web 2.0 tools – though because of the customer data issues, these are not open to the Internet.

Use of real-time marketing

Yes, we do, but we find that long run data on patterns of customer behaviour is more powerful than more recent data. There are a few chaotic events (winning the lottery) that change the predicted pattern – but most others are not that massive and occur in these sub-populations, for example certain groups are more likely to move house, get a new job or start a family, and so are broadly predictable. Most importantly we use our data to get staff talking to the right customer – once they are talking to a member of staff – we expect the staff to change what they offer based on what the customer says. Data prediction is good – but experienced and well-trained humans will always do better once they start talking. But picking which three customers to talk to about something out of a queue of 100 is better with the data – unless the person pays in their lottery winner's cheque.

Future use of real-time marketing

This depends what you mean by real-time. But yes, inbound and outbound opportunities – integrated across products and channels – available to support all staff and machine interactions in an appropriate and easy-to-do business method – with as much individual soft data as possible.

Case study 2: Bank

How far customers want individualisation, personalisation and enhanced, relevant information

Increased expectation and stronger rejection of poor/mass targeting. However, also keen on experience being consistent (for example, online banking web pages not changing format frequently).

Plans to investigate and exploit the tendency of customers to use web-based methods to buy or recommend the kind of products and services your company supplies, or collaborate with each other in making decisions about them

Use of aggregator sites for commodity products (for example car/home insurance). Active monitoring of social networking sites and engaging to respond to debate.

How your company's intermediated business will be affected by the above methods

Do not use agents or distributors apart from limited search aggregators.

The benefits of web-based and similar methods

See above.

The risks of these methods

See above.

How these developments affect how customers are managed across different channels

Channel integration now moved from competitive advantage to competitive necessity.

The difference between how different generations of customers use these methods

Multi-channel behaviour is increasing across all age and demographic groups. Younger customers are more direct. Channel use increasingly determined by activity/product being undertaken. Branch footfall for transactional activity falling, but visits for more complex advice increasing across all groups.

Use of such methods in managing staff

We are applying CRM techniques to staff, personalising development plans and tailoring communication (use of online blogs and discussion groups, mentoring). Compensation is moving to increase in flexible benefits component and ‘total pay’ philosophy.

Use of real-time marketing

Parts of our group have tested real-time engines. Results show good uplift where there is limited or poor-quality centralised customer data. However, not so clear results where we have frequent customer contact and depth of customer knowledge.

Data are incorporated in real-time across channels on offer responses to avoid repetition and then daily, weekly or monthly depending on strategy. Use of limited real-time data within decision engines across all channels.

Future use of real-time marketing

Real-time engines to ‘sense and respond’ are in development and we would see these being deployed as an integral part of our decision engines and driving straight through processing further upstream (in customer research-exploration-quotes).

Case study 3: Insurer

How far customers want individualisation, personalisation and enhanced, relevant information

We sell personal lines insurance product to the general public via intermediaries. It is the intermediaries that usually require this bespoking. We see evidence that many intermediaries put too much store in differentiated products and we would question some of the assumptions made as regards to loyalty, customer lifetime value and so on. In our view, most personal lines insurance end-users consider the product a commodity and buy only on price. Thus, your brand has to be very powerful to pull customers by bespoking alone. Also, there is no robust way to get across bespoking or differentiation at the pre-sale stage, as many consumers now turn to web-based sources, which leave little opportunity to express policy features.

Plans to investigate and exploit the tendency of customers to use web-based methods to buy or recommend the kind of products and services your company supplies, or collaborate with each other in making decisions about them

We have close relationships with technology companies to give us access to SMS and net distribution. In addition, we see it as a strategic priority to be able to provide products by whatever channel the end-user wants to use. Web channels are especially valuable in distributing low-margin products such as travel insurance. They are also easily branded to match affinity needs. We don’t yet use web service for post-sale activities, as we build our reputation on insourced claims-handling, based in the United Kingdom and without the more irritating aspects of using call centres like IVR. We have, however, web-enabled our systems, and should we detect a shift in partner/customer needs/wants we will deploy it.

How your company's intermediated business will be affected by the above methods

We sell exclusively via agents of one sort or another. Brokers, affinities, aggregators, IFAs, owned brokers. The methods you describe will (we think) change motivation, compensation and communication, but this is at present an evolving area. We are trialling various models. The intermediaries are also experimenting with extracting value from different parts of the value chain.

The benefits of web-based and similar methods

Benefits will change depending on the type of intermediary and the product sold. Our model must be able to flex to accommodate these variations. For example, travel insurance sold via a high street broker needs to be simple, quick and to involve the broker as little as possible, as the margins are low and the product simple. However, for a client like major retailers we would be seeking to deploy the technology to assist in achieving benefits while also making sure that costs are controlled. We maintain that efficiency equals service in this commoditised market, so we try to make the sales process especially as low-friction as possible unless partners seek a more complex journey.

The risks of these methods

We have developed systems that can be deployed very cost-effectively. We own the IT so we can make it work for us quickly and at a low cost. We do, however, recognise that some partners will find the process less easy than others. They have to accept lower margins or lower sales as the payback for this inertia. We are finding a lot of interest in the intermediary market in controlling the customer journey. It is stated that this interest is to enable the application of a consistent service across panels, but at its core is the desire to control customers to allow exploitation of claims income possibilities. This has been driven by increased use of aggregator sites to sell product. To compete on such highly competitive sites, the sellers frequently accept lower (or indeed zero to negative) margins, and thus have to earn profit elsewhere in the value chain.

How these developments affect how customers are managed across different channels

By and large, our retailers do the customer management so we are less affected other than to make sure we have competitive product available on all channels. This is a challenge, as we are seeing that underwritable behaviours affecting the profitability of groups of customers are no longer following some of the traditional ‘rules.’ For example, we have found that some of the old assumptions around which customers are attracted to particular brands have altered, in part because of the intermediary exercising more control over end price to the consumer, making underwriting risk trickier. A discount applied by a retailer can make a policy priced to avoid young drivers, for example suddenly become attractive to young drivers. Thus, underwriters will have to be more sophisticated in selecting risks in future. Brand assumptions are now getting riskier also. We find that, for example, motor policies sold through an up-market retailer are being bought by younger drivers with no allegiance to the retailer's brand.

The difference between how different generations of customers use these methods

Yes there are differences. Over-60 year olds are remaining with the traditional channels, especially in lower socio-economic groups. In 30–60 year olds, there is a mixed picture with many using web technology to at least assure themselves of the price. Under 30s don’t want a relationship with an insurer and prefer the commoditised, anonymous and quick convenience of the web. We are not sure whether this last group understands what it is buying when it buys insurance. They see it as a tax on ownership (especially cars) and only see the benefits in terms of what it does for them. Older customers still see that they are also protecting others from what they might do to them. These three groups also have a different view of their needs in a claim. The over-60s, being more stoic, are more likely to trust the insurer to guide them and more resistant to the attempts of ambulance-chasers to tempt them away from the insurer. These are sweeping generalisations, and we are seeking better market intelligence. It is safe to say the world is a different place these days and some of the old business ‘rules’ around loyalty, brand and so on are no longer valid.

Use of such methods in managing staff

We use web-based systems to communicate, train and inform staff. In this way, we can disseminate information quickly, apply variations where necessary and check who has accessed the information and how often. We also seek to use the technology to enrich their roles by taking away routine work and allowing them more time to work with customers to do a better job. We also find that the use of such systems aids our business process evolution in that one can make changes to process and measure effectiveness far more easily. Interestingly, rather than promoting the Six Sigma suppression of variation, we use the systems to allow customers to apply variation to our claims processes. This gives the customer the feeling of involvement and control in their own claim and reduces attrition-related costs of failure and complaint. It also seems to positively affect opportunist fraud rates.

Use of real-time marketing

We are now using such methods with our owned broker. The product went live recently and it is as yet too early to make conclusions. Sales numbers are encouraging. However, the proof of the pudding will come later in the loss ratio.

Future use of real-time marketing

Yes. In our owned distribution and where we are the chosen solus insurance provider to affinities. The web-based systems will be key.

Case study 4: Insurer

How far customers want individualisation, personalisation and enhanced, relevant information

The company believes in improving the customer experience, but this voice of the customer needs to be balanced by the voice of the business. Also, customers should not be expected to pay for increased personalisation or enhanced information unless there is a genuine benefit to them. To a degree, the information we provide is dictated by the regulatory environment.

Plans to investigate and exploit the tendency of customers to use web-based methods to buy or recommend the kind of products and services your company supplies, or collaborate with each other in making decisions about them

The company invests in quote and buy functionality on our main consumer websites. This tends to be directed towards improving the sales process and tailoring this to the customers needs rather than provide content. We have also invested in building relationships with aggregators (price comparison websites) and white-label functionality for use by our affinity partners.

How your company's intermediated business will be affected by the above methods

In our personal lines insurance business (in particular but also a slight shift in commercial lines) direct sales have shifted away from our broker network. Within the direct sales channel there has been a shift towards web (away from phone), and most recently a move to aggregators. In recent times, one industry leader has moved away from aggregators, which might cause others to follow. For our own brokers, we are relying more heavily on e-mail communication and have also established a broker extranet. We have also established an online risk management tool. We would expect this increase in electronic communication to increase in both directions. Changes in broker compensation may be appropriate if the nature of the broker's involvement in the sales process changes.

The benefits of web-based and similar methods

Web-based methods can increase the speed of communication and action. They will increase customer satisfaction where they are offered alongside other communication options giving customers a choice of how they interact with us. There are likely to be improvements in customer retention through more sophisticated marketing (and inertia selling). There will also be benefits from cost efficiencies as customers ‘self-serve’. The company should also become more agile providing that the appropriate systems, design and marketing support is provided.

The risks of these methods

Our company has a network of sales branches that can provide a local and personal service, but this comes at a cost. The Internet allows others with lower-cost operations (and less experience/stability) to appear to compete on level terms. The aggregators have tended to drive the consumer down to the lowest cost option. While this might be considered a ‘perfect’ market, this model has driven a lot of profit out of (particularly) motor insurance, and is unsustainable in the long term. One risk is the lack of investment in appropriate IT solutions and being overtaken by more sophisticated technology. Process re-engineering is also a challenge, but one that has generally been overcome on the basis of our test-and-learn philosophy. We are working hard to break down silos within the organisation and rationalise our systems platforms.

How these developments affect how customers are managed across different channels

Customer management has become more complex, but this has been seen as an opportunity as well as a challenge. The adoption of a new CRM system for our commercial brokers has led to significant improvements in our customer management.

The difference between how different generations of customers use these methods

It would be true to say that the younger generation of customers is more likely to use new technologies either as consumers or intermediaries, but this generalisation has many exceptions. The rate of adoption of web-based systems within the broker market has no doubt been influenced by the older profile of the average brokerage.

Use of such methods in managing staff

Services available online for our employees include payslips, expenses, regulatory tests, training, benefits, staff surveys and company car administration.

Use of real-time marketing

We are probably behind the game here with little activity in either the use of recent customer data or real-time marketing.

Future use of real-time marketing

I don’t believe this will become a critical issue across the business, but will become more important in some consumer markets.

Case study 5: Insurer

How far customers want individualisation, personalisation and enhanced, relevant information

Our products are becoming more tailored for individual requirements or circumstances, for example postcode pricing on annuities, improved poor health annuities (covering more serious medical conditions) and a wider range of funds being available on defined contribution pension funds.

Plans to investigate and exploit the tendency of customers to use web-based methods to buy or recommend the kind of products and services your company supplies, or collaborate with each other in making decisions about them.

We have a project in place to develop online annuity quotations – this will probably work with customers filling in the details and customer services ringing back to discuss the quote. We also intend to make available online client contact for change of address, bank details and so on.

How your company's intermediated business will be affected by the above methods

A major channel for us is IFAs. All our products and services are generally being developed to obtain greater sales in these channels, with appropriate marketing and sales support being put in place.

The benefits of web-based and similar methods

We expect to retain market share in annuities, improved sales in savings bonds, enhanced annuities and lifetime mortgages. Our systems are being improved to reduce the cost of maintaining these products with some products being outsourced with the promised integration of systems and so on.

The risks of these methods

The main issue is ensuring that agents gain access to our systems and providing automatic underwriting for more complex enhanced annuities. Lifetime mortgages are sold and serviced by our own staff. Regarding servicing, we have a project to improve the reliability and Management Information available to us. Management Information has also been developed in respect of Treating Customers Fairly, which highlights areas that need further work.

How these developments affect how customers are managed across different channels

The plan is to integrate our clients across platforms – so should improve overall management, servicing and our ability to sell additional products.

The difference between how different generations of customers use these methods

As the majority of our clients is over 50, there is not as great difference for different servicing channels, with those over 70 still preferring phone/mail. Clients generally prefer to see advisers for sales/fund advice for larger-sized transactions. Our direct channel has had mixed success.

Use of such methods in managing staff

Not at present.

Use of real-time marketing

Not particularly, though one can see how this could be advantageous in choosing relative funds to offer. We talk to and question IFAs regularly to understand their and their clients’ needs to tailor products appropriately

Future use of real-time marketing

The main area is around working with employers to provide information/advice around retirement.

Case study 6: Insurer

How far customers want individualisation, personalisation and enhanced, relevant information

Generally subject to cost – people wish to be treated as individuals and feel that they have received a personal and relevant service.

Plans to investigate and exploit the tendency of customers to use web-based methods to buy or recommend the kind of products and services your company supplies, or collaborate with each other in making decisions about them

The company recognises the power of the web and has made strategic software investments to support our efforts to expand in this area.

How your company's intermediated business will be affected by the above methods

We are dedicated to a broker distribution methodology. The use of the web still enables us to label ourselves as intermediary distributed. From a claims perspective, our efforts are dedicated to creating efficiencies through web-based interactions and a ‘soft copy’ electronic file and workflow system.