Abstract

This paper investigates the impact of social media practices on wine sales in US wineries as perceived by winery owners and general managers. An online survey research methodology involving a sample of 375 US wineries was used to gather data. MS Excel software was used to analyze data, including descriptive statistics and ANOVAs. Results illustrate that 87 per cent of wineries in the sample report a perceived increase in wine sales due to social media practices. Using multiple social media platforms, rather than just a couple, is statistically significant with reported increases in wine sales. Wine marketers in the United States would benefit from adopting social media into their marketing mix, especially smaller wineries. The results suggest to start with Facebook and to ensure the winery owner responds to consumer comments on TripAdvisor and Yelp.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

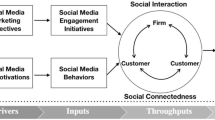

Social media marketing entered the realm of business and industry in the mid-2000s and has since stirred significant interest and controversy as a novel means of advertising products and services. Defined as user-generated content delivered via the web- and mobile-based technologies, social media allows users to communicate, discuss, recommend, co-create and modify content.1 Common social channels include Facebook, Twitter, Wikipedia, Pinterest, TripAdvisor and Yelp, as well as a myriad of mobile applications (apps) for smartphones. These channels and others have altered the marketing landscape from a traditional one-to-many broadcast of messages to an inclusive many-to-many conversation accelerating word-of-mouth (WOM) influence on purchasing decisions. In fact, for high involvement products, 50 per cent of purchases originate from WOM sharing.2 Digital knowledge-sharing and gathering on multiple social channels encompasses the customer’s ‘digital journey’ where the brand experience is social and emotional, as well transactional.3

In 2014, Statistica reported 1.6 billion people used social media and projected an increase of 2.3 billion users by 2017.4 Customers now expect companies to have a social media presence, which adds brand credibility.5 Savvy companies position themselves in their customer’s environments and allocate marketing budgets to the digital economy. A recent social media marketing survey found that 92 per cent of brand managers felt social media was indispensable to their firm’s marketing goals.6 In 2014, a global study on the corporate sector’s use of social media reported that 60 per cent of firms employed social media personnel, a remarkable adaptation to consumer needs.7 Gains are best achieved by companies that strategically implement social media campaigns, including key performance metrics and web analytics. In fact, digital consulting firms Econsultancy and Redyeye surveyed 700 digital marketers in 2011 and found that strategic conversion practices increased sales.8

This paper focusses on the wine industry’s use of social media marketing and its impact on wine sales. Although many wineries have adopted social media marketing, there remain conflicting reports regarding the return-on-investment (ROI) from using these new tools. Yet, wine is an ideal product for social media marketing due to the high-level of consumer confusion when presented with over 10,000 labels on the market.9 To reduce confusion, wine consumers often rely on experts and friends to help them determine wine purchases. 10 In the past, wine consumers consulted books, magazines and newsletters, but increasingly they use social media to seek advice from friends and acquaintances to reduce the risk of dissatisfying purchases.11, 12, 13 Indeed, statistics from Google searches show that wine appears as a keyword search more frequently than do many other consumer products.14

The United States is home to 10,417 wineries producing over 375 million cases in 2014.15 Revenues were estimated at over US$37bn, yet the amount of wine sold online is estimated to be less than 2 per cent — far less than the international wine market standard and far less than other consumer product categories.16 Although complex shipping regulations, transportation hurdles due to temperature control and variations in state alcohol laws are to blame for some of this, certain experts suggest the US wine industry is not doing enough to be competitive in the ecommerce area.

Despite the fact that consumers use social media for wine-related conversations, social media marketers in the US wine industry question whether social media strategies significantly impact wine sales. Although some wineries have created social media marketing positions to incorporate social media into their marketing and public relations efforts, others remain doubtful, hence the need for research. The research presented in this paper is a part of a multinational collaborative study on the use of social media by wineries around the world. This paper extends that study to focus on how winery owners or general managers in the United States perceive social media marketing’s impact on sales. Well-known issues with unverified self-reported data limit the strength of any conclusions we may draw from the data — nonetheless, the findings provide interesting insight into an area of increasing importance to the US wine industry.

Review of the literature

Some of the more common types of social media include:

-

Social networking sites: where consumers create profiles, share information and interact with friends and colleagues. Such sites include Facebook, Twitter and LinkedIn.17, 18 Today, Facebook is the largest social networking site with over 1 billion active users. In China, common social media platforms include Weibo and WeChat.19

-

Blogs (abbreviation of ‘web-logs’): sites where users can write short articles or opinion pieces.20

-

Online photos: sites where consumers share photos. Examples include Pinterest, Flickr and Yahoo Images.18

-

Vlogs (online videos): websites such as YouTube that allow users to share and store videos.18, 20

-

Mobile: the ability to access online information on a mobile device, such as a smart phone. Mobile also includes geographic tracking so users can find wineries and other business within their vicinity or ‘check in’ to let their friends know their location.21 Foursquare and Foodspotting are examples of apps that function in this way.

Numerous studies describe how social media can be useful to wine consumers and wineries. Leigon suggests that social media assists wine sales because of the pervasiveness of WOM opinion among wine consumers.11 Wilson and Quinton found that the socialization aspect of social media was a good fit with wine, as it allowed consumers to exchange information and encourage others to try different wines.13 Socialization supports Lockshin and Corsi’s study that identified personal recommendations as an important influence on purchasing wine.22 Of particular note, Atkin and Thach identified Millennials as a customer segment especially prone to social media marketing — raised in the information era, they use social media channels to learn about wine brands and reduce purchasing risks.23

Regarding social media channels and wine consumers, Newman revealed that people watch 700,000 wine videos per month, tweet 7,000 wine messages per day and that 300 iPhone apps exist.24 Yet, Facebook dominates as the preferred channel. Facebook’s popularity is partially explained by Pietro and Pantano’s seminal study — they found a high correlation between platform ease of use, usefulness through eWOM knowledge gathering and social enjoyment to user purchasing intent.25 Supporting Facebook’s contribution to usefulness and enjoyment, Breslin reports wine drinkers spend approximately 6.2 hours per week socializing on Facebook.26

Twitter follows Facebook in popularity. Wilson and Quinton conducted an interesting research on Twitter’s contribution to winery revenue. Although they proved Twitter’s contribution to soft values, hard values in terms of ROI were inconclusive.13 However, McMaster and Schwartz argue that mobile social platforms such as Twitter are the most immediate methods of contacting consumers as messages are read after four minutes of sending versus email at 48 hours.27 Timeliness translates to reliability in gathering accurate customer feedback, representing potential cost savings. Mobile marketing also includes geo-tracking and the ability to send promotional messages to nearby consumers.28 If the goal is to develop high-value customer relationships, blogs tend to be the best channel. Alder Yarrow’s popular Vinography blog lists over 700 English language wine blogs alone and estimates that over 100,000 people read wine blogs per month.29, 30

Several studies have investigated social media practices in the global wine industry. One of the earliest (Thach) analyzed web 2.0 practices of 208 US wineries and found that, although 61 per cent had online shopping for consumers, only 11 per cent were using vlogs (video) and only 2 per cent using blogs to increase brand awareness.20 At that time, linking to social network sites such as Facebook was not yet a standard feature on winery websites. In 2013, Alonso et al. conducted a study on wineries in Australia, Canada, New Zealand, Spain, Italy, South Africa and the United States, and discovered that 35 per cent reported using social media.31 Of these users, the number one reason was to communicate with customers about events at the winery. The second top reason was to promote and market wines. By 2014, the statistics on social media usage having increased dramatically, a cross-cultural team of researchers (Szolnoki et al.) proved a high-level of social media acceptance throughout Old World and New World wineries. This study confirmed Facebook, followed by Twitter, as the leading social platforms.32 Consistent with previous studies, the 8th International Conference of the Academy of Wine Business Research confirms that wineries use social media to communicate, promote events, advertise wines and acquire new customers.33

Although limited documentation exists on social media ROI in the wine industry, there is a growing collection of cases for both Old World and New World wineries. A German study surveyed 321 German wineries’ use of Facebook and concluded that 64 per cent of winery owners managed the social media accounts and 83 per cent of them spent 1–3 hours per week managing these accounts.32 Consumers confirmed that they were perceptive to marketing promotions made on Facebook. In fact, Szolnoki found that recommendations on Facebook motivated wine purchases for 75 per cent of the winery fans and that fans purchased 40 per cent more wine than did non-fans directly from wineries.

As for the New World, one of the most well-known studies is that on Murphy-Goode Winery located in Sonoma County, California. Murphy-Goode implemented a 6-month social media strategy to obtain 880 million media displays, leading to a 130 per cent growth in sales revenue and a 70 per cent rise in tasting room traffic.34 Also in Sonoma County, La Crema’s ‘Virtual Vintner’, a digital wine making experience where 22,290 registered consumers vote for steps in the wine making process, from appellation to barrel regime, is hosted by La Crema’s winemaker Elizabeth Grant-Douglas. An omni-channel digital campaign accompanies the Virtual Vintner for full customer engagement. According to Mark Gordon, senior digital communications manager, Jackson Family Wines (La Crema’s parent company) reports the comprehensive campaign added 15,000 email subscribers and inspired 300,000 social media engagements within 3 months of launching. Information Resources Incorporated scan data confirms it sold an additional 7,780 cases of wine off-premise and increased ecommerce sales by 134 per cent over the previous year, resulting in a 12 per cent revenue growth.35

Another example, Pacific Rim Winery located in Willamette County, Oregon, launched a $10,000 social media campaign in 2010 with the objective of educating consumers about the Riesling grape.36 Marketers created an online promotional book available free of charge in exchange for consumer ‘likes’ on its Facebook page. Pacific Rim also invited consumers to participate in a contest describing why they loved Riesling. Results showed that the campaign achieved a 15 per cent increase in revenue by driving more than 7,000 consumers to the Pacific Rim website.37

Further abroad, Stormhoeck, a small winery in South Africa, increased revenue because of social media strategy when it hired a wine blogger to write about its wines.38 It also incentivized international wine bloggers to write about the brand by shipping them a free bottle of wine and inviting them to attend one of its 100 wine-paired dinners. Results showed an increase in sales from 50,000 cases a year to 300,000.

In 2013, behemoth wine corporation Constellation established a new digital marketing division as part of its global marketing efforts. The division strategically placed its wine brands on multiple social media platforms. For example, it now markets 27 brands on Facebook alone. In 2014, Karena Breslin, Constelation’s vice president for digital marketing, reported 37 per cent higher sales and $42m in retail sales due to digital marketing.39 It also implemented online promotions and mobile coupons. For example, it recently conducted an email promotion for its Woodbridge brand and grew retail sales by 127 per cent. It also placed an ad on the app ‘Hello Vino’ that caused 13,000 consumers to include Constellation brand wines on their shopping lists. The cost of the ad was $70,000, but it achieved $876,000 in retail value, creating a positive ROI.40 Constellation also invested $200,000 into its Arbor Mist’s Facebook page. The Facebook advertisements gained 42,100 additional fans, translating to a $1.3m increase in sales, an impressive ROI.39

Methodology

A quantitative online survey was used to measure social media’s perceived impact on wine sales and winery demographics. The survey, originally developed by Geisenheim University, was modified to include questions on wine sales. The resulting survey included a total of 25 questions using standard 5-point Likert-type scales, simple rating questions, and short answer replies. In order to measure wine sales, respondents were asked their perceptions on the following question: ‘In general, how much impact do you believe your social media efforts have on wine sales?’ Possible answers could be: 0 per cent, 5 per cent, 10 per cent, 15 per cent, 20 per cent, 25 per cent, 30 per cent, 35 per cent, 40 per cent, 45 per cent, 50 per cent or more than 50 per cent.

The survey was beta-tested and minor revisions were made. The survey was launched on Survey Monkey for 3 weeks in November of 2013. An email with a link to the survey was sent to the owner or general manager of each of the 7,240 wineries in the Wines & Vines Database, requesting that they complete the survey to support wine business research in the USA. Two follow-up emails were also sent to encourage a higher response rate.

A total of 438 responses were received (6 per cent response rate), but some responses were discarded because of lack of completion — the final sample for analysis was 375 surveys. For the analysis of variance (ANOVA) analyses, 14 additional wineries were removed from the sample because survey participants indicated no use of social media and said that social media had no impact on their sales. The data was analyzed using the statistical functions of Excel, including descriptive statistics and ANOVAs. The descriptive statistics divided the survey responses into four categories:

-

No impact on wine sales (0 per cent)

-

Low impact on wine sales (5 per cent–10 per cent)

-

Moderate impact on wine sales (>10 per cent–<30 per cent)

-

High impact on wine sales (30 per cent and above).

The ANOVA analyses investigated the extent to which different factors influenced the perceived impact on wine sales. We investigated two factors influencing social media’s perceived impact on sales:

-

1)

intensity of social media use based on the number of different platforms used and

-

2)

whether or not the social media marketer was paid for their work.

Results

Of the 375 wineries that completed the survey, 235 (62.7 per cent) were from California. The other 140 wineries (37.3 per cent) represent a total of 35 states. Respondents listed over 110 different regions or American Viticulture Areas other than the state. The case volume of the respondents ranged from 4 to 4 million cases per year, with an average of just under 41,100 cases. Vineyard ownership ranged from no ownership to 6,500 acres. The average number of vineyard acres owned was 121.4 among all respondents and 165.5 among those who own vineyards.

The data was sorted into four categories of wineries on the basis of perceived impact of social media practices on wine sales:

-

1)

No impact on wine sales (0 per cent) — 48 wineries;

-

2)

Low impact on wine sales (5 per cent–10 per cent) — 153 wineries;

-

3)

Moderate impact on wine sales (>10 per cent–<30 per cent) — 107 wineries; and

-

4)

High impact on wine sales (30 per cent and above) – 67 wineries.

A frequency count was then used to analyze nine common social media practices in the US wine market (see Table 1).

Results show Facebook as the gateway platform into social media marketing for most wineries. Typically, wineries that did not use Facebook used no social media marketing. No specific platform seems to offer an advantage on impacting wine sales. As discussed earlier, being on multiple platforms increases social media’s impact on wine sales. This data suggests that social media engagement, such as monitoring and responding to customer review sites like TripAdvisor and Yelp, may be important to driving wine sales.

The analysis also looked at the purpose of using social media within levels of use intensity (see Table 2). Not surprisingly, wineries that do not have a clear idea of what purposes are served by using social media are less likely to see a strong impact on their wine sales. Beyond that, more research is needed to determine the benefit to wineries of having defined social media marketing objectives.

A third analysis examined who was managing social media efforts within the winery (see Table 3). Results show that the social media’s effectiveness does not depend on expertise in that field — however, social media marketing seems to be most effective when the owner maintains social media accounts and keeps the information current. Benefiting from social media requires an investment of time and, often, it is the owner’s time that has the greatest impact on wine sales.

The data was also analyzed using ANOVA. We examined three factors that influence social media practice’s impact on wine sales. For the dependent variable, we used winery manager’s reported impact of social media use on wine sales. Survey respondents could choose between 0 per cent and 50 per cent in 5 percentage-point increments or choose ‘more than 50 per cent’. For purposes of the ANOVA analysis, we replaced ‘more than 50 per cent’ with 55 per cent for the six wineries out of 361 respondents (6 per cent) who chose that response.

Number of social media platforms used

The first analysis determined whether wineries benefit from taking a diversified approach to using social media rather than focussing on one or two platforms. We divided the sample into three groups on the basis of how many social media platforms they reported using:

-

wineries using only two platforms (30 per cent of the wineries);

-

wineries using three to five platforms (45 per cent of the wineries); and

-

wineries using six or more platforms (25 per cent of the wineries).

Results (see Table 4) show wineries that use multiple social media platforms experience a greater impact on wine sales from their use of social media.

Another factor that could influence social media’s impact on wine sales is the expertise or experience of the person maintaining the social media activities. As a proxy for expertise, we divided the wineries into two groups on the basis of whether the person maintaining social media marketing was paid (41 per cent of the wineries) or unpaid, such as the winery owner, family member or friend (59 per cent of the wineries). The ANOVA analysis shows that unpaid social media personnel has a stronger influence on wine sales, but the results are not statistically significant. This shows that a combination of passion for the task and time devoted to it has a greater impact on wine sales, and both could be lower from a person being paid to maintain the social media.

Finally, we looked at whether the size of the winery, measured by case volume, influenced the impact of social media on wine sales. The data in our sample reveals that a winery’s case volume does not play a factor in determining the impact of social media marketing, except for larger wineries where the impact of social media marketing is less. When we define a large winery as having an annual production of 50,000 cases or more, the difference between the large and not-as-large wineries is significant at the 0.10 level. When the annual case production for a large winery is defined as 100,000 or more, the results are significant at the 0.05 level as shown by the ANOVA analysis (see Table 5).

Discussion, future research and limitations

The research results provide several implications for wine marketers and researchers. Of the 375 survey respondents, at least 87 per cent perceived an impact on wine sales due to social media efforts, with at least 18 per cent of these attributing an increase in wine sales of 30 per cent or more due to social media. This suggests that, in the US market, social media impacts wine sales. This implies that winery-marketing professionals would benefit from adopting at least some social media practices into their marketing mix. At the same time, one limitation of this study is the measurement of perceived wine sales rather than actual sales data — therefore, additional research on this area is warranted.

Regarding social media practices that appear to be most beneficial, Facebook was identified as the ‘gateway’ platform, but those who used multiple platforms benefited from the greatest increase in wine sales. Also, wineries responding to consumers who posted comments on TripAdvisor and Yelp were some of those who reported the highest revenues. This reveals that wine marketing professionals need to utilize multiple platforms and pay special attention to feedback from consumers in online forums. Other hospitality-based industries, such as hotels and restaurants, frequently respond to customer comments on TripAdvisor and Yelp — it may be beneficial for wineries to follow suit. Again, this could be a fertile area for additional research on wine marketing.

One of the most intriguing results of this research is that of staffing the social media functions. Wineries reporting higher wine sales reported the owner as managing most of the social media efforts. Although this means more work by the owner, it does suggest that customers want to engage with someone intrinsic to the business. Consistent with other research, customers crave authenticity in their social media interactions.41 Furthermore, although the ANOVA did not conclusively prove this, the results reveal that smaller wineries may participate in social media arenas and respond to customers more quickly than may larger wineries. Although the diverse range of winery sizes (4–4 million cases) limits this research, the suggestion of ‘smaller and more responsive’ wineries is a useful topic for future social media marketing research. It implies to wine marketers that there may be a potential advantage in using social media for small wineries with relatively unknown brands.

References

Kaplan, A. and Haenlein, M. (2010) ‘Users of the world, unite! The challenges and opportunities of social media’, Business Horizons, Vol. 53, No. 1, pp. 59–68.

Mckinsey.com. (2015) , ‘Getting a sharper picture of social media’s influence’, available at http://www.mckinsey.com/insights/marketing_sales/getting_a_sharper_picture_of_social_medias_influence, accessed 22 November 2015.

Wolny, J. and Charoensuksai, N. (2014) ‘Mapping customer journeys in multichannel decision-making’, Journal of Direct, Data and Digital Marketing Practices, Vol. 15, No. 4, pp. 317–326.

Facts, U. (2015) , ‘Topic: Wine market’, www.statista.com, available at http://www.statista.com/topics/1541/wine-market/, accessed 16 November 2015.

Parsons, A. (2013) ‘Using social media to reach consumers: A content analysis of official Facebook pages’, Academy of Marketing Studies Journal, Vol. 17, No. 2, pp. 27–36.

Stelzner, M. (2015) , ‘Social media marketing industry report: How marketers are using social media to grow their businesses’, Social Media Examiner, available at http://www.socialmediaexaminer.com/SocialMediaMarketingIndustryReport2015.pdf, accessed 22 November 2015.

Johnson, N. (2014) , ‘Whitepapers|Research & Reports|B2B Marketing Resources|The State of Corporate Social Media’, B2bmd6dev.tsadm.tincan.co.uk, available at http://b2bmd6dev.tsadm.tincan.co.uk/resources/listing/whitepapers, accessed 22 November 2015.

Chaffey, D. and Patron, M. (2012) ‘From web analytics to digital marketing optimization: Increasing the commercial value of digital analytics’, Journal of Direct, Data and Digital Marketing Practices, Vol. 14, No. 1, pp. 30–45.

Mondavi, R. (2008) Forward in Wine Marketing & Sales: Success Strategies for a Saturated Market, The Wine Appreciation Guild, San Francisco.

Chossat, V. and Gergaud, O. (2003) ‘Expert opinion and gastronomy: The recipe for success’, Journal of Cultural Economics, Vol. 27, No. 2, pp. 127–141.

Leigon, B. (2011) Grape/Wine Marketing with New Media and Return of the Boomer, Practical Winery & Vineyard Journal, San Rafael.

Laverie, D. A., Humphrey, W. F., Velikova, N., Dodd, T. H. and Wilcox, J. B. (2011) , ‘Building wine brand communities with the use of social media: A Conceptual Model’, 6th AWBR International Conference Bordeaux Management School, BEM, France.

Wilson, D. and Quinton, S. (2012) ‘Let’s talk about wine: Does twitter have value?’ International Journal of Wine Business Research, Vol. 24, No. 4, pp. 271–286.

Rosenberg, J. (2011) , ‘Presentation on social media and Wine Tourism’, Wine Tourism Conference, Napa, CA, Summer 2011.

Wineinstitute.org. (2014) , ‘California wine sales grow 4.4 per cent by Volume and 6.7 per cent by Value in the US — The Wine Institute’, available at https://www.wineinstitute.org/resources/pressroom/05192015, accessed 16 November 2015.

Gibb, R. (2015) , ‘Internet wine sales top $5 billion|Wine News & Features’, Wine Searcher, available at http://www.wine-searcher.com/m/2013/06/internet-wine-sales-top-5-billion, accessed 16 November 2015.

Kaplan, A. M. and Haenlein, M. (2010) ‘Users of the world, unite! The challenges and opportunities of social media’, Business Horizons, Vol. 53, No. 1, pp. 59–68.

Pitt, L., Mills, A. J., Chan, A., Menguc, B. and Plangger, K. (2011) , ‘Using Chernoff faces to portray social media wine brand images’, 6th AWBR International Conference Bordeaux Management School, BEM, France.

Yung-Hui, L. (2012) , ‘1 billion Facebook users on earth are we there yet?’, available at http://www.forbes.com/sites/limyunghui/2012/09/30/1-billion-facebook-users-on-earth-are-we-there-yet/, accessed 26 January 2013.

Thach, L. (2008) Direct Wine Sales and Wine 2.0 (eds, 2nd edit) Wine: A Global Business, Miranda Press, New York.

Walton, Z. (2012) , ‘Foursquare integrates Foodspotting, Other Apps Into Its Core Service’, available at http://www.webpronews.com/foursquare-integrates-foodspotting-other-apps-into-its-core-service-2012-06, accessed 19 October 2013.

Lockshin, L. and Corsi, A. M. (2012) ‘Consumer behavior for wine 2.0: A review since 2003 and future directions’, Wine Economics & Policy, November. Vol. 1, No. 1, pp. 2–23.

Atkin, T. and Thach, L. (2012) ‘Millennial wine consumers: Risk perception and information search’, Wine Economics and Policy, Vol. 1, No. 1, pp. 54–62.

Newman, K. (2010) , ‘How wine lovers use social media: Wine and social media have created an incredible force within the industry’, Wine Enthusiast, available at http://www.winemag.com/Wine-Enthusiast-Magazine/March-2010/Wine-Online-How-Wine-Lovers-Use-Social-Media/, accessed 22 November 2015.

di Pietro, L. and Pantano, E. (2013) ‘Social network influences on young tourists: An exploratory analysis of determinants of the purchasing intention’, Journal of Direct, Data and Digital Marketing Practices, Vol. 15, No. 1, pp. 4–19.

Breslin, K. (2013) , ‘Presentation on Constellation Digital Marketing in 2012’, San Francisco, CA, November 2013.

McMaster, M. and Schwartz, G. (2013) ‘Emotion and feedback: The keys to customer engagement’, Journal of Digital & Social Media, Vol. 1, No. 3, pp. 256–273.

Pelet, J. and Lecat, B. (2014) ‘Smartphones and wine consumers: A study of Gen-Y’, International Journal of Wine Business Research, Vol. 26, No. 3, pp. 188–207.

Cosenza, T., Solomon, M. and Kwon, W. (2014) ‘Credibility in the blogosphere: A study of measurement and influence of wine blogs as an information source’, Journal of Consumer Behaviour, Vol. 14, No. 2, pp. 71–91.

Beninger, S., Parent, M., Pitt, L. and Chan, A. (2014) ‘A content analysis of influential wine blogs’, International Journal of Wine Business Research, Vol. 26, No. 3, pp. 168–187.

Duarte Alonso, A., Bressan, A., O’Shea, M. and Krajsic, V. (2013) ‘Website and social media usage: Implications for the further development of wine tourism, hospitality, and the wine sector’, Tourism Planning & Development, Vol. 10, No. 3, pp. 229–248.

Szolnoki, G., Taits, D., Nagel, M. and Fortunato, A. (2014) ‘Using social media in the wine business’, International Journal of Wine Business Research, Vol. 26, No. 2, pp. 80–96.

Eighth International Conference of the Academy of Wine Business Research. (2014) , International Journal of Wine Business Research.

Kakaviatos, P. (2011) , ‘Wine and web 2: Social marketing: What wineries need to do and what bloggers are already doing’, available at http://www.connectionstowine.com/wine-and-the-web-2/social-media/, accessed 22 March 2012.

Swindell, B. (2014) , ‘La Crema uses crowdsourcing to make wine, engage consumers’, Santa Rosa Press Democrat, available at http://www.pressdemocrat.com/business/3078429-181/la-crema-uses-crowdsourcing-to?page=2, accessed 16 November 2015.

Emerson, M. F. (2012) , ‘Using social media to promote an underdog wine’, available at http://boss.blogs.nytimes.com/2012/07/06/using-social-media-to-promote-an-underdog-wine/?_r=0, accessed on 21 July 2013.

Moore, B. (2012) , ‘Facebook marketing case study: Pacific Rim Riesling wine’, available at http://www.furlongpr.com/facebook-marketing-case-study-pacific-rim-riesling-wine/#more-8914, accessed 20 January 2013.

Resnick, E. (2008) Wine Brands, Success Strategies for New Markets, New Consumers and New Trends, Palgrave MacMillan, New York, NY.

Franson, P. (2014) , ‘Wine social media pays off’, Wines & Vines, available at http://www.winesandvines.com/template.cfm?section=news&content=135197, accessed 16 November 2015.

Breslin, K. (2013) , Presentation on Constellation Digital Marketing in 2012. San Francisco, CA, November 2013.

Olsen, J. and Hermsmeyer, J. (2008) ‘Direct wine sales and wine 2.0in L. Thach and T. Matz (eds) Wine: A Global Business, 2nd edn Miranda Press, New York.

Author information

Authors and Affiliations

Additional information

1MW is the Distinguished Professor of Wine and a Professor of Management at the Wine Business Institute of Sonoma State University in California, USA.

2is the Associate Dean of Academics in the Chaplin School of Hospitality and Tourism Management at Florida International University, USA.

3is a Wine MBA candidate at the Wine Business Institute of Sonoma State University in California, USA.

Rights and permissions

About this article

Cite this article

Thach, L., Lease, T. & Barton, M. Exploring the impact of social media practices on wine sales in US wineries. J Direct Data Digit Mark Pract 17, 272–283 (2016). https://doi.org/10.1057/dddmp.2016.5

Published:

Issue Date:

DOI: https://doi.org/10.1057/dddmp.2016.5