Abstract

The representative agent (RA) approach of the mainstream economics allows a rich analysis of intertemporal maximization; but it rules out the possibility of the analysis of complex interactions. It is the latter that are at the root of this and other crises. We argue that the RA approach is simply not up to the task of enhancing our understanding of modern macroeconomies and that the standard cannot provide an adequate framework for understanding the economy even in more normal times.We advocate a bottom-up approach, where high-level (macroeconomic) systems may possess new and different properties than the low-level (microeconomic) systems on which they are based. The heterogeneous agent approach provides an alternative, one which has already proven its metal in helping us understand the interlinkages which helped give rise to the crisis.

Similar content being viewed by others

A CRITIQUE OF THE MAINSTREAM APPROACH

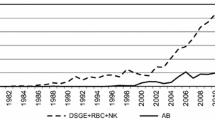

The current economic crisis is one of several factors contributing to questioning the robustness and the limitations of the mainstream approach. Formulated as a DSGE (dynamic stochastic general equilibrium) model, it is based upon the process of intertemporal maximization of utility in the market clearing context of a standard competitive equilibrium theory. There have been numerous critiques of that theory, for example, related to the assumptions of rational expectations and perfect competition. Our analysis focuses on another feature that makes the model's usefulness in macro-economic analysis particularly limited. Built upon the representative agent (RA) framework,Footnote 1 it rules out most of the key macro-economic interactions by assumptionFootnote 2: since most of what is relevant in economics concerns interaction and coordination of heterogeneous agents, the RA framework undermines macroeconomic analysis. The model begins with assumptions that trivially lead to conclusions that there can be no unemployment or liquidity crises; how can such a model provide much insight into the economy's current predicament of high unemployment, or how it got there? This approach also has (by construction) nothing to say about the network aspects of lending and inter-bank linkages that have become apparent during the current crisis. Economic theory based on the RA model has, in short, nothing to say about financial crises, bankruptcies, domino's effects, systemic risk and any pathology in general. Any claim it might make about the efficiency of the market is suspect: it is a result of the extreme assumptions underlying the model.Footnote 3

In an RA model, there are no lenders, no borrowers, and therefore no credit markets. Small departures from the perfect information hypothesis have been shown to undermine most of the key propositions of the standard competitive model. (Stiglitz 1992, 2001, if prices convey information about the quality there cannot be an equilibrium price as determined by a standard demand-supply analysis, since demand curves themselves depend on the probability distribution of the supply; Grossman and Stiglitz 1976, p. 98; 1980).

In short, the RA framework of the DSGE models adopts the most extreme form of conceptual reductionism in which macroeconomics and the financial network are reduced to the behavior of an individual agent.Footnote 4 The RA in economics tantamount to saying that “macroeconomics equals microeconomics.”

THE ALTERNATIVE: A HETEROGENEOUS AGENT-BASED APPROACH

There are alternative frameworks, still in their infancy, that provide a more promising research strategy for providing insights into what has happened in this and other crises. But this alternative framework is also useful in providing insights into the workings of the economy out of crises. Financial markets (lending and borrowing) are still central, and these can only be studied within a framework with heterogeneous agents. We believe a change of focus is necessary: an appropriate micro foundation that considers interaction at an agent-based level.

In a multi-agent framework with heterogeneous agents, the crisis is a phenomenon emerging from the microeconomic interaction. If the reductionist paradigm is applied, however, the deep understanding of the interplay between the micro and macro levels is ruled out, as well as any “pathological” problems, such as coordination failure. Only with such models can we make sense of what has come to the center of the policy debate today, the notion of systemic risk. Indeed, we might argue that the RA model is partly to blame for the crisis, for in those models, there is no such thing as systemic risk; policy makers, comforted by the notion that they were following “best practices” of the most advanced monetary theories in taming inflation, assuring the stability of the economy, paid no attention to the far more important issues of financial structure. In the straightjacket of this methodology, it is hardly surprising that the standard macro framework is without any help in understanding the current events.

Fortunately, over the past decade, there has been extensive research providing the foundations of a multi-agent approach focusing on credit linkages. Although this research has received scant attention within the mainstream [with notable exceptions: Freixas et al. 2000; Allen and Gale 2001; Furfine 2003; Stiglitz and Greenwald 2003; Boss et al. 2004; Boissay 2006; Iori et al. 2006; Battiston et al. 2007; Nier et al. 2007], it has recently been the subject of intense interest by the Bank of England [Haldane 2009].

In order to develop sound micro founded models, requires a methodology which allows for the interactions of economic agents and their links in a networked economy. We believe that there has to be some degree of heterogeneity of agents. They may be affected, for instance, by different shocks. Even more important are differences in information.

A model with heterogeneous agents (ABM) interacting in a network has to be seen as a first step toward modeling serious microfoundations. For instance, in a series of papers [Gallegati et al. 2008; Battiston et al. 2009; Delli Gatti et al. 2009, 2010] we have shown how a structure of connections between firms, banks, and households allows a deeper analysis of the systemic risk, bankruptcies, and domino effects in the financial sector, and their repercussions on output.

CREDIT LINKAGES

As we have noted, one central aspect of these interrelationships are those related to credit. Building upon ideas expounded first in Stiglitz and Greenwald [2003, chapter 7], we have modeled a credit network consisting of households, firms, and banks. Agents are linked by “inside” credit (e.g. credit relationships connecting firms belonging to different layers of the same industry, or connecting banks on the interbank market) and “outside” credit (i.e. credit relationships connecting agents belonging to different sectors, i.e. banks and firms).

Balance sheets and financial flows are, of course, central in understanding links among agents in the firm-banking sectors within a network theory framework. But this literature has called attention to aspects that previously received little notice. For instance, bankruptcy itself is not central to the RA literature; yet one cannot understand credit markets and credit interlinkages — or liquidity crises — without an understanding of the risks of bankruptcy. As the net worth of a firm decreases, the interest rate which it has to pay — to compensate for the risk of bankruptcy — increases. As a result, in stochastic models there is an effect which we call “trend reinforcement,” the likelihood of a further decline in firm net worth is increased.

There are at least three fundamental features of the real-world mechanisms based on the effects of shocks on the network of credit relationships that are ignored by the RA approach.

First and foremost, by construction, the shock which gives rise to the macro-economic fluctuation is uniform across agents. The presumption is that idiosyncratic shocks, affecting different individuals differently, would “cancel out.” But in the real world idiosyncratic shocks can well give rise to aggregative consequences; such shocks can be the source of an “epidemic,” giving rise to financial distress, the effects of which diffuse throughout the economy, and can often does translate into a contraction of real GDP. In other words, in a financial network idiosyncratic shocks usually do not cancel out in the aggregate, especially if the shocks hit crucial nodes (hubs) of the network. Studying when that can be the case — and how the structure of the network affects the aggregative impacts — should be a prime focus of macro-economic analysis.

Second, the aggregate (RA) view does not (cannot) capture the fact that the spreading of a financial disease may proceed at different speeds in different parts of the macroeconomics. For some agents, financial robustness may be procyclical, whereas for other agents it is financial fragility that may be pro-cyclical.

Last but not least, in a credit network a shock (bankruptcy) in one firm (bank) can lead to an avalanche of bankruptcies. Suppose, for instance, that a firm goes bust. Both the suppliers and the banks, which made business with the bankrupt firm, will be adversely affected by the default. The deterioration of the bank's financial condition because of the borrower's bankruptcy may be absorbed if the size of the loan is small and/or the bank's net worth is high. If this is not the case, the bank could go bankrupt. If the bank survives, however, it will restrain credit supply and/or make credit conditions harsher raising the interest rate on loans across the board for all its borrowers. Therefore, the default of one agent can bring about an avalanche of bankruptcies. Although the proximate cause of the bankruptcy of a certain firm in the middle of the avalanche is the interest rate hike, the remote cause is the bankruptcy of a firm at the beginning of the avalanche that forced the banks to push interest rates up. The interest rate hike leads to more bankruptcies and eventually to a bankruptcy chain: “the high rate of bankruptcy is a cause of the high interest rate as much as a consequence of it” [Stiglitz and Greenwald 2003, p. 145].Footnote 5

An avalanche of bankruptcies therefore is because of the positive feedback of the bankruptcy of a single agent on the net worth of the “neighbors,” linked (directly or indirectly) to the bankrupt agent by credit links of one sort or another. Bankruptcy cascades may be of different size depending not only on the magnitude of the shock but also on the topology of the network. Some network designs may be good at absorbing small shocks, when there can be systemic failure when confronted with a large enough shock. Similarly, some topologies may be more vulnerable to highly correlated shocks. When the corporate and/or the banking sector are polarized, the vulnerability of the network to a shock (i.e. systemic risk) increases when there is a highly connected agent, because his default, due to a relatively rare event, may generate a non-negligible cascade of bankruptcies.

FURTHER RESULTS

Although models of heterogeneous agents with network credit linkages are still in its infancy, a number of interesting results have already been obtained. One central set of results concerns risk diversification vs contagion. Standard models argue that the more widely shared risks, the better the performance of the economic system. This notion was central to the push for securitization. At the same time, concerns have been raised about “contagion,” the notion that a downturn in one country could lead to that in another. This is, of course, a result of some form of linkage — and often financial linkages. Most of the standard models provide no insights into the problem of contagion, and most policy analyses (e.g. those associated with the IMF) have compartmentalized their thinking: Before crises, they focus on the benefits of risk diversification; only in the midst of a crisis does the emphasis switch to the risk of contagion. In Gallegati et al. [2008], we provide a general characterization of diffusion processes, allowing analyzing both risk sharing and contagion effects at the same time. Interdependencies in real and financial assets are beneficial from a social point of view when the economic environment is favorable and detrimental when the economic environment deteriorates. In the latter case, private incentives are such that too many linkages are formed, with respect to what is socially desirable. The risk of contagion increases the volatility of the outcome and thus reduces the ability of the financial networks to provide the putative benefits associated with risk sharing. This analysis helps us understand the role of securitization in the current crisis — beyond the absence of transparency about the characteristics of the underlying assets that the multiple layers of financial intermediation fostered.

This analysis calls for a different emphasis on the role of public intervention. It shows that market equilibrium are not by themselves (constrained) Pareto efficient. This is, of course, a general result whenever information is imperfect or risk markets incomplete. [Greenwald and Stiglitz 1986]. But these models highlight particular sources of inefficiency, for example, in the structure of linkages, and natural forms that the intervention might take (for instance, interventions that weaken the channels that induce positive correlations and “disconnecting” the economy at crucial nodes (e.g. through circuit breakers) in the event of downturns. Both of these reduce the risk of contagion — and when done optimally, balance that benefit with the costs of risk diversification in more normal times.

Some of the results are, of course, similar to those derived in more conventional models: policy interventions should be aimed at rescuing institutions, but not their managers. Diminishing the cost of default actually increases the inefficiency because of the divergence between the social and the individual optimum.

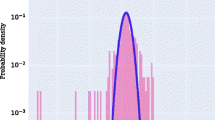

In Battiston et al. [2009], we characterize the evolution over time of a credit network as a system of coupled stochastic processes, each one of which describes the dynamics of individual financial robustness. The coupling comes from the connectivity of the network, since each agent's financial robustness is associated with the financial robustness of the partners through risk sharing, distress propagation, and the bankruptcy cascade effects. In this framework we consider the effects of a shock to a specific node as network connectivity increases. Under specific conditions, we detect the emergence of a trade-off between decreasing individual risk — because of risk sharing — and increasing systemic risk — because of the propagation of financial distress. The larger the number of connected neighbors, the smaller the risk of an individual collapse but the higher systemic risk. In other words, the relationship between connectivity and systemic risk is not monotonically decreasing as usually found in the literature. In more conventional models, as we have noted, risk sharing by itself would lead systemic risk to zero as the connectivity increases. Distress propagation and the bankruptcy cascade effect together with the financial accelerator may amplify the effect of the initial shock and lead to a full-fledged systemic crisis if they more than offset risk sharing.

CONCLUDING REMARKS

All modeling requires simplifications; and in making simplifications there are trade-offs. The RA approach allows a richer analysis of intertemporal maximization, but it rules out the possibility of the analysis of complex interactions. It is the latter that are at the root of this and other crises. We have argued that the RA approach is simply not up to the task of enhancing our understanding of modern macro-economies. We advocate is a bottom-up approach: let us start from the analysis of the behavior of heterogeneous constitutive elements (defined in terms of simple, observation-based behavioral rules) and their local interactions, and allow for the possibility that interaction nodes and individual rules change in time (adaptation). At the next meso-level, statistical regularities emerge that cannot be inferred from the primitives of individuals (self-emerging regularities). This emergent behavior not only feeds back to the individual level (downward causation), but also produces aggregate regularities at the next hierarchical level. High-level (macroeconomic) systems may possess new and different properties than the low-level (microeconomic) systems on which they are based (much as water has different properties from the atoms of hydrogen and oxygen that constitute it.)

This approach allows each and every proposition to be falsified at micro, meso and macro levels. No one should ever have claimed that the RA approach provided a precise description of how agents in the economy behaved. The hope was that by studying intensely and deeply these models, we could provide insights into the behavior of the aggregate. We should have, of course, tested the predictions of the model at every level — both at the level of the individual, the household and firm, and the macro-economy. It is now clear that model cannot provide an understanding of what happened in this and other crises. But we would argue that it cannot provide an adequate framework for understanding the economy even in more normal times. The heterogeneous agent approach provides an alternative, one which has already proven its metal in helping us understand the interlinkages which helped give rise to the crisis.

Notes

The RA framework is still used although the lack of theoretical foundations of the proposition according to which the properties of an aggregate function reflect those of the individual components have been demonstrated by Arrow [1963], Sonnenschein [1972], and Mantel [1974]. As put forcefully by two former advocates of the General Economic Equilibrium: Hildenbrand and Kirman [1988]: “There are no assumptions on isolated individuals, which will give us the properties of aggregate behavior. We are reduced to making assumptions at the aggregate level, which cannot be justified, by the usual individualistic assumptions. This problem is usually avoided in the macroeconomic literature by assuming that the economy behaves like an individual. Such an assumption cannot be justified in the context of the standard model.”

The representative agent model also rules out key problems of asymmetric information, which are essential in explaining unemployment and credit rationing.

See, for instance, Greenwald and Stiglitz [1986].

In natural sciences, the notion of reductionism is much more limited since it amounts to understanding the nature of macro-phenomena by the analysis of their constitutive elements, whose interaction allows for emergent phenomena, that is, characteristics not present in the single element.

Another important example of indirect interaction can be appreciated by arguing along the following lines [Greenwald and Stiglitz 1993; Delli Gatti et al. 2005]. Suppose that the equilibrium interest rate on loans is determined by a large number of credit contracts in a market for bank loans. Suppose moreover that, due for instance to a financial crisis, a non-negligible number of borrowers goes bankrupt. A loss because of non-performing loans shows up in the banks’ balance sheet. Banks react to this deterioration of their financial conditions by restraining the quantity of new loans and/or making credit conditions harder for the borrowers. This leads to a sudden increase of the market interest rate. The single (surviving) agent who is currently looking for a loan on that market is indirectly affected through the increase of the interest rate by the aggregate solvency (determined by the crisis and the associated bankruptcies) of the borrowers. Credit being now more expensive because of the adjustment process of the market price of credit, that is, the interest rate, the agent will be more cautious in getting into debt. This is true also of the other agents, of course. A tendency to reduce indebtedness will spread among borrowers. This second round effect plays a stabilizing role, attenuating the upward dynamic pattern of the interest rate. In this example, however, this is not the end of the story. In a setting characterized by heterogeneous financial conditions, the increase of the interest rate is likely to be lethal to those firms, which were already on the verge of bankruptcy because of an extremely low level of net worth. In other words, these firms will be pushed out of the market. The balance sheets of the lenders will be negatively affected by this new wave of bankruptcies, so that they will react by pushing even further up the interest rate. This too is a second round effect, but it plays a de-stabilizing role, exacerbating the upward dynamic pattern of the interest rate. In conclusion, there are two types of second-round effects at work here: the first one is essentially a negative feedback effect with a stabilizing role, whereas the second one is a positive feedback effect with a destabilizing role. With a slight abuse of terminology, this second round effect can be defined as a financial accelerator.

References

Allen, F., and D. Gale . (2001). Financial Contagion. Journal of Political Economy, 108 (1): 1–33.

Arrow, K.J. (1963). Social Choice and Individual Values, 2nd ed., New Haven: Yale University Press.

Battiston, S., D. Delli Gatti, M. Gallegati, B. Greenwald, and J.E. Stiglitz . (2007). Credit Chains and Bankruptcies Avalanches in Production Networks. Journal of Economic Dynamics and Control, 31 (6): 2061–2084.

Battiston, S., D. Delli Gatti, M. Gallegati, B. Greenwald, and J. Stiglitz . (2009). Liaisons Dangereuses: Increasing Connectivity, Risk Sharing and Systemic Risk, NBER Working Paper No. 15611.

Boissay, F. (2006). Credit Chains and the Propagation of Financial Distress, European Central Bank, Working Paper No. 573.

Boss, M., M. Summer, and S. Thurner . (2004). Contagion Flow Through Banking Networks. Lecture Notes in Computer Science, 3038: 1070–1077.

Delli Gatti, D., C. Di Guilmi, E. Gaffeo, M. Gallegati, G. Giulioni, and A. Palestrini . (2005). A new Approach to Business Fluctuations: Heterogeneous Interacting Agents, Scaling Laws and Financial Fragility. Journal of Economic Behaviour and Organization, 56 (4): 489–512.

Delli Gatti, D., M. Gallegati, B. Greenwald, A. Russo, and J. Stiglitz . (2009). Business Fluctuations and Bankruptcy Avalanches in an Evolving Network Economy. Journal of Economic Interaction and Coordination, 3: 195–212.

Delli Gatti, D., M. Gallegati, B. Greenwald, A. Russo, and J. Stiglitz . (2010). The Financial Accelerator in an Evolving Credit Network. Journal of Economic Dynamics and Control, forthcoming.

Freixas, X., B.M. Parigi, and J.-C. Rochet . (2000). Systemic Risk, Interbank Relations, and Liquidity Provision by the Central Bank. Journal of Money, Credit and Banking, 32: 611–638.

Furfine, C. (2003). Interbank Exposures: Quantifying the Risk of Contagion. Journal of Money, Credit and Banking, 35 (1): 111–129.

Gallegati, M., B. Greenwald, M. Richiardi, and J. Stiglitz . (2008). The Asymmetric Effect of Diffusion Processes: Risk Sharing and Contagion. Global Economic Journal, 3.

Greenwald, B., and J.E. Stiglitz . (1986). Externalities in Economies with Imperfect Information and Incomplete Markets. The Quarterly Journal of Economics, 101: 229–264.

Greenwald, B., and J.E. Stiglitz . (1993). Financial Market Imperfections and Business Cycles. The Quarterly Journal of Economics, 108: 77–114.

Grossman, S.J., and J. Stiglitz . (1976). Information and Competitive Price Systems. The American Economic Review, 66 (2): 246–253.

Haldane, A.G. (2009). Rethinking the Financial Network, mimeo.

Hildenbrand, W., and A.P. Kirman . (1988). Equilibrium Analysis: Variations on the Themes by Edgeworth and Walras. Amsterdam: North-Holland.

Iori, G., S. Jafarey, and F. Padilla . (2006). Systemic Risk on the Interbank Market. Journal of Economic Behaviour and Organization, 61 (4): 525–542.

Mantel, R. (1974). On the Characterization of Aggregate Excess Demand. Journal of Economic Theory, 7: 348–353.

Nier, E., J. Yang, T. Yorulmazer, and A. Alentorn . (2007). Network Models and Financial Stability. Journal of Economic Dynamics and Control, 31 (6): 2033–2060.

Sonnenschein, H. (1972). Market Excess Demand Functions. Econometrica, 40: 549–563.

Stiglitz, J. (2001). Information and the Change in the Paradigm in Economics, Nobel Prize Lecture.

Stiglitz, J., and B. Greenwald . (2003). Towards A New Paradigm in Monetary Economics. Cambridge: Cambridge University Press.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Stiglitz, J., Gallegati, M. Heterogeneous Interacting Agent Models for Understanding Monetary Economies. Eastern Econ J 37, 6–12 (2011). https://doi.org/10.1057/eej.2010.33

Published:

Issue Date:

DOI: https://doi.org/10.1057/eej.2010.33