Abstract

To borrow a phrase once used about business cycles, it can be said that “the study of super cycles necessarily begins with the measurement of super cycles” (adapted from Baxter and King, 1999). Are metal prices currently in the early phase of such a “super cycle”? Many market observers believe the answer is yes. Academics, on the other hand, are generally skeptical about the presence of long cycles. This paper searches for evidence of super cycles in metal prices by using band-pass filters to extract particular cyclical components from time series data. The evidence is consistent with the hypothesis that there have been three super cycles in the past 150 years or so, and that we are currently in the early phase of a fourth super cycle. Most analysts attribute the latter primarily to Chinese urbanization and industrialization.

Similar content being viewed by others

Notes

See also Armstrong, Chaundry, and Streifel (2006), Heap (2007), and Morgan Stanley (2006), as well as Rogers (2004), who cofounded the Quantum Fund with George Soros, and was among the first to highlight commodities as a long-term investment opportunity in the new millennium. Others in the investment industry followed.

This is an adaptation of the comment that Baxter and King (1999) made about business (rather than super) cycles.

Although producer price series from industry sources span many decades, LME trading began at different times for the various metals: copper and tin (1877), lead (1903), zinc (1915), aluminum (1978), nickel (1979).

For an examination of super cycles in steel, pig iron, and molybdenum, see Jerrett and Cuddington (2008).

See Radetzki (2008, Chapter 9) on the importance of the latter in the mineral and energy sectors.

Recall that periodicity and frequency in a cycle are inversely related. The period of the cycle is its duration from one trough, through the expansion and contraction phase, to the beginning of the next trough. The frequency is the number of cycles per unit of time (in days, month, years, etc., depending on the frequency with which the data are measured).

These techniques attempt to isolate stochastic rather than deterministic cycles in the data; they do not amount to fitting the best possible regular sine wave to the data series.

Although it is straightforward to decompose our “other shorter cycles” into business cycles (2–8 years) and, say, intermediate cycles (8–20 years), this is not necessary for the study of super cycles, especially given that the various cycles are roughly uncorrelated with each other. See Appendix IV for details.

We initially experimented with three different band-pass specifications for defining super cycles: BP(20,70), BP(20,50), and BP(20,70). These band-pass windows seem roughly consistent with the duration of super-cycle expansions discussed in Heap (2005, 2007) After some experimentation, we chose BP(20,70) as a reasonable characterization of what Heap had in mind. Appendix II shows how the different definitions of super cycle periodicity affect the characterization of the super cycle in the case of copper.

Note that the BP(2,70 and BP(70,∞) are complements; that is, their sum equals the actual price series.

Interestingly, the first version of our paper considered only five of the six LME base metals. Tin was overlooked. The later inclusion of tin in the super-cycle dating analysis at the end of the paper had remarkably little effect on our conclusions. Thus, our results are robust in that sense, at least.

Appendix III addresses the choice of deflator.

Tilton (2006) raises the interesting question: when using the ACF filter, how much recharacterization of super cycles and other shorter cycles will occur as more data come in over time? We hope to address this issue in our future research on super cycles.

It is interesting to note that the Great Depression actually includes two business cycles according to the NBER dating, with the deep contraction of 1929 being interrupted by a 50-month expansion between March 1933 and May 1937. See www.nber.org/cycles.

Our decomposition produces conclusions regarding the nickel price trend that differ from Maxwell (1999, p. 4): “Over the last fifty years as well there has been a downward trend in nickel prices, though price movements in the nickel have been volatile in the short run.”

The interested reader can reference the working paper version of the paper at www.mines.edu/~jcudding/.

Private correspondence with the authors during the fall of 2007 and early winter of 2008.

Note that the Comin-Gertler definition of business cycle is atypical in that it includes shorter seasonal and irregular components (with periods from 2 to 8 quarters), rather just the cycles with periods from 8 to 32 quarters as in Baxter and King (1999).

The U.S. Bureau of Labor Statistics website has a nice discussion of the differences in coverage between PPI and CPI: http://www.bls.gov/ppi/ppicpippi.htm.

The long U.S. PPI series for the period 1833 through 2005 was kindly provided by Chris Gilbert. We updated the series through 2006 using the PPI figures from the U.S. Bureau of Labor Statistics (via the Haver USECON database).

An article on the BLS website contains a discussion of lead lag relationships between the PPI and the CPI: http://www.bls.gov/opub/mlr/2002/11/art1full.pdf.

References

Adelman, I., 1965, “Long Cycles: Fact or Artifact?” The American Economic Review, Vol. 55, No. 3, pp. 444–463.

Armstrong, C., O. Chaundry, and S. Streifel, 2006, “The Outlook for Metals Markets,” paper presented at the G-20 Deputies Meeting, Sydney, Australia.

Baxter, M., and R.G. King, 1999, “Measuring Business Cycles: Approximate Band-Pass Filters for Economic Time Series,” The Review of Economics and Statistics, Vol. 81, No. 4, pp. 575–593.

Blanchard, O., 1997, “The Medium Run,” Brookings Papers on Economic Activity, No. 2, pp. 89–158.

Cashin, P., and J. McDermott, 2002, “The Long-Run Behavior of Commodity Prices: Small Trends and Big Variability,” IMF Staff Papers, Vol. 49, No. 2, pp. 1–26.

Christiano, L., and T. Fitzgerald, 2003, “The Band Pass Filter,” International Economic Review, Vol. 44, No. 2, pp. 435–465.

Cogley, T., and J.M. Nason, 1995, “Effects of the Hodrick-Prescott Filter on Trend and Difference Stationary Time Series Implications for Business Cycle Research,” Journal of Economic Dynamics and Control, Vol. 19, No. 1–2, pp. 253–278.

Comin, D., and M. Gertler, 2006, “Medium-Term Business Cycles,” The American Economic Review, Vol. 96, No. 3, pp. 523–551.

Cuddington, J.T., and C.M. Urzúa, 1989, “Trends and Cycles in the Net Barter Terms of Trade: A New Approach,” The Economic Journal, Vol. 99, No. 396, pp. 426–442.

Cuddington, J.T., R. Ludema, and S.A. Jayasuriya, 2007, “Prebisch-Singer Redux,” in Natural Resources: Neither Curse not Destiny, ed. by D. Lederman and W.F. Maloney (Stanford, California, Stanford University Press).

Davis, G., and M. Samis, 2006, “Using Real Options to Manage and Value Exploration,” Society of Economic Geologists Special Publication, Vol. 12, No. 14, pp. 273–294.

Deaton, A., and R. Miller, 1995, “International Commodity Prices, Macroeconomic Performance, and Politics in Sub-Saharan Africa,” Princeton Essays in International Finance, No. 79.

Evans, G.W., S. Honkapohja, and P. Romer, 1998, “Growth Cycles,” The American Economic Review, Vol. 88, No. 3, pp. 495–515.

Gilbert, C.L., 2007, “Metals Price Cycles,” paper presented at the Minerals Economics and Management Society, Golden, Colorado, April 17.

Gorton, G., and K.G. Rouwenhorst, 2004, “Facts and Fantasies about Commodity Futures,” Financial Analyst Journal, Vol. 62, No. 2, pp. 47–68.

Heap, A., 2005, China—The Engine of a Commodities Super Cycle (New York, Citigroup Smith Barney).

Heap, A., 2007, “The Commodities Super Cycle & Implications for Long Term Prices,” paper presented at the 16th Annual Mineral Economics and Management Society, Golden, Colorado, April.

Howrey, E.P., 1968, “A Spectrum Analysis of the Long-Swing Hypothesis,” International Economic Review, Vol. 9, No. 2, pp. 228–252.

Jerrett, D., and J.T. Cuddington, 2008, “Broadening the Statistical Search for Metal Price Super Cycles to Steel and Related Metals,” Resources Policy, Vol. 33, No. 4 (forthcoming).

Labys, W.C., A. Achouch, and M. Terraza, 1999, “Metal Prices and the Business Cycle,” Resources Policy, Vol. 25, No. 4, pp. 229–238.

London Metal Exchange, 2008, “Non-Ferrous Metals,” London Metal Exchange (March 10). Available on the Internet: lme.com/non-ferrous.asp.

Maxwell, P., 1999, “The Coming Nickel Shakeout,” Minerals and Energy, Vol. 14, pp. 4–14.

McDermott, J.C., P.A. Cashin, and A. Scott, 1999, “The Myth of Co-Moving Commodity Prices,” Bank of New Zealand Discussion Paper G99/9, Wellington, New Zealand.

Morgan Stanley, 2006, Global Commodities Review (New York, Morgan Stanley).

Nelson, C.R., and H. Kang, 1981, “Spurious Periodicity in Inappropriately Detrended Time Series,” Econometrica, Vol. 49, No. 3, pp. 741–751.

Pindyck, R.S., and J.J. Rotemberg, 1990, “The Excess Co-Movement of Commodity Prices,” The Economic Journal, Vol. 100, pp. 1173–1189.

Radetzki, M., 2006, “The Anatomy of Three Commodity Booms,” Resources Policy, Vol. 31, No. 1, pp. 56–64.

Radetzki, M., 2008, A Handbook of Primary Commodities in the Global Economy (Cambridge, Cambridge University Press).

Rogers, J., 2004, Hot Commodities: How Anyone Can Invest and Profitably in the World's Best Market (New York, Random House).

Sillitoe, R.H., 1995, “Exploration and Discovery of Base- and Precious-Metal Deposits in the Circum-Pacific Region During the Last 25 Years,” Resource Geology Special Issue, Vol. 19, p. 119.

Solow, R., 2000, “Toward a Macroeconomics of the Medium Run,” Journal of Economic Perspectives, Vol. 14, No. 1, pp. 151–158.

Tilton, J.E., 2006, “Outlook for Copper Prices—Up or Down?,” Paper presented at the Commodities Research Unit World Copper Conference. Santiago, Chile, April.

Tilton, J.E., and G. Lagos, 2007, “Assessing The Long-Run Availability of Copper,” Resources Policy, Vol. 32, No. 1–2, pp. 19–23.

Additional information

*John T. Cuddington is the Coulter Professor of Mineral Economics and Daniel Jerrett is a Ph.D. candidate at the Colorado School of Mines. Helpful discussions with Neil Brewster, Graham Davis, Rod Eggert, Alan Heap, and John Tilton are gratefully acknowledged.

Appendices

Appendix I. End Use Statistics for the LME Metals

Table A1 shows current global end use consumption of each LME metal used in the analysis in the paper. Although each metal has specific industry end-uses, many of the metals' consumption usages are related in one way or another to construction and transportation activities. End use has, of course, changed over time. For example, tin has gradually replaced lead in soldering applications.

Appendix II. Elaboration on Choice of Cutoff Points for Various Cyclical Components Obtained from the BP Filter

The BP filter methodology has the advantage that it is possible to decompose a time series into a number of mutually exclusive and exhaustive components. For our purpose, the natural choice revolves around the definition of the super cycle. Initially, we experimented with super-cycle definitions of 20 to 50 years, 30 to 70 years and 20 to 70 years, as these alternatives seemed broadly consistent with the description of super cycles in Heap (2005, 2007).

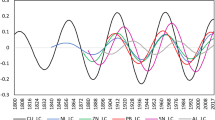

Figure A1 shows how the three definitions of the super cycle differ when applied to the natural logarithm of the real (CPI-deflated) price of copper.

Real Copper Super-cycle Components. Varying Filter Windows(Deflated by CPI)

Note: This figure graphs three possible window specifications for the asymmetric Christiano-Fitzgerald BP filter (BP) used to define super cycles the six LME metals in the paper. The figure shows how the definition of the super cycle for the natural logarithm of the CPI-deflated price of copper is affected by extracting cycles between 20 and 50 years vs. 30 and 70 years, vs. 20 and 70 years. Ultimately, we opted to use the BP(20–70) filter, as it produced super-cycle timing roughly consistent with that proposed by Heap (2005).

We ultimately settled on the 20 to 70-year definition of super cycles. With this definition, it makes sense to define the trend to include all cycles with periods above 70 years (denoted LP(70,∞)). We define all cycles with periods between 2 (the minimum detectible cycle period) and 20 years as “other shorter cycles,” denoted LP(2, 20). Thus, the log of each real metal price is decomposed into the three components described in the text.

If one is also interested in business-cycle movements in metals prices using the traditional definition of cycles in the 2- to 8-year range, it is straightforward to decompose our shorter cycles into two separate components, business cycles LP(2, 8) and, say, intermediate cycles LP(8, 20):

Comin and Gertler (2006) take a similar approach, decomposing various quarterly macroseries into a business cycle component, a medium-term component, and a trend, defined as follows:

Their medium-term business cycles are defined as the sum of the business cycle (2 to 32 quarters) and medium-term components (32 to 200 quarters).Footnote 19 The Comin-Gertler choice of cut-off periods at 200 quarters (that is, 50 years) is somewhat arbitrary, as is our choice of the 20- to 70-year BP window in defining super cycles.

Appendix III. Choice of Deflators: CPI vs. PPI

Discussions of real commodity price behavior invariably raise the question of the “appropriate” deflator (CPI, PPI, MUV, U.S.-based or other). No deflator can make the claim that it is universally “most relevant.” Ultimately, this depends on what relative prices one is most interested in for the questions at hand. For example, suppose a U.S. financial investor is considering investments in commodities (or industrial metals, or precious metals) as an asset class. Presumably she wants to know how their prices move over time relative to the CPI. Percentage changes in the metals prices deflated by the CPI would be the relevant “real” return. Gorton and Rouwenhorst (2004), for example, use the U.S. CPI as their deflator in their analysis of commodities as an asset class.

On the other hand, if one is looking for the price of metal inputs relative to output prices, then one would want to select the particular outputs of interest. Here the PPI for final goods (or particular Subcategories of interest) might be viewed as more relevant, because the PPI includes capital as well as consumption goods and excludes distribution costs and indirect taxes.Footnote 20 For a mining company that produces copper using energy inputs, the relative price of copper in terms of an energy input price index may be especially important to the overall profitability of the operation.

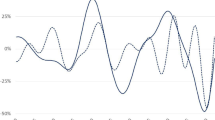

The analysis in the text uses the U.S. CPI from Heap (2005) to deflate nominal metal prices. To illustrate how the choice of deflator might affect our analysis, we consider the alternative of using the U.S. PPI.Footnote 21 Figure A2 shows the time plot of the CPI and PPI in log scale (LCPI and LPPI respectively) in the upper panel and their respective super-cycle components in the lower panel. Comparing the LCPI and LPPI series, it is clear that the CPI has risen more rapidly over the last century and a half than the PPI. Therefore the long-term trend in real commodity prices will be less positive or more negative when the CPI is the chosen deflator. Figure A3 compares the super-cycle components of the two deflators (LCPI_SC and LPPI_SC), one finds that the PPI super cycle has higher amplitude and generally leads the super-cycle component of the CPI, especially in the first half of the sample.Footnote 22

Comparing the U.S. CPI and PPI

Note: Comparing the CPI and PPI series, it is clear that the CPI has risen more rapidly over the last century and a half than the PPI. Therefore the long-term trend in real commodity prices will be less positive or more negative when the CPI is the chosen deflator. Comparing the super-cycle components of the two deflators, one finds that the PPI super cycle has higher amplitude and generally leads the super-cycle component of the CPI, especially in the first half of the sample. In each case, the super-cycle component was obtained by applying the asymmetric Christiano-Fitzgerald BP filter to extract periods between 20 and 70 years from the price series.

Comparison of Copper Super Cycle and Various Deflators

Note: The three series in the upper portion of the figure show the super-cycle components for the logarithm of the nominal prices of copper, the U.S. consumer price index and the U.S. producer price index. The lower portion of this graph shows the resulting super cycles for the (log of the) real copper price depending on which deflator is used. Subtracting the super cycle in the CPI from the nominal copper price's super cycle yields the super cycle for the CPI-deflated price of copper. Analogously, subtracting the super cycle in the PPI from the nominal copper price's super cycle yields the super cycle for the PPI-deflated price of copper. Because the super-cycle component of the PPI leads the CPI, especially during the early years of the sample, the use of the PPI rather than the CPI as deflator would shift the copper super cycle forward in time. In particular, note how the first super-cycle expansion in the later 1800s and early 1900s is shifted forward in time and is lower in amplitude when the PPI is chosen as the deflator.

The choice of deflator can have a potentially large impact on the characterization of super cycles in real metals prices. The logarithm of the real price of copper used in the text is, of course, just the log of the nominal price minus the log of the CPI. Interestingly, this identity continues to hold when examining super-cycle components (as the BP filter is a linear operator):