Abstract

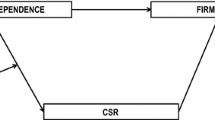

This article analyses how board structure can affect both financial and social performance, comparing family and non-family firms. Our theoretical framework is based on the integration of the agency theory, traditionally used in the analysis of the impact of the board on the firm’s financial performance, with the stakeholder theory, which is more appropriate in the analysis of the social aspects of the firm. Three main aspects are addressed: the analysis of the firm’s social performance; the integration of agency theory with stakeholder theory; and the study of the specific characteristics of family firms’ boards. The research confirms that neither the agency theory nor the stakeholder theory is fully able to explain on its own, without the other, the link between board structure and firm performance. The article has both practical and theoretical implications for the firm’s activities and increases our knowledge about the relationship between the board and firm performance.

Similar content being viewed by others

Notes

The ‘organicistic’ vision spread in the years following World War I (Ackoff, 1981) and still finds advocates in different cultural contexts (Landier, 1987; De Geus, 1997).

There are several empirical studies that have investigated the possible relationship between social and financial performance. However, results are contradictory (Griffin and Mahon, 1997; Preston and O’Bannon, 1997).

Developed by Tobin (1969), this ratio compares two different valuations of the same physical asset: the market value of a company’s stock and the equity book value of the same company. It can be used to reflect the ‘value added’ of intangible factors such as reputation or governance.

In June 2009, the name of the index changed from the FTSE MIB Index to the S&P/MIB 40 Index, and includes the 40 most liquid and capitalized Italian companies.

Data required for this study is not available for other firms quoted on the S&P/MIB 40 and other years.

Reputation ratings (such as the Fortune Index) or surveys of managers, financial analysts, directors and students come from respondents perceptions, often very different, and they suffer from excessive subjectivity. The information provided by firms, like that in a social report, could be unreliable because of lack of knowledge of the criteria for inclusion and omission of information. Moreover, the scales constructed on the basis of this information to qualitatively assess social performance could be affected by the objectives of the researcher. The quantitative measurements (such as corporate philanthropy and amount of pollutant emissions) are indirect and unreliable indicators of overall social performance, and they may be applied only for a limited sample of firms.

The ‘significance criteria’ were used as the entry requirement. According to these criteria, only the variables that contributed significantly to the model fit were included in the regression model. The individual contribution of a variable to the model fit was established by testing, from the partial correlation coefficients, the hypothesis of independence between that variable and the dependent variable. The significance criterion applied was that the introduced variable was significant at the 5 per cent level (10 per cent for the probability of taking the variable out of the model). Likewise, the increase in the R2 value as a result of including the variable in the model had to be statistically different from zero.

References

Ackoff, R.L. (1981) Creating the Corporate Future: Plan or Be Planned For. New York: John Wiley and Sons.

Adam, R.B. and Feirrera, D. (2003) A Theory of Friendly Boards. Stockholm, Sweden: SITE, Stockholm School of Economics. Working Paper.

Adams III F.A., Manners, G.E., Astrachan, J.H. and Mazzola, P. (2004) The importance of integrated goal setting: The application of cost-of-capital concepts to private firms. Family Business Review 17 (4): 287–302.

Agrawal, A. and Knoeber, C. (1996) Firm performance and mechanisms to control agency problems between managers and shareholders. Journal of Financial and Quantitative Analysis 31 (3): 377–397.

Anderson, R.C. and Reeb, D.M. (2003) Founding-family ownership and firm performance: Evidence from the S&P500. The Journal of Finance 58 (3): 1301–1328.

Anderson, R.C. and Reeb, D.M. (2004) Board composition: Balancing family influence in S&P500. Administrative Science Quarterly 49 (2): 209–237.

Bai, G. (2003) How Do Board Size and Occupational Background of Directors Influence Social Performance in For-profit and Non-profit Organizations? Evidence from California Hospitals. Journal of Business Ethics 118 (1): 171–187.

Baltagi, B.H. (2001) Econometric Analysis of Panel Data. Chichester, UK: Wiley&Sons.

Bammens, Y., Voordeckers, W. and Van Gils, A. (2008) Boards of directors in family firms: A generational perspective. Small Business Economics 31 (2): 163–180.

Bartholomeusz, S. and Tanewski, G. (2006) The relationship between family firms and corporate governance. Journal of Small Business Management 44 (2): 245–267.

Baysinger, B. and Hoskisson, R. (1990) The composition of boards of directors and strategic control: Effects on corporate strategy. Academy of Management Review 15 (1): 72–87.

Beiner, S., Drobetz, W., Schmid, F. and Zimmerman, H. (2004) Is board size an independent corporate governance mechanism? Kyklos 57 (3): 327–356.

Bhagat, S. and Black, B. (1999) The uncertain relationship between board composition and firm performance. Business Lawyer 54 (3): 921–963.

Bozec, R. and Dia, M. (2007) Board structure and firm technical efficiency: Evidence from Canadian state-owned enterprises. European Journal of Operational Research 177 (3): 1734–1750.

Carroll, A.B. (1979) A three-dimensional conceptual model of corporate social performance. Academy of Management Review 4 (4): 497–505.

Carroll, A.B. (1991) The pyramid of social responsibility: Toward the moral management of organizational stakeholders. Business Horizons 34 (4): 39–48.

Catturi, G. (2003) L’azienda universale. L’idea forza, la morfologia e la fisiologia (trad. The universal firm. The strength idea, the morphology and the physiology). Padova, Italy: Cedam.

Charkham, J. (1995) Keeping Good Company. A Study Of Corporate Governance in Five Countries. Oxford: Oxford University Press.

Chua, J.H., Chrisman, J.J. and Sharma, P. (1999) Defining the family business by behavior. Entrepreneurship Theory and Practice 23 (4): 19–39.

Clarkson, M.B. (1995) A stakeholder framework for analyzing and evaluating corporate social performance. Academy of Management Review 20 (1): 92–117.

Coles, J.L., Daniel, N. and Naveen, L. (2008) Boards: does one size fit all? Journal of Financial Economics 87 (2): 329–356.

Corbetta, G. and Montemerlo, D. (1999) Ownership, governance, and management issues in small and medium-size family businesses: A comparison of Italy and the United States. Family Business Review 12 (4): 361–374.

Corbetta, G. and Salvato, C.A. (2004) The board of directors in family firms: One size fits all. Family Business Review 27 (19): 119–134.

Corbetta, G. and Tomaselli, S. (1996) Boards of directors in Italian family businesses. Family Business Review 9 (4): 403–421.

Dahya, J. and McConnell, J. (2007) Board composition, corporate performance and the Cadbury committee recommendation. Journal of Financial and Quantitative Analysis 42 (3): 535–564.

Dalton, D.R., Daily, C.M., Ellstrand, A.E. and Johnson, J.L. (1998) Meta-analytic reviews of board composition, leadership structure, and financial performance. Strategic Management Journal 19 (3): 269–290.

De Geus, A. (1997) The Living Company. Boston, MA: Harvard Business School Press.

Donaldson, L. and Davis, J.H. (1991) Stewardship theory or agency theory: CEO governance and shareholder returns. Australian Journal of Management 16 (1): 49–64.

Donaldson, T. and Preston, L.E. (1995) The stakeholder theory of the corporation: Concepts, evidence and implications. Academy of Management Review 20 (1): 65–91.

Drakos, A.A. and Bekiris, F.V. (2010) Endogeneity and the relationship between board structure and firm performance: A simultaneous equation analysis for the Athens stock exchange. Managerial and Decision Economics 31 (6): 387–401.

Dyer, W.G. (1986) Cultural Change in Family Firms. San Francisco, CA: Jossey-Bass.

Dyer, W.G. (1989) Integrating professional management into a family owned business. Family Business Review 2 (3): 221–235.

Dyer, W.G. (2006) Examining the ‘family effect’ on firm performance. Family Business Review 19 (4): 253–273.

Eisenberg, T., Sundgren, S. and Wells, M. (1998) Larger board size and decreasing firm value in small firms. Journal of Financial Economics 48 (1): 35–54.

Eisenhardt, K.M. (1989) Agency theory: An assessment and review. Academy of Management Review 14 (1): 57–74.

Elkington, J. (1998) Cannibals with Forks. Gabriola Island, Canada: New Society.

Fama, E. and Jensen, M. (1983) Separation of ownership and control. Journal of Law and Economics 22 (2): 301–325.

Filatotchev, I. and Bishop, K. (2002) Board composition, share ownership and underpricing of UK IPO firms. Strategic Management Journal 23 (10): 941–955.

Filatotchev, I., Lien, Y. and Piesse, J. (2005) Corporate governance and performance in publicly listed, family-controlled firms: Evidence from Taiwan. Asia Pacific Journal of Management 22 (3): 257–283.

Freeman, R.E. (1984) Strategic Management: A Stakeholder Approach. Boston, MA: Pitman.

Galbreath, G. (2010) Drivers of corporate social responsibility: The role of formal strategic planning and firm culture. British Journal of Management 21 (2): 511–525.

Griffin, J.J. and Mahon, J.F. (1997) The corporate social performance and corporate financial performance debate. Business and Society 36 (1): 5–31.

Gujarati, D. (1992) Econometría, 2nd edn.New York: Mc Graw Hill.

Hall, A. and Nordqvist, M. (2008) Professional management in family businesses: Toward an extended understanding. Family Business Review 21 (1): 51–69.

Hendry, J. (2002) The principal’s other problems: Honest incompetence and the specification of objectives. Academy of Management Review 27 (1): 98–113.

Hermalin, B. and Weisbach, M. (1991) The effects of board composition and direct incentives on firm performance. Financial Management 20 (4): 101–121.

Hilman, A. and Dalziel, T. (2003) Boards of directors and firm performance: Integrating agency and resource-dependence perspectives. Academy of management review 28 (3): 383–396.

Hodge, G. (2000) Privatization: An International Review of Performance. Boulder, CO: Westview Press.

Hung, H. (2011) Directors’ roles in corporate social responsibility: A stakeholder perspective. Journal of Business Ethics 103 (3): 385–402.

Huse, M. (1994) Board-management relations in small firms: The paradox of simultaneous independence and interdependence. Small Business Economics 6 (1): 55–72.

Ibrahim, N. and Angelidis, J. (1995) The corporate social responsiveness orientation of board members: Are there differences between inside and outside directors. Journal of Business Ethics 14 (5): 405–410.

IFERA (International Family Enterprise Research Academy) (2003) Family businesses dominate. Family Business Review 16 (4): 235–240.

Jensen, M. (1993) The modern industrial revolution, exit and the failure of internal control systems. Journal of Finance 48 (3): 831–880.

Jensen, M.C. and Meckling, W.H. (1976) Theory of the firm: Managerial behaviour, agency costs and ownership structure. Journal of Financial Economics 3 (4): 305–360.

Johannisson, B. and Huse, M. (2000) Recruiting outside board members in the small family business: An ideological challenge. Entrepreneurship and Regional Development 12 (4): 353–378.

Johnson, H.L. (2001) Corporate social audits: This time around. Business Horizons 44 (3): 29–36.

Johnson, J.L., Daily, C.M. and Ellstrand, A.E. (1996) Boards of directors: A review and research agenda. Journal of Management 22 (3): 409–438.

Johnson, R.A. and Greening, D.W. (1999) The effects of corporate governance and institutional ownership types on corporate social performance. The Academy of Management Journal 42 (5): 564–576.

Landier, H. (1987) L’enterprise Polycellulaire. Paris, France: ESF.

Lane, S., Astrachan, J., Keyt, A. and McMillan, K. (2006) Guidelines for family business boards of directors. Family Business Review 19 (2): 147–167.

Lipton, M. and Lorsch, J. (1992) A modest proposal for improved corporate governance. Business Lawyer 48 (1): 59–77.

Luoma, P. and Goodstein, J. (1999) Stakeholder and corporate boards: Institutional influences on board composition and structure. Academy of Management Journal 42 (5): 553–563.

Miller, D. and Le Breton-Miller, I. (2003) Challenge versus advantage in family business. Strategic Organization 1 (1): 127–134.

Moore, M.T. (2002) Corporate governance: An experienced model. Director’s Monthly 26 (3): 1–9.

Muth, M. and Donaldson, L. (1998) Stewardship theory and board structure: A contingency approach. Corporate Governance: An International Review 6 (1): 5–29.

Neubauer, F. and Lank, A.G. (1998) The Family Business: Its Governance for Sustainability. London: McMillan Press.

Pfeffer, J. and Salancik, G. (1978) The External Control of Organizations: A Resource Dependence Perspective. New York: Harper and Row.

Portes, A. (1998) Social capital: Its origins and applications in modern sociology. Annual Review of Sociology 24 (1): 1–24.

Prencipe, A., Markarian, G. and Pozza, L. (2008) Earnings management in family firms: Evidence from R&D cost capitalization in Italy. Family Business Review 21 (1): 71–88.

Preston, L.E. and O’Bannon, D.P. (1997) The corporate social-financial performance relationship: A typology and analysis. Business and Society 36 (4): 419–429.

Rosenstein, S. and Wyatt, J. (1990) Outside directors, board independence and shareholders’ wealth. Journal of Financial Economics 26 (2): 175–184.

Schein, E.H. (1983) The role of the founder in creating organizational culture. Organizational Dynamics 12 (1): 13–28.

Schultz, E.L., Tan, D.T. and Walsh, K.D. (2010) Endogeneity and the corporate governance-performance relation. Australian Journal of Management 35 (2): 145–163.

Schulze, W.S., Lubatkin, M.H., Dino, R.N. and Buchholtz, A.K. (2001) Agency relationships in FBs: Theory and evidence. Organization Science 12 (1): 99–116.

Sciascia, S. and Mazzola, P. (2008) Family involvement in ownership and management: Exploring nonlinear effects on performance. Family Business Review 21 (4): 331–345.

Shleifer, A. and Summers, L. (1988) Breach of trust in hostile takeovers. In: A. Auerbach (ed.) Corporate Takeovers: Causes and Consequences. Chicago, IL: University of Chicago Press.

Sonnenfeld, J.A. (2002) What makes great board great. Harvard Business Review 80 (9): 106–113.

Sorenson, R.L. (1999) Conflict management strategies used in successful family businesses. Family Business Review 12 (2): 133–146.

Sraer, D. and Thesmar, D. (2007) Performance and behaviour of family firms: Evidence from the French stock market. Journal of the European Economic Association 5 (4): 709–751.

Thomsen, S. (2008) An Introduction to Corporate Governance. Mechanism and Systems. Copenhagen, Denmark: DJØF Publishing Copenhagen.

Tobin, J. (1969) A general equilibrium approach to monetary theory. Journal of Money Credit and Banking 1 (1): 15–29.

Uhlenbruck, N. and De Castro, J.O. (1998) Privatization from the acquirer’s perspective: A mergers and acquisitions based framework. Journal of Management Studies 35 (5): 619–640.

Villalonga, B. and Amit, R. (2006) How do family ownership, control and management affect firm value? Journal of Financial Economics 80 (2): 385–417.

Voordeckers, W., Van Gils, A. and Van den Heuvel, J. (2007) Board composition in small and medium sized family firms. Journal of Small Business Management 45 (1): 137–156.

Wang, J. and Dewhirst, H.D. (1992) Boards of directors and stakeholder orientation. Journal of Business Ethics 11 (2): 115–123.

Wartick, S.L. and Cochran, P.L. (1985) The evolution of the corporate social performance model. Academy of Management Review 10 (4): 758–769.

Webb, E. (2004) An examination of socially responsible firms’ board structure. Journal of Management and Governance 8 (3): 255–277.

Williams, R.J. (2003) Women on corporate boards of directors and their influence on corporate philanthropy. Journal of Business Ethics 42 (1): 1–10.

Wood, D.J. (1991) Corporate social performance revisited. Academy of Management Review 16 (4): 691–718.

Yermack, D. (1996) Higher market valuation of companies with a small board of directors. Journal of Financial Economics 40 (2): 185–212.

Zahra, S.A. and Sharma, P. (2004) Family business research: A strategic reflection. Family Business Review 17 (1): 331–346.

Zahra, S.A., Oviatt, B.M. and Minyard, K. (1993) Effects of corporate ownership and board structure on corporate social responsibility and financial performance. Academy of Management Best Paper Proceedings, pp. 336–340.

Zhang, J.Q., Zhu, H. and Ding, H. (2013) Board composition and corporate social responsibility: An empirical investigation in the post Sarbanes-Oxley era. Journal of Business Ethics 114 (3): 381–392.

Zocchi, W. (2004) Il Family Business. Milano, Italy: Il Sole 24 ore.

Author information

Authors and Affiliations

Corresponding author

Additional information

The study has been carried out with the financial support of the Spanish National R&D Plan through research project ECO2010-17463.

Rights and permissions

About this article

Cite this article

Bachiller, P., Giorgino, M. & Paternostro, S. Influence of board of directors on firm performance: Analysis of family and non-family firms. Int J Discl Gov 12, 230–253 (2015). https://doi.org/10.1057/jdg.2014.2

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jdg.2014.2