Abstract

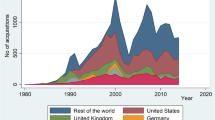

Based on the concepts of North's (1990) political economy of national institutions and economic behavior, we investigate how formal and informal institutional features influence the likelihood that a cross-border acquisition deal will be completed, as well as the time taken for its completion after announcement. Additionally, we study how past experience with completed acquisition deals moderates the effects of institutional differences. We focus on a relatively new context – the pre-completion stage of acquisition processes. We test our hypotheses using data from 2389 announced cross-border acquisition deals in the international business service industry (1981–2001). We find that differences in national formal and informal institutions explain part of the variation in the likelihood that an announced cross-border acquisition deal will be completed, as well as the duration of the deal-making. In addition, organizational learning moderates the effects of institutional distance: past experience with completed cross-border acquisition deals increases the likelihood of a subsequent deal completion in institutionally closer environments, but shortens the deal duration in institutionally distant environments.

Similar content being viewed by others

Notes

We concede to Reuer, Shenkar, and Ragozzino (2004), who argue that there are two streams of literature on international acquisitions: one falls within the field of entry mode research, presenting acquisitions as alternatives to greenfield and alliance establishments, and the other looks at the value-creation potential of acquisitions. The former literature addresses strategic decisions made before the deal announcement; the latter literature examines the period after the completion of the deal. Since neither of the two research streams examines deal developments in the period between initial announcement and completion, we refrain from an extensive review of this past literature on international acquisitions (for this, see Reuer et al., 2004).

This description of M&A announcement strategies at the firm level is taken, by way of illustration, from Eastbury Partnership, Internal communications during mergers & acquisitions: a checklist, accessed at http://www.eastbury.co.uk/internalcomms.html on 4 July 2007.

In this paper, we focus on national culture. National culture, albeit an important element of informal institutions, is not representative of all aspects of informal institutions. Here, however, we chose to examine only national cultural differences, as they directly influence the intermediate acquisition phase. For the sake of theoretical consistency, we generally refer to national culture as informal institutions.

In robustness tests, we included abandonment experience and unrelated (industry) experience. Their inclusion did not change the estimated coefficients of our institutional distance variables. Abandonment experience turned out to be insignificant. The inclusion of unrelated (industry) experience resulted in somewhat weaker (smaller) effects for related (industry) experience, suggesting that some amount of learning also occurs from unrelated contexts. Given the support in past literature (both theoretical and empirical) on the value of learning from related contexts over unrelated contexts, and the marginal evidence on omitted variable bias, we have chosen to present the results from the specification with accumulated experience in related contexts only. This result is corroborated by literature on the limited value of learning from failure and unrelated experience (Hayward, 2002).

We also estimated the model with controls for the acquiring firm's country, but decided not to present these results since the estimated coefficients of the acquirer country dummies were insignificant and the estimated coefficients of the other variables remained unchanged.

Estimates were obtained using xtlogit and xtreg in Stata version 10.

To check our findings against past literature on the similarity of past acquisitions, we calculated a measure capturing the similarity of past acquisitions to one another, as in Hayward (2002). We included it as a regressor in addition to overall experience (unrelated and related aggregated together), as estimated by Hayward (2002), and found that both overall experience and the Hayward measure are insignificant, suggesting that aggregating experience across different contexts might result in a measure of experience that is too agglomerated to be informative.

We estimate a negative binomial model to study the number of cross-border acquisitions within country pairs.

References

Arnold, M., & Parker, D. 2007. UK competition policy and shareholder value: The impact of merger inquiries. British Journal of Management, 18 (1): 27–43.

Ashkenas, R. N., DeMonaco, L. J., & Francis, S. C. 1998. Making the deal real: How GE Capital integrates acquisitions. Harvard Business Review, 76 (1): 165–178.

Asquith, P. 1983. Merger bids, uncertainty, and stockholder returns. Journal of Financial Economics, 11 (1): 51–83.

Bainbridge, S. M. 1990. Exclusive merger agreements and lock-ups in negotiated corporate acquisitions. Minnesota Law Review, 75 (1): 239–334.

Barkema, H. G., & Schijven, M. 2008. How do firms learn to make acquisitions? A review of past research and an agenda for the future. Journal of Management, 34 (3): 594–634.

Beatty, C., & Gordon, J. 1988. Barriers to the implementation of CAD/CAM systems. Sloan Management Review, 29 (4): 25–33.

Belsley, D. A. 1984. Demeaning conditioning diagnostics through centering. American Statistician, 38 (2): 73–77.

Bittlingmayer, G., & Hazlett, T. W. 2000. DOS Kapital: Has antitrust action against Microsoft created value in the computer industry? Journal of Financial Economics, 55 (3): 329–359.

Bockermann, P., & Lehto, E. 2003. Does geography play a role in takeovers? Theory and Finnish micro-level evidence, Working Paper 190, Labor Institute for Economic Research, Helsinki.

Boone, A. L., & Mulherin, J. H. 2007. How are firms sold? The Journal of Finance, 112 (2): 847–875.

Calori, R., Lubatkin, M., & Very, P. 1994. Control mechanisms in cross–border acquisitions: An international comparison. Organization Studies, 15 (3): 361–379.

Cartwright, S., & Cooper, C. L. 1996. Managing mergers and acquisitions and strategic alliances: Integrating people and cultures. Oxford: Butterworth-Heinemann.

Coates, J. C., & Subramanian, G. 2000. A buy-side model of M&A lockups: Theory and evidence. Stanford Law Review, 53 (2): 307–396.

Coff, R. W. 1999. How buyers cope with uncertainty when acquiring firms in knowledge-intensive industries: Caveat emptor. Organization Science, 10 (2): 144–161.

Coff, R. W. 2002. Human capital, shared expertise, and the likelihood of impasse in corporate acquisitions. Journal of Management, 28 (1): 107–128.

Echambadi, R., & Hess, J. D. 2007. Mean-centering does not alleviate collinearity problems in moderated multiple regression models. Marketing Science, 26 (3): 438–445.

Ekelund, R. B., Ford, G. S., & Thornton, M. 2001. The measurement of merger delay in regulated and restructuring industries. Applied Economics Letters, 8 (8): 535–537.

Grote, M. H., & Umber, M. P. 2006. Home biased? A spatial analysis of the domestic merging behaviour of US firms. Working Paper 161, Finance and Accounting Working Paper Series, Department of Finance, Goethe University Frankfurt am Main.

Hair, J. F., Anderson, R. E., Tatham, R. L., & Grablowsky, B. J. 1984. Multivariate data analysis. New York: Macmillan.

Haleblian, J., & Finkelstein, S. 1999. The influence of organizational acquisition experience on acquisition performance: A behavioral learning perspective. Administrative Science Quarterly, 44 (1): 29–56.

Haspeslagh, P., & Jemison, D. 1991. Managing acquisitions: Creating value through corporate renewal. New York: Free Press.

Hayward, M. L. A. 2002. When do firms learn from their acquisition experience? Evidence from 1990 to 1995. Strategic Management Journal, 23 (1): 21–39.

Hébert, L., Very, P., & Beamish, P. W. 2005. Expatriation as a bridge over troubled water: A knowledge-based perspective applied to cross-border acquisitions. Organization Studies, 26 (10): 1455–1476.

Hitt, M. A., Harrison, J. S., Ireland, R. D., & Best, A. 1998. Attributes of successful and unsuccessful acquisitions of US firms. British Journal of Management, 9 (2): 91–114.

Hofstede, G. 1980. Culture's consequences: International differences in work-related values. London: Sage.

Hofstede, G. 1991. Cultures and organizations. Maidenhead: McGraw-Hill.

Holl, P., & Kyriazis, D. 1996. The determinants of outcome in UK takeover bids. International Journal of Economics and Business, 3 (2): 165–184.

Homburg, C., & Bucerius, M. 2006. Is speed of integration really a success factor of mergers and acquisitions? An analysis of the role of internal and external relatedness. Strategic Management Journal, 27 (4): 347–367.

Hotchkiss, E. S., Qian, J., & Song, W. 2005. Holdups, renegotiation and deal protection in mergers. Working Paper, SSRN, http://ssrn.com/abstract=705365.

House, R. J., Hanges, P. J., Javidan, M., Dorfman, P. W., & Gupta, V. 2004. Culture, leadership and organizations: The GLOBE study of 62 societies. Thousand Oaks, CA: Sage Publications.

Hsieh, J., & Walkling, R. 2005. Determinants and implications of arbitrage holdings in acquisitions. Journal of Financial Economics, 77 (3): 605–648.

Javidan, M., House, R. J., Dorfman, P. W., Hanges, P. J., & de Luque, M. S. 2006. Conceptualizing and measuring cultures and their consequences: A comparative review of GLOBE's and Hofstede's approaches. Journal of International Business Studies, 37 (6): 897–914.

Jemison, D. B., & Sitkin, S. B. 1986. Acquisitions: The process can be a problem. Harvard Business Review, 64 (2): 107–116.

Kostova, T., & Zaheer, S. 1999. Organizational legitimacy under conditions of complexity: The case of the multinational enterprise. Academy of Management Review, 24 (1): 64–81.

Lee, T.-J., & Caves, R. E. 1998. Uncertain outcomes of foreign investment: Determinants of the dispersion of profits after large acquisitions. Journal of International Business Studies, 29 (3): 563–582.

Lei, D., Hitt, M. A., & Bettis, R. 1996. Dynamic core competences through meta-learning and strategic context. Journal of Management, 22 (4): 549–569.

Lubatkin, M. 1983. Mergers and the performance of the acquiring firm. Academy of Management Review, 8 (2): 218–225.

Luo, Y. 2005. Do insiders learn from outsiders? Evidence from mergers and acquisitions. Journal of Finance, 60 (4): 1951–1982.

Meyer, C. B., & Altenborg, E. 2008. Incompatible strategies in international mergers: The failed merger between Telia and Telenor. Journal of International Business Studies, 39 (3): 508–525.

Mitchell, M., & Pulvino, T. 2001. Characteristics of risk and return in risk arbitrage. Journal of Finance, 56 (6): 2135–2175.

Mitchell, M., Pulvino, T., Stafford, E. 2002. Limited arbitrage in equity markets. Journal of Finance, 57 (2): 551–584.

Mitchell, M., Pulvino, T., & Stafford, E. 2004. Price pressure around mergers. Journal of Finance, 59 (1): 31–63.

Morosini, P., Shane, S., & Singh, H. 1998. National cultural distance and cross-border acquisition performance. Journal of International Business Studies, 29 (1): 137–159.

Murphy, M. 1999. The rise and rise of the strategic business service. OECD Observer, 219 (December): 18–21.

North, D. 1990. Institutions, institutional change and economic performance. Cambridge: Cambridge University Press.

Officer, M. S. 2003. Termination fees in mergers and acquisitions. Journal of Financial Economics, 69 (3): 431–467.

Parboteeah, K. P., Hoegl, M., & Cullen, J. B. 2008. Managers’ gender role attitudes: A country institutional profile approach. Journal of International Business Studies, 39 (5): 795–813.

Porth, S. J. 1992. Horizontal mergers and bank profitability: A matched-pair analysis. American Business Review, 10 (1): 36–40.

Pothukuchi, V., Damanpour, F., Choi, J., Chen, C. C., & Park, S. H. 2002. National and organizational culture differences and international joint venture performance. Journal of International Business Studies, 33 (2): 243–265.

Pryor, F. L. 2001. Dimensions of the worldwide merger boom. Journal of Economic Issues, 35 (4): 825–840.

Ramaswamy, K. 1997. The performance impact of strategic similarity in horizontal mergers: Evidence from the US banking industry. Academy of Management Journal, 40 (3): 697–715.

Reuer, J., Shenkar, O., & Ragozzino, R. 2004. Mitigating risk in international mergers and acquisitions: The role of contingent payouts. Journal of International Business Studies, 35 (1): 19–32.

Roberts, J. 2003. Competition in the business services sector: Implications for the competitiveness of the European economy. Competition and Change, 7 (2–3): 127–146.

Rosenkranz, S., & Weitzel, U. 2005. Bargaining in mergers: The role of outside options and termination provisions. Discussion Paper Series 05–32, Tjalling C. Koopmans Research Institute, Utrecht University.

Ruckman, K. 2005. Technology sourcing through acquisitions: Evidence from the US drug industry. Journal of International Business Studies, 36 (1): 89–103.

Shaver, J. M. 2006. Interpreting empirical findings. Journal of International Business Studies, 37 (4): 451–452.

Singh, A. 2002. Competition and competition policy in emerging markets: International and developmental dimensions. Working Paper No. 246, ESCRC Centre for Business Research, University of Cambridge.

Skrondal, A., & Rabe-Hesketh, S. 2004. Generalized latent variable modelling: Multilevel, longitudinal and structural equation models. Boca Raton, FL: Chapman & Hall/CRC Press.

Slovin, M. B., & Sushka, M. E. 1998. The economics of parent–subsidiary mergers: An empirical analysis. Journal of Financial Economics, 49 (2): 255–279.

Toschi, L., Bolognesi, E., & Angeli, F. 2007. A meta-analytic answer to an old dilemma: Do M&As create value? Evidence from European banks. Paper presented at the Academy of Management Conference, 1 November, Philadelphia.

UNCTAD. 2004. World investment report 2004: The shift towards services. New York: United Nations.

Vermeulen, F., & Barkema, H. 2001. Learning through acquisitions. Academy of Management Journal, 44 (3): 457–476.

Very, P., & Schweiger, D. M. 2001. The acquisition process as a learning process: Evidence from a study of critical problems and solutions in domestic and cross-border deals. Journal of World Business, 36 (1): 11–31.

Very, P., Lubatkin, M., Calori, R., & Veiga, J. 1997. Relative standing and performance of recently acquired European firms. Strategic Management Journal, 18 (8): 593–614.

Weber, Y., Shenkar, O., & Raveh, A. 1996. National and corporate cultural fit in mergers/acquisitions: An exploratory study. Management Science, 42 (8): 1215–1228.

Weston, J. F., & Jawien, P. S. 1999. Perspectives on mergers and restructuring. Business Economics, 34 (1): 29–33.

Weston, J. F., Mitchell, M. L., & Mulherin, J. H. 2004. Takeovers, restructuring and corporate governance, (4th ed.). Englewood Cliffs, NJ: Prentice-Hall.

Wier, P. 1983. The costs of antimerger lawsuits: Evidence from the stock market. Journal of Financial Economics, 11 (1–4): 207–224.

Wong, P., & O’Sullivan, N. 2001. The determinants and consequences of abandoned takeovers. Journal of Economic Surveys, 15 (2): 145–186.

Acknowledgements

We thank Professor Robert E Hoskisson and three anonymous reviewers for their insightful comments.

Author information

Authors and Affiliations

Additional information

Accepted by editor, Robert Hoskisson, Consulting Editor, 24 October 2008. This paper has been with the authors for three revisions.

Rights and permissions

About this article

Cite this article

Dikova, D., Sahib, P. & van Witteloostuijn, A. Cross-border acquisition abandonment and completion: The effect of institutional differences and organizational learning in the international business service industry, 1981–2001. J Int Bus Stud 41, 223–245 (2010). https://doi.org/10.1057/jibs.2009.10

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/jibs.2009.10