Abstract

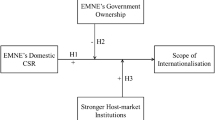

This article examines the link between the condition of institutional voids in emerging markets and the use of the practice of corporate social responsibility (CSR) reporting by emerging market multinational enterprises (EM-MNEs). Based on neo-institutional theory and in light of the specificity of emerging markets, we propose a positive relationship between institutional voids and CSR reporting. Home-country institutional voids push companies to internationalize as a way to escape the institutional constraints and inefficiencies in their own markets, but at the same time create legitimacy challenges for these companies abroad. In particular, EM-MNEs from less institutionally developed countries are likely to face liabilities of origin – negative perceptions in host countries about these firms’ willingness and ability to conduct legitimate business. CSR reporting is an effective strategy to overcome such liabilities and barriers to legitimation as it conveys to host countries and global stakeholders alignment with global meta-norms and expectations. Internationalization, listing on developed country stock exchanges, and time, further magnify EM-MNEs’ legitimacy challenges and thus the use of CSR reporting to mitigate them. Our hypotheses are supported in a longitudinal study of 157 of the largest EM-MNEs ranked by the United Nations Conference on Trade and Development (UNCTAD) between 2004 and 2011.

Abstract

Cet article examine le lien entre l’état de vides institutionnels dans les marches émergents et l’utilisation de la pratique du rapport de responsabilité sociale des entreprises (RSE) par les entreprises multinationales de marchés émergents (EMN-ME). En nous appuyant sur la théorie néo-institutionnelle et compte tenu des spécificités des marchés émergents, nous proposons une relation positive entre les vides institutionnels et le rapport de RSE. Les vides institutionnels du pays d’origine incitent les entreprises à s’internationaliser pour échapper aux contraintes institutionnelles et aux inefficacités de leurs propres marchés, mais créent en même temps des problèmes de légitimité pour ces entreprises à l’étranger. En particulier, les EMN-ME de pays moins développés sur le plan institutionnel risquent de s’exposer aux faiblesses liées à leur pays d’origine – les perceptions négatives dans les pays d’accueil de leur volonté et capacité à conduire des affaires de manière légitime. Le rapport de RSE constitue une stratégie efficace pour surmonter ces faiblesses et obstacles de légitimation, parce qu’il assure aux pays d’accueil et parties prenantes globales un alignement sur les méta-normes et attentes globales. L’internationalisation, les cotations en bourse dans les pays développés et le temps amplifient les problèmes de légitimité des EMN-ME et ainsi l’utilisation du rapport de RSE pour les atténuer. Nos hypothèses sont validées à l’aide d’une étude longitudinale de 157 parmi les plus grandes EMN-ME classées par la Conférence des Nations Unies pour le Commerce et le Développement (CNUCED) entre 2004 et 2011.

Abstract

Este artículo examina el vínculo entre la condición de vacíos institucionales en mercados emergentes y el uso de la practica de presentación de informes de responsabilidad social empresarial (RSE) en empresas multinacionales de mercados emergentes (EM-MNEs). Con base en la teoría neo-institucional y a la luz de las especificidades de mercados emergentes, proponemos una relación positiva entre vacíos institucionales y los reportes de RSE. Los vacíos institucionales en el país de origen empujan a las empresas a internacionalizarse como una manera de escapar las limitaciones e ineficiencias en sus propios mercados, pero al mismo tiempo, crea retos de legitimidad para estas empresas en el extranjero. En particular, las empresas multinacionales de mercados emergentes de países menos desarrollados institucionalmente son propensas a sufrir limitaciones de origen – percepciones negativas en países receptores acerca de la disposición y la habilidad de estas empresas de tener negocios legítimos. Los informes de RSE son una estrategia efectiva para sobreponer estas limitaciones y barreras para legitimación debido a que ya se transmite a los países anfitriones y a las partes interesadas globalmente una alineación de meta-normas y expectativas globales. La internacionalización, cotizar en bolsas en países desarrollados, y el tiempo, aumentan aún más los retos de legitimidad de las empresas multinacionales de mercados emergentes, y es por eso que los reportes de RSE mitigan estos retos. Nuestra hipótesis son apoyadas con un estudio longitudinal de las 157 empresas multinacionales de mercados emergentes más grandes incluidas en el ranking de la Conferencia de las Naciones Unidas para el Comercio y el Desarrollo (UNCTAD) entre 2004-2011.

Abstract

Este artigo analisa a relação entre a condição de vazios institucionais nos mercados emergentes e o uso da prática de comunicar atos de responsabilidade social corporativa (CSR) por empresas multinacionais de mercados emergentes (EM-MNEs). Baseados na teoria neo-institucional e à luz da especificidade de mercados emergentes, nós propomos uma relação positiva entre vazios institucionais e comunicados sobre CSR. Vazios institucionais do país de origem pressionam empresas a se internacionalizarem como uma forma de se esquivar das restrições institucionais e ineficiências em seus próprios mercados, mas, ao mesmo tempo, criar desafios de legitimidade para essas empresas no exterior. Em particular, EM-MNEs de países menos desenvolvidos institucionalmente são suscetíveis a enfrentar desvantagens de origem - percepções negativas nos países de destino a respeito da vontade e capacidade para realizar negócios lícitos. Comunicados sobre CSR são uma eficaz estratégia para superar tais desvantagens e barreiras à legitimação, que transmite aos países de acolhimento e a outros atores globais alinhamento com metas, normas e expectativas globais. Internacionalização, listagem em bolsas de valores de países desenvolvidos, e tempo ampliam ainda mais os desafios de legitimidade das EM-MNEs e, por consequência, o uso de comunicados sobre CSR para mitigá-los. Nossas hipóteses são suportadas em um estudo longitudinal de 157 das maiores EM-MNEs classificados pela Conferência das Nações Unidas sobre Comércio e Desenvolvimento (UNCTAD) entre 2004 e 2011.

Abstract

这篇文章研究了新兴市场制度孔隙的条件和新兴市场跨国公司 (EM-MNEs) 企业社会责任 (CSR) 报告实践做法之间的关系。基于新制度理论并鉴于新兴市场的特殊性, 我们提出制度孔隙和CSR报告之间正相关。母国制度孔隙推动企业将国际化作为一种逃避制度约束和自身市场低效率的一种方式, 但与此同时, 也为这些公司在国外发展带来了合法性的挑战。特别是, 来自制度不发达国家的EM-MNEs可能面临起源地劣势——即东道国对这些公司经营合法性业务的意愿和能力的负面感知。CSR报告是一种克服合法化劣势和障碍的有效性战略, 因为它向东道国和全球利益相关者联盟传达了全球元规范和期望的取向。国际化、在发达国家股票交易所上市, 以及时间, 进一步放大了EM-MNEs的合法性挑战, 因此使用CSR报告来降低这些挑战。在一项针对2004-2011年期间由联合国贸易和发展会议 (UNCTAD) 排名的157家最大的EM-MNEs的纵向研究中, 我们的假设得到了支持。

Similar content being viewed by others

Notes

The data were obtained from UNCTAD World Investment Reports, downloadable from http://unctad.org/en/Pages/Publications.aspx.

For more information, refer to: http://database.globalreporting.org.

For more information refer to: http://corporateregister.com.

Although there is a “debate over the classification of countries as developed or developing” (Hope, Thomas, & Vyas, 2011: 147), we follow the United Nations’ classification, as reflected in UNCTAD’s World Investment Reports from 2006 to 2013. From that report we have extracted the list of “Top 100 Non-Financial TNCs from Developing Countries” for the years 2004–2011. The United Nations relies on this classification across its various units and research publications (e.g., UN, 2013). The same country classification has been used in several empirical studies, including at least two articles that were recently published in the Journal of International Business Studies (i.e., Hope et al, 2011; Lu, Liu, Wright, & Filatotchev, 2014) and others, including: Ramamurti (2012), Mathews (2006), and Sauvant, Economou, Gal, Lim, and Wilinski (2014). Furthermore, the sample of countries included in our study is consistent with The Economist’s list of emerging markets for the examined time period (see, for example, The Economist’s 2011 Emerging Market Overheating Index: http://www.economist.com/blogs/dailychart/2011/06/overheating-emerging-markets-0).

For more information, refer to: http://info.worldbank.org/governance/wgi/index.aspx#home.

For more information, refer to: http://www.freetheworld.com/datasets_efw.html.

We thank one of the anonymous reviewers for suggesting this possible extension of our work.

We thank the Special Issue Editor for suggesting examining this valuable implication of our research.

References

Adams, C. A., & Harte, G. 1998. The changing portrayal of the employment of women in British banks’ and retail companies’ corporate annual reports. Accounting, Organizations and Society, 23(8): 781–812.

Adams, C. A., & Kuasirikun, N. 2000. A comparative analysis of corporate reporting on ethical issues by UK and German chemical and pharmaceutical companies. European Accounting Review, 9(1): 53–80.

Adams, C. A., & McNicholas, P. 2007. Making a difference: Sustainability reporting, accountability and organisational change. Accounting, Auditing and Accountability Journal, 20(3): 382–402.

Ahlstrom, D., Levitas, E., Hitt, M. A., Dacin, M. T., & Zhu, H. 2014. The three faces of China: Strategic alliance partner selection in three ethnic Chinese economies. Journal of World Business, 49(4): 572–585.

Aiken, L. S., & West, S. G. 1991. Multiple regression: Testing and interpreting interactions. Newbury Park, CA: Sage.

Ashforth, B. E., Harrison, S. H., & Corley, K. G. 2008. Identification in organizations: An examination of four fundamental questions. Journal of Management, 34(3): 325–374.

Association of Chartered Certified Accountants (ACCA). 2013. Business benefits of sustainability reporting in Singapore. Available at: http://www.accaglobal.com/content/dam/acca/global/PDF-technical/other-PDFs/sustainability-roundtable.pdf, accessed 18 March 2015.

Backaler, J. 2014. China goes West: Everything you need to know about Chinese companies going global. New York: Palgrave Macmillan.

Ballinger, G. A. 2004. Using generalized estimating equations for longitudinal data analysis. Organizational Research Methods, 7(2): 127–150.

Banalieva, E. R., & Dhanaraj, C. 2013. Home-region orientation in international expansion strategies. Journal of International Business Studies, 44(2): 89–116.

Bansal, P. 2005. Evolving sustainably: A longitudinal study of corporate sustainable development. Strategic Management Journal, 26(3): 197–218.

Bansal, P., & Clelland, I. 2004. Talking trash: Legitimacy, impression management, and unsystematic risk in the context of the natural environment. Academy of Management Journal, 47(1): 93–103.

Bansal, P., & Kistruck, G. 2006. Seeing is (not) believing: Managing the impressions of the firm’s commitment to the natural environment. Journal of Business Ethics, 67(2): 165–180.

Bartlett, C. A., & Ghoshal, S. 2000. Going global: Lessons from late movers. Harvard Business Review, 78(3): 132–142.

Belsley, D. A., Kuh, E., & Welsch, R. E. 1980. Regression diagnostics: Identifying influential data and sources of collinearity. New York: Wiley.

Bhattacharya, A. K., & Michael, D. C. 2008. How local companies keep multinationals at bay. Harvard Business Review, 86(3): 84–95.

Block, S. A., & Vaaler, P. M. 2004. The price of democracy: Sovereign risk ratings, bond spreads and political business cycles in developing countries. Journal of International Money and Finance, 23(6): 917–946.

Bureau van Dijk. 2014. Osiris. Amsterdam: Bureau van Dijk.

Campbell, J. T., Eden, L., & Miller, S. R. 2012. Multinationals and corporate social responsibility in host countries: Does distance matter? Journal of International Business Studies, 43(1): 84–106.

Chakrabarty, S. 2009. The influence of national culture and institutional voids on family ownership of large firms: A country level empirical study. Journal of International Management, 15(1): 32–45.

Chapple, W., & Moon, J. 2005. Corporate social responsibility (CSR) in Asia: A seven-country study of CSR web site reporting. Business & Society, 44(4): 415–441.

Choi, J. H., & Wong, T. J. 2007. Auditors’ governance functions and legal environments: An international investigation. Contemporary Accounting Research, 24(1): 13–46.

Chouinard, Y., & Stanley, V. 2012. The responsible company. Ventura, CA: Patagonia Books.

Christmann, P., & Taylor, G. 2001. Globalization and the environment: Determinants of firm self-regulation in China. Journal of International Business Studies, 32(3): 438–458.

Colpan, A., Hikino, T., & Lincoln, M. (Eds) 2010. The Oxford handbook of business groups. Oxford: Oxford University Press.

Contractor, F. J., Kundu, S. K., & Hsu, C. C. 2003. A three-stage theory of international expansion: The link between multinationality and performance in the service sector. Journal of International Business Studies, 34(1): 5–18.

Cormier, D., Magnan, M., & Van Velthoven, B. 2005. Environmental disclosure quality in large German companies: Economic incentives, public pressures or institutional conditions? European Accounting Review, 14(1): 3–39.

Crilly, D., Ni, N., & Jiang, Y. 2015. Do no harm versus do good social responsibility: Attributional thinking and the liability of foreignness. Strategic Management Journal, advance online publication 15 May. doi: 10.1002/smj.2388.

Cuervo-Cazurra, A. 2011. Global strategy and global business environment: The direct and indirect influences of the home country on a firm’s global strategy. Global Strategy Journal, 1(3/4): 382–386.

Cuervo-Cazurra, A. 2012. Extending theory by analyzing developing country multinational companies: Solving the Goldilocks debate. Global Strategy Journal, 2(3): 153–167.

Cuervo-Cazurra, A., & Genc, M. 2008. Transforming disadvantages into advantages: Developing-country MNEs in the least developed countries. Journal of International Business Studies, 39(6): 957–979.

Cuervo-Cazurra, A., Inkpen, A., Musacchio, A., & Ramaswamy, K. 2014. Governments as owners: State-owned multinational companies. Journal of International Business Studies, 45(8): 919–942.

Cuervo-Cazurra, A., & Ramamurti, R. (Eds) 2014. Understanding multinationals from emerging markets. Cambridge: Cambridge University Press.

Czarniawska, B., & Sevón, G. (Eds) 1996. Translating organizational change. Berlin: Walter de Gruyter.

Czarniawska, B., & Sevón, G. (Eds) 2005. Global ideas: How ideas, objects and practices travel in the global economy. Malmö: Liber & Copenhagen Business School Press.

Dacin, M. T., Oliver, C., & Roy, J. P. 2007. The legitimacy of strategic alliances: An institutional perspective. Strategic Management Journal, 28(2): 169–187.

Darendeli, I. S., & Hill, T. L. 2016. Uncovering the complex relationships between political risk and MNE firm legitimacy: Insights from Libya. Journal of International Business Studies, 47(1): 68–92.

Dau, L. A. 2013. Learning across geographic space: Pro-market reforms, multinationalization strategy, and profitability. Journal of International Business Studies, 44(3): 235–262.

Dhaliwal, D. S., Li, O. Z., Tsang, A., & Yang, Y. G. 2011. Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. The Accounting Review, 86(1): 59–100.

DiMaggio, P. J., & Powell, W. W. 1983. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2): 147–160.

Doh, J., Rodrigues, S., Saka-Helmhout, A., & Makhija, M. 2014. Call for papers: Special issue of the Journal of International Business Studies on international business responses to institutional voids, http://www.palgrave-journals.com/jibs/cfp_institutional_voids.html, accessed 9 February 2016.

Durand, R., & Jacqueminet, A. 2015. Peer conformity, attention, and heterogeneous implementation of practices in MNEs. Journal of International Business Studies, 46(8): 917–937.

Dutton, J. E., & Dukerich, J. M. 1991. Keeping an eye on the mirror: Image and identity in organizational adaptation. Academy of Management Journal, 34(3): 517–554.

Eccles, R. G., & Krzus, M. P. 2010. One report – integrated reporting for a sustainable society. Hoboken, NJ: John Wiley & Sons.

Edelman. 2015. Edelman trust barometer executive summary, http://www.edelman.com/insights/intellectual-property/2015-edelman-trust-barometer/trust-and-innovation-edelman-trust-barometer/executive-summary/, accessed 4 April 2015.

Elkington, J. 1997. Cannibals with forks: The triple bottom line of 21st century business. Oxford: Capstone.

Fifka, M. S. 2013. Corporate responsibility reporting and its determinants in comparative perspective – A review of the empirical literature and a meta-analysis. Business Strategy and the Environment, 22(1): 1–35.

Flammer, C. 2014. Does product market competition foster corporate social responsibility? Evidence from trade liberalization. Strategic Management Journal, 36(10): 1469–1485.

Fortanier, F., Kolk, A., & Pinkse, J. 2011. Harmonization in CSR reporting. Management International Review, 51(5): 665–696.

Garud, R., Hardy, C., & Maguire, S. 2007. Institutional entrepreneurship as embedded agency: An introduction to the Special Issue. Organization Studies, 28(7): 957–969.

Ghemawat, P. 2007. Redefining global strategy. Cambridge, MA: Harvard Business School Publishing.

Ghemawat, P., & Hout, T. 2008. Tomorrow’s global giants: Not the usual suspects. Harvard Business Review, 86(11): 80–88.

Globerman, S., & Shapiro, D. 2003. Governance infrastructure and US foreign investment. Journal of International Business Studies, 34(1): 19–39.

Greenwood, R., Raynard, M., Kodeih, F., Micelotta, E. R., & Lounsbury, M. 2011. Institutional complexity and organizational responses. Academy of Management Annals, 5(1): 317–371.

Gwartney, J., Lawson, R., & Hall, J. 2012. 2012 Economic Freedom Dataset. Economic Freedom of the World: 2012 Annual Report, Fraser Institute, http://www.freetheworld.com/datasetsefw.html, accessed 2 April 2014.

Halme, M., & Huse, M. 1997. The influence of corporate governance, industry and country factors on environmental reporting. Scandinavian Journal of Management, 13(2): 137–157.

Hill, T. L., & Mudambi, R. 2010. Far from Silicon Valley: How emerging economies are re-shaping our understanding of global entrepreneurship. Journal of International Management, 16(4): 321–327.

Holland, L., & Foo, Y. B. 2003. Differences in environmental reporting practices in the UK and the US: the legal and regulatory context. British Accounting Review, 35(1): 1–18.

Hope, O. K., Thomas, W., & Vyas, D. 2011. The cost of pride: Why do firms from developing countries bid higher? Journal of International Business Studies, 42(1): 128–151.

Hoskisson, R. E., Eden, L., Lau, C. M., & Wright, M. 2000. Strategy in emerging economies. Academy of Management Journal, 43(3): 249–267.

Julian, S. D., & Ofori-dankwa, J. C. 2013. Financial resource availability and corporate social responsibility expenditures in a sub-Saharan economy: The institutional difference hypothesis. Strategic Management Journal, 34(11): 1314–1330.

Kaufmann, D., Kraay, A., & Mastruzzi, M. 2006. Governance matters V: Aggregate and individual governance indicators for 1996–2005, https://openknowledge.worldbank.org/bitstream/handle/10986/9276/wps4012.pdf?sequence=1&isAllowed=y, accessed 4 June 2014.

Khanna, T., & Palepu, K. G. 1997. Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75(4): 41–51.

Khanna, T., & Palepu, K. 2010. Winning in the emerging economies: A road map for strategy and execution. Cambridge, MA: Harvard University Press.

Klein, J. G. 2002. Us versus them, or us versus everyone? Delineating consumer aversion to foreign goods. Journal of International Business Studies, 33(2): 345–363.

Kolk, A. 2010. Trajectories of sustainability reporting by MNCs. Journal of World Business, 45(4): 367–374.

Kolk, A., & Perego, P. 2010. Determinants of the adoption of sustainability assurance statements: An international investigation. Business Strategy and the Environment, 19(3): 182–198.

Kostova, T., & Roth, K. 2002. Adoption of an organizational practice by subsidiaries of multinational corporations: Institutional and relational effects. Academy of Management Journal, 45(1): 215–233.

Kostova, T., Roth, K., & Dacin, M. T. 2008. Institutional theory in the study of multinational corporations: A critique and new directions. Academy of Management Review, 33(4): 994–1006.

Kostova, T., & Zaheer, S. 1999. Organizational legitimacy under conditions of complexity: The case of the multinational enterprise. Academy of Management Review, 24(1): 64–81.

KPMG. 2013. The KPMG survey of corporate responsibility reporting, 2013, https://www.kpmg.com/Global/en/IssuesAndInsights/ArticlesPublications/corporate-responsibility/Documents/corporate-responsibility-reporting-survey-2013-exec-summary.pdf, accessed 21 September 2014.

Kraatz, M. S., & Block, E. S. 2008. Organizational implications of institutional pluralism. In R. Greenwood, C. Oliver, R. Suddaby, & K. Sahlin-Andersson (Eds), Handbook of organizational institutionalism: 243–275. Los Angeles, CA: Sage.

Kumar, V., Gaur, A. S., & Pattnaik, C. 2012. Product diversification and international expansion of business groups. Management International Review, 52(2): 175–192.

Larrinaga, C., Carrasco, F., Correa, C., Liena, F., & Moneva, J. M. 2002. Accountability and accounting regulation: The case of Spanish environmental disclosure standard. European Accounting Review, 11(4): 723–740.

Lawrence, T. B., Hardy, C., & Phillips, N. 2002. Institutional effects of interorganizational collaboration: The emergence of proto-institutions. Academy of Management Journal, 45(1): 281–290.

LexisNexis. 2014. Corporate affiliations online. New Providence, NJ: National Register Publishing.

Li, J., & Qian, G. 2005. Dimensions of international diversification: Their joint effects on firm performance. Journal of Global Marketing, 18(3/4): 7–35.

Li, S., Fetscherin, M., Alon, I., Lattemann, C., & Yeh, K. 2010. Corporate social responsibility in emerging markets. Management International Review, 50(5): 635–654.

Lu, J., Liu, X., Wright, M., & Filatotchev, I. 2014. International experience and FDI location choices of Chinese firms: The moderating effects of home country government support and host country institutions. Journal of International Business Studies, 45(4): 428–449.

Luo, Y., & Tung, R. L. 2007. International expansion of emerging market enterprises: A springboard perspective. Journal of International Business Studies, 38(4): 481–498.

Luo, Y., & Wang, S. L. 2012. Foreign direct investment strategies by developing country multinationals: a diagnostic model for home country effects. Global Strategy Journal, 2(3): 244–261.

Maignan, I., & Ralston, D. A. 2002. Corporate social responsibility in Europe and the US: Insights from businesses’ self-presentations. Journal of International Business Studies, 33(3): 497–514.

Mair, J., & Marti, I. 2009. Entrepreneurship in and around institutional voids: A case study from Bangladesh. Journal of Business Venturing, 24(5): 419–435.

Marano, V., & Tashman, P. 2012. MNE/NGO partnerships and the legitimacy of the firm. International Business Review, 21(6): 1122–1130.

Marano, V., & Kostova, T. 2015. Unpacking the institutional complexity in adoption of CSR practices in multinational enterprises. Journal of Management Studies, 53(1): 28–54.

Mathews, J. A. 2006. Dragon multinationals: New players in 21st century globalization. Asia Pacific Journal of Management, 23(1): 5–27.

McKinsey & Company. 2005. Global champions from emerging markets. The McKinsey Quarterly, 2.

McKinsey & Company. 2013. Beyond corporate social responsibility: Integrated external engagement. The McKinsey Quarterly, March.

McKinsey Global Institute. 2013. Urban world: The shifting global business landscape, http://www.mckinsey.com/insights/urbanization/urban_world_the_shifting_global_business_landscape?cid=other-eml-nsl-mip-mck-oth-1310, accessed 23 September 2014.

McWilliams, A., & Siegel, D. 2000. Corporate social performance and financial performance: Correlation or misspecification. Strategic Management Journal, 21(5): 603–609.

Mergent Online. 2014. Mergent online. New York: Mergent.

Meyer, J. W., & Rowan, B. 1977. Institutionalized organizations: Formal structure as myth and ceremony. American Journal of Sociology, 83(2): 340–363.

Montiel, I., Husted, B. W., & Christmann, P. 2012. Using private management standard certification to reduce information asymmetries in corrupt environments. Strategic Management Journal, 33(9): 1103–1113.

Nachum, L., & Song, S. 2011. The MNE as a portfolio: Interdependencies in MNE growth trajectory. Journal of International Business Studies, 42(3): 381–405.

Nikolaeva, R., & Bicho, M. 2011. The role of institutional and reputational factors in the voluntary adoption of corporate social responsibility reporting standards. Journal of the Academy of Marketing Science, 39(1): 136–157.

Oetzel, J., & Doh, J. P. 2009. MNEs and development: A review and reconceptualization. Journal of World Business, 44(2): 108–120.

Peng, M. W. 2003. Institutional transitions and strategic choices. Academy of Management Review, 28(2): 275–296.

Peng, M. W., & Delios, A. 2006. What determines the scope of the firm over time and around the world? An Asia Pacific perspective. Asia Pacific Journal of Management, 23(4): 385–405.

Pinkse, J., & Kolk, A. 2012. Multinational enterprises and climate change: Exploring institutional failures and embeddedness. Journal of International Business Studies, 43(3): 332–341.

Ramachandran, J., & Pant, A. 2010. The liabilities of origin: An emerging economy perspective on the costs of doing business. In T. M. Devinney, T. Pedersen, & L. Tihanyi (Eds), The past, present and future of international business and management. Advances in international management, Vol. 23: 231–265. New York: Emerald.

Ramamurti, R. 2012. Competing with emerging market multinationals. Business Horizons, 55(3): 241–249.

Ramamurti, R., & Singh, J. V. (Eds) 2009. Emerging multinationals in emerging markets. Cambridge: Cambridge University Press.

Sanders, W. G., & Tuschke, A. 2007. The adoption of institutionally contested organizational practices: The emergence of stock option pay in Germany. Academy of Management Journal, 50(1): 33–56.

Sauvant, K. P., Economou, P., Gal, K., Lim, S., & Wilinski, W. P. 2014. Trends in FDI, home country measures and competitive neutrality. In A. K. Bjorklund (Ed), Yearbook on international investment law & policy 2012–2013: 3–108. New York: Oxford University Press.

Sethi, S. P. 1990. An analytical framework for making cross-cultural comparisons of business responses to social pressures. In L. E. Preston (Ed), International and comparative corporation and society research: 29–56. Greenwich, CT: JAI Press.

Sharma, S. 2000. Managerial interpretations and organizational context as predictors of corporate choice of environmental strategy. Academy of Management Journal, 43(4): 681–697.

Siegel, J. 2005. Can foreign firms bond themselves effectively by renting US securities laws? Journal of Financial Economics, 75(2): 319–359.

Siegel, J. 2009. Is there a better commitment mechanism than cross-listings for emerging economy firms? Evidence from Mexico. Journal of International Business Studies, 40(7): 1171–1191.

Standard & Poor’s. 2014. Compustat. Centennial, CO: Standard & Poor’s.

Strike, V. M., Gao, J., & Bansal, P. 2006. Being good while being bad: Social responsibility and the international diversification of US firms. Journal of International Business Studies, 37(6): 850–862.

Suchman, M. C. 1995. Managing legitimacy: Strategic and institutional approaches. Academy of Management Review, 20(3): 571–610.

Sullivan, D. 1994. Measuring the degree of internationalization of a firm. Journal of International Business Studies, 25(2): 325–342.

Sullivan, A., & Sheffrin, S. M. 2003. Economics: Principles in action. Upper Saddle River, NJ: Pearson Prentice Hall.

Tashman, P., & Rivera, J. 2010. Are members of business for social responsibility more socially responsible? Policy Studies Journal, 38(3): 487–514.

Teegen, H., Doh, J. P., & Vachani, S. 2004. The importance of nongovernmental organizations (NGOs) in global governance and value creation: An international business research agenda. Journal of International Business Studies, 35(6): 463–483.

United Nations (UN). 2013. Composition of macro geographical (continental) regions, geographical sub-regions, and selected economic and other groupings, http://unstats.un.org/unsd/methods/m49/m49regin.htm#developed, accessed 1 February 2015.

United Nations Conference on Trade and Development (UNCTAD). 2006. The top 100 non-financial TNCs from developing countries, ranked by foreign assets, 2004. World Investment Report 2006, http://unctad.org/en/Docs/wir2006_en.pdf, accessed 1 February 2015.

United Nations Conference on Trade and Development (UNCTAD). 2011. Corporate governance disclosure in emerging markets: Statistical analysis of legal requirements and company practices, http://unctad.org/en/Docs/diaeed2011d3en.pdf, accessed 10 June 2014.

Wang, S. L., Luo, Y., Lu, X., Sun, J., & Maksimov, V. 2013. Autonomy delegation to foreign subsidiaries: An enabling mechanism for emerging-market multinationals. Journal of International Business Studies, 45(2): 111–130.

Westphal, J. D., & Zajac, E. J. 1998. The symbolic management of stockholders: Corporate governance reforms and shareholder reactions. Administrative Science Quarterly, 43(1): 127–153.

Williamson, P. J., Ramamurti, R., Fleury, A., & Fleury, M. T. L. (Eds) 2013. The competitive advantage of emerging market multinationals. Cambridge: Cambridge University Press.

World Economic Forum (WEF). 2012. Emerging best practices if Chinese globalizers: Tackle the operational challenges, http://www3.weforum.org/docs/WEF_EmerginBestPracticesofChineseGlobalizers_2014.pdf, accessed 18 March 2015.

Young, M. N., Tsai, T., Wang, X., Liu, S., & Ahlstrom, D. 2014. Strategy in emerging economies and the theory of the firm. Asia Pacific Journal of Management, 31(2): 331–354.

Young, S., & Marais, M. 2012. A multi-level perspective of CSR reporting: The implications of national institutions and industry risk characteristics. Corporate Governance: An International Review, 20(5): 432–450.

Zeger, S. L., & Liang, K. Y. 1986. Longitudinal data analysis for discrete and continuous outcomes. Biometrics, 42(1): 121–130.

Zhao, M., Park, S. H., & Zhou, N. 2014. MNC strategy and social adaptation in emerging markets. Journal of International Business Studies, 45(7): 842–861.

Author information

Authors and Affiliations

Corresponding author

Additional information

Accepted by Ayse Saka-Helmhout, Guest Editor, 30 January 2016. This article has been with the authors for three revisions.

Rights and permissions

About this article

Cite this article

Marano, V., Tashman, P. & Kostova, T. Escaping the iron cage: Liabilities of origin and CSR reporting of emerging market multinational enterprises. J Int Bus Stud 48, 386–408 (2017). https://doi.org/10.1057/jibs.2016.17

Published:

Issue Date:

DOI: https://doi.org/10.1057/jibs.2016.17