Abstract

How could global equity investors fight climate change and what are the implications for their portfolios? We construct a new climate alignment database to address these questions. Investors can fight climate change in two ways: by funding firms aligned with a sub 2 °C scenario; and by engaging firms to lower their climate footprint. Investing in climate-aligned firms does not raise portfolio risk much. For example, a simple 1.5 °C equity portfolio is only 0.9 pp more volatile than global equities. The reason is simple: most sectors have climate-aligned firms. Hence, “low-temperature” portfolios can diversify across sectors. Engagement has huge potential. All firms adopting their sector’s existing best practices may bring the world economy back on a 2 °C trajectory. Moreover, engagement does increase portfolio risk, and may even boost returns. Overall, investors can fight climate change without foregoing returns or increasing portfolio risk substantially.

Similar content being viewed by others

Introduction

Climate change poses an existential threat to the world. Global temperatures rising 3 °C above pre-industrial norm would multiply the number of people facing heatwaves by 80; sea levels would rise 0.4 to 0.9 m, threatening $15tn in coastal assets; and crop yields would fall 24% (CRO Forum 2019). Climate change raises two challenges for investors: including global warming’s financial costs into investment decisions; and how to fight climate change. Some papers address the first question. For example, Reid et al. (2019) discuss financial costs. Shen et al. (2018) analyze what these costs mean for an asset allocation. Few papers address the second question. An exception is Andersson et al. (2016). It analyzes how equity indices can lower carbon intensity while keeping tracking errors moderate.

We elaborate on how global equity investors can fight climate change. We use a global climate alignment database. Each firm has a “temperature” summarizing its climate alignment. Climate change alignment does not correlate with financial variables. Better climate alignment is not associated with higher returns, lower volatility or higher company valuation. Climate alignment correlates slightly with ESG scores, though.

We assess how global equity investors can fight climate change. They can do so in two ways: funding cleaner parts of the economy, helping it grow (funding channel), and convincing management and voting at general meetings (engagement and voting channel). The funding channel can in turn take two forms: selecting “cleaner” sectors or regions (asset allocation); and selecting “cleaner” stocks within sectors or regions (stock picking).

We focus on the funding channel first. We analyze better aligned firms. Perhaps surprisingly, how clean the sectors and regions in which firms operate drive only one-third of their “lower temperature.” Firm-specific efforts (over and above sector/region) account for two-thirds. Hence, selecting firms with best climate practices across many sectors is at least as important to fight climate change as investing in “green” sectors. That is, stock picking within sectors/countries is at least as important as asset allocation.

As a consequence, fighting climate change is consistent with significant diversification. For example, a simple equally weighted 2 °C portfolio includes 500 stocks. It covers much more than the traditionally “green” sectors. Indeed, our 2 °C portfolio covers 51 out of 65 sectors (78%). Low-temperature portfolios are therefore only moderately more volatile than global ones. For example, 1.5 and 2 °C portfolios are 0.9 and 0.4 pp more volatile than global equities, respectively. Tracking errors are 4.1% and 2%, respectively, though. They reflect low-temperature portfolios deviating significantly from their benchmark. We use equally weighted portfolios. Optimizing portfolios would lower volatility and/or tracking error further.

We then focus on the engagement channel. Successful engagement may defeat climate change. Firms below 2 °C (6% of total) are 1.8 °C colder than global average. 70% of these 1.8 °C (1.3 °C) reflect idiosyncratic efforts, that is, how much these firms have reduced their temperature given their sector and country exposure. Other firms in the same sectors and countries could lower temperature by similar amounts. Crucially, all firms adopting their sectors’ existing best practices may bring the world economy on or close to a 2 °C trajectory. Hence, engagement plays a crucial role in fighting climate change.

Our paper includes five parts. First, we present the data. Second, we review how climate alignment correlates with financial variables. Third, we analyze the funding channel. We quantify how much country/sector allocation and stock picking can lower a portfolio’s temperature. We also assess implications for portfolio risk. Fourth, we discuss how engagement can fight climate change. And we conclude last.

Data

We use I Care and Arvella’s climate alignment database, Climate SBAM. It covers 2686 firms, including MSCI ACWI stocks. The database includes two climate alignment metrics:

A “bottom-up metrics.” It embeds all available firm-level data. Such metrics is available for 362 stocks in carbon-intensive sectors.

A “top-down” metrics. The database gives the climate alignment “temperature” for 65 sectors in 6 regions (hence for 390 “climate bricks”). A firm’s temperature is the average of the climate bricks’ temperatures weighted by the firm’s revenue in these sectors/regions. Such metrics is available for all 2686 stocks.

The climate alignment data use all three carbon emissions scopes.

The Appendix describes the climate database in greater detail.

We use the more detailed bottom-up estimate when available unless specified otherwise.

All other data come from Refinitiv.

Climate alignment and financial variables

Few firms are aligned with a 2 °C scenario. Average temperature for global equities is about 3 °C. Only 6% of firms are below 2 °C. Only 4% are below 1.5 °C. Nearly 50% of firms are between 2.5° and 3 °C (Fig. 1).

Alignments do not display a significant difference between regions, with a 0.4 °C range between lowest and highest temperature regions (Table 1). Within sectors, the differences are more significant: with a range of 1.2 °C for American firms and 0.8 °C for global firms (Table 2).

Climate alignment does not correlate with traditional financial variables. We compute annualized returns and monthly volatilities since 2010 (the reference year for the International Energy Agency (IEA)’s carbon emission benchmarks). Correlations with climate change are negligible (Table 3).Footnote 1 Analyzing returns and volatilities by temperature quintiles does not suggest a pattern either (Figs. 2 and 3).

Similarly, climate alignment does not correlate significantly with valuation metrics such as price to earnings, price to book or dividend yield (Table 3 and Fig. 4). Better climate alignment not being associated with a higher valuation may be surprising. Firms with better environmental practices tend to enjoy a lower cost of capital. For example, Bauer (2010), Chava (2014) and Schneider (2011) find that stronger environmental performance is associated with a lower cost of debt. Better environmental practices lower the cost of equity too, as Ghou et al. (2011) and Sharfman and Fernando (2008) find. Focusing on carbon emissions, Matsumura et al. (2013) and Saka Chika (2014) find that higher disclosure and lower emissions boost US and Japanese firm value, respectively. Garvey et al. (2018) also document that stocks with lower carbon footprints tend to outperform. Climate alignment is a new concept. Moreover, data are scarce. Hence, markets may not have fully reflected climate alignment into stock prices yet.

Moving to non-financial data, climate alignment does not correlate with firm size (Table 3 and Fig. 5). Such finding contrasts with larger firms enjoying higher ESG ratings on average (see, e.g., Breedt et al. (2019), and Mercereau et al. (2019).

Finally, climate alignment correlates slightly with ESG scores in aggregate and with the environmental pillar. Correlation was strongest with the environmental innovation score, a subcomponent of the E pillar score defined as “…a company’s capacity to reduce the environmental costs and burdens for its customers, thereby creating new market opportunities through new environmental technologies and processes or eco-designed products” (Table 3)(Refinitiv, 2019). Quintiling illustrates that the correlation is moderate (Fig. 6).

Funding channel: sector/country allocation versus stock picking

How could global equity investors allocate capital to fight climate change? They can invest in cleaner sectors, such as renewable energy, electric cars or railroads. Investors can also emphasize cleaner firms across many sectors. Which matters more is an empirical question. We try to address it here.

We focus on firms for which bottom-up climate alignment data are available. We compute the temperature gap between average world temperature and each firm’s bottom-up estimate. We decompose the gap into two components: one that reflects the sectors and countries the firm operates in; and one that reflects the firm’s idiosyncratic elements. The sectors and countries component is the difference between world average and the firm’s top-down estimate. The idiosyncratic component is the difference between bottom-up and top-down estimates.

For example, Tesla is aligned with a 1.3 °C scenario according to a full bottom-up analysis (1.6 °C below world average). A top-down (sector/country) analysis suggests a 3.3 °C alignment (0.4 °C above world average). The main sector and especially region in which Tesla operates (Auto Components—North America) would suggest a temperature 0.8 °C above global average. Yet, firm-specific efforts (producing electric cars) push the temperature down 3.3 °C to 1.3 °C. By contrast, Ferrari is aligned with a 5.9 °C scenario. A top-down analysis suggests a 2.4 °C alignment (0.5 °C below world average). Country exposure explains why a top-down analysis suggests a higher temperature for Tesla than for Ferrari. Tesla sells mostly in the USA, where cars are bigger on average (emitting more). Ferrari sells globally and in Europe, where cars are smaller on average (emitting less). Yet, firm-specific effects (producing oil-intensive cars) push Ferrari’s temperature up 2.4 °C to 5.9 °C (Fig. 7).

We compute both components for firms below two degrees using bottom-up data. Such firms are 1.8 °C below global average (Fig. 8). Sector/country composition accounts for 0.6 °C reduction on average. Firm-specific efforts for 1.3 °C. That is, firm-specific efforts drive over two-third of climate improvement, sector/country allocation less than a third.

Results are consistent when doing the same analysis for firms below 1.5 °C (Fig. 8). Their temperature averages 0.9 °C, 2.0 °C below global average. Sector/country composition accounts for 0.7 °C on average. Firm-specific efforts are for 1.3 °C. That is, firm-specific efforts drive almost two-third of climate improvement; sector/country allocation slightly more than a third.

Such results have crucial implications for global investors. Fighting climate change does not only mean investing in “green” sectors. Investing in cleaner companies across a wider range of sectors is at least as important.

We then assess whether firm-specific climate “efforts” (positive or negative) correlates with financial or ESG variables. We find no significant correlation, except small correlations with ESG data and again with the environmental innovation score (Table 4).Footnote 2

Funding channel: fighting climate change and portfolio risk

Global equity investors may want to include their climate footprint in their investment decisions. Yet, few companies are aligned with a two-degree scenario. Hence, a smaller climate footprint may lower diversification, increasing risk. How big is this trade-off between climate alignment and portfolio risk, though?

We start by analyzing 1.5 and 2 °C portfolios. We construct equally weighted portfolios using the more aligned firms. The portfolio’s temperature rises as the number of stocks increases (Fig. 9). A 1.5 °C portfolio includes 198 stocks out of 2686 (7% of total). A 2 °C portfolio includes 500 stocks (19% of total). How well portfolios diversify across countries and sectors is also important. 1.5 and 2 °C portfolios cover 181 and 260 of 390 country/sector bricks (46% and 67%), respectively (Table 5). 1.5 and 2 °C portfolios also include 42 and 51 of 65 sectors (65% and 78%), respectively (Table 6). Both portfolios include all six geographies. A closer look at bricks and sector composition suggests that a 2 °C portfolio is reasonably diversified. For example, we rank bricks from the largest to the smallest weight in a portfolio. The biggest bricks, accounting for 80% of a 2 °C portfolio, include 17% of all bricks. The figure is 27% for a standard global portfolio. We run a similar exercise for sectors. The largest sectors, covering 80% of the 2 °C portfolio, include 23% of all sectors. The figure is 31% for a standard global portfolio. Hence, a 2 °C portfolio covers much more than the traditionally “green” sectors. For example, other key sectors include chemicals, real estate services, and electrical component and equipment. Climate-conscious global equity investors can therefore choose from a wide range of sectors and geographies (Table 7).

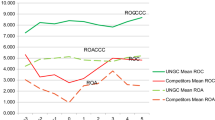

How does lower diversification translate into portfolio volatility? Fewer stocks mean higher volatility. We rank firms from coolest to hottest. We compute the volatility of equally weighted portfolios as the number of stocks increases. We also compute the volatility of a portfolio with the same number of stocks selected randomly. We repeat the random selection 100 times for each portfolio size. We average volatilities across the 100 draws. That way, we can compare the volatility of a low-temperature portfolio with a normal portfolio with the same number of stocks. Figures 10 and 11 summarize the results. They suggest two key takeaways. First, a “low-temperature” portfolio has a higher volatility than a standard portfolio with the same number of stocks. For example, a 30-stock portfolio with low-temperature stocks has a volatility of 16.9% vs 14.4% for an average portfolio. A low-temperature portfolio covers fewer bricks/sectors. Hence, a low-temperature portfolio cannot diversify risks as well. Second, a full 2 °C portfolio is only moderately more volatile than a global equity one: 13.7% versus 13.3%. Intuitively, we can build a 2 °C portfolio with enough stocks spanning enough sectors and regions to diversify many risks. Hence, a global equity investor can build a 2 °C portfolio raising volatility only moderately. Targeting an even lower temperature increases the volatility, though. For example, a 1.5 °C portfolio has a 14.2% annual volatility, 0.9 pp higher than global equities.

Some investors also care about tracking error. We compute low-temperature portfolios’ tracking error versus an equally weighted global equity benchmark. Tracking errors are significant: 4.1% and 2% for 1.5 and 2 °C portfolios, respectively (Table 8). Low-temperature portfolios may not be much more volatile than their benchmark. Yet, low-temperature portfolios differ significantly from them. The intuition is simple. The world economy is on a path of excessive global warming. Avoiding global warming requires a very different path. A large tracking error reflects how different such two paths are.

We also assess whether low-temperature portfolios are associated with lower extreme risks. Skewness and kurtosis are not significant across temperatures when measured with monthly data (Appendix B).

Finally, we analyze alternative weighting schemes. We use a best-in-class weighting scheme (that is, we construct portfolios using the coldest stock in each climate sector, then the second coldest, etc.…). We also weight stocks by (the inverse of their) temperature and by the (the inverse of their) volatility. Results confirm that low-temperature portfolios are only moderately more volatile than higher-temperature ones (Appendix B).

Overall, we find a moderate trade-off between a portfolio’s temperature and risk. Moreover, our weighting exercises are simple. More sophisticated portfolio optimizations may reduce volatility further. Hence, global equity investors have significant room to lower their portfolio’s temperature while keeping their risk exposure acceptable.

Engagement and voting channel

Investors can lower their climate contributions by choosing which firms to invest in (funding channel). They can also lobby firms to lower their climate footprint. Empirical studies find that engagement and voting can improve E, S or G. For example, Lee and Lounsbury (2011) find that shareholder resolutions improved environmental performance at US petroleum and chemical firms. Guercio et al. (2008) conclude that shareholder actions help improve corporate performance. Similarly, Ertimur et al. (2010) find that shareholder “vote no” campaigns reduce CEO compensation. How much could a company reduce its temperature, and hence, how much impact investors can expect from engagement and voting?

Strikingly, successful engagement may defeat climate change. The gap between leading firms and their peers offers a yardstick. We can measure that gap in two ways.

First, we can analyze firms with bottom-up data. Firms below 2 °C (13% of total bottom-up stocks) are 1.8 °C colder than global average. 1.3 of these 1.8 °C reflect idiosyncratic efforts, that is, how much these firms have reduced their temperature over and above their sector and country exposure.

Expecting a firm to shave 1.3 °C off its temperature is therefore reasonable. It does not rely on moving activity to cleaner sectors or regions.

All firms above 2 °C shaving 1.3 °C off their temperature would lower global temperature from 3 to 1.7 °C. We have bottom-up data for carbon-intensive sectors only, though. Hence, our 1.7 °C estimate assumes that firms in other sectors could also shave 1.3 °C off their temperature (Fig. 12).

Alternatively, we use the best-aligned firm in each climate sector. Their average temperature is 2 °C. Hence, all firms adopting their sector’s existing best practices would lower global temperature to about 2 °C. Such method underestimates how much engagement could achieve, though. Non-carbon-intensive sectors use top-down temperature estimates. Such estimates are less dispersed than bottom-up ones (standard deviation for bottom-up estimates is 15.5% versus 13.3% for top-down ones). Analyzing all sectors bottom-up would increase dispersion. Doing so should lower the average lowest temperature by sector and hence on how “cold” a trajectory the world economy could go. That said, all firms achieving a sector’s best practice is not always feasible with existing technology. For example, better aligned cement companies tend to use technologies that are unsuited for taller buildings.

Moreover, many assets are not listed. Our estimates for the world economy therefore assume that unlisted asset’s owners would follow listed ones. Such outcome may require a specific strategy.

Yet, our analysis illustrates that successful engagement would have a dramatic impact on climate change.

Moreover, engagement does not assume excluding any stocks. Hence, engagement does not raise portfolio risk. In addition, successful engagement could boost returns, consistent with lower carbon emissions boosting firm value (Matsumura et al. 2013 and Chika 2014). Overall, engagement is an unusually powerful tool that most investors have failed to use aggressively.

Conclusion

Climate change poses an existential threat. An increasing number of investors will want their investments to help prevent it. Our paper analyzes what fighting climate change means for global equity investors.

Investors can fight climate change in two ways:

Deciding where to invest (funding channel). Maybe counter-intuitively, stock selection is at least as important as sector and country allocation. Partly as a result, low-temperature portfolios can diversify into more than traditional “green” sectors. Hence, low-temperature equity portfolios are only moderately more volatile than global ones. For example, a simple 1.5 °C portfolio is only 0.9 pp more volatile than global equities.

Engagement and voting. Such strategy could lower global temperatures dramatically. For example, all firms adopting their sector’s existing best practices would bring the world economy back to a sub 2 °C trajectory. Moreover, successful engagement does not raise portfolio risk. It may even boost returns.

Overall, investors have the tools to defeat climate change. Doing so does not require increasing portfolio risk let alone lowering returns. More research would help sharpen existing tools and develop new ones. Yet, investors could use existing tools with great impact today.

Appendix A

Climate data methodology

Climate SBAM (“Climate Science-Based Alignment Metric”) is a climate alignment database. I Care & Consult developed a methodology to measure a firm’s climate alignment in 2017. In 2019, I Care & Consult and Arvella Investments expanded the methodology to cover more stocks.

Climate SBAM builds on and expands the international framework to fight climate change. Let us summarize such international framework first. We will discuss how our methodology builds upon it second.

International framework for fighting climate change

The international framework for fighting climate change has three main pillars:

The Intergovernmental Panel on Climate Change (IPCC) analyzes the relationship between greenhouse gas emissions and global warming.Footnote 3 They use the latest scientific evidence to estimate the maximum level of greenhouse gas emissions to avoid climate disaster.

The International Energy Agency (IEA) produces economic scenarios for the world economy and climate change.Footnote 4 The scenarios use IPCC evidence. The IEA computes a plausible transition to below 2 °C for the world economy. A plausible transition path needs to reflect transition costs. For example, some people advocate divesting from oil as the only strategy to defeat climate change. The associated transition path is very costly: stopping to use oil overnight would entail large costs for the world economy. Such path is therefore not plausible. Instead, the IEA computes a 2 °C transition for the world economy that minimizes transition costs. Under that approach, all sectors and countries should adjust. How much each sector/country should cut emissions depends on two things: how much the sector/country emits; and how costly cutting emissions are for this sector/country. A transition path minimizing global adjustment costs is more plausible.

The Science-Based Target Initiative (SBTI) offers firms a framework to reduce their climate footprint.Footnote 5 Established in 2015, the SBTI uses the IEA scenarios to design a carbon intensity 2 °C reference trajectory for each firm. How much a firm should cut emissions depends on its sector(s) and region(s). Firms can use that framework to commit to measurable climate actions. As of December 2019, over 750 firms have committed to climate action using the SBTI framework. Their number is growing rapidly.

Measuring a firm’s climate alignment

Climate SBAM elaborates on the SBTI framework. The methodology translates the difference between a firm’s actual trajectory and its 2 °C reference trajectory into a temperature. A temperature does not only reflect how much a firm emits: It reflects how much effort a firm does compared with how much it should do.

We use all three carbon emission scopes. Including scope 3 is critical when assessing climate impact. For example, 98% of car manufacturers’ emissions fall under scope 3 (Stephens et al. 2017). The most relevant scopes and carbon intensity definitions vary across sectors. For example, scope 3 is key for automakers (with tons of CO-2 per passenger*km measuring carbon intensity). Scopes 1 & 2 are more relevant for steel producers (with carbon intensity being tons of CO-2 per ton of steel).

We use a two-tier approach to produce firms’ alignment temperature. For carbon-intensive sectors, we use all available firm-level data. Such “bottom-up” approach gives precise estimates for the biggest emitting sectors (accounting for around 90% of global carbon emissions). For other sectors, we use a simpler (“top-down”) approach. Doing so allows covering many firms.

Carbon-intensive sectors (bottom-up approach)

Our methodology involves three steps: computing a firm’s carbon intensity’s trajectory; comparing it with its (SBTI-style) 2 °C reference trajectory; and translating the difference between the two into a temperature.

Computing a firm’s carbon intensity trajectory. We estimate backward- and forward-looking carbon intensities using all available firm-level data. Our estimates start in 2010. We forecast carbon intensities until 2050. We use SBTI-approved carbon intensity targets when available. If so, we adjust target for credibility using past carbon reduction. If not, we extrapolate carbon emission trends mechanically until 2050.

Reference trajectory. We use the IEA/SBTI sector reference trajectories when available. We develop similar reference trajectories for sectors the IEA/SBTI do not yet cover (e.g., auto components, electrical equipment, agriculture and forestry…). In that sense, climate SBAM not only uses but also expands the international framework for analyzing climate change. We can then compute a specific benchmark for each firm.

Alignment. The difference between a firm’s carbon trajectory and its 2 °C sector reference trajectory translates into a temperature alignment in °C.

We have bottom-up data for 362 firms in our sample.

Other sectors (top-down approach)

-

The approach allows covering many firms in less carbon-intensive sectors. We split the world economy into 65 sectors in 6 geographies.Footnote 6 Our sector definition builds on the GICS sub-industry classification. We group or split sub-sectors according to how similar their climate dynamics are, though. These 65 sectors in six geographies give us 390 “climate bricks.” We compute the temperature of each brick. We then split each firm’s revenue into the 390 climate bricks. A firm’s temperature is the average of its bricks’ weighted by revenue. Our model also uses scope 1&2 emissions for the few firms for which these scopes are most relevant.Footnote 7

-

We apply our methodology to all firms in the MSCI World ACWI. We include an additional 145 stocks for which bottom-up climate alignment data are available. We exclude stocks when data quality fails. Overall, our dataset includes 2686 firms. We have both bottom-up and top-down (brick-based) climate alignment metrics for 362 stocks. We use the more detailed bottom-up estimate for such firms unless specified otherwise.

Overall, climate SBAM tracks how international businesses today commit to fight climate change. Moreover, the methodology adds new dimensions to the IEA/SBTI framework global businesses use. To our knowledge, climate SBAM is the first climate alignment metrics doing so. Its methodology allows comparing firms across sectors and geographies. Hence, the metrics is useful for global investment decisions.

Appendix B

See Table 9.

Notes

Climate alignment is a firm’s temperature. The lower the temperature, the better the alignment.

A higher effort means a lower temperature.

North America, Europe, Developed Asia, China, non-OECD ex. China, and World.

Extracted from Refinitiv/DataStream. Accounts for only 60 companies in our database.

References

Andersson, Mats, Patrick Bolton, and Frédéric Samama. 2016. Hedging climate risk. Financial Analysts Journal 72: 13–32.

Bauer, R., and D. Hann. 2010. Corporate Environmental Management and Credit Risk. SSRN. https://doi.org/10.2139/ssrn.1660470.

Breedt, A., S. Ciliberti, S. Gualdi, and P. Seager. 2019. Is ESG an Equity Factor or Just an Investment Guide? The Journal of Investing 28 (2): 32–42.

Chava, S. 2014. Environmental Externalities and Cost of Capital. Management Science 60 (9): 2223–2247. https://doi.org/10.1287/mnsc.2013.1863.

Chika, Saka. 2014. Disclosure effects, carbon emissions and corporate value. Sustainability Accounting, Management and Policy Journal 5 (1): 22–45. https://doi.org/10.1108/SAMPJ-09-2012-0030.

CRO Forum (2019). The heat is on: Insurability and Resilience in a Changing Climate. https://www.thecroforum.org/wp-content/uploads/2019/01/CROF-ERI-2019-The-heat-is-on-Position-paper-1.pdf. Accessed 3 Sept 2019.

Ertimur, Y., F. Ferri, and V. Muslu. 2010. Shareholder Activism and CEO Pay. The Review of Financial Studies 24 (2): 535–592.

Garvey, G.T., M. Iyer, and J. Nash. 2018. Carbon Footprint and Productivity: Does the “E” in ESG Capture Efficiency. Journal of Investment Management 16 (1): 59–69.

Ghou, S.E., O. Guedhami, C.C.Y. Kwok, and D.R. Mishra. 2011. Does corporate social responsibility affect the cost of capital? Journal of Banking & Finance 35 (9): 2388–2406. https://doi.org/10.1016/j.jbankfin.2011.02.007.

Guercio, D.D., L. Seery, and T. Woidtke. 2008. Do boards pay attention when institutional investor activists “just vote no”? Journal of Financial Economics 90 (1): 84–103.

Lee, M.-D.P., and M. Lounsbury. 2011. Domesticating Radical Rant and Rage: An Exploration of the Consequences of Environmental Shareholder Resolutions on Corporate Environmental Performance. Business and Society 50 (1): 155–188.

Matsumura, E.M., R. Prakash, and S.C. Vera-Muñoz. 2013. Firm-Value Effects of Carbon Emissions and Carbon Disclosures. The Accounting Review 89 (2): 695–724. https://doi.org/10.2308/accr-50629.

Mercereau, B., J.P.C.C. Sertã, and C. Gavini. 2019. Promoting Sustainability Using Passive Funds. The Journal of Index Investing. 10 (2): 43–62. https://doi.org/10.3905/jii.2019.1.071.

Reid, J., A. Bernhardt, K. Brett, K. Lockridge, and S. Sowden. 2019. Investing in a Time of Climate Change. New York: Mercer.

Schneider, T.E. 2011. Is Environmental Performance a Determinant of Bond Pricing? Evidence from the US Pulp and Paper and Chemical Industries*. Contemporary Accounting Research 28 (5): 1537–1561. https://doi.org/10.1111/j.1911-3846.2010.01064.x.

Sharfman, M.P., and C.S. Fernando. 2008. Environmental risk management and the cost of capital. Strategic Management Journal 29 (6): 569–592. https://doi.org/10.1002/smj.678.

Shen, S., A. LaPlante, and A. Rubtsov. 2018. Strategic Asset Allocation With Climate Change. SSRN. https://doi.org/10.2139/ssrn.3249211.

Stephens, S., H. Guez, and L. Smia. 2017. Estimating Portfolio Coherence with Climate Scenarios. Paris: Mirova Responsible Investing.

Acknowledgements

We thank Constance Gavini, Nabeel Abdoula, Bruno De Kegel and Antoine de Salins, for their help and insights. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Mercereau, B., Neveux, G., Sertã, J.P.C.C. et al. Fighting climate change as a global equity investor. J Asset Manag 21, 70–83 (2020). https://doi.org/10.1057/s41260-020-00150-9

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41260-020-00150-9