Abstract

We extend the internalization literature by theorizing on how public disclosure of corporate social irresponsibility (CSI) can damage reputation-based firm-specific advantages of multinational companies (MNCs) and how foreign subsidiary governance can subsequently be used as strategic responses. Specifically, we distinguish between two foreign subsidiary governance mechanisms – information control and ownership control – that the prior literature has often assumed operate in parallel, and posit that they function in divergent directions in this context. Furthermore, we explain how two host-country characteristics – press freedom and regulatory quality – amplify the need for MNCs to utilize different governance mechanisms as responses to CSI disclosure.

Résumé

Nous élargissons la littérature sur l’internalisation en théorisant sur la façon dont la divulgation publique de l’irresponsabilité sociale des entreprises (ISE) peut nuire aux avantages spécifiques fondés sur la réputation des entreprises multinationales (EMN) et comment la gouvernance des filiales étrangères peut ensuite être utilisée comme réponse stratégique. Plus précisément, nous distinguons deux mécanismes de gouvernance des filiales étrangères - le contrôle de l’information et le contrôle de la propriété - que la littérature antérieure a souvent supposé fonctionner en parallèle et postule qu’ils fonctionnent dans des directions différentes dans ce contexte. En outre, nous expliquons comment deux caractéristiques du pays hôte - la liberté de la presse et la qualité de la réglementation - renforcent la nécessité pour les EMN d’utiliser différents mécanismes de gouvernance en réponse à la divulgation de l’ICE.

Resumen

Extendemos la literatura de internalización mediante la teorización sobre cómo la divulgación pública de la irresponsabilidad social corporativa (ISC) puede dañar la ventaja específica de las empresas multinacionales basada en la reputación de la empresa y como cómo la gobernabilidad de las subsidiarias en extranjero puede ser usado subsecuentemente como respuestas estratégicas. Específicamente distinguimos entre dos mecanismos de gobernabilidad de las subsidiarias en el extranjero -control de la información y el control de la propiedad – que la literatura anterior ha asumido con frecuencia que opera en paralelo y postula que funcionan en direcciones divergentes en este contexto. Además. Explicamos como dos características de país anfitrión -libertad de prensa y calidad regulatoria- amplifican la necesidad de las empresas multinacionales a utilizar diferentes mecanismos de gobernabilidad como respuesta a la divulgación de la ISC.

Resumo

Estendemos a literatura de internalização, teorizando sobre como a divulgação pública da irresponsabilidade social corporativa (CSI) pode prejudicar a vantagem específica da empresa baseada em reputação de empresas multinacionais (MNCs) e como a governança subsidiária estrangeira pode subsequentemente ser usada como respostas estratégicas. Especificamente, distinguimos entre dois mecanismos de governança de subsidiárias estrangeiras - controle de informação e controle de propriedade - que a literatura existente frequentemente supôs operar em paralelo e postulamos que eles funcionam em direções divergentes nesse contexto. Além disso, explicamos como duas características do país hospedeiro - liberdade de imprensa e qualidade regulatória - ampliam a necessidade de MNCs utilizarem diferentes mecanismos de governança como respostas à divulgação de CSI.

摘要

我们通过对企业对社会不负责任(CSI)的公开披露如何破坏跨国公司(MNCs)基于声誉的公司特定优势以及国外子公司治理随后将如何能用作战略响应的理论化拓展了内部化文献。具体来说, 我们区分了两个国外子公司治理机制 – 信息控制和所有权控制 – 以前的文献经常假定其作用等同, 并假设它们在这种情境下发挥不同作用。此外, 我们解释了两个东道国特征 – 新闻自由和监管质量 – 如何扩大跨国公司利用不同治理机制作为对CSI披露的回应的需求。

Similar content being viewed by others

Introduction

As a general theory of multinationals (Rugman, 1981), internalization theory has provided rich insights into how multinational companies (MNCs) govern foreign subsidiaries to develop, leverage, and augment firm-specific advantages (FSAs) in seeking rents across national borders and/or enlarging international market share (Buckley & Casson, 1997; Buckley & Hashai, 2009; Narula & Santangelo, 2012; Narula & Verbeke, 2015). However, researchers have not adequately examined how to govern subsidiaries when FSAs, particularly reputation-based FSAs, are damaged or weakened. Reputation reflects stakeholders’ assessment of a firm’s overall reliability and trustworthiness in the global market (Fiaschi, Giuliani, & Nieri, 2017; Fombrun & Shanley, 1990; Wartick, 2002). This is an important gap to fill in the research because it can take years for a firm to build reputation-based FSAs that a negative incident can almost instantly damage severely.

The context of corporate social irresponsibility (CSI) provides us with an excellent natural experiment with which to examine how MNCs respond to reputation-based FSA damage in host countries. CSI refers to corporate actions that negatively violate related social expectations, as judged by a majority of impartial global stakeholders1 (Armstrong, 1977; Armstrong & Green, 2013). Some of the most controversial incidents of CSI include BP’s Deepwater Horizon oil spill in the Gulf of Mexico, disclosed in 2010; Wal-Mart’s bribery scandal in Mexico, disclosed in 2012; Findus’ meat contamination scandal in Sweden and France, discovered in 2013; and Volkswagen’s emissions scandals in global markets starting in 2015 (RepRisk, 2012, 2014, 2016). More stakeholders are increasingly demanding that MNCs should have broad social and environmental accountability for their actions. No matter their causes, publicly disclosed CSI often hurt MNCs’ performance and even endanger their survival (Kölbel, Busch, & Jancso, 2017). More important than the resulting financial losses, the breakdown of trust among stakeholders can erode the overall competitive advantages that underpin MNCs’ global operations.

Specifically, in this paper, we propose two core arguments. First, we explain how CSI incidents damage MNCs’ reputation-based FSAs and thus what challenges MNCs face in repairing the damage. Because of MNCs’ global footprints and visibility, perceptions that an MNC has been socially irresponsible can negatively affect the judgments that stakeholders make across all related geographic locations worldwide. The reputation of an MNC is increasingly non-location-bound (Rugman, Verbeke, & Nguyen, 2011), and reputation damage is even more so because of the negativity bias of human cognition and decision making (Fiske & Taylor, 1991; Kölbel et al., 2017). Moreover, the consequences of reputation damage are severe and can result in a breakdown of trust from stakeholders and cast a negative halo effect over MNCs’ future activities. Hence, after incidents of CSI, MNCs need to address two primary challenges: prevent further erosion of the reputation critical to their operations and expansion in the global market, and minimize their association with culpability in the local markets.

Second, we propose how different dimensions of governance can be used as a strategic response to these two challenges arising from the reputation damage caused by CSI disclosure. Building on recent developments in internalization theory that acknowledge that foreign subsidiary governance is multidimensional (Kano, 2018; Narula & Verbeke, 2015), we distinguish between two different dimensions of control – information control and ownership control. In doing so, we argue that different dimensions of control can serve varying purposes in the face of reputation damage. We propose that greater internalization in the form of information control is needed because MNCs need to efficiently collect and share information with all related global stakeholders in order to prevent further reputation erosion and to end continuation of doubts about their overall trustworthiness. In contrast, greater externalization in the form of ownership control is needed because, when judging the degree of corporate culpability, stakeholders are influenced by the extent to which the focal firm owns the source of the negative incident (Hansen, 2008; Lange & Washburn, 2012). By leveraging the varying functions of different dimensions of control, MNCs can achieve the advantages of both internalization and externalization. In doing so, we extend the internalization theory by providing a fresh angle from which to examine the connections between internalization and externalization, thus complementing the traditional dichotomous viewpoints that weigh the trade-offs of each position.

We tested our arguments in a novel multisource panel dataset of 135,348 observations at the foreign subsidiary-year level. These observations represent 3,528 MNCs’ CSI disclosures during 2007–2015 in 140 host countries. Specifically, we found that CSI disclosure in host countries is associated with higher subsequent information control but lower subsequent ownership control of foreign subsidiaries. Furthermore, we tested how host-country conditions can amplify these relationships. The positive association between CSI and subsequent information control of foreign subsidiaries is stronger when the host countries have higher press freedom, and the negative association between CSI and subsequent ownership control of foreign subsidiaries is stronger when host countries have higher regulatory quality.

We make three important theoretical contributions to the international business (IB) literature through our study. The first two relate directly to internalization theory. First, complementing the prior internalization literature focusing on building and leveraging FSAs, our study examines the other side of the coin, namely, the damage to FSAs because of CSI disclosure. By “widening… [essential] concepts of internalization theory…. [and encompassing] the changing realities of the world economy” (Buckley, 1990: 662), this study extends the existing research theme based on internalization theory. Specifically, our results extend the theoretical predictions of internalization theory in the context of CSI by explaining how CSI incidents can damage MNCs’ reputation – an essential FSA for international operations – and consequently affect internalization decisions. In doing so, our paper also responds to the recent call to investigate how social and environmental concerns affect FSA bundles (Narula, 2018; Narula & Verbeke, 2015).

Second, the majority of previous studies using internalization theory have assumed that ownership equals control. Thus, ownership control is the most studied governance means of foreign subsidiaries in the IB literature; this is likely because of the quantifiable nature and availability of its empirical measures. However, recent scholars have suggested ownership does not always translate into control (Meyer, Mudambi, & Narula, 2011; Narula & Verbeke, 2015). In our paper, we build on these studies and further theorize and empirically demonstrate that information control and ownership control are both important governance mechanisms available to MNCs but serve divergent functions in their responses to public disclosure of CSI. Moreover, our arguments contribute to internalization theory by relaxing the assumed dichotomy between internalization and externalization that is the implicit basis for the traditional internalization theory of the MNC. By integrating different dimensions of controls, MNCs can achieve the benefits of both internalization and externalization as a response to the multifaceted challenges in the context of FSA erosion.

Finally, our paper contributes to the research stream on CSI in the IB context. Although IB scholars have recently paid explicit attention to studying CSI as a unique construct (Crilly, Ni, & Jiang, 2016; El Ghoul, Guedhami, & Kim, 2017; Kölbel et al., 2017; Tashman, Marano, & Kostova, 2019), existing research has focused on how CSI negatively affects firms’ reputation and performance in home countries (Paruchuri & Misangyi, 2015). As a consequence, we have been left with an inadequate understanding of how to respond to CSI in different foreign countries. Within the limited research on responses to CSI, scholars have concentrated on public relations management and crisis management strategies (Coombs, 2007). By borrowing insights from internalization theory, we have highlighted in our paper a different response by adjusting the governance of host-country activities. This focus presents a new perspective for responses to CSI by understanding and managing the triggering factors of CSI incidents.

Theoretical Framework

Reputation-Based FSA Damage in the Context of Public Disclosure of CSI

FSAs are critical to MNCs for managing the complexity of international expansion (Narula & Verbeke, 2015; Rugman et al., 2011); reputation-based FSAs are increasingly recognized for their effectiveness in harnessing the benefits of operation across countries and, if damaged, their instant threat to MNCs’ overall survival. Scholars have defined reputation as the aggregated assessment of firms’ public approval or overall favorability relative to rivals (Bitektine, 2011; Deephouse, 2000; Fombrun & Shanley, 1990; Zavyalova, Pfarrer, Reger, & Hubbard, 2016).2 Compared with rival companies, reputation indicates “collective assessments of the financial, social, and environmental impacts attributed to the corporation over time” (Barnett, Jermier, & Lafferty, 2006: p. 34). Because of enhanced communication technologies, the reputation of an MNC is increasingly non-location-bound (Rugman et al., 2011). That is, reputation can generate favorable global brands that underpin MNCs’ survival, profitability, and growth in host countries.

However, reputation-based FSAs can also be fragile (Birkinshaw & Hood, 1998; Rugman & Verbeke, 2001). In contrast to the traditional internalization research focusing on building and exploiting FSAs, our focus is on damage to FSAs and the ways firms can manage them via internalization adjustment. Specifically, we examine reputation damage in the context of CSI disclosure. CSI incidents are defined as intentional or unintentional corporate violations of social or environmental expectations, as judged by a majority of impartial global stakeholders (Armstrong, 1977; Lange & Washburn, 2012; Riera & Iborra, 2017). Such incidents include environmental incidents (e.g., global or local pollution, impacts on ecosystems and landscapes), social incidents (e.g., forced labor, impacts on communities, social discrimination), governance incidents (e.g., corruption, fraud, misleading communication, tax evasion), and crosscutting incidents (e.g., controversial products and services and supply chain issues). Public disclosure implies that the information about such incidents is “published” and presented to stakeholders. For instance, the media has been the main publicity source of CSI incidents (Carroll & McCombs, 2003; Kölbel et al., 2017).

In the context of CSI disclosure, damage to reputation can affect MNCs negatively in two ways. First, because of the enhanced visibility of MNCs in the global market, such incidents tend to attract more attention from global stakeholders and are thus associated with negative perceptions, especially when compared with similar incidents by smaller and/or local organizations (Crilly et al., 2016; Mithani, 2017). For example, Samsung, the South Korean multinational, received harsher criticism in 2012 in China than some Chinese suppliers who were worse offenders because of its subsidiary’s violations of work hours and use of underage workers (BBC, 2012). Because MNCs operate in multiple countries, public disclosure of CSI incidents in one location can erode a company’s reputation across other host countries. Indeed, today’s enhanced access to and use of information and communication technologies can escalate the spread of such incidents across the world. This ease and speed of communication give urgency to repairing damage to FSAs while also adding to the difficulty of the repairs (Rhee & Valdez, 2009).

After reputation damage, interactions with socially and environmentally concerned global stakeholders are difficult to manage. Stakeholders’ perceptions are subjective. They tend to be affected more by negative events that violate their expectations and threaten their interests than by positive events (Kölbel et al., 2017). Moreover, the frequency and intensity of the dialogue and information exchange between global and local stakeholders become heightened. With the advance of information and communication technologies, global stakeholders, such as international nongovernmental organizations, proactively reach in to local stakeholders to share the importance, standards, and best practices on social and environmental topics. Local stakeholders, such as civil society, also reach out to global stakeholders to pressure firms to resolve issues (Li & Zhou, 2017). Thus, after CSI disclosure, an MNC needs a governance mechanism that can facilitate such arduous interactions with global stakeholders to repair its reputation.

Second, reputation damage from incidents of CSI tends to remain salient and even escalate if not properly addressed. After a publicly disclosed incident, a focal MNC is viewed either as incapable of operating responsibly in the host country or as lacking the integrity and/or interest in doing so. Thus, such reputation damage generates suspicions and has a negative halo effect on the overall evaluation of an MNC’s future activities (Smith-Bingham, 2014). Consequently, investors may shun investment in and consumers may avoid purchases from a firm that is perceived as irresponsible (Barnett & Salomon, 2006; Chatterji & Toffel, 2010).

Moreover, public attention to these incidents tends to remain salient because of human cognitive biases toward negative events (Rozin & Royzman, 2001). CSI incidents are likely to capture the attention of social and environmental activists, making MNCs targets of lawsuits, consumer boycotts, and various forms of protest (Charlottesville & Cambridge, 2009). Studies have shown that firms with a history of prior reputation damage have greater difficulties in repairing their reputations (Coombs, 2007). Firms’ previous irresponsibility is likely to become “a notorious source of inspiration for muckraking journalists of the day” (Campbell, 2007: 954). For example, Fonterra, a New Zealand company, first made headlines as one of the “most environmentally and socially controversial firms” in 2008 when it was involved in a scandal in China involving contaminated baby formula that allegedly resulted in the deaths of at least six children and the hospitalization of 300,000 babies (RepRisk, 2008). In 2013, when another controversy resulted in product recalls, the criticism was harsher and the economic damage was more severe. Russia banned all dairy products from Fonterra, and China temporarily stopped all imports of powdered milk from Australia and New Zealand (RepRisk, 2014). Thus, after CSI disclosure, MNCs need a governance mechanism that can reduce their association with culpability.

Although a handful of researchers outside the internalization literature have examined how to respond to public disclosure of CSI incidents from a crisis management perspective, they have focused mainly on the characteristics of negative events and immediate crisis-management strategies (Grewal, Johnson, & Sarker, 2007). However, without substantive strategies to repair a firm’s trustworthiness, these efforts might be considered as inauthentic or merely seeking to greenwash their past mistakes (Kang, Germann, & Grewal, 2016). Thus, a perspective that focuses on substantive mechanisms to repair reputation damage is needed. Our study fills this gap by presenting a model that proposes how MNCs can use foreign subsidiary governance as a response to the public disclosure of CSIs to repair their reputation. We also take into consideration host-country contexts during this repair process.

Foreign Subsidiary Governance as a Response to CSI Disclosure: Information Control and Ownership Control

In discussing how MNCs can manage foreign subsidiary governance in response to public disclosure of CSI, we especially relax the traditional assumption that ownership is equivalent to control. Control is indicated by “the ability to influence systems, methods, and decisions” (Anderson & Gatignon, 1986: p. 3). Building on recent developments in internalization theory that acknowledge control and governance as multidimensional (Kano, 2018; Narula & Verbeke, 2015), we emphasize that MNCs can use multiple governance or control mechanisms to align subsidiaries’ behavior with stated corporate objectives. For example, Kim et al. (2003) identified four specific integrating or controlling modes based on people, information, formalization, and centralization. Their findings show that, depending on the business function (i.e., manufacturing, marketing, or research and development), MNCs use different levels of control based on these four modes. Luo (2003) separated subsidiary governance into resource commitment and information flow and emphasized how environmental factors influence control flexibility. Filatotchev, Stephan, and Jindra (2008) found that equity control and direct involvement in management decisions complement each other in the governance of foreign subsidiaries to support exporting. By leveraging the multidimensional control of foreign subsidiaries, MNCs can simultaneously internalize some dimensions of foreign subsidiary governance while externalizing other dimensions to serve different purposes. This allows these firms to maintain internalization advantages and meanwhile achieve some externalization benefits such as flexibility (Buckley, 2016; Kotha, 1995; Strange & Newton, 2006).

In accordance with the heritage of internalization theory and in recognizing the multidimensionality of control, our study focused on two types of internalization control that are salient in the context of CSI: information control and ownership control. Although the tendency has been to assume that these two types of control act in unison, we propose that they can vary in their purposes after disclosure of CSI. Information control is a means of designing a system so that headquarters can efficiently obtain information from and communicate information to foreign subsidiaries. Obtaining and communicating information are especially salient in managing social and environmental issues because such issues tend to carry little weight in firms’ daily, even monthly, agendas (Bansal & Roth, 2000). For example, Russo and Harrison (2005) found that firms with environmental managers who report directly to top managers can influence organizational decision making on environmental issues and ultimately have greater emissions reductions. In contrast, ownership control is reflected in the retention of equity (Dhanaraj & Beamish, 2004; Malhotra & Gaur, 2014). It captures the rights and responsibilities of headquarters derived from equity ownership of the focal subsidiary.

Although ownership control is the most studied governance means in foreign subsidiaries, recent scholars have noted that ownership does not equal control (Huang, 2018; Meyer et al., 2011). Similarly, foreign subsidiaries that have higher information control from headquarters do not necessarily have higher equity control by the parent company and vice versa. For example, in 2012, BP, the British multinational, owned 50% of its Russian subsidiary, TNK-BP, but directly supervised this subsidiary through a direct reporting line; in contrast, although it owned 100% of its Canadian subsidiary, BP Canada Energy Company, it did not implement direct supervision. The Canadian subsidiary first reported to BP Corporation North America, then to BP America, and finally to the ultimate parent company. This separation of information control and ownership control also supports the arguments in the organizational control literature that control is multidimensional and that different types of control can achieve different goals (Ouchi, 1979).

Information control as a response to CSI disclosure

Although MNCs can adopt various forms of information control, in this paper, we focus on information control in terms of how parent firms “exercise control through reporting relationships” (Geringer & Hebert, 1989: p. 241). We argue that greater information control after public disclosure of CSI incidents can help MNCs prevent the erosion of reputation in the global market in two ways.

First, in the context of CSI disclosure, greater control of information allows MNCs to leverage internalization advantages to interact with global stakeholders to prevent the erosion of reputation in the global market. Because of their diverse geographic presence, MNCs interact with a large group of global stakeholders whose perceptions may be negatively affected by public disclosure of CSI. To cope with the speed with which reputational damage can spread around the world and to prevent further damage in the global market, MNCs need to efficiently collect and share information with all related global stakeholders to counter their potential doubts about the companies’ overall trustworthiness and capabilities. This task must be implemented and coordinated by MNCs’ headquarters because information accuracy and transparency are critical to MNCs’ efforts to repair their reputations and overcome negative impressions of their organizations (Gillespie & Dietz, 2009). Greater information control after CSI disclosure can lessen information loss and overcome information barriers between foreign subsidiaries and their MNC parents. Greater information control can also foster frequent and comprehensive information exchange with these subsidiaries and with global stakeholders.

Second, if needed, greater information control enables headquarters to monitor foreign subsidiaries’ actions to preclude further violations of stakeholders’ interests. Although, theoretically, all foreign subsidiaries can draw upon information and best practices from the entire MNC network, in practice only those subsidiaries closely monitored by the parent company are likely to gain enough attention and needed information (Doz & Prahalad, 1984; Kostova, Marano, & Tallman, 2016). In fact, as demonstrated by a recent survey by Deloitte, nearly a third of subsidiaries feel their parent companies fail to spend enough time and attention on subsidiary oversight (Deloitte, 2013). MNCs may exert various degrees of direct supervision over different subsidiaries even when the subsidiaries are located in the same country. For example, in 2015, General Motors exercised diverse levels of direct supervision over its three UK subsidiaries: Millbrook Proving Ground Ltd. reported directly to the ultimate parent company in the U.S.; GMAC UK first reported to GMAC International in the Netherlands and then to the ultimate parent company; and IBC Vehicles Ltd. first reported to Vauxhall Motors Ltd. in the UK, then to Adam Opel GmbH in Germany, and then to the ultimate parent company. Greater information control can eliminate uncertainties in gathering and interpreting information about activities taking place at foreign subsidiaries. Hence, higher information control can motivate foreign subsidiaries diligently to pursue the interests of the MNCs as a whole (Buckley & Strange, 2011). These discussions lead to the following hypothesis:

Hypothesis 1:

Public disclosure of an MNC’s CSI in a host country is associated with higher subsequent information control of foreign subsidiaries in that country.

Ownership control as a response to CSI disclosure

Ownership control uses equity holdings to achieve control of foreign subsidiaries’ activities. Prior research has focused on how equity ownership of foreign subsidiaries is shaped by economic-based analyses of business-to-business transaction costs (Hennart, 1993; Hennart, Roehl, & Zietlow, 1999). We focus on how CSI disclosure affects subsequent ownership control of foreign subsidiaries. We argue that, when confronting public disclosure of CSI, MNCs need to minimize their association with culpability in the local market, a goal that can be achieved through lower subsequent equity ownership of foreign subsidiaries.

First, in the context of CSI disclosure, MNCs tend to lower ownership control to avoid potential internalization disadvantages because, when judging the degree of corporate culpability, stakeholders rely on the extent to which the focal firm owns the source of the negative incidents (Hansen, 2008; Lange & Washburn, 2012). For example, although Fonterra contacted local Chinese officials as soon as it became aware of the baby formula contamination, the public directed fierce criticism at the company because the public believed “a 43% ownership of a company will certainly apportion 43% of the blame” (Yan, 2011: p. 4). As perceived culpability increases, internalization disadvantages from ownership control increases. Communication and interaction with stakeholders who have been financially or emotionally affected by CSI incidents are complex; 43% of the blame is certainly hard to quantify in assessing any reputation damage. Hence, MNCs are inclined to lessen ownership control of foreign subsidiaries to decouple from such outbreaks of disappointment and biases. The greater an MNC’s disclosure of CSI in the host country, the greater its internalization disadvantages from ownership control, and thus the greater the subsequent adjustment in ownership control of foreign subsidiaries. In an extreme case, MNCs may exit from the host countries in which such incidents occur. For example, Tan (2009) found MNCs would often “immediately terminate their contracts” and “abandon [foreign subsidiaries] without commitment once faced with publicized scandals or evidence of ethical violations” (p. 185).

Second, because negative perceptions are more attention-grabbing and their effects are more enduring compared with neutral or positive events of equal intensity (Rozin & Royzman, 2001), prior internalization advantages from ownership control tend to shrink after disclosure of CSI. More local stakeholders have developed high expectations of the social and environmental responsibilities of MNCs (Crilly et al., 2016). After disclosure of CSI, local stakeholders may question the overall reliabilities of related foreign subsidiaries in delivering on their goals and promises. Rhee and Valdez (2009) have argued that, when a negative incident violates the positive expectations of firms, the incident tends to attract greater external visibility and, therefore, inflicts greater damage on these firms’ reputation. The reputation damage inflicted on MNCs can even preclude their future business opportunities in focal host countries. Because reputation is one critical FSA that underpins MNCs’ international operations and expansion, MNCs may lose their original internalization advantages in the focal host countries. For instance, Foxconn, the Taiwanese company that appeared as one of the top five most controversial companies in 2010 because of the “harsh labor condition at its facilities in China” (RepRisk, 2010), began to diversify into other countries afterward. Furthermore, lower subsequent ownership control can minimize association with culpability when further negative contagion or an escalation of legal liability by local stakeholders establishes an overall socially irresponsible profile for the focal MNC.

Summarizing these ideas, we propose the following hypothesis:

Hypothesis 2:

Public disclosure of an MNC’s CSI in a host country is associated with lower subsequent ownership control of foreign subsidiaries in that country.

Host country characteristics as moderators

We further argue that certain host-country conditions can strengthen the relationship between public disclosure of CSI incidents and subsequent foreign subsidiary governance. In other words, the need for MNCs to respond to FSA erosion is contingent upon specific locational conditions. Specifically, we propose that two host-country conditions are particularly salient in this context: (1) press freedom, or the degree of freedom for the society to independently communicate and express opinions, and (2) regulatory quality, or the degree to which policies and regulations are effectively formulated and implemented. Press freedom is relevant because it concerns the extent to which stakeholders are sensitive to information on CSI and to the corresponding responses from MNCs. Regulatory quality is important because it captures the extent to which a host country has complete and sufficient legal regulations and law enforcement, thus affecting the need to reduce association with culpability in the local market. Although many countries have higher (e.g., Norway, Netherlands) or lower (e.g., North Korea, Uzbekistan) scores in both press freedom and regulatory quality, these two conditions do not always go hand in hand. Some countries have more press freedom but weaker regulatory quality (e.g., Haiti, Jamaica, Ghana), or vice versa (e.g., China, United Arab Emirates). Our separation of the two conditions allows us to go beyond the general argument that host country conditions matter; instead, we explain which conditions matter for specific dimensions of foreign subsidiary governance in response to public disclosure of CSI.

Press Freedom Press freedom in host countries represents the degree to which the local stakeholders can independently express and spread information and opinions. Countries with higher press freedom have more information intermediaries that function freely and independently from governmental, religious, or other influences (Fiaschi et al., 2017; Jensen, Li, & Rahman, 2010). With lesser degrees of press freedom, the level of information asymmetry is higher. As part of responses to control erosion of reputation in the global market after public disclosures of CSI, MNCs need to increase information control, as Hypothesis 1 suggests; this need is even stronger in host countries with a higher level of press freedom.

First, in host countries with higher press freedom, local stakeholders often have greater access and sensitivity to CSI disclosure, and thus MNCs have a stronger need to use information control to temper reputation damage. Not only does greater press freedom monitor noncompliance, but it also imposes sanctions for noncompliance in the context of CSI. An extensive body of literature has suggested that firms respond to press pressure because they fear they will otherwise tarnish their image (Campbell, 2007; King & Soule, 2007). Thus, the need for MNCs to respond to threats of reputation damage is greater in those countries with higher levels of press freedom that permit more scrutiny of businesses as well as other entities. Strategic responses like information control can be more valuable by implying that the focal MNC has learned a lesson and is intrinsically committed to allocating managerial attention to the incident and behaving differently. In contrast, when the host country has less press freedom, the flow of information is more likely to be inhibited and expressions of opinions more likely to be restricted. What is worse, in such contexts, local media and journalists may be corrupt themselves (Brunetti & Weder, 2003; Chowdhury, 2004) and may choose not to spread CSI-related information to the public. Consequently, responses to reputation damage in host countries with lower press freedom are less salient.

Second, when a host county has a higher level of press freedom, reputation damage from CSI is more likely to cross country boundaries to the global market. Because of greater press freedom, local stakeholders can freely reach out to global stakeholders, and global stakeholders can easily reach into local stakeholders (Fiaschi et al., 2017). Reputation damage from CSI disclosure in one country can be rapidly disseminated to various global stakeholders. Consequently, facing CSI disclosure, MNCs need to improve their information-processing efficiency with the global stakeholders and thus subsequently increase information control of foreign subsidiaries. Thus, if public disclosure of CSI occurs in countries with higher press freedom, MNCs have a greater need to use information control as part of a response to address the pressure to repair reputation damage in the global market. In other words, the level of press freedom in host countries amplifies the importance of subsequent information control after public disclosure of CSI. Thus, we propose the following hypothesis:

Hypothesis 3:

The positive effect of public disclosure of an MNC’s CSI in a host country on its subsequent information control of foreign subsidiaries in the country is stronger when the host country has higher press freedom.

Regulatory Quality The degree of regulatory quality in a host country refers to how regulations are conceived, made, and implemented. The existing literature has used the degree of regulatory quality as a proxy for the efficacy of policies and regulations in a country (Doh, Rodrigues, Saka-Helmhout, & Makhija, 2017). Rules are essential for governing not only economic activities but also social and environmental activities. As a response to their association with culpability in a local market after public disclosure of CSI, MNCs need to decrease ownership control as a response, as Hypothesis 2 suggests; this need is even stronger in host countries with a high level of regulatory quality.

First, in host countries with higher regulatory quality, MNCs will expect more complete laws and greater legal sanctions for CSI incidents, and thus have a stronger need to reduce ownership control of foreign subsidiaries to decouple from the association with culpability. In countries with lower regulatory quality, some CSI, although undesirable, may not technically break the law because of either a lack of laws applicable to social and environmental regulation or because of loopholes in extant laws (Crotty, Driffield, & Jones, 2016; Mayda & Mayda, 1985). Because of weaker legal penalties, CSI incidents – including environmental damage, human rights abuses, poor working conditions, and other unethical practices and misconduct – are more prevalent in countries with weaker regulations and laws (RepRisk, 2013; Rugman & Verbeke, 1998). Wherever regulatory quality is weak, the need to lessen the association with culpability is undermined. As Surroca, Tribó, and Zahra (2013) found, to minimize costs, MNCs tend to transfer CSI to host countries with fewer and less stringent social and environmental regulations. As an anecdotal example, the Volkswagen emissions scandal was first discovered in the U.S. in 2015 and later became the target of regulatory investigations in other countries such as China. Moreover, the penalty charged by the U.S. government was the highest with a $2.8 billion criminal fine (Rogers & Spector, 2017), but in China, the penalty was merely the recall and repair of vehicles (Feng, 2017). In countries with higher regulatory quality, policies formally and explicitly specify a broader level of CSI issues (Li & Zhou, 2017). In such cases, more stringent standards for social and environmental issues are in effect, and higher legal penalties exist for non-compliance. Hence, when CSI incidents occur in host countries with a higher level of regulatory quality, the consequence of perceived culpability is more frightening, thus generating a stronger need for the focal MNC to reduce ownership control of subsidiaries as a response.

Second, when a host county has a higher level of regulatory quality, MNCs will expect greater regulatory transparency and more stringent law enforcement, and, consequently, have fewer alternative responses such as bribery to conceal their culpability. In countries with higher regulatory quality, penalties associated with CSI incidents are higher, and MNCs can anticipate the enforcement of such consequences (Crotty et al., 2016). Therefore, MNCs have a heightened need to distance themselves from the culpability of foreign subsidiaries in these countries. In contrast, in host countries with a lower level of regulatory quality, weak enforcement of existing laws and regulations can make it hard for MNCs to know how to interpret and respond to the host-country governments (Peng & Heath, 1996). Furthermore, the lack of enforcement and unpredictable implementation can make it more likely that MNCs will resort to nonmarket strategic activities, such as bribery, as potentially more effective alternative responses (Iriyama, Kishore, & Talukdar, 2016). For example, Ioannou and Serafeim (2012) found that firms are more likely to engage in unethical practices in countries where they can use corruption as a means to reduce costs and avoid moral criticisms. Thus, the need for MNCs to use ownership control as a response amid CSI disclosure is less salient in host countries with lower regulatory quality. Summarizing these arguments, we propose the following hypothesis:

Hypothesis 4:

The negative effect of public disclosure of an MNC’s CSI in a host country on its subsequent ownership control of foreign subsidiaries in the country is stronger when the host country has higher regulatory quality.

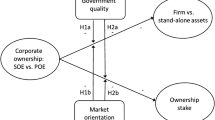

Figure 1 offers an illustration of our theoretical framework.

Methods

Data

We obtained our data from two sources: the Directory of Corporate Affiliations (DCA) database, which provides information on MNCs’ foreign subsidiary governance (our dependent variable) and other basic information on subsidiaries and parent companies (our control variables), and (2) the RepRisk database, which provides information on publicly disclosed CSI incidents (our independent variable). We used the annual files of the DCA to identify information on foreign subsidiaries worldwide. This database by the LexisNexis Group contains ownership profiles and subsidiary reporting linkages to the MNCs’ headquarters (“who reports to whom”) on a yearly basis. The DCA database includes U.S.-based companies that have annual sales that exceed $10 million and non-U.S.-based companies that have annual sales of more than $50 million.

We then relied on RepRisk, a Zurich-based data provider and consultant on social and environmental controversies and incidences, to obtain information on public disclosure of CSI incidents. Founded in 2007, RepRisk now daily screens more than “80,000 media, stakeholder, and third-party sources including print and online media, NGOs, government bodies, regulators, think tanks, newsletters, social media, and other online sources at the international, national and local level in 15 languages” (RepRisk, 2017: p. 25). RepRisk’s methodology is “issues-driven, rather than company-driven.” First, it detects daily all potential worldwide incidents of CSI by using the approach described above. Second, it records all companies involved and analyzes the magnitude of the incident. As presented in Table 1, the 28 issues RepRisk covers include all standards from the World Bank Group Environmental, Health, and Safety Guidelines, the International Finance Corporation Performance Standards, the Equator Principles, the Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Enterprises, and the International Labour Organization Conventions. This measure of CSI also aligns well with our conceptual definition of this construct.

After combining these two databases and deleting observations that have missing values for our variables of interest, we obtained a final sample of 135,348 observations at the foreign subsidiary–year level. These observations represented 3,528 MNCs’ disclosures of CSI in 140 host countries during 2007–2015.

Variables and Measurements

Dependent variables

We have two dependent variables: information control and ownership control. First, we measured information control according to the approach used by Russo and Harrison (2005) and Zhou (2015). Specifically, we first collected the number of reporting lines between the focal foreign subsidiary and the ultimate parent company. For example, the number of reporting lines between General Motors Benelux in the Netherlands and the ultimate parent General Motors Company in the U.S. was two in 2015 because the subsidiary first reported to General Motors (Europe) AG in Switzerland and then to the ultimate parent company. The largest number of reporting lines between foreign subsidiaries and ultimate parent companies is nine. We reverse-coded this variable by subtracting the values from ten, with a larger number indicating a higher degree of information control. Second, to measure ownership control, we obtained the percentage of equity ownership in the focal foreign subsidiary by the ultimate parent company in each year. This variable is also a continuous variable, with a larger number indicating a higher level of ownership control.

Independent variable

We measured public disclosure of CSI incidents using the number of news reports of incidents of CSI in a focal host country in a year weighted by the severity and reach of the news. Severity measured the degree of “harshness of the criticism” and reach measured the degree of the “reporting medium’s circulation and geographic range” (Kölbel et al., 2017). Both severity and reach had three levels: high, medium, and low. Severity was based on: (1) the direct consequences of the incidence (e.g., whether it has resulted in major injuries, deaths or property damage), (2) the horizontal extent of the incidence (e.g., whether it affects a small number or a large number of stakeholders), and (3) the cause of the incident (i.e., accident, negligence, intent, or even a systematic plan). Reach was based on the international stature of the news outlet. Specifically, reach was high if the news was from international media outlets such as The Wall Street Journal, Financial Times, The New York Times, BBC News, CNN International, Forbes, Fortune, The Economist, and others. Reach was rated medium if the news was from a local or national news outlet with a circulation above 150,000. Low reach included local newspapers with a circulation of less than 150,000. If a particular incident appeared in multiple reach levels, RepRisk took the score from the highest level. Appendix A reports more details on the operationalization of our CSI measure.

Like previous studies (Fritz & Busch, 2013; Li & Wu, 2016), we set the numeric values for the severity/reach levels as {High, Medium, Low} = {3, 2, 1}. We adjusted the final score of industry means (i.e., subtracting the industry’s mean from the focal firm’s CSI disclosure score), following the common practice in the literature (Hoffman & Gavin, 1998; Kim, Pathak, & Werner, 2015; Sørensen, 2002). This practice takes into account industry differences (i.e., some industries, such as tobacco manufacturing, may inherently receive more CSI-related media coverage than others) (Campbell, 2007) and thus allows easier model interpretation. As a robustness check, we calculated the three scores using an alternative set of numeric values: {High, Medium, Low} = {10, 5, 1}. The use of this alternatively computed variable produced largely similar results.

Moderators

Press freedom We measured the extent of press freedom in a host country via the annual Press Freedom Index that Reporters Without Borders produce (obtained from https://rsf.org/en) (Short, Toffel, & Hugill, 2016). Begun in 2002, this index measures the level of press freedom in 180 countries. It combines a qualitative analysis of expert responses with quantitative data on violence against journalists in each country. The qualitative analysis questionnaire asks questions about pluralism, media independence, environment and self-censorship, legislative framework, transparency, and infrastructure. In the raw score, a larger score corresponds to less freedom of the press. We reverse-coded this score by subtracting the raw score from the largest value so that a larger number indicates greater press freedom in a focal host country. We replaced the missing values for certain years (e.g., 2011) with the average score for the previous and following years.

Regulatory quality We adopted a widely accepted measure of regulatory quality developed by the World Bank (Danis, Chiaburu, & Lyles, 2010; Lu, Liu, Wright, & Filatotchev, 2014; Short et al., 2016). Regulatory quality captures a government’s ability to design and implement sound policies and regulations in various areas. The scores cover 214 countries. They are based on such factors as trade protection, discriminatory taxes, stringency of environmental regulations, and the effectiveness of antitrust policies. This measure takes on a value between − 2.5 and 2.5; higher values indicate a stronger regulatory quality. In addition to its fit with our theory, this measure also covers the largest number of countries in our sample. Another proxy that directly measures environmental laws and regulation, such as the Environmental Policy Stringency Index, developed by the OECD, only covers 33 countries (27 OECD countries and 6 non-OECD ones), and if available, this proxy is highly correlated with our current measure.

Control variables

We included a number of control variables to tease out potential confounding effects. First, we controlled for a set of firm-level characteristics that might affect subsidiary governance in a host country. We controlled for parent company size and foreign subsidiary size (both measured as the natural log of the number of employees), parent company age (measured as years since the MNC was founded), and parent company performance (measured as sales per employee) (Makhija, 2004). We added these controls because parent MNC size and age may affect configurations of informational structure and ownership in subsidiaries (Birkinshaw & Morrison, 1995). The size of a foreign subsidiary may affect the amount of attention and allocation of resources the parent company provides, and, finally, the performance of the parent company may affect the amount of attention or resources that it can allocate to a subsidiary (Dhanaraj & Beamish, 2004). In addition, previous studies have suggested that corporate diversification may affect stakeholder relationships (David, O’Brien, Yoshikawa, & Delios, 2010) and subsidiary governance and performance (Luo, 2002). Thus, we controlled for product diversification, measured by the number of industries judged by four-digit Standard Industrial Classification (SIC) codes in which the focal MNC operates (Luo & Chung, 2013). We obtained measures for the above variables from the Corporate Affiliation Database.

We also controlled for the focal MNC’s CSI profile. Specifically, we controlled for the focal MNC’s CSI disclosure in other countries, as measured by the number of CSI incidents in countries other than the focal host country because previous responses to incidents elsewhere may have helped the MNC accumulate experience in handling similar public disclosures of CSI (Gillespie & Dietz, 2009). We obtained related information from RepRisk. We also controlled for the extent that the focal MNC’s CSI was concentrated in environmental issues. This is because the social or environmental dimension of CSI has its unique attributes and impacts (Wang, Tong, Takeuchi, & George, 2016) and thus might affect MNCs’ responses differently. Specifically, we calculated the percentage of incidents of CSI in the environmental dimension. We obtained this information from RepRisk.

Next, we controlled for the relationship between foreign subsidiaries and their headquarters. As in prior research (Surroca et al., 2013), we coded a subsidiary’s vertical relatedness as 1 when its headquarters’ one-digit SIC code was larger than that of the subsidiary’s (lower SIC values correspond to activities related to raw inputs), and 0 otherwise. We obtained the SIC codes for parents and subsidiaries from the DCA. Resource-seeking FDI seeks to “obtain competitive labor costs and/or reliable input supplies” and is “much larger and less mobile” than other types of FDI such as market-seeking FDI (Brouthers et al., 2008: p. 675). Thus, we included a dummy variable equal to 1 if the focal subsidiaries operate in labor-seeking industries (e.g., textiles, machinery and equipment manufacturing, and clothing) or industries seeking raw materials (e.g., mining, quarries, and petroleum) (Brouthers et al., 2008).3 We also obtained this information from the DCA.

Finally, at the country level, we controlled for the host country’s market size by using its total population (log-transformed) because it might affect the reach of news circulation and thus have an impact on the MNCs’ responses to disclosure of CSI. We obtained this information from the World Bank. We also controlled for the geographic distance between each home and host country pair (i.e., the distance between the two capital cities) (Berry, Guillén, & Zhou, 2010) and whether the home and host country pair shared common languages (i.e., a dummy variable that equals 1 if the official languages in the two countries are the same) (Kang & Kim, 2010). These two variables can also affect the spread of incidents of CSI and their potential impact in the focal host country. We obtained such information from the CEPII database. Finally, we controlled for the 2008 financial crisis (i.e., a dummy variable that equals 1 for year 2008)4 because some companies were forced to reduce ownership because of their weak financial performance but others found opportunities to increase investments. For example, the Hong Kong subsidiary CITIC Pacific was 100% owned by its Chinese parent company before the crisis; ownership dropped to 20.48% after the crisis. Table 2 presents the descriptive statistics and correlation matrix. As in prior studies using fixed-effects models (Guillén & Capron, 2016), we report within-firm correlations.

Estimation methods

We conducted panel estimation. Specifically, we estimated all models with firm-level fixed-effects models with robust standard errors to test the hypotheses. We used a 1-year lag for all independent, moderating, and control variables to empirically model the dependent variables as subsequent responses after CSI incidents (Meyer, Van Witteloostuijn, & Beugelsdijk, 2017). With fixed-effect estimation, we were able to control for all time-invariant unobserved heterogeneities that could confound our results (Baltagi, 2008; Guillén & Capron, 2016). All cross-sectional variation was absorbed by the constant term, and only longitudinal variation in the sample drove the results (Guillén & Capron, 2016). Our dependent variables were measured at the subsidiary–year level, whereas our independent variable CSI disclosure was measured at the MNC–host country–year level. To account for possible nonindependence of observations within the same MNC, we followed prior studies in reporting robust standard errors that are clustered at the MNC level.

We also recognized that that CSI disclosure in the host country might not be exogenous. That is, the association between CSI disclosure and foreign subsidiary control may be contaminated by the existence of omitted variables that contribute to both. In that case, the results of ordinary least squares regressions are biased; hence, we identified appropriate instrument variables to reduce such a threat (Semadeni, Withers, & Certo, 2014; Wooldridge, 2002). Like in the prior literature (Cheng, Ioannou, & Serafeim, 2014; Lee & Weng, 2013), we generated the first instrument variable by calculating the average score of public disclosure by its peer firms (i.e., other MNCs operating in the same host country) in a given year. Using the average level of disclosure of CSI by peer firms to instrument a focal firm’s CSI disclosure is theoretically appropriate because such information is expected to be correlated with the focal firm’s CSI disclosure because of a mimetic effect but not correlated with the focal firm’s subsidiary governance. The second instrument variable is market concentration, measured by the actual number of MNCs from the same home country in a specific host country (Miletkov, Poulsen, & Wintoki, 2017). Market concentration by MNCs from the same home countries was expected to be correlated to the focal firm’s CSI disclosure because of a learning effect but not correlated with the focal firm’s subsidiary governance. We first tested the endogeneity assumption and our instrument’s validity by using the Durbin–Wu–Hausman tests. The Durbin–Wu–Hausman F scores are 83.3 (p = 0.000) and 5.03 (p = 0.02), hence rejecting the null hypothesis that CSI disclosure in the host country is exogenous.

With the instrument variables, we performed regressions using the two-stage residual inclusion (2SRI) approach. Recent developments also argue that 2SRI can be advantageous over two-stage least squares in estimating our two-step model with quadratic terms (Guillén & Capron, 2016; Jourdan & Kivleniece, 2017; Terza, Basu, & Rathouz, 2008). Like these studies, we used 2SRI in all models because it helped us not only to address the endogeneity issue but also to more clearly analyze and interpret the interaction effects.

Results

Results for Descriptive Statistics

The host countries in our sample represented more than 90% of total world domestic product and population in the years of our study. Host countries with the highest disclosures of CSI are Nigeria, the U.S., China, South Korea, the UK, Thailand, India, Zambia, Colombia, and Peru. Industries with the highest public disclosures of CSI include commercial banks, petroleum refiners, motor vehicle and passenger car manufacturers, pharmaceutical companies, and metal mining. In our sample, 1.2% of incidents ranked as high severity, 33.8% as medium severity, and 65% as low severity. In terms of reach, 26.7% of incidents ranked as high, 46.9% as medium, and 26.3% as low.

Table 2 presents the descriptive statistics and the correlation matrix for the model variables. We carefully examined potential multicollinearity problems by calculating variance inflation factors (VIFs) for the independent variables, moderator, and control variables specified in the linear regression model. The variable CSI disclosure in all locations has the largest VIF, with an average VIF value of 1.68, indicating multicollinearity threats were of no concern.

Results for Hypotheses Testing

Table 3 presents the regression results for information control, and Table 4 presents the regression results for ownership control. We standardized the independent variable and the moderators to avoid possible multicollinearity issues that could have arisen when modeling the interaction (Aiken & West, 1991; Anokhin & Wincent, 2012). In both Tables 3 and 4, Model 1 shows the first-stage results, and Model 2 to Model 4 shows the second-stage results. Specifically, Model 2 is the baseline model, including the moderator and all control variables. Model 3 tests the main effect, and Model 4 tests the moderating effect. In both tables, the instrument variables have a significant effect on our independent variable (all p values are smaller than 0.01). In both tables, residuals from the first stage have a significant effect in the second-stage regression (p = 0.000, p = 0.042), once again confirming our efforts to address the endogeneity issue.

Hypothesis 1 posits that public disclosure of CSI in a host country is associated with higher subsequent information control of foreign subsidiaries in the host country. As shown in Model 3 of Table 3, the effect of public disclosure of CSI on subsequent information control is positive and statistically significant (β = 0.071, p = 0.000). Our results show that if the focal MNC has one news coverage of CSI with high severity and high reach (i.e., a numerical value of 9), subsequent information control will increase by 0.639. In other words, two such news counts will result in one less reporting line between an MNC headquarters and its foreign subsidiaries, which is a meaningful impact. In Model 4 of Table 3, the main effect remains statistically significant. Hence, we found empirical support for Hypothesis 1. This finding confirms our argument on information control as a strategic response to CSI disclosure.

Hypothesis 2 proposes that public disclosure of CSI is associated with lower equity holdings of foreign subsidiaries in the host country. As is shown in Model 3 of Table 4, the effect of public disclosure of CSI on the subsequent equity holdings of foreign subsidiaries is negative and statistically significant (β = − 0.099, p = 0.029). This result suggests that if the focal MNC has one news coverage of CSI with high severity and high reach (i.e., a numerical value of 9), subsequent ownership control will decrease by 0.9. If the total investment in the focal subsidiary is $100 million, then the 0.9% decrease in equity control amounts to a reduced investment of $900,000. In Model 4 of Table 4, the main effect remains significant (p = 0.029). Hence, Hypothesis 2 also received empirical support, confirming our argument on ownership control as a response to CSI disclosure.

Hypotheses 3 and 4 examine the moderating role of the host-country characteristics. As shown in Model 4 of Table 3, for which the dependent variable is information control, the interaction term between public disclosure of CSI and host-country press freedom is positive and statistically significant (β = 0.012, p = 0.040). To better illustrate the interaction effects, we plotted the moderation effect in Fig. 2a. The plot presents the predictive margins of foreign subsidiary control. The plotting is based on the moderator values at two standard deviations below and above the mean (Kim & Jensen, 2014). As illustrated in Fig. 2a, public disclosure of CSI in host countries has a positive effect on subsequent information control of foreign subsidiaries; when host countries have lower press freedom, the effect becomes much weaker with a flatter slope. The 95% confidence intervals do not overlap. Thus, Hypothesis 3 received strong statistical support.

As shown in Model 4 of Table 4, for which the dependent variable is ownership control, the interaction term between public disclosure of CSI and host-country regulatory quality is negative and marginally significant (β = − 0.072, p = 0.035). As illustrated in Fig. 2b, public disclosure of CSI in host countries has a negative effect on subsequent equity control of foreign subsidiaries when host countries have higher regulatory quality. However, the effect becomes much weaker and displays a flatter slope when host countries have lower regulatory quality. Although the 95% confidence intervals overlap, the “proportion overlap” is not large because “the overlap of the 95% CIs is no more than about half the average margin of error” (Cumming & Finch, 2005: 176). In other words, unsupported results occur when the extreme (also least likely) values of one coefficient overlap with the most extreme (also least likely) values of the other, thus presenting a situation in which it is highly unlikely that both coefficients will be at the extreme end of the confidence interval. Taking a conservative approach, we suggest that Hypothesis 4 received partial empirical support. In most cases, subsequent ownership controls of foreign subsidiaries as a response to public disclosure of CSI is more salient in host countries with relatively higher regulatory quality.

Finally, we observed statistically significant coefficients for several control variables, suggesting interesting future research directions. For example, we found that CSI disclosure in other locations is negatively associated with subsequent information control and is positively related to subsequent ownership control. Host-country population is negatively related to information control. A parent company’s age and a parent company’s performance are negatively related to ownership control of foreign subsidiaries. It is also interesting to note that foreign subsidiaries that are vertically related to headquarters or seeking resources in host countries have less control of information.

Robustness Checks and Additional Analyses

Our results are robust to a variety of sensitivity analyses. The analyses are available in the supplementary file. First, given that the results of an extensive cross-country dataset could be driven by some outlying nations (Autio, Pathak, & Wennberg, 2013), we removed those host countries that accounted for a relatively larger sample size (i.e., the UK with 10.88% of our sample) than other countries. The exclusion of these countries did not change the results for the hypothesized effects from our previous models in any meaningful way. We also removed some countries with the lowest sample size (i.e., Albania, Mauritania, Rwanda, and Swaziland, each with less than 0.01% of our sample). Again, our results remained the same.

Second, although we controlled for MNCs’ overall rating of CSI as a proxy for their tendency to be (ir)responsible, we conducted a robustness check by replicating the analyses, this time using a sample of MNCs with at least one CSI disclosure. Our hypothesized results remained the same. These results demonstrate that the patterns underlying how internalization can be affected by the magnitude of CSI disclosure are similar between responsible and irresponsible MNCs as well as among irresponsible MNCs.

Third, we checked whether CSI disclosure affects ownership type in the focal host country [i.e., from wholly owned subsidiaries (equity holdings by parent equal or greater than 99%) to major-owned subsidiaries (equity holdings by parent greater than 50% and less than 99%) to and minor-owned subsidiaries (equity holdings by parent equal to or less than 50%)]. Because such cases are rare, it was difficult to conduct complex multilevel regressions and compare results. Nevertheless, we conducted an ANOVA test and found that foreign subsidiaries involving ownership type changes experienced a higher CSI disclosure at year t − 1 (F = 4.42; p = 0.036). This finding suggests that a greater CSI disclosure not only affects the amount of decrease in equity holdings continuously (our focus in this paper) but also the type of ownership.

Finally, although we are aware that institutional distance and host-country information and communication technologies are important controls, adding the two variables to the model did not affect our results. However, institutional distance is highly correlated with host-country press freedom (r = − 0.52), host-country regulatory quality (r = − 0.57), and host-country information and communication technologies (r = − 0.47). Host-country information and communication technologies are also highly correlated with host-country press freedom (r = − 0.52), and host-country regulatory quality (r = − 0.79). Thus, we excluded both variables from our final model.

Discussion and Conclusion

It is an established argument that, to survive and prosper in host countries, MNCs must possess and exploit FSAs (Buckley & Casson, 1997; Narula & Verbeke, 2015). However, research on the erosion of FSAs has been limited, particularly reputation-based FSA erosion which can threaten MNCs’ survival; and the threat is often instantly felt across multiple host countries of an MNC’s operation. To examine whether and how MNCs manage reputation-based FSA erosion, we focused in this paper on the context of public disclosure of CSI in host countries. Over the past decade, social and environmental issues have evolved as some of the most pressing challenges that attract stakeholders’ attention. According to Forbes Insights (2014), reputation damage was rated as the top risk concern for executives worldwide, and failure to meet stakeholders’ social and environmental expectations, in a growing scale, contribute to reputation damage.

Focusing on foreign subsidiary governance as a strategic response, we have presented two important arguments. First, we explain how CSI disclosure damages MNCs’ reputation and gives rise to the need for them to address two crucial challenges: preventing further erosion of reputation in the global market and minimizing their association with culpability in the local market. Second, we propose that MNCs can use different dimensions of control in subsidiaries to address these two challenges. We empirically tested our arguments in a multisource, unbalanced panel dataset of 135,348 observations at the foreign subsidiary–year level, representing 3,528 MNCs’ disclosures of CSI in 140 host countries during 2007–2015. Specifically, we found that, when facing public disclosure of CSI incidents, MNCs tend to have higher subsequent information control but lower subsequent ownership control of foreign subsidiaries. Furthermore, we found host-country press freedom strengthens the positive relationship between public disclosure of CSI and subsequent information control. Similarly, host-country regulatory quality strengthens the negative relationship between public disclosure of CSI and subsequent ownership control. Our findings provide important theoretical extensions to internalization theory and also have timely managerial implications.

Theoretical Implications

Our study advances internalization theory in two important ways. First, the conventional application of internalization theory has long concentrated on how internalization is shaped by the need to deploy and exploit FSAs. However, little attention has been given to salvaging fading FSAs. Although the literature has acknowledged the potential depletion of bundles of FSAs (Birkinshaw & Hood, 1998; Rugman & Verbeke, 2001), investigations of how damage to reputation-based FSAs may affect MNCs’ internalization decisions are rare. This important research gap is surprising because, whereas the development of FSAs is time-consuming, the loss of reputation and the resulting erosion of FSAs can happen very quickly. As Warren Buffett shared with his All-Star managers (i.e., the CEOs running his companies), “We can afford to lose money – even a lot of money. We cannot afford to lose reputation – even a shred of reputation. … It took us 43 years to build a firm’s advantages and success; we can lose (them) in 43 min” (Sellers, 2009). With damaged reputation-based FSAs, MNCs are constrained in their ability to handle the complexity of international operations in host countries.

As Buckley (1990) advocated, “The widening of concepts is essential to encompass the changing realities of the world economy,” and to extend existing internalization-based theories, research should “capture areas that have to some degree disengaged from the core theory” (p. 662). Our research offers timely broadening and theoretical advancement of the existing internalization literature by examining how MNCs can leverage their governance of foreign subsidiaries in response to reputation-based FSA damage caused by public disclosures of CSI. Pragmatically, public disclosure of CSI provides us with an ideal setting to study damage to FSAs because such public disclosure can quickly cause severe damage to a firm’s reputation. Understanding how reputational damage may arise after disclosure of CSI is critical in developing response strategies. Although we focus on one unique FSA – reputation, our findings can have broader implications for erosions of other types of FSAs. That is, our study reinforces the importance of FSAs and thus the need to repair FSAs when erosion occurs. In addition, although the existing IB literature based on internalization theory has started to highlight how corporate social responsibility is an increasingly important higher-order ownership advantage (Crotty et al., 2016; Narula & Santangelo, 2012), our findings complement this view by explaining how failing to meet stakeholders’ social expectations can damage other FSAs. This is important because, whereas the higher-order ownership advantages can be location-bounded (Narula & Santangelo, 2012), the damage to other FSAs is not location-bounded and can result in escalated global reputation-based FSA erosion and endanger MNCs’ global operation.

Second, in addition to the focus on reputation-based FSA damage, our research widens the existing internalization literature by demonstrating the multidimensional nature and function of internalization. The broader literature based on internalization theory has overwhelmingly focused on ownership control, assuming that ownership control and information control are equivalent. Although the two may function the same in other settings, we theorized and demonstrated their distinctive roles in MNCs’ responses to CSI disclosure. By focusing on foreign subsidiary governance, we have shown that greater subsequent information control is a response to circumvent the further erosion of reputation-based FSAs and that lower subsequent ownership control is a response to distance MNCs from the culpability of CSI incidents. This separation is an important extension of the internalization literature because the multidimensional nature of internalization has only been argued implicitly (Narula & Verbeke, 2015) instead of explicitly theorized and tested. Our theoretical and empirical demonstration of the different (even opposite) roles played by two distinctive aspects of internalization heightens the urgent need for IB scholars to take the multidimensionality of internalization into consideration to gain a deeper understanding of the antecedents of, changes to, and effectiveness of foreign subsidiary governance (Bouquet & Birkinshaw, 2008; Gomes-Casseres, 1989; Rugman & Verbeke, 2001). Although the prior literature has recognized that internalization can enhance organizational governance and that externalization increases organizational flexibility, we argue that these two arrangements, supported by different dimensions of organizational control, can be used together to give a MNC a mechanism for dealing with FSA erosion (reputation-based or not). Hence, we also contribute to internalization theory by empirically demonstrating a situation in which internalization and externalization can both be used in governing foreign subsidiaries.

In addition, our research broadens the existing literature on internalization theory by introducing host-country conditions as important moderators. Adding to the country contingencies of MNC internalization identified in prior research (Rugman & Verbeke, 1992, 2001), our findings indicate that strategies to prevent the erosion of FSAs need to match the press freedom and regulatory quality of host countries. Thus, our focus supplements the existing theme of internalization contingencies and enriches the variety of country-specific conditions. Our study shows that host-country conditions may stimulate the responses of MNCs to incidents of CSI if they occur. Host countries are heterogeneous across different conditions that may further amplify MNCs’ responses to FSA damage from public disclosure of CSI incidents. Future research can continue to take such country heterogeneity into consideration in studies on MNC internalization.

Finally, our paper contributes to the existing research stream on CSI. The recent IB literature has reported ample evidence of the negative consequences of CSI on firms’ financial performance (e.g., Kölbel, Busch, & Jancso, 2017; Paruchuri & Misangyi, 2015). However, few investigations have been made into how MNCs’ governance of foreign subsidiaries may potentially be adjusted as a response to CSI disclosure. Thus, our study contributes not only to internalization theory by emphasizing the internalization implications of FSA damage but also to the broader research stream on CSI. Specifically, although recent scholarship has promoted an explicit focus on CSI as a unique construct (Crilly et al., 2016; Kölbel et al., 2017; Lange & Washburn, 2012), the majority of studies of CSI have investigated it in one location, typically home countries, without taking into account how locational factors may affect response strategies to it. Our study includes a broad coverage of home and host countries, thus complementing existing studies focusing on home-country effects (Surroca et al., 2013). Our paper not only provides empirical evidence that disclosure of CSI can affect foreign subsidiary governance but also shows the importance of different conditions in host countries where CSI incidents occurred.

Managerial Implications

Easy access to information technology has significantly transformed the global competitive environment over the past two decades. Executives at MNCs face rapidly increasing social scrutiny by stakeholders residing not only in their home countries but also in numerous host countries. Consequently, they need to learn to manage more complicated global operations and quickly address any negative exposure that occurs. Public disclosure of CSI can significantly affect MNCs’ strategies and outcomes, and MNC executives should not undermine either global or local stakeholders’ expectations. Understanding both pressures (global and local) enables these executives to anticipate the level of threat that disclosure of CSI poses and thus the scope of strategic modification needed.

For practitioners, our study highlighted that modifying foreign subsidiary governance is a critical response to CSI disclosure. We emphasize that, although ownership control may be beneficial in exploiting technological and managerial advantages, it can have some internalization disadvantages and thus backfire in the face of publicity about CSI. On the other hand, information control can have some internalization advantages by providing actual control effects when managing CSI disclosure. In other words, information control and ownership control can function differently in responses to CSI disclosure in host countries. Therefore, differences across foreign subsidiary governance mechanisms should be recognized and used accordingly. When responding to public disclosure of CSI, MNC executives can implement greater subsequent information control to understand the incidents and manage their interactions with global stakeholders, but lower equity holdings to distance themselves from the incidents.