Abstract:

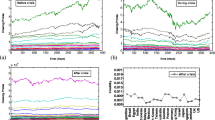

Following the recently introduced concept of transfer entropy, we attempt to measure the information flow between two financial time series, the Dow Jones and DAX stock index. Being based on Shannon entropies, this model-free approach in principle allows us to detect statistical dependencies of all types, i.e. linear and nonlinear temporal correlations. However, when available data is limited and the expected effect is rather small, a straightforward implementation suffers badly from misestimation due to finite sample effects, making it basically impossible to assess the significance of the obtained values. We therefore introduce a modified estimator, called effective transfer entropy, which leads to improved results in such conditions. In the application, we then manage to confirm an information transfer on a time scale of one minute between the two financial time series. The different economic impact of the two indices is also recovered from the data. Numerical results are then interpreted on one hand as capability of one index to explain future observations of the other, and on the other hand within terms of coupling strengths in the framework of a bivariate autoregressive stochastic model. Evidence is given for a nonlinear character of the coupling between Dow Jones and DAX.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Received 22 October 2001 / Received in final form 30 August 2002 Published online 29 November 2002

Rights and permissions

About this article

Cite this article

Marschinski, R., Kantz, H. Analysing the information flow between financial time series . Eur. Phys. J. B 30, 275–281 (2002). https://doi.org/10.1140/epjb/e2002-00379-2

Issue Date:

DOI: https://doi.org/10.1140/epjb/e2002-00379-2