Abstract

As global demand for consumer goods continues to rise, the problem of waste electrical and electronic equipment (or e-waste) increases. E-waste is of particular concern to the world’s governments and environmentalists alike, not just because of the sheer quantity that is being produced annually, but also because e-waste often contains both hazardous materials and scarce or valuable materials. Much research is now focused upon how this waste can be treated safely, economically, and in an environmentally sound manner. This paper presents the findings from a literature review and case study research conducted as a small part of the Globally Recoverable and Eco-friendly E-equipment Network with Distributed Information Service Management (GREENet) project. The GREENet project aims to share knowledge and expertise in e-waste treatment across Europe (in this case, the UK) and China. The focus of this particular study was upon ‘design for remanufacture’ and e-waste in China: as a remanufacturing industry begins to emerge, are Chinese original equipment manufacturers (OEMs) prepared to design more remanufacturable products and could electrical and electronic products become a part of this industry? Findings presented in this paper suggest that design for remanufacture could become more relevant to Chinese OEMs in the near future, as environmental legislation becomes increasingly stringent and a government remanufacturing pilot scheme expands. However, findings from case studies of Chinese e-waste recyclers would suggest that electrical and electronic products are not presently highly suited to the remanufacturing process.

Similar content being viewed by others

Background

Design for remanufacture

Remanufacturing is the process of returning a used product to a like-new condition through inspection, disassembling, cleaning, reprocessing, reassembling, and testing. Components which cannot be reused in this way are replaced with new components, and the final remanufactured product may be sold at a lower price than a newly manufactured equivalent, but with an equal warranty [1]. Remanufacturing differs from traditional recycling in that the used products are ‘recycled’ at a component level, as opposed to a raw material level (see Figure 1). Remanufacturing is often confused with reconditioning, when the used product is returned to a working condition but will not have an equal warranty to a newly manufactured equivalent. ‘Repair’ typically involves simply the correction of specific faults in the product. While remanufacturing requires more work (including energy and expense) than reconditioning or repairing, the resultant product will be of a higher quality with a further extended life in use. Therefore, remanufacturing can often be considered more energy-saving and cost-effective when compared to other end-of-life processes [2].

End-of-life treatment ‘loops’. Unlike recycling, remanufacturing does not require raw material processing or component manufacture [3].

However, not all products are suitable for remanufacture. As a general rule, the product must be durable (able to withstand multiple lifecycles) and contain high-value parts (worth investing in). Also, there must be market demand for the remanufactured products. Products typically remanufactured in the UK include automotive products, pumps and compressors, and off-road equipment [4]. As well as product characteristics such as high-value parts or a return flow of used products (i.e., factors beyond the control of the designer), the efficiency and effectiveness of the remanufacturing process can also greatly depend upon how the product has been designed (factors within the designers’ control): features such as fastening and joining methods, product architecture, and material choice can have an effect upon ease of disassembly, ease of reprocessing, and so on [5, 6]. This understanding has led to the concept of ‘design for remanufacture’ or ‘DfRem’, and the development of DfRem guidelines [5]. According to the literature, very few companies currently design for remanufacture [7]. However, in the USA and Europe, examples can be found of companies with successful remanufacturing operations, maximising the potential of their products through DfRem [8, 9].

E-waste in the UK and China

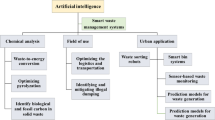

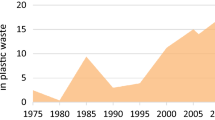

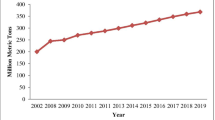

The term ‘e-waste’ refers to waste electrical and electronic equipment, such as computers, wireless devices, and white goods. It is most commonly used within the context of discarded consumer products. E-waste is a growing global problem, with million tonnes annually discarded by UK households alone. Some of this waste may be reused or recycled, but the significant proportion of this mass that ends up in landfill or incineration can have a highly detrimental environmental impact [10]. Furthermore, as our consumer culture shows little sign of abatement, including populous, emerging economies such as China [11], the situation is likely to get worse before it improves. Therefore, many countries, including the UK (European Union (EU)) and China have made attempts to implement legislation with the intention of reducing the volume of e-waste generated and ensuring that producers of such products take responsibility for the environmentally sound treatment and disposal of their waste.

Waste electrical and electronic equipment legislation in the UK and China

The European Union was among the first to attempt to legislate e-waste, with the introduction of the waste electrical and electronic equipment (WEEE) Directive [12]. Although all member states were expected to comply by 2004, it was not until 2007 that the UK finally implemented the WEEE Directive [13]. The EU WEEE Directive promotes ‘extended producer responsibility’ (EPR) with which original equipment manufacturers (OEMs) are obliged to contribute financially to the treatment of all WEEE in their given country. In the UK, OEMs of electrical and electronic equipment (which fall within the ten categories outlined in the Directive) must pay into a ‘producer compliance scheme’ which will finance the take-back and recycling of all electronic products which qualify, regardless of brand. Producer compliance schemes must be approved by the Environment Agency in the UK, and the funds they raise will be used by approved companies for e-waste recycling. Furthermore, OEMs are obliged to provide free take-back of e-waste, either through a take-back scheme or through retailers. Collection targets, however, are placed on the member states, as opposed to the OEMs: at least 4 kg of household waste per capita per year [14]. This target is surprisingly low, considering electronic waste accounts for an estimated 4% of European household waste, which would mean that around 18 kg of e-waste is discarded per capita in the UK [15]. However, a revision of this target has been proposed which would mean that by 2016, 65% of the average weight of e-waste must be collected [14].

In addition to the WEEE Directive, the EU’s ‘Restriction of Hazardous Substances’ (RoHS) legislation is also applicable to waste electrical and electronic products in the UK. RoHS, implemented in 2006, restricts the use of six materials which are considered hazardous to the environment: lead, mercury, cadmium, hexavalent chromium, polybrominated biphenyls, and polybrominated diphenyl ether. These restrictions only apply to products sold within the EU; however, OEMs are expected to pass these requirements to their supply chain [16]. This means that OEMs operating in other countries must also comply with both the WEEE Directive and RoHS if the products are destined to be sold in the EU.

While the UK struggles to control its own e-waste, the problem in China also continues to grow at a rapid pace: a 13% to 15% increase each year [17]. Therefore, in 2007 and 2011, respectively, the China RoHS (Management Measure for the Prevention of Pollution from Electronic Information Products) and China WEEE Directive (Management Regulations on the Recycling and Disposal of Waste Electronic and Electrical Products) were introduced (however, WEEE legislation is still to be fully implemented). The China RoHS is very similar to its European equivalent, with the same six substances being banned from use in electrical and electronic products intended for Chinese consumer and commercial and industrial markets [18]. It is possible that this list will be extended to include more hazardous substances in the future [16]. An addition to the China RoHS is that the regulation requires producers to include an ‘environmental expiry date’ with their products (e.g., in the user manual) to inform customers of the safe usage period of their products, before hazardous substances pose a risk to health and the environment.

In the past, and ongoing today, recycling in China was an informal industry sector, unregulated and often damaging to the local environment [11]. The China WEEE Directive, like its EU equivalent will insist upon ‘extended producer responsibility’. Formal recycling companies, approved by the government, will receive subsidies to operate safe, environmentally sound recycling for consumer and industrial e-waste, the funds for which will have been provided by the OEM producers [18]. Slightly different from the EU WEEE Directive is the definition of which products apply to the legislation. While in Europe there are ten categories of e-waste which are subject to the WEEE Directive, in China there is a catalogue outlining in detail all products which apply [18]. Furthermore, due to particular problems in this area, the China WEEE Directive also states that informal recyclers, who are not government-approved and are not operating in an environmentally sound manner, can be punished. However, how this will be enforced and the nature of punishment remain unclear [18]. The Chinese government has an overall recycling target of 70% by 2015, considerably more ambitious than the European WEEE Directive’s ‘4 kg’ target, but comparable to the proposed new ‘65%’ target for 2016 [19].

E-waste challenges in China

As mentioned in the previous section, informal (and now illegal) recycling is an ongoing problem in China due to its detrimental effect on local environments, as well as employee health and safety. This long-established informal recycling industry also poses several other challenges upon an EPR system in China. First, of all consumers are accustomed to being paid good prices for their e-waste from informal collectors [20]. This means that in order to remain competitive, formal recyclers must also pay the same price for their e-waste, ruling out the recycling fee strategy currently in operation in Japan, for example [14]. Formal recyclers have greater costs than informal, because they must ensure employee health and safety plus environmental protection. Hence, government subsidies are essential for competitiveness. Some pilot studies in China had previously failed because the formal recyclers could not collect enough e-waste for these reasons [21].

Another challenge that the China WEEE Directive must address is ‘orphan products’. Orphan products are those which cannot be paid for by the original producer for a variety of reasons. This is a problem in any country, but will be a particularly problematic issue in China because firstly, the sheer number of manufacturing companies in the country combined with a fast-moving economy means that producers are regularly going out of business, often without trace [21]. Also, China has a particular problem with imitation or counterfeit products, an underground operation which is again difficult to hold to account for recycling [21]. While the export of e-waste to China is now illegal, it is still an ongoing problem for the country, which creates further volumes of ‘orphaned’ e-waste [20].

Another, social problem regarding e-waste in China is collection. According to Li et al. [11], it is common for Chinese consumers to hold on to their e-waste for much longer than is the norm in other countries, due to a belief that the products could somehow become useful again in the future, or be sold to the second-hand market.

For these reasons, Li et al. [20] argue that simply copying the EU’s extended producer responsibility system will not provide a solution to the problem of China’s e-waste; China needs a system that is specifically designed to accommodate these country-specific issues. Yu et al. [22] suggest that integrating the informal recyclers with the formal may be an option for the future, for example paying informal collectors to supply formal recyclers.

Methods

Research aim

This research was conducted as part of the ‘Globally Recoverable and Eco-friendly E-equipment Network with Distributed Information Service Management’ project, or ‘GREENet’. The project is a 3-year collaboration between various institutes in the EU and China. Part of the programme involves the study of the status of remanufacturing and e-waste across the two global locations. This particular study was conducted during a short visit by UK researchers to Tsinghua University and the Research Centre for Eco-Environmental Sciences in Beijing.

Specifically, the research discussed in this paper is focused upon the status of design for remanufacture. Therefore, the research questions addressed in this paper are:

-

a)

How does the ‘design for remanufacture’ situation in China compare to the UK?

-

b)

How suited are electrical and electronic products to the remanufacturing process with regards to product design?

The first research question was explored primarily through the literature, searching for information on the prevalence of both remanufacture and DfRem in China for comparison with the authors’ experiences from the UK. The second question was explored through case study research, as outlined in the next section.

Case studies

Information was gathered during visits to three case study companies in the Beijing, Shanghai and Qingdao regions of China:

Company 1: One of the largest e-waste treatment facilities in Shanghai, it is involved in the collection, sorting, treatment, recycling, and safe disposal of a variety of electrical and electronic products including used televisions, ink cartridges, and white goods.

Company 2: This is a global e-waste recycling company with several facilities in China, Beijing, and Shanghai, where a recycling centre is located. The company treats all manner of e-waste, yet at the visited facility, the focus was upon the recycling of PCB boards to extract precious metals (copper and gold).

Company 3: This company operates a large ‘eco-industrial park’ which has become an all-inclusive provider of waste solutions, ranging from hazardous and medical waste treatment to soil remediation and recycling. The company’s e-waste recycling operations include products such as refrigerators, televisions, air conditioners, washing machines, and computer equipment.

The companies were all part of the ‘formal’ Chinese recycling industry, and therefore received government subsidies. They have a waste management licence which enables them to collect waste products from a variety of client sources, for example, factory rejects and community collection boxes. They are then responsible for the reverse logistics, treatment, and safe disposal or resale of raw materials (see Figure 2). The companies’ waste recycling activities produce recycled ferrous materials (iron steel, manganese, chromium), non-ferrous materials (gold, aluminium, copper, zinc), and non-metal materials (plastic, cardboard, glass, foam). An example of a case study recycling process is illustrated in Figure 3. The companies will then sell on their reclaimed materials to various manufacturing plants, depending on where the best price could be negotiated. The case study companies each have their own research and development centres and hold patents for state-of-the-art automated recycling equipment.

The three case study companies always recycle: they are not involved in any remanufacturing, refurbishment, or repair activities. At least one of the case study companies collected used products which contain remanufacturable components (for example motors in white goods). However, the lack of a remanufacturing infrastructure in China means that even these parts are currently recycled.

Case study questions and protocol

The following questions were asked to the case study companies in order to gain information on the suitability of e-waste for both remanufacture and design for remanufacture in China:

-

a)

What is the recycler’s connection/relationship to the OEMs of their e-waste?

-

b)

What product design-related problems and barriers do they currently face?

-

c)

What other problems and challenges are they currently facing?

Understanding the recycler’s relationship with OEMs not only provides context to the case studies but may also reveal any inter-organisational barriers to design for remanufacture, for example, access to intellectual property or design collaboration. This will compliment any findings regarding the technical problems and barriers a recycler may face.

Case studies involved a visit to the company’s recycling facilities, where e-waste products could be observed being disassembled and where materials are segregated and re-processed. This tour was followed by an interview with one or more members of site management. The findings reported in this paper represent only a small part of the overall GREENet project, and the authors have identified scope for future contributions from project researchers under this particular theme.

Literature survey

Remanufacturing in China

Unlike in Europe where remanufacturing has been a common industry practice for many decades, remanufacturing is a fairly new concept in China, with recent interest due to the dramatically rising number of vehicles on Chinese roads in recent years [23]. In 2008, the National Development and Reform Committee launched Regulations of Remanufacturing Pilot of Automotive Parts, a pilot study of 14 vehicle remanufacturers, with a view to encourage more remanufacturing activities in the future. This pilot study, which is ongoing at the time of writing, has been the first time vehicle engines, transmissions, starting gears, starters, and generators can be legally remanufactured in China [24]. Remanufacture has also been listed in the National Long and Medium Term Program of Science and Technology Development Planning as a key future manufacturing field in China [24]. Both Caterpillar (Illinois, USA) and IBM (NY, USA) have also recently launched remanufacturing ventures in China, another reason to suggest that remanufacturing is becoming a lucrative business venture [25, 26]. However, for the time being, there is very little information in the literature regarding remanufacture in China.

Some potential barriers to future remanufacturing expansion are similar to those found in other parts of the world, namely public perceptions that remanufactured products are ‘second hand’ and, therefore, inferior in quality. Others are more specific to China. For example, Chinese manufacturing often prefers to rely upon cheap labour rather than investing in the latest technologies, something which could slow the development of a strong remanufacturing industry in the country [23]. Local governments can also be wary of registering vehicles with remanufactured parts [24]. Zhang et al. [24] also noted that intellectual property laws in China could prevent third party remanufacturers from establishing themselves (third party remanufacturers play a major role in the European remanufacturing industry). As the kind of products typically remanufactured do not fall under the category of e-waste, there is currently no specific standards or regulations regarding remanufacture in China [24]. As there is very little remanufacturing currently happening in China, it can also be concluded that there is very little, if any, DfRem happening within Chinese OEMs today.

Design for remanufacture in China

While there may be little or no DfRem happening in China, it is possible to look to ecodesign for some insight. Although ecodesign research and DfRem research are not entirely inter-changeable, there are some similarities between the two, which mean it is worth exploring ecodesign for a comparison [27]. Something that the EU and China have in common is that their environmental legislation (Article 4 of the EU WEEE Directive and Articles 9 and 10 of China RoHS) both call for ecodesign from producers of electronic products; however, neither directive offers measurement for compliance [16].

While ecodesign is also a relatively new concept in China, it is likely to be of rising interest to Chinese designers as the country moves from simply manufacturing products to taking part in the innovation as well [28, 29]. If the remanufacturing industry were to expand in China over the next few years, the same could be said of DfRem.

Lindahl [30] conducted a survey of Asian electrical and electronic companies, including those operating in China, to study designers’ and managers’ awareness and abilities in ecodesign. At the time of the survey, most people interviewed were aware of the need to comply with European environmental legislation when selling to those countries, but not China (the directives were very much in their infancy at the time). Larger Chinese companies surveyed said they had implemented ecodesign measures to reduce energy consumption in their products and had eliminated hazardous substances. Some companies had made attempts to reduce materials usage, but in general, end-of-life considerations were not a major concern in these firms. The survey found that most designers and managers had some basic knowledge of ecodesign; however, the researchers admitted that the research could be biased. It is likely that the companies with no knowledge of ecodesign would not choose to take part in the study [30]. Similar to research conducted in the EU, for example [31], designers interviewed in China did not use ecodesign tools during their design work and felt that any tools implemented in the future would have to be quick to learn and low-cost to implement [30].

Yu et al. [16] conducted a similar survey with Chinese electrical and electronics companies. While they suspected their respondents were over-positive, the results suggested that 58% of companies have responded to the China RoHS legislation with ecodesign, although most of this has simply involved the removal of toxic substances. The survey found that, in general, Chinese companies have limited knowledge of ecodesign at present. However, Chung and Zhang [18] point out that China, in general, has better e-waste and ecodesign awareness than most developing countries.

These surveys highlight a point that is also made by Behrisch et al. [32] following an internet survey of Chinese design consultancy websites. Because the Chinese environmental legislation is so new (and in the case of WEEE Directive still to be fully put into practice), any ecodesign occurring in Chinese companies today is likely to be motivated instead by European legislation, for products destined for those countries. This is likely to change in years to come as Chinese environmental legislation is implemented. However, as with the EU, it is important that future amendments to environmental legislation include not just a mention of the importance of ecodesign/DfRem, but practical guidance and measurements that design engineers can follow, e.g., joining and fastening methods, disassembly targets, and material choices.

Lindahl [30] points out that for a developing country such as China, it will be important to the government that any move towards environmental improvement and increased ecodesign does not hinder economic development. An advantage DfRem has over ecodesign in this respect is that remanufacturing decisions are typically motivated by profitability, not environmental impact [5].

Results

This section outlines the preliminary findings and observations made from data collected during the three case study visits.

Company relationship with OEMs

The case study companies (from now on referred to as ‘the recyclers’) had many partner OEMs in China, including Panasonic (Osaka, Japan), Sony (Tokyo, Japan), Kodak (New York, USA), and Lenovo (North Carolina, USA). Most of the recycler’s e-waste is collected directly from these manufacturers. Some of this e-waste will be used or faulty products returned by the end customer or the plant’s own used office goods, but most of the products are factory rejects. OEMs in China are increasingly obligated to take responsibility for the recycling of this waste, due to EPR policies being introduced through the China WEEE and RoHS Directives.

If the collected e-waste contains hazardous waste, which the recycler must treat and safely dispose, WEEE regulations insist that the OEM must pay the recycler for this service. This service enables OEMs to comply with China RoHS legislation and, therefore, cannot legally be avoided. However, most often the precious metals and other materials of value contained within e-waste mean that the waste is considered to be of high market value. In these circumstances the recycler must purchase the e-waste from the OEM. This relationship is in some ways similar to an independent third-party remanufacturing scenario and also to contract remanufacturing. The relationship between the recycler and the OEMs of their e-waste is likely to be complex as, in many ways, the OEM is the supplier of e-waste, but is also the recycler’s customer as the OEM relies upon the recycler to ensure environmental legislation is complied with.

Communication between the recycler and the OEMs of e-waste comes firstly at point of collection and also during auditing processes as specified by the OEM. Because the OEM is legally obliged to be environmentally responsible for their e-waste, it is important that the company can be sure that their products are being treated in the correct manner. If the recycler has a contractual agreement with an OEM, that OEM will provide strict recycling instructions. The recycler is then required to provide the OEM with regular reports, providing evidence that these instructions are being followed. The recycling managers interviewed for this study stated that they would not provide information in these reports regarding common faults, or proposed design changes, mostly because product design is not of concern to them, and because they are not in a position of power to request design changes from an OEM. However, if the recycler is facing difficulties in recycling a particular product, they may be able to consult the OEM for advice, and interviewees in one of the companies interviewed stated that their OEMs will sometimes provide details of the hazardous waste contained within their products (i.e., a materials list) and occasionally will request reusable parts be sent back to their manufacturers.

Even if there is some design-related communication with the OEMs, the recyclers are never provided with any design information for their collected e-waste due to intellectual property concerns. This is also the case for contract remanufacturers. Therefore, it is necessary for the recyclers to ‘reverse engineer’ any new product that arrives at the plant to determine the proportions of precious metals present and the best course of action for retrieving them. Unlike reverse engineering for remanufacture, it is not necessary for recyclers to consider the disassembly of the new products, as discussed in the next section.

Product design barriers and challenges

Unlike remanufacturing, where the used product must be disassembled without damage to valuable parts, e-waste arriving at the recycling plants can be disassembled destructively. For example, a plastic casing for an air conditioner may be cracked open, because the materials will be shredded for recycling anyway. This advantage eliminates many of the design-related problems found in remanufacturing processes; therefore, the recyclers involved in this study did not recognize product design as a barrier to their recycling process.

Another design issue that creates problems in some remanufacturing processes is the disassembly of components containing hazardous wastes. Almost all disassembly for remanufacture is manual; therefore, the safe removal of these components can at times provide a challenge to remanufacturing staff [7]. However, at the Chinese recycling companies, the process is almost entirely automated, often using patented equipment. Ink cartridges, for example, can be fed into machinery that will crush and clean the products, removing hazardous waste automatically at no risk to recycling staff. Figure 3 illustrates a similarly automated process, where cathode ray tubes are fed onto a moving belt; several automated steps later, non-hazardous, hazardous and recyclable materials are produced.

The recyclers interviewed stated that there was little difference between new and old models of products; as product design has changed over the years, their recyclability has changed very little. This means that the technological stability of a product will have little effect on recycling effectiveness. Remanufacturing, on the other hand, is very much affected by technological stability, because the products are being re-sold as opposed to being broken down to their base materials. For example, as mobile phone technology is changing rapidly, by the time a used mobile phone is returned and remanufactured, there may be very little market demand for such an out-of-date model. This is simply not an issue for companies breaking down the mobile phones to their raw materials for recycling.

Other challenges

A great challenge for the recyclers is being able to predict profitability. In remanufacturing, this is also the case because it is very difficult for remanufacturers to predict the rate of used product (called ‘cores’) collection and the condition of the cores once collected (cores in poorer condition will be more expensive to return to an as-new condition). The predictability issues at recycling companies are slightly different; it is a result of varying market prices for the various materials they deal with. The recyclers must be very selective over the e-waste they choose to deal with and the companies they choose to work with to ensure the company maintains profitability. The interviewed recyclers stated that sometimes they would take on a contract that they know will be a loss-maker in order to build long-term relationships with customers and suppliers that will prove profitable in the future.

Some of this uncertainty is alleviated by government subsidies. As ‘formal’ recycling companies (as opposed to the now illegal informal recycling plants common across China), the companies involved in this study qualified for government financial assistance. The funds for these subsidies are provided by the OEMs under new WEEE legislation and are essential to ensure that formal recycling companies can remain competitive. A problem with informal recycling in China is its lack of worker safety and detrimental effect on the local environment. In order to obtain the required certification (e.g., ISO 9001 and ISO 14001), recyclers must invest in technologies and practices that would ensure that their recycling operations are both safe for employees and to the environment. These additional costs would reduce the competitiveness of formal recyclers without government subsidy [21].

Discussion

Remanufacture of E-waste in China

With the onset of WEEE regulations in China, which insist that OEMs of electrical and electronic products ensure the responsible end-of-life treatment of their e-waste (and take financial responsibility too), the role of formal recycling companies will become increasingly important in the industry. Whether China’s up-and-coming remanufacturing industry will also play a role in ‘extended producer responsibility’ in the future remains unclear, at least until the outcomes of the Chinese government’s current pilot studies are known in more detail.

While the recycling industry in China is primarily driven by environmental legislation, the remanufacturing industry in Europe is driven by profit. Many of the companies involved in remanufacture are not currently subject to any end-of-life legislation that would promote this choice; instead, they have realized that there is customer demand for affordable remanufactured products and spare parts [33]. Despite this contrast, both the recycling and remanufacturing industries will be just as interested in improving the efficiency and effectiveness of their processes, and often, this can be assisted through product design. The recognition that product design can affect the efficiency, effectiveness, and therefore profitability of product end-of-life processing is one reason why ‘design for recycling’, ‘design for remanufacture’, ‘design for environment’, and ‘ecodesign’ have become familiar terms in the engineering literature.

However, this study has found that many of the product design concerns commonly associated with remanufacturing are simply not important when considering recycling. This becomes clear when considering some points of the ‘RemPro’ matrix [6], a model which highlights different product design considerations affecting remanufacture. Ease of access, handling, disassembly, and reassembly are irrelevant in the modern recycling technologies used by the Chinese formal recyclers. These recyclers are only interested in the extraction of hazardous substances and the separation of recyclable materials. The most effective way to achieve this is to quickly disassemble the products by the easiest means possible, which may involve breaking casings and snapping joining components. Products that could only be disassembled through breakage would be a major problem for a remanufacturer, but makes no difference to the recycler. After initial separation, the products are essentially crushed and separated by entirely automated means.

This does not confirm that design for recycling is entirely unnecessary. Firstly, as contract recyclers, the case study companies were unable to discuss the product design of their e-waste in any great detail. A 1995 paper on design for recycling guidelines [34] contains many guidelines familiar to remanufacturing research: modularization, minimal joints, easily accessible hazardous parts, etc. However, as recycling technology has progressed to become increasingly sophisticated and increasingly automated, many of these guidelines do not apply to a product destined for a modern recycling facility. At the same time, many of the OEMs that work with the recyclers involved in this study do claim to optimise their products for recycling. For example, on their website, Panasonic claims to be involved in ‘green design’. The company claims to be committed to reducing materials such as PVC, which is difficult to recycle; the company also states it is committed to designing more ‘recycling-oriented products’ [35]. Chinese OEM Lenovo claims to aim to comply with the European WEEE Directive by ‘designing equipment with consideration to future dismantling, recovery and recycling requirements’ [36].

Considering the suitability of e-waste for remanufacture, the information gathered to date would suggest that, in general, electrical and electronic products are not currently suitable candidates for remanufacture; the process is not a feasible alternative end-of-life solution to current recycling practices. The key reasons for this conclusion, based on the findings from this study, are as follows:

-

At present, electrical and electronic products are not typically designed for non-destructive disassembly because modern recycling technologies have deemed this previous requirement unnecessary.

-

Many electrical and electronic products contain high volumes of precious metals, which, once recovered through recycling, have a higher market value than a remanufactured product most likely would.

-

Most of the used products that arrived at the case study recycling facilities would be considered technologically ‘out-of-date’, even if they are only a few years old. There would be little market demand for a remanufactured laptop or mobile phone for this reason (hence, low market value).

-

A very important part of the e-waste recycling process is data wiping. While this can also be carried out for electronic remanufacture or refurbishment, unlike with recycling, the sensitive components would be reused, not crushed and recycled. It is possible that many customers would be untrusting, potentially reducing the number of used products that can be collected and then resold.

Design for remanufacture in China

Because environmental legislation has so recently been introduced, ecodesign (and related concepts such as DfRem) is still a very new concept to Chinese producers. Findings from the three case study recyclers would suggest that these new ideas have not yet trickled down to those working in the product end-of-life phase. Design for remanufacture is a relatively uncommon concept in UK companies, and it would appear that China is even further behind. However, companies in China are beginning to make changes to the way they design products (for example the reduction of hazardous materials), and as legislation matures and China expands its research and development sectors, ecodesign can be expected to become increasingly relevant to Chinese design engineers. As discussed in this paper, the highly automated technology used in China’s state-of-the-art recycling facilities may render many traditional ecodesign guidelines unnecessary; yet, design considerations that facilitate effective collection and transportation (for example design for stacking or product-service design) remain important. The collection of e-waste was a significant part of the three case study recyclers’ businesses and is likewise a significant factor in the remanufacturing industry.

At present, remanufacturing in China is more or less limited to 14 pilot studies recently launched by the government. These studies, which are focused upon the automotive industry, are intended to gather knowledge and experience of the remanufacturing process to enable the development of guidance, standards, and strategies that will expand China’s remanufacturing industry. It will be interesting to learn the findings from these pilot studies, which include product design guidelines or requirements. However, these pilot studies are concerned with automotive (not electronic) products. It is most likely that a move towards DfRem in China will begin in the mechanical/electromechanical industries, which has been the case in the UK.

To date, there is no specific environmental legislation encouraging companies to remanufacture in China. As such, DfRem is virtually unknown, and very little remanufacturing research can be found in the literature. However, if the pilot studies prove successful and remanufacturing industry expands in years to come, it is possible that DfRem will follow a similar path to ecodesign in the future. Research conducted in the UK would suggest that there are a number of steps OEMs can take to help ensure that DfRem considerations are included in the design process. Designers must be motivated to design for remanufacture and have knowledge and understanding of their company’s remanufacturing processes and capabilities. Management must also be committed to optimising remanufacturability. Key factors which may influence DfRem integration include the presence of remanufacturing requirements in design specifications and regular and quality communication between design engineering teams and the remanufacturers of their products [9].

Conclusion

Summary

This paper has presented the findings from a literature survey and case study research conducted in three Chinese recyclers of waste electrical and electronic products. Recent progress in environmental legislation in China has meant that manufacturers are under increasing pressure to ensure the environmentally sound treatment of their e-waste, and the changes have also led to an increase in formal recycling industrial activity in China. Remanufacturing, on the other hand, remains relatively unknown and un-tried as an end-of-life solution in China; as a result, the concept of ‘design for remanufacture’ is also virtually unknown. However, it is possible that DfRem could become more relevant to Chinese OEMs in the future, if a government pilot scheme for automotive remanufacturing proves a success, and ecodesign concerns in general become a more common knowledge among Chinese product designers.

Considering e-waste specifically, however, evidence gathered from the three case study companies would suggest that electrical and electronic products are not highly suited to the remanufacturing process due to a combination of technical design and market factors. Also, the remanufacturing process is not as suited to e-waste, in comparison to the hi-tech recycling processes now utilized by China’s formal recyclers. Considering that much of the DfRem literature published to date has focused upon electrical and electronic products [27], the issues raised in this paper should be taken into consideration when discussing the future directions of both the remanufacturing industry and future e-waste solutions.

Future work

The findings presented in this paper represent an outlook on design for remanufacture and e-waste in China, from a European (UK) perspective. However, to gain a full understanding of this subject, more in-depth research is required which covers not only the recyclers’ perspective but also the perspective of the OEM (specifically design engineering). More evidence of DfRem practice in China is required to further address the research aims stated in this paper. Not only will this enhance our understanding of the relationships between OEMs and their waste treatment facilities but studying those who are responsible for the design of electrical and electronic products may also reveal a wider set of barriers, challenges, and opportunities regarding DfRem and e-waste which must be taken into account during any discussion of the subject. Therefore, future case study work in this area should include relevant design engineers, design managers, and aftermarket management working within electrical and electronics OEMs. An understanding of the existing design process and organisational issues in Chinese OEMs will enable the development of DfRem guidelines that are appropriate for China’s organisational structures and cultures, as well as the country’s existing product end-of-life technologies and infrastructure.

Due to the nature of the GREENet project, this research was conducted with a specific focus upon electrical and electronic products. However, studies from the UK would suggest that Chinese remanufacturing and DfRem practice is most likely to develop in the mechanical/electromechanical industries first [4]. Therefore, to gain an improved early understanding of emerging DfRem challenges and requirements, more insight into these industries is required.

If the Chinese government’s remanufacturing pilot scheme is a success and the remanufacturing industry of China is set to expand, the need for DfRem within Chinese OEMs will increase, and research in this subject will become more relevant. Aside from the development of DfRem guidelines, another important part of this research will be determining how these guidelines may best be integrated into the design processes of Chinese OEMs: a country- and culture-specific study of the operational factors that would enable successful DfRem integration.

Finally, this research has revealed that the design of electrical and electronic products in China is not highly suited to the remanufacturing process, partly because the existing state-of-the-art recycling processes do not require disassembly. However, many of the other challenges to e-waste remanufacture identified through this research were market-driven: in the opinion of waste treatment facilities, customers simply do not want remanufactured electronic goods; therefore, recycling is a more economically lucrative strategy. Further research is required to understand these issues from both sides: What can designers do to increase the emotional longevity of electronic products in an era of rapid technological advancement, and how can society challenge the view that ‘new’ is always desirable in a world of limited resources?

Authors’ information

GDH graduated from the University of Strathclyde, Glasgow (UK) with a BSc (Hons) degree in Product Design and Innovation from the Department of Design, Manufacture and Engineering Management (DMEM). She is a member of the University of Strathclyde’s remanufacturing research group, currently completing a Ph.D. in product design for remanufacture, and is also currently a Teaching Associate in the DMEM Department. WLI is one of the UK’s leading Remanufacturing researchers with elements of her work incorporated in British Standards Institute (e.g. BS 8887–2:2009- Terms and definitions). She is a member of national and international committees established to help industry meet international environmental legislation (e.g. TDW/004/0-/05 Design for MADE BSI, The UK Energy Minister’s WEEE Advisory Group). She is the initiator and the Editor-in-Chief of Springer’s International Journal of Remanufacturing. She is a founding member of the IEEE Robotics and Automation Society technical committee on “sustainable production and service”. She created and heads the University of Strathclyde remanufacturing research group, which specialises in interdisciplinary and practitioner-based research, and consists of 14 active researchers with 21 industrial partners. Including current research, she has been actively involved in over 17 industry-focused remanufacturing projects at Ph.D. or post doctorate level (6 as researcher and 10 as supervisor). With key EU and Chinese research institutions, she is developing Information and Communication Technologies-based strategies to enhance global product end-of-life management. She has developed and teaches MSc classes on Sustainable Design and Manufacture. She undertakes knowledge transfer to industry, academia and the public. JFCW received the degrees BEng (Electronic Engineering) in 1998 and Ph.D. (Electromagnetic Force Microscopy) in 2002, both from the University of Plymouth, Plymouth (UK). After his Ph.D. research, he became a post-doctoral Research Associate at the School of Biological Sciences, University of Bristol, Bristol, UK, in 2003, working on insect auditory systems. In 2008, he moved to the University of Strathclyde, Glasgow, UK, to take up the position of Lecturer in the Centre for Ultrasonic Engineering, in the Department of Electronic and Electrical Engineering, where he undertakes research into biologically inspired acoustic systems, with a focus on non-destructive testing and sustainable engineering. In 2011, he was appointed to the position of Senior Lecturer.

Abbreviations

- DfRem:

-

design for remanufacture

- EPR:

-

extended producer responsibility

- EU:

-

European union

- GREENet:

-

Globally Recoverable and Eco-Friendly E-Equipment Network with Distributed Information Service Management

- OEM:

-

original equipment manufacturer

- RoHS:

-

reduction of hazardous substances

- WEEE:

-

waste electrical and electronic equipment.

References

Ijomah W: A model-based definition of the generic remanufacturing business process. The University of Plymouth, Plymouth; 2002.

Lindahl M, Sundin E, Ostlin J: Environmental issues within the remanufacturing industry. In 13th CIRP International Conference on Life Cycle Engineering. Leuven; 31 May–2 June 2006.

King A, Burgess S, Ijomah W, McMahon C: Reducing waste: repair, recondition, remanufacture or recycle? Sustainable Dev 2006, 14: 257–267. 10.1002/sd.271

Chapman A, Bartlett C, McGill I, Parker D, Walsh B: Remanufacturing in the UK. Centre for Remanufacturing and Reuse, UK; 2009.

Ijomah W, McMahon C, Hammond G, Newman S: Development of robust design-for-remanufacturing guidelines to further the aims of sustainable development. Int J Prod Res 2007, 45: 4513–4536. 10.1080/00207540701450138

Sundin E, Bras B: Making functional sales environmentally and economically beneficial through product remanufacturing. J Cleaner Prod 2005, 13: 913–925. 10.1016/j.jclepro.2004.04.006

Charter M, Gray C: Remanufacturing and Product Design: Designing for the 7th Generation. The Centre for Sustainable Design, Surrey; 2008.

Kerr W, Ryan C: Eco-efficiency gains from remanufacturing: a case study of photocopier remanufacturing at Fuji Xerox Australia. J Cleaner Prod 2001, 9: 75–81. 10.1016/S0959-6526(00)00032-9

Hatcher G, Ijomah W, Windmill J: Integrating design for remanufacture into the design process: the operational factors. J Cleaner Prod 2012, 39: 200–208.

Scottish Environment Protection Agency: Waste electrical and electronic equipment. (WEEE). . Accessed 12 November 2012 http://www.sepa.org.uk/waste/waste_regulation/producer_responsibility/weee.aspx

Li J, Tian B, Liu T, Liu H, Wen X, Honda S: Status quo of e-waste management in Mainland China. J Mater Cycles Waste Manage 2006, 8: 13–20. 10.1007/s10163-005-0144-3

Europa: Waste Electrical and Electronic Equipment (WEEE) Directive. . Accessed 20 May 2012 http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=CELEX:32002L0096:EN:NOT

Turner M, Callaghan D: UK to finally implement the WEEE directive. Comput Law Secur Rep 2007, 23: 73–76. 10.1016/j.clsr.2006.11.007

Ongondo F, Williams I, Cherrett T: How are WEEE doing? A global review of the management of electrical and electronic wastes. Waste Manag 2011, 31: 714–730. 10.1016/j.wasman.2010.10.023

Recycling. . Accessed 12 November 2012 http://www.environment-agency.gov.uk/cy/ymchwil/llyfrgell/data/34425.aspx

Yu J, Hills P, Welford R: Extended producer responsibility and eco-design changes: perspectives from China. Corp Soc Responsibility Environ Manage 2008, 15: 111–124. 10.1002/csr.168

He K, Li L, Ding W: Research on Recovery Logistics Network of Waste Electronic and Electrical Equipment in China. In 3rd IEEE Conference on Industrial Electronics and Applications. Singapore; 3–5 June 2008.

Chung S, Zhang C: An evaluation of legislative measures on electrical and electronic waste in the People’s Republic of China. Waste Manag 2011, 31: 2638–2646. 10.1016/j.wasman.2011.07.010

Freyberg T: China Takes Charge. . Accessed 18 May 2012 http://www.waste-management-world.com/articles/print/volume-12/issue-6/regulars/from-the-editor/china-takes-charge.html

Li B, Du H, Ding H, Shi M: E-waste recycling and related social issues in China. Energy Procedia 2011, 5: 2527–2531.

Kojima M, Yoshida A, Sasaki S: Difficulties in applying extended producer responsibility policies in developing countries: case studies in E-waste recycling in China and Thailand. J Mater Cycles Waste Manage 2009, 11: 263–269. 10.1007/s10163-009-0240-x

Yu J, Williams E, Ju M, Shao C: Managing E-waste in China: policies, pilot projects and alternative approaches. Resour Conserv Recycling 2010, 54: 991–999. 10.1016/j.resconrec.2010.02.006

Xiang W, Ming C: Implementing extended producer responsibility: vehicle remanufacturing in China. J Cleaner Prod 2011, 19: 680–686. 10.1016/j.jclepro.2010.11.016

Zhang T, Wang X, Chu J, Cui P: Remanufacturing mode and it’s reliability for the design of automotive products. In 5th International Conference on Responsive Manufacturing - Green Manufacturing (ICRM 2010). Ningbo; 11–13 January 2010.

Caterpillar: Caterpillar announces remanufacturing joint venture with China Yuchai to promote China’s sustainability and environmental preservation initiatives. . Accessed 18 May 2012 http://www.caterpillar.com/cda/files/2501386/7/121409%20Caterpillar%20Announces%20Remanufacturing%20Joint%20Venture%20with%20China%20Yuchai.pdf

IBM: IBM Opens the First Server Remanufacturing Center in China. . Accessed 18 May 2012 http://www-03.ibm.com/press/us/en/pressrelease/36976.wss

Hatcher G, Ijomah W, Windmill J: Design for remanufacture: a literature review and future research needs. J Cleaner Prod 2011, 19: 2004–2214. 10.1016/j.jclepro.2011.06.019

Wong S, El-Abd H: Why electronics in China - a business perspective. IEEE Trans Components Packaging Technol 2003, 26: 276–280. 10.1109/TCAPT.2003.812608

Altenburg T, Schmitz H, Stamm A: Breakthrough? China’s and India’s transition from production to innovation. World Dev 2007, 36: 325–344.

Lindahl M: The State of Eco-Design in Asian Electrical and Electronic Companies: A Study in China, India. Thailand and Vietnam. The Centre for Sustainable Design, Surrey; 2007.

Lofthouse V: EcoDesign tools for designers: defining the requirements. J Cleaner Prod 2006, 14: 1386–1395. 10.1016/j.jclepro.2005.11.013

Behrisch J, Ramirez M, Giurco D: Representation of ecodesign practice: international comparison of industrial design consultancies. Sustainability 2011, 3: 1778–1791. 10.3390/su3101778

Seitz M: A critical assessment of motives for product recovery: the case of engine remanufacturing. J Cleaner Prod 2007, 15: 1147–1157. 10.1016/j.jclepro.2006.05.029

Kriwet A, Zussman E, Seliger G: Systematic integration of design-for-recycling into product design. J Cleaner Prod 1995, 38: 15–22.

Panasonic: Green design. +Panasonic/Green+Design/1555006/index.html#anker_1556569. Accessed 20 May 2012 http://www.panasonic.co.uk/html/en_GB/About

Lenovo: Lenovo Statement Concerning WEEE. . Accessed 20 May 2012 http://www.lenovo.com/social_responsibility/us/en/sustainability/Lenovo_WEEE_statement.pdf

Acknowledgements

The authors would like to thank the School of Environment, Tsinghua University and the RCEES in Beijing for their accommodation and support of this research. We also thank the three case study companies involved in this research. This work is carried out as a part of GREENet which was supported by a Marie Curie International Research Staff Exchange Scheme Fellowship within the 7th European Community Framework Programme under grant agreement No. 269122. The paper only reflects the author's views and the Union is not liable for any use that may be made of the information contained therein.

Author information

Authors and Affiliations

Corresponding author

Additional information

Competing interests

The authors declare that they have no competing interests.

Authors’ contributions

GDH drafted the manuscript and acquired, analysed, and interpreted the data. WLI made critical revisions for the intellectual content of the manuscript. JFCW also contributed to the critical revision for the intellectual content of the manuscript. All authors read and approved the final manuscript.

Authors’ original submitted files for images

Below are the links to the authors’ original submitted files for images.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 2.0 International License (https://creativecommons.org/licenses/by/2.0), which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

About this article

Cite this article

Hatcher, G.D., Ijomah, W.L. & Windmill, J.F. Design for remanufacturing in China: a case study of electrical and electronic equipment. Jnl Remanufactur 3, 3 (2013). https://doi.org/10.1186/2210-4690-3-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/2210-4690-3-3