Abstract

Background: Previously published research by the authors found that returns on research and development (R&D) for drugs introduced into the US market in the 1970s and 1980s were highly skewed and that the top decile of new drugs accounted for close to half the overall market value. In the 1990s, however, the R&D environment for new medicines underwent a number of changes including the following: the rapid growth of managed-care organisations; indications that R&D costs were rising at a rate faster than that of overall inflation; new market strategies of major firms aimed at simultaneous launches across world markets; and the increased attention focused on the pharmaceutical industry in the political arena.

Objective: The aim of this study was to examine the worldwide returns on R&D for drugs introduced into the US market in the first half of the 1990s, given that there have been significant changes to the R&D environment for new medicines over the past decade or so.

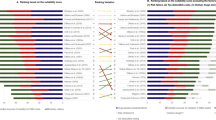

Results: Analysis of new drugs entering the market from 1990 to 1994 resulted in findings similar to those of the earlier research — pharmaceutical R&D is characterised by a highly skewed distribution of returns and a mean industry internal rate of return modestly in excess of the cost of capital.

Conclusions: Although the distribution of returns on R&D for new drugs continues to be highly skewed, the analysis reveals that a number of dynamic forces are currently at work in the industry. In particular, R&D costs as well as new drug introductions, sales and contribution margins increased significantly compared with their 1980s values.

Similar content being viewed by others

Notes

Since our sample is centred around 1992, we utilise the following linear extrapolation equation to derive R&Dcosts: R&D92 = R&D84 + (8/13) R&D97

DiMasi et al.[5] obtained data from all the firms participating in his survey on pre-approval and post-approval R&D expenditures. On the basis of an analysis of these data, they estimated that out-of-pocket R&D expenditures for product extensions in the post-approval period were 34.8% of pre-approval R&Dexpenditures. Applying this percentage to our estimate of $US308.4 million for pre-approval R&D yields an estimate of $US107 million (in $US, 2000 values) as the R&D cost for post-launch product improvements.

Tradenames are used for identification purposes only and do not imply product endorsement.

References

Grabowski H, Vernon J. Returns to R&D on new drug introductions in the 1980s. J Health Econ 1994; 13: 383–406

Grabowski H, Vernon J. A new look at the returns and risks to pharmaceutical R&D. Manage Sci 1990; 36 (7): 167–85

Scherer FM. The link between gross profitability and pharmaceutical R&D spending. Health Aff 2001; 20 (5): 136–40

Shulman S, Healy EM, Lasagna L, editors. PBMs: reshaping the pharmaceutical distribution network. New York: Haworth Press, 1998

DiMasi JA, Hansen RW, Grabowski HG. The price of innovation: new estimates of drug development costs. J Health Econ 2002. In Press

Congress of the United States. Congressional Budget Office. How health care reform affects pharmaceutical research and development. Washington: US Government Printing Office, Jun 1994

Congress of the United States. Congressional Budget Office. How increased competition from generic drugs has affected prices and returns in the pharmaceutical industry. Washington: US Government Printing Office, Jul 1998

Grabowski H, Vernon J. The distribution of sales revenues from pharmaceutical innovation. Pharmacoeconomics 2000; 18 Suppl. 1: 21–32

Myers SC, Shyum-Sunder L. Measuring pharmaceutical industry risk and the cost-of-capital. In: Helms RB, editor. Competitive strategies in the pharmaceutical industry. Washington (DC): AEI Press, 1996: 208–37

US Congress, Office of Technology Assessment Pharmaceutical R&D. Costs, risks and rewards. Washington (DC): US Government Printing Office, 1993

Myers SC, Howe CD. A life-cycle financial model of pharmaceutical R&D: working paper; program on the pharmaceutical industry. Cambridge (MA): MIT, 1997

Poterba JM, Summers LH. A CEO survey of US companies time horizons and hurdle rates. Sloan Manage Rev 1995; Fall: 43–53

DiMasi J, Hansen R, Grabowski H, et al. The cost of innovation in the pharmaceutical industry. J Health Econ 1991; 10: 107–42

Thomas LG. Industrial policy and international competitiveness in the pharmaceutical industry. In: Helms B, editor. Competitive strategies in the pharmaceutical industry. Washington (DC): AEI Press, 1996: 107–129

Annual report: the Med Ad News 500: the world’s best-selling medicines. Med Ad News 2001; 20 (5)

Grabowski H, Vernon J. Effective patent life in pharmaceuticals. Int J Technol Manag 2000; 19: 98–120

Burstall ML, Reuben BG, Reuben AJ. Pricing and reimbursement regulation in Europe: an update of the industry perspective. Drug Inf J 1999; 33: 669–88

Rosenthal MB, Berndt ER, Donohue JM, et al. Promotion of prescription drugs to consumers. N Engl J Med 2002; 346 (7): 498–505

Best Practices LLC. Global marketing launch: an executive summary. Chapel Hill, NC (USA): Best Practices, Feb 2000. Available on the web with associated reports from: URL: http://internet8.eapps.com/bestp/domrep

Scherer FM, Harkoff D, Kudies J. Uncertainty and the size distribution of rewards from technological innovation. J Evolut Econ 2000; 10: 175–200

Grabowski H, Vernon J. The determinants of pharmaceutical research and development expenditures J. Evolut Econ 2000; 10: 201–15

Cutler DM, McClellan M. Is technological change in medicine worth it? Health Aff 2000; 20 (5): 11–29

Lichtenberg FR. Are the benefits of newer drugs worth their cost?.: evidence from the 1996 MEPS. Health Aff 2000; 20 (5): 241–51

Grabowski H. Drug regulation and innovation. Washington: AEI Press, 1976

Baily MN. Research and development costs and returns: the US pharmaceutical industry. J Pol Econ 1972; 80 (1): 70–85

Scherer FM. Technological maturity and waning economic growth. Arts and Sciences 1978; 1: 7–11

Anderson WH, Fitzgerald CQ, Manasco PK. Current and future applications of pharmacogenomics. New Horiz 1999; 7 (2): 262–29

The fruits of genomics: drug pipelines face indigestion until the new biology ripens. New York: Lehman Brothers, Jan 2001

Acknowledgements

This paper was supported by an unrestricted grant from the Program in Pharmaceuticals and Health Economics at Duke University. We are indebted to a number of individuals who commented on prior versions of this paper, including Mike Scherer, Dennis Mueller, Bill Comanor, Patricia Danzon, Vivian Ho, Mike Morissey, David Grabowski, Robert Helms, Adrian Towse, Paul Meyer, and Steve Propper. Any errors that remain in the manuscript are the responsibility of the authors.

The Program receives support from various foundations, health sector entities and pharmaceuticals firms.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Grabowski, H., Vernon, J. & DiMasi, J.A. Returns on Research and Development for 1990s New Drug Introductions. Pharmacoeconomics 20 (Suppl 3), 11–29 (2002). https://doi.org/10.2165/00019053-200220003-00002

Published:

Issue Date:

DOI: https://doi.org/10.2165/00019053-200220003-00002