The development of green finance under the goal of carbon neutrality: A review from China’s perspective

- 1School of Management Engineering, Qingdao University of Technology, Qingdao, China

- 2Smart City Construction Management Research Center (New Think Tank), Qingdao, China

Extreme environmental and climate problems have been ravaging the world, causing serious economic losses and hindering human development, so that carbon neutrality has become a global undertaking related to the survival of human civilization. To ensure climate change mitigation and carbon emission reduction, this paper finds that green finance as an important and efficient tool has become a legislative priority for many countries and have been embedded in the path to achieve carbon neutrality. On the basis of in-depth analysis of the evolution and development of global green finance, this paper reviews and summarizes the development of green finance in China through literature analysis and horizontal comparison, and explores concrete recommendations and feasible tools that can be tailored to China’s carbon neutrality goal and stage of development. It is concluded that China needs to improve the green finance operation mechanism and flexible policy framework, to formulate a more accurate timetable and roadmap, to strengthen the modernization of the governance system and governance capacity and to promote the global green finance cooperation.

1 Introduction

On 9 August 2021, the United Nations Intergovernmental Panel on Climate Change (IPCC) held a press conference in Geneva, Switzerland, to officially release the IPCC Sixth Assessment Report Working Group I report “Natural Science Basis of Climate Change 2021”. The report points out that with global warming, more weather events such as droughts and heavy rainfall will occur. For example, the high temperature weather in the northwest of the United States in June 2021 and the heavy precipitation in Zhengzhou, China, in July. Extreme environmental problems have been ravaging the world, encroaching on human life safety, causing serious economic losses and hindering human development, so carbon neutrality has become a global undertaking related to the survival of human civilization. At present, 136 countries and regions around the world have made major strategic commitments to achieve carbon neutrality around the middle of this century.

China has been committed to mitigating climate change. On 22 September 2020, at the general debate of the 75th session of the United Nations General Assembly, China clearly stated that “carbon dioxide emissions should peak before 2030 and achieve carbon neutrality before 2060” (Cao et al., 2021), but China’s coal-dominated energy consumption structure has put tremendous pressure on carbon emission reduction (Solarin et al., 2013). In this context, the development of green economy has become a necessary path to achieve the goal of carbon neutrality (Feng and Ma, 2017; Chai, 2018). In the report of the 19th National Congress, General Secretary Xi Jinping proposed that China should “establish a sound economic system of green, low-carbon and circular development and develop green finance” (Xi, 2017).

The concept of “green finance” is derived from “environmental finance”, which was proposed by White (White, 1996). As early as 1974, Germany established the world’s first policy-based environmental bank to provide preferential loans for environmental projects (Hu et al., 2017). In the United States, the Comprehensive Environmental Response Compensation and Liability Act was enacted in 1980, which recognized the traceability of environmental liability (Guo and Cai, 2015; Jiang and Zhang, 2017). Salazar believes that green finance is the product of combining the financial industry with the green industry and incorporating environmental benefits into financial innovation (Salazar, 1998). In 2002, Japan promulgated the Enforcement Order of the New Energy Utilization Measures Act, which can be regarded as the legal basis for Japan to achieve the goal of carbon neutrality (Du and Li, 2021). In 2008, the South Korean government launched the Low-Carbon Green Growth Strategy, which provides a strong and favorable policy to ensure the smooth development of green finance (Xi, 2011). The European Commission released a policy document “Net Zero Emissions by 2050” in November 2018 (Zhang et al., 2021). In China, in 2005, the State Council issued the Decision on Implementing the Scientific Outlook on Development to Strengthen Environmental Protection, emphasizing the importance of environmental protection (Li et al., 2019). In 2016, green finance was included in the G20 summit for the first time (Chen and Tao, 2021). In the same year, seven ministries and commissions, including People’s Bank of China, jointly issued the Guiding Opinions on Building a Green Financial System, formally establishing a top-level framework for China’s green finance (Bai, 2022). The guidance states that green finance is an economic activity that supports environmental improvement, climate change, conservation and efficient use of resources. Green finance is an important tool to achieve the goal of carbon neutrality. Based on the perspective of carbon emission reduction: green finance can guide the flow of social funds to production activities conducive to green development, and promote more resources to be allocated in the field of pollution control and environmental protection, which will reduce carbon emissions per unit of output and enhance regional carbon removal capacity, thereby promoting carbon neutrality. Based on the perspective of carbon absorption: Green finance can encourage talents and funds to invest in the research of carbon capture, utilization and storage technology (CCUS) to promote carbon neutrality.

At present, China has basically formed a multi-level green financial products and market system such as green credit, green bonds, green funds, etc. The proportion of loans invested by green finance in projects with direct or indirect carbon emission reduction benefits has reached 67%, and has successfully promoted the implementation of green low-carbon transformation projects in China’s energy structure, industrial structure, production and lifestyle.” China’s carbon emission trading market has also been officially launched, which means that carbon finance has become an important part of green finance. Fan Yaping proposed that the establishment of a sound green financial system needs to learn from the development experience of green finance in developed countries (Xia, 2021). Zhang Zhongxiang believed that achieving the goal of carbon neutrality requires accelerating the construction of green finance (Lin et al., 2022).

In summary, although China started to develop green finance slightly late, the issuance of the Guidance on Building a Green Financial System means that China became the first country in the world to formulate a top-level design for green finance (Writing Group of China Green Finance Progress Report, 2021). Understanding and grasping the international green finance development situation is conducive to strengthening the communication and cooperation between China and the international community in the field of green finance development, continuously improving the green finance development system in light of China’s objective and actual conditions, and exploring effective paths for China’s green finance development to promote the achievement of carbon neutrality.

2 Analysis and judgment of current global carbon neutrality goals

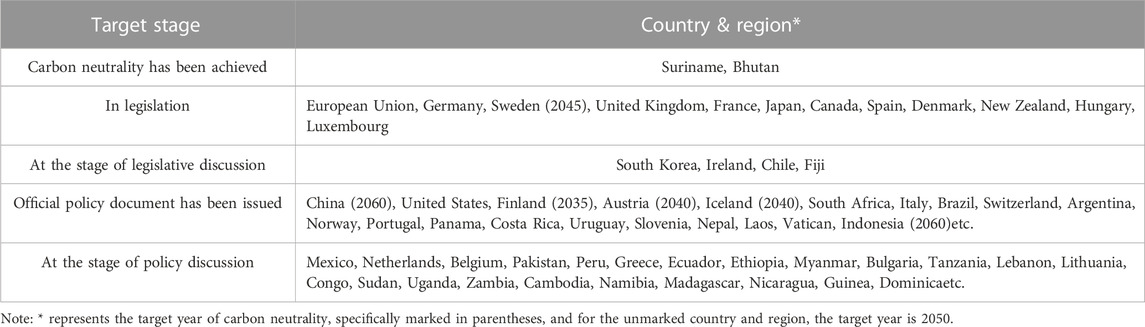

The Paris Agreement, which is the main goal of the global green and low-carbon transition, is a major trend to actively address climate change. In line with the Paris Agreement’s goal of limiting temperature rise to 1.5°C (Savaresi, 2016), countries have put forward carbon neutrality visions. As of December 2021, 136 countries and regions have proposed “zero carbon” or carbon neutral climate goals, in which 2 countries have achieved carbon neutrality, the European Union and 11 other countries have legislated, and 4 countries in the legislative state, according to the Energy and Climate Intelligence Unit. In addition, more than 30 countries have issued formal policy documents, and nearly 100 countries and regions have proposed targets but are still under discussion (Nelson and Allwood, 2021), as detailed in Table 1.

2.1 Carbon neutrality target status

There are two countries that have achieved carbon neutrality - Suriname and Bhutan, which were announced in 2014 and 2018, respectively. Due to their small size, extremely high forest cover and low level of economic development, the two countries are of little relevance to other countries that are still in the process of achieving carbon neutrality.

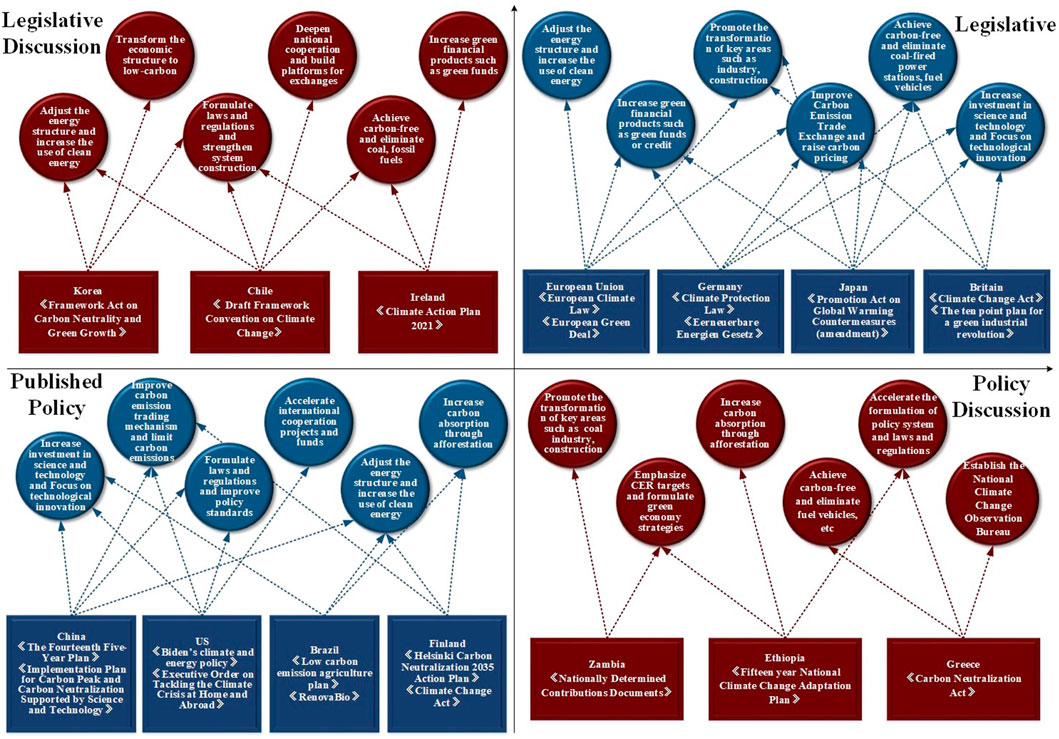

In order to achieve the target of carbon neutrality, different countries and regions have issued key guidance documents and taken specific measures according to their specific conditions, as summarized in Figure 1.

Among the countries and economies that the carbon neutrality target is in legislation, the EU, as a leader in the fight against climate change, first set out its vision of achieving carbon neutrality by 2050 in November 2018. On this basis, the EU has successively published a draft “European Green Deal” and the European Climate Law, which was adopted in June 2021, becoming Europe’s first climate law, which restricts carbon emissions in 27 member states (European Commission, 2020). In the process of achieving carbon neutrality, the EU uses the European Green Deal as the key guiding document (Claeys et al., 2019), controlling carbon emissions from four aspects, supplemented by financial support (Wang Y et al., 2021), the specific measures are shown in Figure 1. Germany and France responded positively to the bill, and Germany introduced the Climate Protection Plan 2050 before the legislation, on the basis of which it enhanced the binding force with laws and regulations such as the Federal Climate Legislation and the Renewable Energy Act, focusing on investments in renewable energy and phasing out coal-fired power plants with a view to achieving carbon neutrality by 2050 (Wang H Y et al., 2021). In April 2020, France issued a decree to adopt “National Low-Carbon Strategy”, which not only accelerates the country’s energy transition and green development, but also focuses on “green diplomacy” with Africa and Latin America, and helps countries in the region to cope with climate change by providing funds and other means.

In addition to European countries, Japan, as the only Asian country that has enacted legislation, promulgated the “Green Growth Strategy for Achieving Carbon Neutrality by 2050” at the end of 2020, mobilizing more than 240 trillion yen for green investment in the private sector through incentives such as regulations and subsidies, and proposing specific development targets for 14 industries such as offshore wind power, nuclear energy, and hydrogen energy (Ozawa et al., 2022).

Currently, there are four countries in the legislative state, and South Korea is the third Asian country to announce carbon neutrality goals after Japan and China. In December 2020, the South Korean government announced the “Carbon Neutrality Promotion Strategy”, in which relevant departments of the central government should carry out long-term planning, such as the Financial Commission to formulate green investment guidelines for the financial sector, and the government to reduce residential energy consumption and encourage waste sorting through publicity and incentives (Phillips, 2021). In addition, Chile is carrying out two activities to achieve carbon neutrality by 2050: afforestation and the development of electric vehicles. Chile, a developing country with China, proposed in October 2020 to achieve carbon neutrality through Sino-Chilean cooperation, encouraging Chinese capital to enter Chile and help it modernize its energy production and industry (Li, 2020). Achieving carbon neutrality through international cooperation is gradually becoming a major development trend in the future. In addition to the above-mentioned countries, most countries, including China, are at the stage of policy document release or policy discussion.

2.2 Specific measures to achieve carbon neutrality

Among the countries that have set carbon neutrality targets, a few have achieved, legislated or proposed legislation, but most are still in the stage of policy release or policy discussion. More than 30 countries have issued official policy documents on carbon neutrality, including developing countries such as China, South Africa and Indonesia, and developed countries such as the United States, Italy and Brazil. In the process of achieving carbon neutrality, developed countries use their advanced production technology to provide certain reference and help to developing countries. For example, the United States returned to the Paris Agreement after Biden took office and pledged to achieve carbon-free power generation by 2035 and carbon neutrality by 2050. The “Biden New Deal” he promulgated can be summarized in three aspects (Wei, 2021; Williams et al., 2021), and the specific measures are shown in Figure 1. Similarly, Brazil has issued nine measures in line with its carbon neutrality goal, completely banning illegal deforestation, increasing forest cover and the proportion of renewable energy, and making specific plans for annual carbon emissions (Chen, 2021). Finland put forward its vision of carbon neutrality in February 2020, aiming to fully offset Finland’s carbon dioxide emissions by planting trees, using renewable energy, and purchasing carbon sinks, so as to achieve carbon neutrality by 2035.

Compared with developed countries, developing countries such as China have not yet achieved carbon peaking, and achieving the goal of carbon neutrality in the short term requires leapfrog development. In March 2021, China included climate change mitigation actions in its 14th Five-Year Plan, with the goal of “peaking carbon emissions by 2030 and achieving carbon neutrality by 2060”. Combined with the Guidance on Accelerating the Establishment of a Sound Economic System for Green, Low-Carbon and Circular Development (The State Council of the People’s Republic of China, 2021) issued in February 2021, China’s climate action is based on the principle of controlling carbon intensity, supplemented by the total amount of carbon, supporting conditional localities and key industries to take the lead in reaching peak carbon emissions, promoting low-carbon and safe and efficient use of energy, and advancing low-carbon transformation in industry, construction, transportation, and other fields.

In addition to China, Indonesia, after announcing its goal of achieving carbon neutrality by 2060, quickly took various actions, such as stopping the construction of new coal-fired power plants after 2023. Governments such as South Africa and Costa Rica have issued green transportation decrees to harmonize vehicle purchase standards and encourage the use of electric or zero-emission vehicles.

At present, there are nearly 100 countries under policy discussion, generally distributed in Africa and the Middle East. In April 2021, for example, Israel announced a plan to reduce greenhouse gas emissions by 85% by 2050 compared to 2015, and set specific targets to reduce the number of coal-fired power plants and expand the use of renewable energy. Zambia set important targets on carbon reduction in 2020, aiming to reduce greenhouse gas emissions by 25%–47% compared to 2010, while including some highly polluting areas in the scope of reduction (Turcotte and Dusyk, 2021). As a major African country, Ethiopia has established a 15-year national climate change adaptation plan. It is worth noting that in the next few years, countries from Africa, the Middle East and other regions are expected to rise head-on in the field of carbon neutrality, proposing policy documents or bills on carbon neutrality, thus bringing about 75% of global emissions under strict regulation for emission reduction.

By comparing the measures of countries and regions in different carbon neutrality status in Figure 1, the measures to promote the process of carbon neutrality can be grouped into five aspects: First, the formulation of climate change laws and regulations. For example, EU member states, the United Kingdom, Japan and other countries have formed a relatively complete regulatory system for low-carbon development, and some developing countries such as China are in the process of carbon neutrality legislation (Zhai et al., 2021). The second is to optimize the energy structure and reduce dependence on fossil energy. For example, Germany, Denmark and Hungary have proposed to accelerate the withdrawal of coal-fired power stations and reduce the use of fuel vehicles, increasing the proportion of overall consumption of green and clean energy. The third is to attach importance to the research and development of low-carbon technologies and promote the use of renewable energy. For example, Austria, Ireland and other countries support the development of renewable energy by increasing allocations and reducing the tax of renewable energy. The fourth is to improve the carbon emission trading market and improve the green financial system (Zhao et al., 2022). For example, China opened its national carbon emissions trading market in 2021, and there have been eight carbon trading pilots so far. The European ETS reasonably stipulates the carbon emissions of enterprises, making a great contribution to reducing carbon emissions in the world. Fifth, encourage green consumption, cultivate citizens’ green production methods, and reduce carbon emissions from life. With the support of various national policies, green transportation such as new energy vehicles is gradually becoming the main tool for citizens to travel.

According to the 2019 world ranking of carbon emissions (Friedlingstein et al., 2020), China, the United States, Japan, Germany, the United Kingdom, and South Korea are in the top 10 and are also at the forefront of the push to achieve carbon neutrality. Japan, Germany, the United Kingdom and South Korea are already in the stage of legislation or legislative discussion. Although China and the United States have not legislated, they are also actively promoting the promulgation of relevant laws and regulations, China has written carbon neutrality into the 14th Five-Year Plan and proposed to enact the Carbon Neutrality Promotion Law as soon as possible at the National Two Sessions, although the United States has not legislated at the national level, but six states have passed legislation at the state level to set targets, both of which have mature legislative opportunities and conditions. The positive response of these major countries will not only have a positive impact on reducing global carbon emissions, but also increase the enthusiasm of other countries to achieve carbon neutrality.

3 The development situation of international green finance under the goal of carbon neutrality

3.1 The development situation of green finance-related research

As an organic combination of financial and environmental issues, green finance is an important contribution to achieving the goal of carbon neutrality and has become an important global issue (Xu, 2020). In order to explore the research focus of green finance by scholars at home and abroad, and to find out the research themes and development trends of green finance-related research, this paper uses CiteSpace software and Web of science literature retrieval tool to co-appear the keywords of the literature related to green finance, as shown in Figure 2.

Through keyword visualization, it is found that green bonds, green innovation, digital finance, environmental protection, and green credit policies are keywords with more common frequency, from which it can be seen that green bonds, digital finance, and green credit, as important components of the green financial system, are closely related topics for the further research and improvement of the green financial system. The research on green innovation and environmental protection is mainly discussed from the perspective of research purpose, and whether the establishment of green financial system improves the level of green innovation and environmental protection in countries or regions is a research theme that scholars at home and abroad are more concerned about. For other keywords such as accelerating green investment and green supply chain, the co-emergence reflects the further refinement of scholars’ research on green finance.

3.2 International development trend of green financial system

The relevant research on green finance theory by scholars at home and abroad is finally reflected in the construction of the national financial system, and at the specific construction level of the green financial system, the green finance practice of various countries is mainly reflected in the green finance standard system, information disclosure requirements, incentive and constraint mechanisms, green financial product tools, and international cooperation in green finance. The summary is as follows:

3.2.1 Green finance standard system

Internationally, some countries have established standards in related fields, including the Equator Principles (Principles, 2013), the Green Bond Principles (Ehlers and Packer, 2017), and the Climate Bond Standards (Climate Bond Initiative, 2011). Robert F. Lawrence & William L. Thomas briefly describe the sustainability of the Equator Principles in long-term practice (Lawrence and Thomas, 2004). Kariyawasam has found that better adherence to green bond principles has had a significant positive impact on investor demand, contributing to the development of green finance (Nanayakkara and Colombage, 2021). The Climate Bonds Initiative calls the Climate Bonds Standard is the key to sustainable development (Palleschi, 2016). CEIBS has taken the lead in publishing the Common Taxonomy of Sustainable Finance. China has issued the Green Industry Guidance Catalogue and updated standard documents such as the Catalogue of Green Bond-Backed Projects, which has effectively promoted the rapid development of green finance in China. Green finance requires that all funds raised must be used for the construction of green projects that meet the criteria, however, the study found that some of the current international standards are consistent, but there are also more differences. Different standards across countries may have implications for financial products based on such industries and even cross-border capital flows, and may even create “greenwashing” or arbitrage risks (Kong, 2022). Therefore, sound policy support is the foundation of China’s green financial standards system. For example, the Guiding Opinions on Building a Green Financial System, issued in August 2016, provides an overall plan for the green finance standard system at the national level. The Overall Plan for the Construction of a Green Finance Reform and Innovation Pilot Zone in Guangzhou, Guangdong Province, released in July 2017, provides in-depth practice of the green finance standard system at the local level.

3.2.2 Financial institution regulation and information disclosure

Some countries in the world have been relatively mature in the formulation of information disclosure systems, information disclosure content and frameworks. In 2018, Japan issued the latest Environmental Reporting Guidelines, which further set detailed requirements for information such as reporting enterprises and reporting standards for environmental reports (Islam et al., 2020). The Regulations on the Content and Format of Financial Information Disclosure and the Regulations on the Content and Format of Non-Financial Information Disclosure, which have been used in the United States, stipulate the content of corporate environmental disclosure (Manes-Rossi et al., 2020). Moalla M clarified that the establishment of an environmental information committee in France and environmental external guarantees are conducive to the timeliness of environmental reporting (Moalla et al., 2020). China has initially established an environmental information disclosure system and issued documents such as the Guidelines for Environmental Information Disclosure (Youth Research Group of the International Department of the People’s Bank of China, 2021).

Under the current legal system in China, information disclosure is still not transparent enough compared to foreign countries, the current mandatory disclosure of environmental information covers key pollutant dischargers, listed companies and green finance bond issuers. Due to the late involvement of environmental information disclosure, China’s green finance information disclosure system is still imperfect at this stage, especially the lack of disclosure system and detailed implementation standards for environmental benefits and high-carbon asset information. Due to the large number of subjects and contents involved in information disclosure, the existing information disclosure capacity cannot fully meet the needs for carbon emission collection, calculation and assessment, and needs to be further strengthened.

3.2.3 Incentive and constraint mechanisms

Some countries and regions have carried out relatively sound incentive and constraint mechanisms earlier, and the implementation path is clearer, providing inspiration for other countries to develop green financial incentive and constraint mechanisms. The EU actively operates government funds to promote the development of green finance. For example, the German government gives certain interest discounts and interest rates to green project loans, and makes full use of policy-based financial tools such as policy banks to drive private capital into the green economy. The United Kingdom invested 3 billion to establish the United Kingdom’s first green investment bank. The EU Classification Regulation, which comes into force in 2020, provides further incentives for investors to invest in financing transformational projects (Larsen, 2022). The United States has established a special government procurement agency for green financial products to stimulate public interest in green projects (Meltzer and Shenai, 2019). Relatively speaking, the incentive mechanism of green finance in some countries is relatively perfect, which can meet the financing needs of long-term development of green finance.

For green finance and its product system, China has introduced a variety of green finance assessment and incentive mechanisms from the perspective of fiscal, monetary and regulatory aspects, including positive reward mechanisms and negative punishment mechanisms (Qin et al., 2022). In 2020, the Guiding Opinions on Promoting Investment and Financing to Address Climate Change was issued, strengthening the use of refinancing and MPA assessment to encourage financial institutions to promote green credit (Zhang, 2022). Ma Jun believes that in order to change the polluting industrial structure, it is necessary to establish and improve the incentive mechanism to encourage green investment, but compared with the specific implementation measures such as interest discounts and guarantees adopted by other countries for green finance, China’s incentives for green projects are not deep enough and the focus of constraints is not prominent enough, which makes the green financial market lack endogenous power and affects the development of green finance under the goal of carbon neutrality (Ma, 2018).

3.2.4 Products and market systems of green finance

After decades of development, many developed countries have leveraged the market with relatively perfect policy systems and abundant financial tools, making green financial products more abundant.

The United States has always been dominated by mandatory environmental liability insurance, with government intervention and the use of various economic incentives, and has rich experience in green insurance practices (Richardson, 2001). As for China, the balance of green credit at the end of 2021 was 15.9 trillion yuan, an increase of 33% year-on-year. By the end of 2021, China’s green bond stock reached 1.16 trillion yuan. And in terms of carbon trading, the national carbon emission trading market operated for 114 trading days, with a cumulative trading volume of 179 million tons of carbon emission allowances (CEAs) and a cumulative turnover of 7.661 billion yuan. In 2021, the issuance of green investment-related thematic funds exceeded 50, and the scale of green funds was close to 800 billion yuan. China has seen steady growth in the scale of green credit business and rapid development of the green bond market in recent years, further promoting the development of environmental pollution liability insurance and studying the establishment of a compulsory liability insurance system for environmental pollution in high-risk areas of the environment (Zhao et al., 2021), but there is still much room for development.

The mismatch of green finance policies leads to the mismatch of the maturity of green financial products, which cannot fundamentally solve the financing needs of green projects, and the funding gap still exists. In addition, a complete green financial system on which green finance can be effectively relied on for a long time has not yet been formed, there is still a big gap in product diversification and liquidity compared with developed markets, many green financial products have not been linked to carbon footprints, the role of carbon markets and carbon financial products in the allocation of financial resources is still very limited, and the openness of carbon markets to the outside world is still very low.

3.2.5 International cooperation in green finance

More than 120 countries worldwide have already committed to achieve carbon neutral by the mid-21st century, covering 68% of global GDP and 56% of global population, and accounting for 61% of global GHG emissions (Lin et al., 2022). Countries around the world are sparing no effort to promote the green transformation of their economies and should strengthen cooperation to jointly build a community of human destiny (Lee et al., 2022).

The Joint Statement of Chinese and European Leaders on Climate Change and Clean Energy, signed in 2018, in which both sides emphasize the highest political commitment to the full and effective implementation of the Paris Agreement (Gurol and Starkmann, 2021). In 2019, the European Banking Authority (EBA) published the Sustainable Finance Action Plan. In order to promote sustainable and green development across the EU, in December 2019, the European Commission announced the “European Green Deal”, which proposed a series of green development goals, such as Europe taking the lead in achieving carbon neutrality globally by 2050 (Zhuang and Zhu, 2021). In November 2020, the Italian Presidency of the G20 co-hosted with the United Kingdom the 26th session of the Conference of the Parties to the United Nations Framework Convention on Climate Change, and Italy has proposed to reactivate the work of the Sustainable Finance Research Working Group, focusing on green finance development. The United Kingdom government and the City of London have jointly established the Green Finance Institute, which aims to promote collaboration between the United Kingdom’s public and private sectors to help investors pursue opportunities. After taking office, Biden announced his rejoining of the Paris Agreement on 19 February 2021. The Sino-US Green Fund, established in 2016 and with an investment of more than 10 billion yuan, will be further promoted (Michaelowa, 2022).

China has made great efforts to promote green finance as a global consensus, promoting green finance cooperation and international exchanges by participating in the initiation of multilateral cooperation platforms and establishing bilateral cooperation mechanisms, and actively publicizing China’s progress and practice in green finance to the world. Deeper cooperation with other countries, including continuing to steadily promote Sino-United Kingdom green finance cooperation, covering topics such as green investment principles, climate and environmental disclosure, ESG investment, and green technology incubators. China and France will discuss in depth the risk weight of green assets, environmental information disclosure, green investment and other topics, and will carry out in-depth cooperation in promoting the unification of green finance standards and exploring green finance incentive mechanisms. China and Germany will cooperate closely on a range of issues related to the promotion of joint development of green finance (Wei et al., 2022). In the process of building a new “double-cycle” development pattern, green finance should become a priority area for financial opening to the outside world. China should further participate in international cooperation in green finance, encourage cross-border capital to carry out green investment, strengthen international cooperation in the construction of the green “the Belt and Road”, enhance international recognition of China’s green finance policies, standards, products and markets, and continuously improve China’s discourse and leadership in this field.

4 Conclusion and outlook

It has become an international consensus to move towards carbon neutrality, and more than 130 countries have proposed carbon neutrality targets so far, many of which have already achieved and legislated. It is worth mentioning that in the next few years, some countries in Africa and the Middle East are expected to join the initiative to achieve carbon neutrality, when most of the world’s carbon emissions will be under effective regulation.

Green finance is an important means to achieve the goal of carbon neutrality, the “Equator Principles” have been internationally recognized green finance related standards, some countries have also established green finance standard systems, while strengthening the supervision of financial institutions and improving the information disclosure system, using incentives and constraints to promote the iterative upgrading of financial products and services, and injecting vitality into the development of green finance into society.

China, as a major energy-consuming country, plays a crucial role in the process of achieving carbon neutrality. Although the relevant theoretical and practical research started slightly later than some developed countries, it has made outstanding contributions in the top-level design framework and international cooperation on low carbon emissions. With the concept of building a community of human destiny, China has been striving to achieve carbon neutrality in four major areas: formulating carbon neutral laws and regulations, optimizing energy consumption structure, developing low-carbon technologies, and improving carbon emission trading market. In terms of green finance, China has more room for improvement. Specifically, compared with developed countries, green finance is not strongly connected with the goal of carbon neutrality and high-quality development of low-carbon transformation. A green finance standard system has not yet been formed. On the one hand, unified standards have not been established for green funds and green insurance, etc. On the other hand, the statistics of green credit and green bonds are affected by factors such as statistical caliber, and there are problems such as ambiguous flow of funds. The environmental information disclosure system of green finance is still imperfect, there is a lack of disclosure of environmental benefits and high-carbon asset information, and the level of environmental information disclosure does not meet the requirements of carbon neutrality target. At present, most Chinese regulators have not yet made it mandatory for companies to disclose carbon emissions and other information, and there is a lack of uniform criteria for identifying green companies, which has led to the phenomenon of “drifting green”. The incentive and constraint mechanism of green finance needs to be strengthened, the incentive and constraint mechanism is not detailed enough, and the focus of incentives and constraints is not prominent, resulting in a lack of enthusiasm for green investment among social investors. And SMEs, as an important market force, lack targeted preferential policies.

In view of the above problems, the next research needs to effectively connect green finance with the goal of carbon neutrality and the high-quality development of low-carbon transformation, to learn from its lessons on the basis of in-depth analysis of the evolution and development status of global green finance, to improve the operation mechanism and policy system, to formulate a more accurate timetable and roadmap, to strengthen the modernization of the governance system and governance capacity of the green financial system embedded in the goal of carbon neutrality, to promote the integration of China’s green finance and lead the process of a new round of globalization, to build a unified domestic green finance standard system that is in line with international standards, to improve the relevant standards for green credit and green bonds, establish in-sector standards such as green funds and green insurance under the goal of carbon neutrality, and determine the identification standards for green enterprises, and strengthen the supervision of green capital flows, to clarify the scope and content of information disclosure, issue targeted information disclosure guidelines for different industries, and use new technologies such as big data to intelligently supervise corporate carbon emissions, to improve incentive and constraint mechanisms, establish carbon neutral performance assessment mechanisms for green projects, financial institutions to guide the flow of green funds to low-carbon and zero-carbon projects, and introduce targeted policies to support SMEs in green transformation.

Author contributions

The manuscript was approved by all authors for publication. YX and YM conceived and designed the study; YX, TM, and TZ did the literature analysis and collected and analyzed the data; All authors wrote the paper. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the youth fund project of the Ministry of Education “Research on the influencing factors and promotion path of green development of resource-based cities under multiple heterogeneity” (No.: 20YJC790158); Qingdao Social Science Planning and Research Project “Evolutionary Mechanism and Improvement Path of Collaborative Governance of Carbon Emission and Air Pollution from a Time Space Dimensional Perspective” (No.: QDSKL2101164).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Bai, X. (2022). Exploring the sustainable development path of a green financial system in the context of carbon neutrality and carbon peaking: Evidence from China. Sustainability 14 (23), 15710. doi:10.3390/SU142315710

Cao, Y., Li, X., Yan, H., and Kuang, S. (2021). China’s efforts to peak carbon emissions: Targets and practice. Chin. J. Urban. Env. Stu. 9 (01), 2150004. doi:10.1142/S2345748121500032

Chai, J. X. (2018). Analysis on mechanism and path of green finance affecting macroeconomic growth. Ecol. Econ. 34, 56–60. [Chinese].

Chen, B. W., and Tao, J. H. (2021). Review and prospect of green finance research. Manag. Adm. 2, 157–162. doi:10.16517/j.cnki.cn12-1034/f.2021.02.033

Chen, W. H. (2021). Brazil has a long way to go to achieve its goal of carbon neutrality. Economic Information Daily.

Claeys, G., Tagliapietra, S., and Zachmann, G. (2019). How to make the European green deal work. Brussels, Belgium: Bruegel.

Du, Q., and Li, Z. Q. (2021). Legal policies and implementation actions for carbon neutrality abroad. China. Environ. news. 6, 12–17. [Chinese].

Ehlers, T., and Packer, F. (2017). Green bond finance and certification. BIS Quarterly Review September Available at: https://ssrn.com/abstract=3042378 (Accessed September 17, 2017).

European Commission (2020). Establishing the framework for achieving climate neutrality and amending regulation (EU) 2018/1999. (Europe Climate Law). Available at: https://www.univiu.org/images/aauniviu2017/GP/co-curr/European_climate_law.pdf (Accessed September, 2021).

Feng, X., and Ma, S. C. (2017). The current situation and problems of China’s green finance development and the enlightenment of international experience. Theory. Mon. 10, 177–182. [Chinese].

Friedlingstein, P., O'sullivan, M., Jones, M. W., Andrew, R. M., Hauck, J., Olsen, A., et al. (2020). Global carbon budget 2020. Earth. Syst. Sci. Data. 12 (4), 3269–3340. doi:10.5194/essd-12-3269-2020

Guo, P. Y., and Cai, Y. C. (2015). The evolution of green finance in developed countries and its enlightenment to China. Environ. Prot. 2, 44–47. doi:10.14026/j.cnki.0253-9705.2015.02.006

Gurol, J., and Starkmann, A. (2021). New partners for the planet? The European union and China in international climate governance from a role-theoretical perspective. Jcms-J. Common. Mark. S. 59 (3), 518–534. doi:10.1111/jcms.13098

Hu, M., Deng, C., and Tang, Y. (2017). Study on green financial support for the development of resource-economical and environment-friendly industry. Econ. Geogr. 34, 107–111. doi:10.15957/j.cnki.jjdl.2014.11.017

Islam, M. J., Roy, S. K., Miah, M., and Das, S. K. (2020). A review on corporate environmental reporting (CER): An emerging issue in the corporate world. Can. J. Bus. Inf. Stud. 2 (3), 45–53. doi:10.34104/cjbis.020.045053

Jiang, X. L., and Zhang, Q. B. (2017). Theory and practice review of green finance for developed country. China. Popul. Resour. Environ. 27, 323–326. [Chinese].

Kong, F. (2022). A better understanding of the role of new energy and green finance to help achieve carbon neutrality goals, with special reference to China. Sci. Progress-Uk 105 (1), 003685042210863. doi:10.1177/00368504221086361

Larsen, M. L. (2022). Driving global convergence in green financial policies: China as policy pioneer and the EU as standard setter. Glob. Policy. 13 (3), 358–370. doi:10.1111/1758-5899.13105

Lawrence, R. F., and Thomas, W. L. (2004). The equator principles and project finance: Sustainability in practice. Nat. Resour. Environ. 19 (2), 20–26. Available at: https://www.jstor.org/stable/40924560.

Lee, C. C., Li, X., Yu, C. H., and Zhao, J. (2022). The contribution of climate finance toward environmental sustainability: New global evidence. Energy Econ. 111, 106072. doi:10.1016/j.eneco.2022.106072

Li, X. P., Zhang, Y. J., and Jiang, F. T. (2019). Green industrial policy: Theory evolution and Chinese practice. J. Financ. Econ. 45 (08), 4–27. doi:10.16538/j.cnki.jfe.2019.08.001

Li, X. X. (2020). Chilean minister of energy: I look forward to the in-depth expansion of energy cooperation between Chile and China. People's Dly.

Lin, Y., Anser, M. K., Peng, M. Y. P., and Irfan, M. (2022). Assessment of renewable energy, financial growth and in accomplishing targets of China's cities carbon neutrality. Renew. Energy 205, 1082–1091. doi:10.1016/j.renene.2022.11.026

Ma, J. (2018). Green financial system construction and development opportunities. J. Financial Dev. Res. 1, 10–14. doi:10.19647/j.cnki.37-1462/f.2018.01.002

Manes-Rossi, F., Nicolò, G., and Argento, D. (2020). Non-financial reporting formats in public sector organizations: A structured literature review. Account. Financial Manag. 32, 639–669. doi:10.1108/JPBAFM-03-2020-0037

Meltzer, J. P., and Shenai, N. (2019). The US-China economic relationship: A comprehensive approach. Available at: https://ssrn.com/abstract=3357900 (Accessed February 22, 2019). doi:10.2139/ssrn.3357900

Michaelowa, A. (2022). “A vision for international climate finance after 2025,” in Handbook of international climate finance (Edward Elgar Publishing), 476–486. doi:10.4337/9781784715656.00030

Moalla, M., Salhi, B., and Jarboui, A. (2020). An empirical investigation of factors influencing the environmental reporting quality: Evidence from France. Soc. Responsib. J. 17, 966–984. doi:10.1108/SRJ-02-2020-0065

Nanayakkara, K. G. M., and Colombage, S. (2021). Does compliance with Green Bond Principles bring any benefit to make G20’s ‘Green economy plan’ a reality? Account. Finance 61 (3), 4257–4285. doi:10.1111/acfi.12732

Nelson, S., and Allwood, J. M. (2021). Technology or behaviour? Balanced disruption in the race to net zero emissions. Energy. Res. Soc. Sci. 78, 102124. doi:10.1016/J.ERSS.2021.102124

Ozawa, A., Tsani, T., and Kudoh, Y. (2022). Japan's pathways to achieve carbon neutrality by 2050–Scenario analysis using an energy modeling methodology. Renew. Sust. Energy Rev. 169, 112943. doi:10.1016/J.RSER.2022.112943

Palleschi, A. (2016). Sustainability advocates eye ‘natural infrastructure’ climate bond standard. Inside EPA's Water Policy Rep. 25 (22), 11–12.

Phillips, D. (2021). Ambient air quality synergies with a 2050 carbon neutrality pathway in South Korea. Climate 10 (1), 1. doi:10.3390/CLI10010001

Principles, E. (2013). The equator principles. A financial industry benchmark for determining, assessing and managing environmental and social risks. Retrieved June 28, 2016.

Qin, M., Su, C. W., Zhong, Y., Song, Y., and Oana-Ramona, L. Ţ. (2022). Sustainable finance and renewable energy: Promoters of carbon neutrality in the United States. J. Environ. Manage. 324, 116390. doi:10.1016/j.jenvman.2022.116390

Richardson, B. J. (2001). Mandating environmental liability insurance. Duke Envtl. L. Pol'y F. 12, 293.

Salazar, J. (1998). Environmental finance: Linking two world. a Workshop Financial Innovations Biodivers. Bratislava 1, 2–18.

Savaresi, A. (2016). The Paris agreement: A new beginning? J. Energy & Nat. Resour. Law 34 (1), 16–26. doi:10.1080/02646811.2016.1133983

Solarin, S. A., Shahbaz, M., Mahmood, H., and Arouri, M. (2013). Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ. Model. 35, 145–152. doi:10.1016/j.econmod.2013.06.037

The State Council of the People’s Republic of China (2021). Guiding Opinions on accelerating the establishment and improvement of a green and low carbon circular economic development system. Development System.

Turcotte, I., and Dusyk, N. (2021). How to get net-zero right. Available at: http://www.pembina.org (Accessed March, 2021).

Wang, H. Y., Wu, S. X., and Zhang, Y. Q. (2021). The path of carbon neutral in Germany and its enlightenment to China. China. Sustain. Trib. 3, 27–30. [Chinese].

Wang, Y., Guo, C. H., Chen, X. J., Jia, L. Q., Guo, X. N., Chen, R. S., et al. (2021). Carbon peak and carbon neutrality in China: Goals, implementation path and prospects. China. Geol. 4 (4), 1–27. doi:10.31035/CG2021083

Wei, T. Y. C. (2021). The impact of biden’s climate and energy policy proposition on China and its suggestions and countermeasures. WORLD SCI-TECH R&D 43 (5), 605. doi:10.16507/j.issn.1006-6055.2021.06.001

Wei, Y. M., Chen, K., Kang, J. N., Chen, W., Wang, X. Y., and Zhang, X. (2022). Policy and management of carbon peaking and carbon neutrality: A literature review. Engineering 14, 52–63. doi:10.1016/j.eng.2021.12.018

White, M. A. (1996). Environmental finance: Value and risk in an age of ecology. Bus. Strateg. Environ. 5 (3), 198–206. doi:10.1002/(SICI)1099-0836(199609)5:3<198:AID-BSE66>3.0.CO;2-4

Williams, J. H., Jones, R. A., Haley, B., Kwok, G., Hargreaves, J., Farbes, J., et al. (2021). Carbon-neutral pathways for the United States. Agu. Adv. 2 (1), 284. doi:10.1029/2020AV000284

Writing Group of China Green Finance Progress Report (2021). Development of green finance and prospect in the 14th Five-Year period. China. Finance. 8, 12–14.

Xi, J. P. (2017). Secure a decisive victory in building a moderately prosperous society in all respects and strive for the great success of socialism with Chinese Characteristics for a new era. The 19th session of national congress of the communist party of China, Beijing.

Xi, L. (2011). Foreign green finance policies and their references. Suzhou: Journal of Suzhou University [dissertation/masters thesis].

Xia, S. Y. (2021). Connotation, practical issues and international experience of green finance [J]. J. Regional Financial Res. (04), 44–48. [Chinese].

Xu, S. (2020). International comparison of green credit and its enlightenment to China. Green. Fianc. 2, 75–99. doi:10.3934/GF.2020005

Youth Research Group of the International Department of the People’s Bank of China (2021). International practice of climate information disclosure. Shanghai: First Financial Daily.

Zhai, G. Y., Wang, S. T., Cui, Y. L., Yang, D. P., and Li, S. S. (2021). The goals, measures and enlightenment of Carbon-nutrition in major global economies. Environ. Prot. 49 (11), 69–72. [Chinese].

Zhang, T. (2022). Problems and suggestions in the development of green finance under the “dual carbon target”. Asian Bus. Res. 7 (3), 1. doi:10.20849/abr.v7i3.1116

Zhang, Y. X., Luo, H. L., and Wang, C. (2021). Progress and trends of global carbon neutrality pledges. Adv. Clim. Change Res. 17 (1), 88. doi:10.12006/j.issn.1673-1719.2020.241

Zhao, X., Ma, X., Chen, B., Shang, Y., and Song, M. (2022). Challenges toward carbon neutrality in China: Strategies and countermeasures. Resour. Conserv. Recy. 176, 105959. doi:10.1016/j.resconrec.2021.105959

Zhao, Y., Yue, Y., and Wei, P. (2021). Financing advantage of green corporate asset-backed securities and its impact factors: Evidence in China. Front. Energy. Res. 283. doi:10.3389/fenrg.2021.696110

Keywords: climate change, carbon neutrality goals, green finance evolution, international cooperation, incentive and constraint mechanisms

Citation: Xue Y, Ma T, Zhuang T and Ma Y (2023) The development of green finance under the goal of carbon neutrality: A review from China’s perspective. Front. Earth Sci. 11:1123020. doi: 10.3389/feart.2023.1123020

Received: 13 December 2022; Accepted: 16 February 2023;

Published: 23 February 2023.

Edited by:

Chuanbao Wu, Shandong University of Science and Technology, ChinaReviewed by:

Xin Zhao, Anhui University of Finance and Economics, ChinaJian Zhang, Central University of Finance and Economics, China

Copyright © 2023 Xue, Ma, Zhuang and Ma. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yingying Ma, muxiaoyin@126.com

Yawei Xue1,2

Yawei Xue1,2  Tianli Ma

Tianli Ma Yingying Ma

Yingying Ma