- 1College of Finance and Economics, Guangdong Polytechnic Normal University, Guangzhou, China

- 2Department of Finance, Guangdong University of Foreign Studies, Guangzhou, China

Executive incentive has long been a hot topic among academics and practitioners. With the continuous development of China's manager market, the spirit of innovation and entrepreneurship among executives has exerted a greater influence on corporate performance. Enterprise innovation is an important part of the entrepreneurial spirit. Moreover, China's supply-side reforms and compensation system of the state-owned enterprises (SOEs) have been advanced and innovative. Therefore, based on the manager human capital theory and the organizational innovation theory, and using 15,492 firm-year observations from China's Shanghai and Shenzhen A-share listed companies for the period 2005–2018, we constructed various models, including the Gorden model, the Growth Rate of Price–Earnings Ratio model (PEG), the Ohlson and Juettner-Nauroth model (OJ), and the Capital Asset Pricing model (CAPM), to measure the cost of equity. We investigated the effect of the institutional innovation of executive incentives on the cost of equity, and the heterogeneous influence of China's special property rights system on the relationship between the two. We found that the innovations of the executive incentive system have a positive governance effect on the cost of equity. In particular, executive compensation incentives significantly reduce a company's equity costs. We also find that the state-owned property rights may weaken the positive effect of institutional innovation of executive incentives. Furthermore, China's executive incentives system and corporate governance mechanism are imperfect; and therefore, institutional innovation is a matter of great urgency and more innovative ideas for the manager market need to be introduced. China's listed companies should give full play to the spirit of innovation and entrepreneurship, constantly innovating incentive-based compensation systems of companies, and establishing a scientific and innovative concept of the cost of equity. The findings are robust after controlling for potential endogeneity concerns.

JEL Classifications

G15; G30; G34

Introduction

For China in the economic transition, the key to overcoming the middle-income trap is to enhance the innovation ability and productivity of the Chinese firms, promoting intensive margin growth. There is an urgent need to innovate executive incentive systems in Chinese enterprises, especially among the SOEs. In 2013, the third plenary session of the 18th Central Committee of China emphasized the importance of innovating modern compensation systems for Chinese SOEs. According to a 2013 survey, the average salary of executives in the financial industry was 90 times that of common citizens, and even the daily salary of a top executive equaled the 3-month salary of a top teller. In 2014, Xinhua reported that the main company leaders earned salaries about 12 times that of other employees in central enterprises. Thus, a plan to reform the compensation systems of centrally administered enterprises was introduced in January 2015. The first batch of institutional innovation involved 72 SOEs, including 53 SOEs, such as Petrochina, Sinopec, and China mobile, and 19 other financial and railway enterprises. During the same year, Kweichow Moutai, a company in the liquor industry, appointed 11 vice presidents, and the annual salaries of 14 liquor executives were significantly higher than those of the executives in other enterprises in the same industry. Such news about unreasonable executive incentives is bound to become even more common in China. It has aroused doubts and discussions within the public and among academic researchers. Thus, we should consider, what is the purpose of executive incentives?

Since Jensen and Murphy (1990) first studied executive incentives, an increasing number of scholars have focused on this topic (Dyreng et al., 2010; Bebchuk et al., 2011; Adhikari et al., 2015; Chen et al., 2018; Fang et al., 2018). However, we should pay more attention to the goal of the incentive mechanism, that is, the coordination of interests between shareholders, management, employees, and creditors (La Porta et al., 1997; Shleifer and Vishny, 1997; Bertay and Uras, 2020; Castro et al., 2020). Capital cost is one of the key factors in management's financial decision making (Collins and Huang, 2011; Hasan et al., 2015; Shen and Zhang, 2020; Luong et al., 2021). It also affects investors' resource allocation decisions (Leone et al., 2006; Pástor et al., 2008), restricting the improvement of corporate production efficiency.

Meanwhile, the specific plan for China's “supply-side” structural reform in 2016 emphasized that the substantive goal was to reduce the capital cost and tax burden of the firms to ultimately improve social productivity. However, due to historical reasons, most of the Chinese companies have not set up a scientific concept of capital cost. This directly restricts the comprehensive competitiveness among the Chinese firms. Capital cost not only affects investors' interests, but also the basic criterion for drafting all kinds of financial policies, such as investment and dividend policies, so it is important for firms to establish a scientific and innovative concept of capital cost. Chinese firms can optimize corporate governance and productivity levels after clarifying the scientific process of “manager's behavior—capital cost—investor wealth—creating firm value.”

Research on executive incentives and capital cost has mainly explored the effects of corporate performance on executive incentive systems (Chen et al., 2018; Fang et al., 2018; Abudy et al., 2020; Chowdhury et al., 2020; Carter et al., 2021; Gao et al., 2021; Ren et al., 2021). For example, Chen et al. (2018) investigated the effect of corporate financial distress risk on the initial compensation contracts of new executives. Fang et al. (2018) verified the effects of major shareholder ownership on executives' excess compensation. With respect to capital cost, recent studies have focused more on the relationship between these costs and information disclosure, CEOs' internal debt, and the social relations between executives and directors (Collins and Huang, 2011; Hasan et al., 2015; Shen and Zhang, 2020; Luong et al., 2021). They often have ignored the impact of executive incentive systems on corporate equity cost.

Against the background of China's supply-side reforms, we investigated the relationship between executive-incentive-system innovation and the cost of equity, as well as the effects of China's special property-rights system on this relationship. Our conclusion provides a theoretic guidance for an in-depth understanding of the capital cost and offers empirical evidence for the necessity and the feasibility of the innovation of executive incentive systems among Chinese firms. We also offer a new explanation of the importance of entrepreneurship in corporate performance. Entrepreneurship is the inner impulse of business people to pursue innovation and indicates that entrepreneurs are willing to meet market challenges, break market equilibrium, and discover new opportunities in changes to policy and the business environment. Entrepreneurship has a significant impact on corporate behavior and financial decisions, promoting the differentiation of enterprises (Wu and Hsu, 2018; He et al., 2019; Howell, 2019). We show that the innovation of executive incentive systems is conducive to creating a favorable environment for institutional innovation, which helps give full play to entrepreneurship, further reducing corporate costs and improving corporate performance.

This study contributes to several strands of research. First, our research further explores the relationship between executive incentives and equity cost. Existing studies have focused on the impact of the characteristics of a firm, such as political association, information disclosure, life cycle, CEOs' internal debt, and the social relations between executives and directors on equity costs (Boubakri et al., 2012; Hasan et al., 2015; Ng and Rezaee, 2015; Gupta et al., 2018; Shen and Zhang, 2020; Luong et al., 2021); however, work that directly explores the relationship between executive incentives and equity cost is rare. For example, Luong et al. (2021) used quasi-natural experiments to study the impact of social relations among executives, directors, and securities traders on the cost of equity. Shen and Zhang (2020) investigated the relationship between CEOs' internal debt and the cost of equity. Ahmed et al. (2018) found that the investment of corporate derivative instruments can reduce the cost of equity. Thus, this paper is the first to fully discuss the governance effect of executive incentives (mainly executive compensation incentives) on the cost of equity, considering China's unique characteristics.

Second, this paper further investigates the effects of property rights on the relationship between executive incentives and equity cost. Corporate property rights in China are different from those of developed countries. They greatly affect the capacity and financial resources of the Chinese firms. Serious “credit discrimination” exists in China's financial market; in other words, banks favor SOEs while discriminating against private enterprises when lending. This is reflected in two aspects: SOEs have relatively easy access to loans, and loan costs for SOEs are lower. Thus, property rights can be regarded as one of the unique characteristics of Chinese enterprises. Furthermore, our data show that the amount of research and development (R&D) investment and the number of patent applications among SOEs is significantly lower than for non-SOEs, indicating that China has not yet established an effective innovation incentive mechanism for SOEs. As a result, this paper has great practical significance for designing an innovation-oriented incentive system for senior executives of SOEs.

Third, this paper discusses the influence of executive traits or entrepreneurship on the cost of equity in China. It extends the research on corporate innovation, providing enlightenment on the entrepreneurial policies of emerging economies. The innovation of executive incentive systems can realize executives' self-value, promoting a virtuous circle between high-quality business startups and excellent entrepreneurial spirit as the core force in corporate institutional innovations. Therefore, executive incentive system innovation can more effectively stimulate the entrepreneurial spirit, improving the level of corporate innovation.

Fourth, our findings provide a reference for establishing an effective and innovative executive incentive mechanism. China's relevant literature has focused on the influence of executive equity incentives on corporate equity cost, and most studies have concluded that equity incentives aggravate agency costs. However, most executives hold few or even no shares in Chinese companies, as shown in our data, and the average rate of executives' shareholdings is only 5%. This indicates that the effectiveness of equity incentives in China needs to be further verified. Therefore, we directly investigated the impact of executive monetary compensation incentives on the equity cost, providing significant guidance for the innovation of executive incentive systems among Chinese SOEs.

This paper has several research limitations and suggests directions for future research. First, due to the low shareholding ratio of senior executives in Chinese enterprises, the effectiveness of equity incentives in China has not been fully verified. Therefore, this study reviewed the impact of monetary compensation incentives on the cost of equity. Other indicators, such as equity incentives, executive promotion incentives, and executive psychological incentives, can be used as indicators of executive incentive systems in future research (Chesney et al., 2020; Wruck and Wu, 2021). Second, the estimation of the cost of equity has always been a difficult and controversial task; as such, many estimation models have been proposed in the literature. Future studies can select the most effective model to further explore the influence of other executive traits on the cost of equity. Finally, future studies can pay more attention to the different effects on special enterprises, such as startups and high-tech companies, and the relationship between executive traits and the cost of equity.

The paper is structured as follows. Section Research Hypothesis develops the research hypothesis, and Section Research Design details the research design. Section Empirical Results presents the empirical results, and additional robustness tests are described in section Robustness Tests. Finally, section Discussion concludes the study.

Research Hypothesis

The Effect of Institutional Innovation of Executive Incentives on the Cost of Equity

The classical organizational innovation theory notes that entrepreneurs play a dynamic role in whether an innovation results in the success or failure of a company. The ability and motivation of managers performing strategic control are the keys to enterprise innovation (Hirshleifer et al., 2012; Aghion et al., 2013; Kong et al., 2020). Berle and Means (1932) were the first to suggest the separation of “ownership” and “management rights” among modern enterprises. They proposed the classic “agent–agent theory,” which stated that the “two rights” separation leads to information asymmetry between the principal and the agent, resulting in agency problems between shareholders and managers and higher agency costs. However, their theory has only been tested using a utility function rather than empirical research (Chen et al., 2018; Fang et al., 2018; Carter et al., 2021).

The groundbreaking empirical research on the agency theory is the contract between the principal and the agent as proposed by Jensen and Meckling (1976). This posits that there is a contractual relationship between the principal and the agent. The shareholder, as the principal, wishes to earn wealth by giving the manager a certain salary and remuneration, whereas the manager, as the trustee, wants to obtain the reward to realize their self-worth. However, during the implementation of the contract, the manager is likely to pursue the self-benefit and damage the interests of shareholders, resulting in the challenges of “moral hazard” and “adverse selection” (Jensen and Meckling, 1976; Biener et al., 2018; Borochin and Knopf, 2021). Thus, shareholders may reduce the investment risks by improving managerial incentives or strengthening supervision (Shen and Zhang, 2020; Luong et al., 2021).

As for corporate capital cost, Skaife et al. (2004) demonstrated that corporate governance factors, such as financial information transparency, audit committee independence, and board independence reduce equity cost, whereas other factors, such as equity concentration and the number of big shareholders increase equity cost. Chen et al. (2003) found that there is a significant negative correlation between information disclosure and equity financing costs as evidenced by Asian emerging capital markets. Chen et al. (2009) suggested that stronger shareholder rights systems, more effective boards of directors, and a better quality of financial information disclosure tend to reduce equity financing costs. Luong et al. (2021) found that the social relationship among executives, directors, and securities brokers reduces the cost of equity, and the influence is more significant in companies where executives hold a high amount of equity. Shen and Zhang (2020) identified a negative correlation between CEOs' internal debts and the cost of equity, and this relationship is more significant in companies with a high leverage ratio.

Corporate governance should guarantee the interests of investors and satisfy their remuneration (Shleifer and Vishny, 1997; La Porta et al., 2000; Denis and McConnell, 2003). Under the separation of two rights, information asymmetry exists between the management and the fund providers, such as shareholders and creditors (La Porta et al., 2000; Denis and McConnell, 2003; Shen and Zhang, 2020; Luong et al., 2021). Investors cannot distinguish the actual risk of their investment; thus, they seek a capital price protection mechanism to reduce their investment risk and guarantee investment interests. According to the risk level, investors require a certain return rate, producing corporate equity cost. This is the basic requirement for equity investors to grant their rights to use the fund, and it leads to an increase in the firm's financing costs (Kabir et al., 2013). Therefore, enterprises can motivate and constrain the management through various governance mechanisms.

Executive incentive is one of the most effective mechanisms to mitigate the agency problem (Graham et al., 2012; Chen et al., 2018; Page, 2018; Gilje et al., 2020). In the modern corporate governance mechanism, the most common goals of executive compensation incentives are as follows: (1) to ensure the interests of capital suppliers and maximize the wealth of shareholders (Shleifer and Vishny, 1997), and (2) to maximize the overall value of the company under the condition of achieving the first goal (Page, 2018; Abudy et al., 2020). In view of these goals, firms tend to incentivize and constrain top executives using executive incentive contracts. Specifically, the firms set a higher level of compensation to reduce the agency problem between executives and shareholders, encouraging the alignment of executives and shareholders' interests (Chen et al., 2013, 2018) and, eventually, a reduction in the cost of equity (Mishra, 2014).

Moreover, with the continuous development of the manager market in China, professional managers' reputations also encourage managers to work hard; that is, executives are most likely to work hard when they pursue self-interest maximization and self-worth realization (Murphy and Zabojnik, 2004; Chen et al., 2018; Shen and Zhang, 2020). The implementation of an effective executive compensation contract not only helps firms attract excellent talent, but also promotes the sharing of benefits and risks between the management and shareholders, mitigates the agency problem, and thus reduces corporate equity cost (Chen et al., 2013; Luong et al., 2021).

As mentioned, the level of executive incentive reflects the agency conflict between shareholders and the management to a certain extent. A higher executive pay may relieve these agency conflicts (Frydman, 2007; Gupta et al., 2018; Rjiba et al., 2021). Also, a firm with a lower equity cost may have retained more earnings to invest in better projects, increasing firm value and shareholders' wealth, and thus improving executives' rewards (Shen et al., 2010; James, 2013; Mishra, 2014; Chen et al., 2018; Gan et al., 2020).

Therefore, in this review, the authors emphasize that the executive incentive system, cost of equity, and the maximization of corporate value should be considered together. The more appropriate the executive incentive system, the higher the executive compensation level will be, and the lower the cost of equity. Based on the above analysis, the authors propose the following hypothesis:

Hypothesis 1: Executive incentive system has a negative effect on the cost of equity.

The Effect of Property Rights on the Relationship Between Executive Incentive and Equity Cost

Most of the executives of Chinese state-owned firms are political officials. The compensation system for state-owned firms has always been controlled by the government—the only “regulating hand.” Salaries of executives of the state-owned firms are controlled by the government, so their compensation has a certain degree of stability, or salary stickiness (Gaver and Gaver, 1998; Jackson et al., 2008; Hoi et al., 2019). Relative to private firms, state-owned firms tend to pay more attention to social benefits, such as employment and environmental protection. In state-owned firms, management goals are more related to political tasks rather than firm value maximization.

Many studies have shown that the performance of private firms is better than that of the state-owned firms. In terms of external financing, private firms are more systematically discriminated against in terms of whether they refinance from the stock market or receive loan financing from banks (Kabir et al., 2013). Chen et al. (2015) also showed that there are significant differences in the effects of Extensible Business Reporting Language on the equity cost of SOEs and non-SOEs.

Given a company's cash flow, a decrease in equity cost means that the company is more likely to improve executive pay with an increase of firm value (Chen et al., 2013). Owner vacancy and the salary restriction system may weaken the negative relationship between executive compensation and equity cost in state-owned firms. Boubakri et al. (2012) stated that the cost of equity in politically affiliated companies is lower than in non-affiliated companies. Szarzec et al. (2021) discussed the impact of SOEs on economic growth in 30 European countries. They find that, when the national economic system is weak, the influence of SOEs on the economy is more harmful. Guan et al. (2021) found that the chairmen of SOEs have a significant impact on financial performance, and mixed ownership improves the efficiency of SOEs. Therefore, we expect that SOEs pay little attention to equity cost and have little incentive to reduce equity cost by increasing executive compensation.

Among private firms, executive incentive systems are more aligned with the development of the market. Private firms tend to suffer more competitive and greater external financing constraints. Thus, they are more willing to raise the level of executive pay to motivate the executives, reducing net payoffs and speculation. Additionally, private firms have stronger motivation to encourage executives to guarantee the interests of shareholders, ultimately mitigating the information asymmetry between the shareholders and the management, and thus reducing equity financing costs. Therefore, we propose the following hypothesis:

Hypothesis 2: Property rights of state-owned firms weaken the effects of executive incentive systems on the cost of equity.

Research Design

Sample Selection and Data Sources

We utilized corporate financial data from the China Stock Market & Accounting Research database (CSMAR), the analysts' earnings forecast data from the Wind database, and risk-free returns data manually calculated by Chinese banks' 1-year regular deposits, which are collected from the website of the People's Bank of China.

This study adopted four models to calculate equity cost: (1) the Gorden model (Gorden and Gorden, 1997); (2) the Growth Rate of Price-Earnings Ratio model (PEG; Easton, 2004); (3) the Capital Asset Pricing model (CAPM; Sharpe, 1964); and (4) the Ohlson and Juettner-Nauroth model (OJ; Ohlson and Juettner-Nauroth, 2005). The Gorden and PEG models are used in baseline regressions, whereas the CAPM and OJ models are used in robustness tests. Since China's analyst data used in the PEG and OJ models have been available since 2005, we use data for A-share listed companies listed on the Shanghai and Shenzhen stock markets from 2005 to 2018.

We processed the dataset as follows. First, in the financial industry, financial data, financial statements, and salary disclosures of the firms are very different from those of listed companies in other industries in China, so we excluded financial and insurance companies based on the Industry Classification Benchmark code. Second, China's main stock market is the Shanghai and Shenzhen A-shares (the stocks listed in China and issued in RMB), so we excluded B shares and H shares (non-RMB stocks issued in foreign countries or Hong Kong) with different characteristics. Third, we excluded companies with a null value for the main variables. Fourth, we winsorized corporate financial continuous variables at the 1% level after considering the influence of extreme values. Fifth, we excluded companies issuing shares for <2 years because the financial disclosure data of those companies were discontinuous. Finally, we excluded companies with an asset–liability ratio higher than one after considering high financial risks caused by excessive liabilities.

We also adopt the following additional methods to deal with the data:

1) In the Gorden model, we excluded data without an initial closing price, P0, and sustainable growth rate, G, and we excluded data with a negative sustainable growth rate and a sustainable growth rate greater than one.

2) In the PEG model, we excluded data without earnings per share EPS1, EPS2, and P0.

3) In the OJ model, we excluded data without a predicted EPS and P0. If EPS1 greater than EPS2 was predicted, we made EPS1 equal to EPS2, following Wang et al. (2014). If a negative value appeared under the square root, the equity cost was made to be equal to A to avoid missing values.

Following this, our final sample comprised 15,492 firm-year observations.

Variable Setting

Executive Compensation Index

We used two indicators to measure executive compensation: (1) pay, the natural logarithm of the total salary of the top three executives; (2) CEOpay, the natural logarithm of the total annual salary of the general manager and CEO; and (3) MPAY2, the median of the total annual salary of the general manager in industry i at year t.

Equity Cost Index

The cost of equity was measured using two methods. The first is the basic model of financial management principles, namely, the “ex ante cost,” as used in the PEG, OJ, and Gebhardt, Lee, and Swaminathan (GLS) models (Chu et al., 2020; Pfister et al., 2020; Husser and Paulet, 2021). This kind of model is based on the idea that the value of a company's future dividends or cash flow discount is equal to the internal return rate of its stock price (Gebhardt et al., 2001; Hou et al., 2012). The second is the risk compensation method, or “ex post,” as used in the Gorden and CAPM models. Equity cost was calculated using historical data in the Fama–French three-factor model (Fama and French, 1993; Chen et al., 2013; Ahmed et al., 2018; Shen and Zhang, 2020; Luong et al., 2021; Rjiba et al., 2021). All five models provide a reasonable estimate of the cost of equity. However, the GLS model assumes that the ROE tends to equal the average ROE of the industry in a linear and equi-differential way, and the residual return remains unchanged after the twelfth period. Also, the calculation method using the higher-order equation is relatively complex. Thus, based on the method used by most scholars (Chen et al., 2013; Ahmed et al., 2018; Chu et al., 2020; Pfister et al., 2020; Shen and Zhang, 2020; Husser and Paulet, 2021; Luong et al., 2021; Rjiba et al., 2021), after considering the available parameters, we adopted four models—Gorden, PEG, CAPM, and OJ—to calculate the cost of equity as follows:

(1) Gorden model:

where dividend payments and future sustainable growth determine a company's equity cost. D1 is the first year's dividend, and G is the growth rate of pre-tax dividends per share.

(2) PEG model:

Proposed by Easton (2004), this model estimates a company's hidden equity cost based on the company's future earnings forecast data. EPS1 and EPS2 are the company's earnings forecasts per share in the next one and 2 years. We select the latest earnings forecast data in each year—that is, December earnings forecasts—and average the forecast data of multiple analysts according to the same stock symbol to obtain the final earnings forecast. P0 is the latest closing price at the end of the year.

(3) CAPM model:

where Rf is the annual risk-free return rate, β is the market risk calculated by the market's comprehensive annual β, and Rm is the market's annual return rate calculated by the market's comprehensive annual return rate and considering the reinvestment of cash dividends.

(4) OJ model:

where D1 is the first year's dividends, δ is the median of the historical dividend payment rate, and (γ−1) is the long-term growth rate of earnings per share. Following Ohlson and Juettner-Narouth (2005), we set this at 5%. If a negative number appears under the radical, the final equity cost may be a missing value. To avoid this, we process the missing values. That is, we let Re equal A.

Variable Definitions and Descriptive Statistics

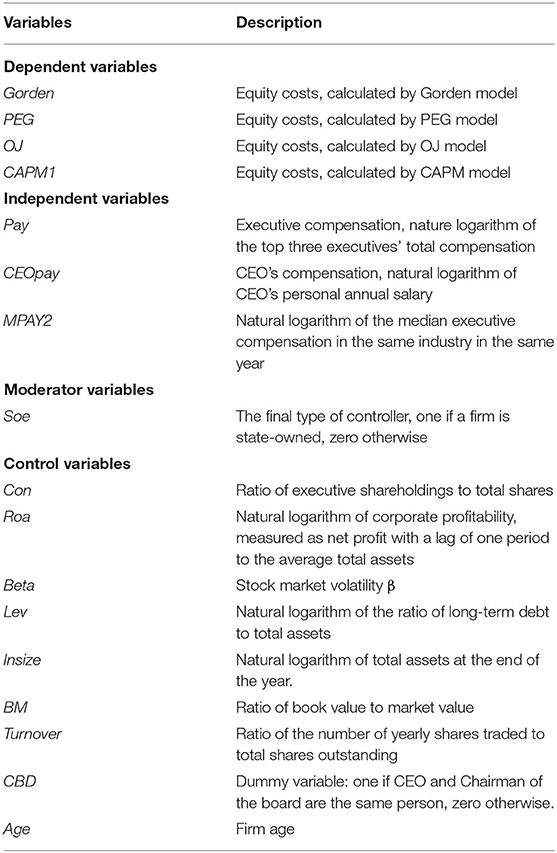

Table 1 presents the definitions of the key indicators, while Table 2 reports each variable's statistics. As shown in Table 2, judging from the median, the average salary of executives has a slight increasing trend. After taking the logarithm of the value, the mean pay is 14.14, the standard deviation is small, and the standard normal distribution is present. After taking the logarithm, the average value of CEOpay is 13.11. The salary of the general manager accounts for a high proportion of the top three values. With respect to control variables, the systemic risk, beta, of China's listed companies from 2005 to 2018 remained basically the same as the market, with the mean and median at about 1.141. The maximum value is also only 1.933, which is consistent with the trend of the stock market as a whole. The values for BM, book-to-market ratio, indicate that the book values and market values of listed companies in China differ greatly, with a minimum value of 0.1301 and a maximum value of 1.113. Judging by the mean and standard deviation, the distribution is consistent with a normal distribution. From 2005 to 2018, the turnover of listed companies' stocks (turnover) is high and the change is large. The average turnover rate is 5.204, the smallest value is only 0.4582, and the maximum value is as high as 19.35, which is consistent with previous research. In terms of scale, China's listed companies are relatively large, with an average lnsize of 22.07, but the return on total assets, roa, is not high—only 5.45%—and the highest value is 21.25%. The distribution of operating income is extremely uneven, and the level of debt is high. The average value of lev reaches 43.51%, the maximum value is close to 1, which is 85.12%, and the minimum value is only 5.43%. There is a large gap in debt levels. Moreover, 22.6% of listed companies are a combination of a chairman and general manager.

We also conducted the Variance Inflation Factor (VIF) test to test for multicollinearity among the variables. Generally, if the maximum VIF value does not exceed 10, there is no obvious multicollinearity. Our results show that the largest VIF value among the main explanatory variables is far <3, and the VIF value for executive compensation is 1.82. This indicates that there is no serious multicollinearity (results omitted for brevity).

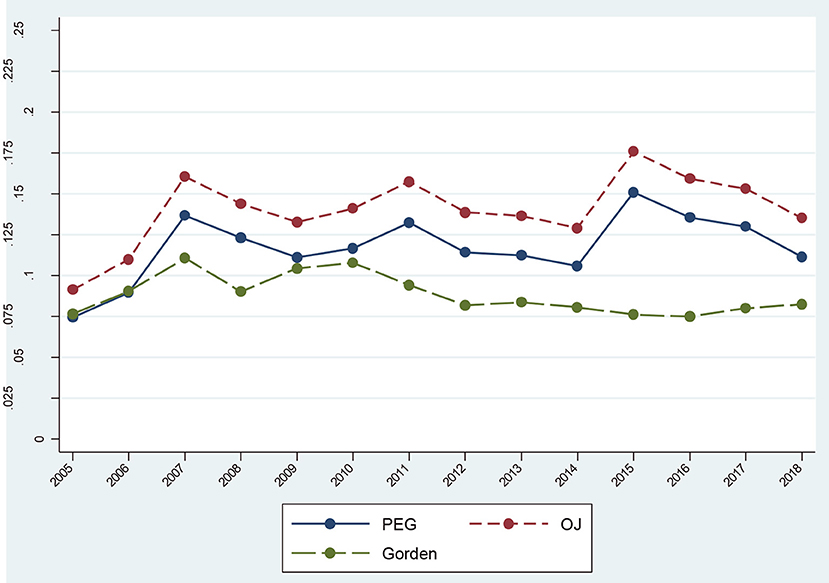

Equity Cost Trends From 2005 to 2018

Figure 1 shows the trend for equity costs of Chinese listed companies from 2005 to 2018. The results illustrate an “M” type, indicating a significant change in equity cost during this period. Equity cost grew after 2005, reaching a record high in 2007. Upon encountering a financial crisis in 2008, it decreased to its minimum in 2009. Since 2010, it has grown rapidly, reaching a new peak in 2015. After falling slowly, the trend presented a certain change cycle and form, in line with capital market development trends. Figure 1 also indicates that the equity cost of listed companies in China, as a whole, were regular and consistent. When the economy was good and the stock market developed well, the rate of return on investment required by shareholders was higher, which was reflected by the higher cost of equity. When the overall environment was bad, especially in a bear market, the compensation demanded by shareholders was relatively low. Meanwhile, the administrative regulations of the state also played a large role. When the equity cost increased to a certain height, the state would use its “invisible hand” to regulate the market.

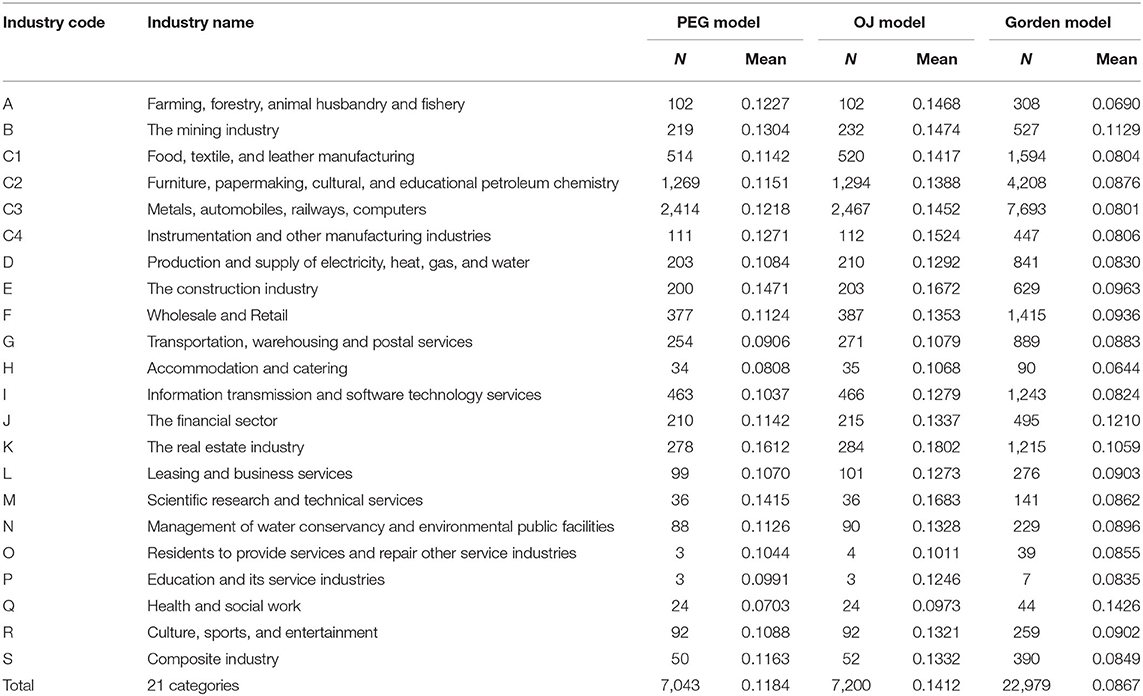

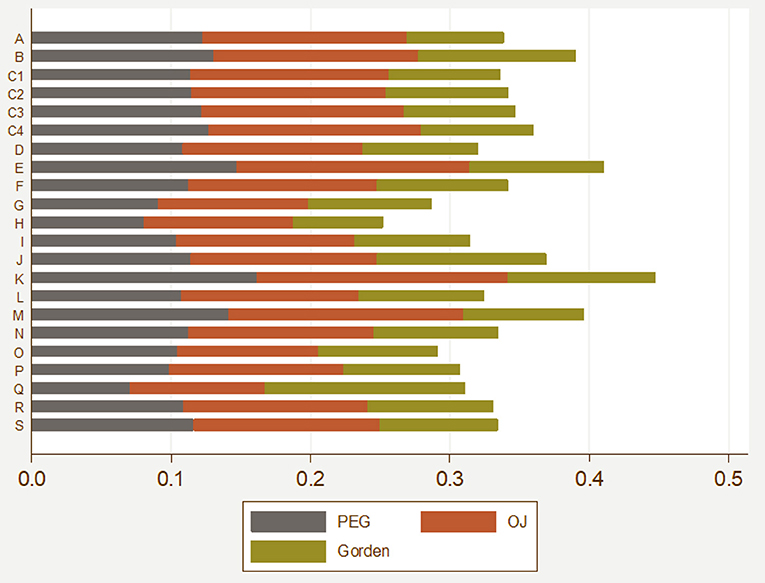

Table 3, Figure 2 show comparative results for the mean value of equity cost by industry. The findings indicate that the highest equity cost among Chinese companies was found for Industry K (the real estate industry) from 2005 to 2018. In Figure 2, the average value of equity cost for industry K was the highest, followed by industries B (mining), E (construction), and J (finance). The overall salary for Industry J (the financial industry) was relatively high, but the cost of equity in this industry was not as high as that of the real estate industry. This is in line with China's development; that is, firms in the real estate industry in China suffered severe financing constraints and high financial costs. In addition, Industry H (accommodations, catering) and Industry O (service repair) had the lowest equity costs.

As shown in Figure 2, the average value of the cost of equity in all industries in China from 2005 to 2018 was no <10%, and it fluctuated between 10 and 15%. Moreover, the difference in the cost of equity of all industries exhibited little change and certain stability. The results indicate that the cost of equity generally accounted for a large proportion and had regularity. Therefore, the cost of equity should be considered an important factor when making investment decisions.

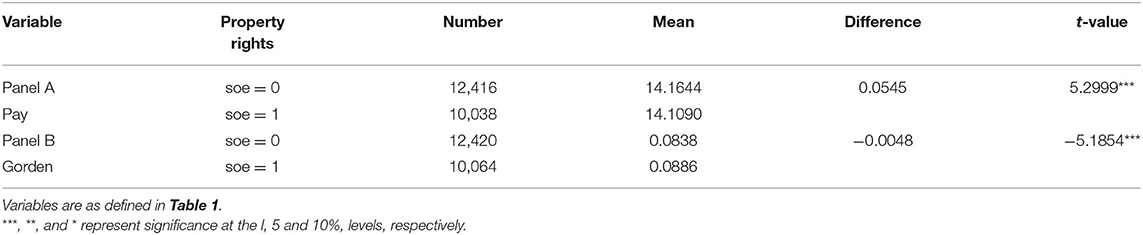

Univariate t-Test Analysis

Table 4 shows the results of the t-tests for executive compensation and equity cost. We classified the full sample into two groups according to property rights. Panel A shows that, due to the implementation of the “salary-restriction order,” executive compensation among private enterprises is significantly higher than that for SOEs in recent years, which is also in line with China's current development situation. In Panel B, firm performance and governance efficiency of SOEs are far lower than that of private enterprises, so the equity cost of private enterprises is significantly lower. This indicates that the innovation of compensation incentive systems in SOEs needs to be continuously promoted.

Empirical Result

Executive Incentive System and Equity Cost

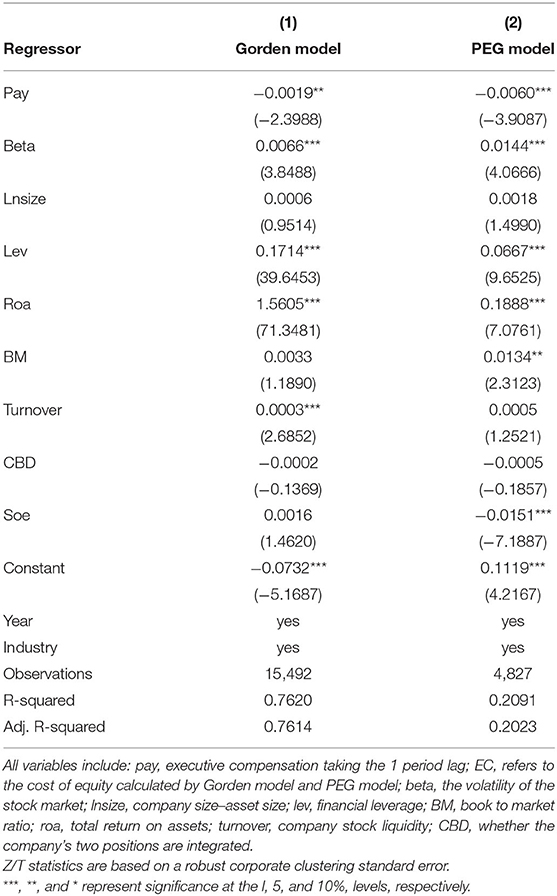

To test Hypothesis 1 (the impact of executive incentive systems on the cost of equity), following existing research (Core et al., 2008; Hoi et al., 2019; Chu et al., 2020; Pfister et al., 2020; Husser and Paulet, 2021), we used the Gorden and PEG models to measure the equity cost:

where payit−1 refers to executive compensation with a one-period lag, and EC refers to the cost of equity calculated by the Gorden and PEG models. According to early research, we propose the following control variables: beta, the volatility of the stock market; lnsize, company size–asset size; lev, financial leverage (Eisfeldt and Papanikolaou, 2013); BM, book-to-market ratio; roa, total return on assets; turnover, company stock liquidity; and CBD, whether or not the company's two positions are integrated.

Table 5 shows that, after controlling for other factors, all coefficients on pay are significant and negative in columns 1 and 2, fully supporting Hypothesis 1. This indicates that higher executive compensation reduces a company's equity cost to a certain extent. According to the principal–agent theory, higher executive compensation tends to mitigate the contradiction between executives and shareholders; executives are likely to work hard for their higher rewards. The cost of equity can be regarded as a reflection of executive ability; specifically, if the level of the company's executive management is higher, firm risks tend to be smaller, and shareholders may require a lower return rate when evaluating investments. As a result, the company tends to pay a lower cost of equity, have more allocated funds to reinvest, create higher value addition, and thereby pay higher compensation to executives.

It can also be seen in Table 5 that, among other control variables, the coefficient between systematic risk (beta) and the cost of equity is positive and significant, indicating that the higher the risk of the stock system, the higher the return rate of the stock will be, which is also consistent with the literature. Next, leverage (lev) is significantly and positively correlated with equity cost in both models; Fama and French (1993) and some Chinese scholars showed that corporate leverage is directly proportional to stock investment return. In addition, the coefficients on roa and turnover are significant and positive, indicating that China's current securities market still exhibits the phenomenon of a “small fry”; in other words, many large SOEs and state shares are not valued by the market, and are underestimated.

As we know, entrepreneurs with high professional identity tend to show better innovation performance and higher returns on assets (He et al., 2019; Howell, 2019). Our results prove that the innovation of executive incentive systems is conducive to the creation of a favorable environment for institutional innovation, which helps give full play to entrepreneurship and, thus, reduce corporate costs. The findings are in line with earlier literature (Bosma et al., 2018; Wu and Hsu, 2018; He et al., 2019; Howell, 2019).

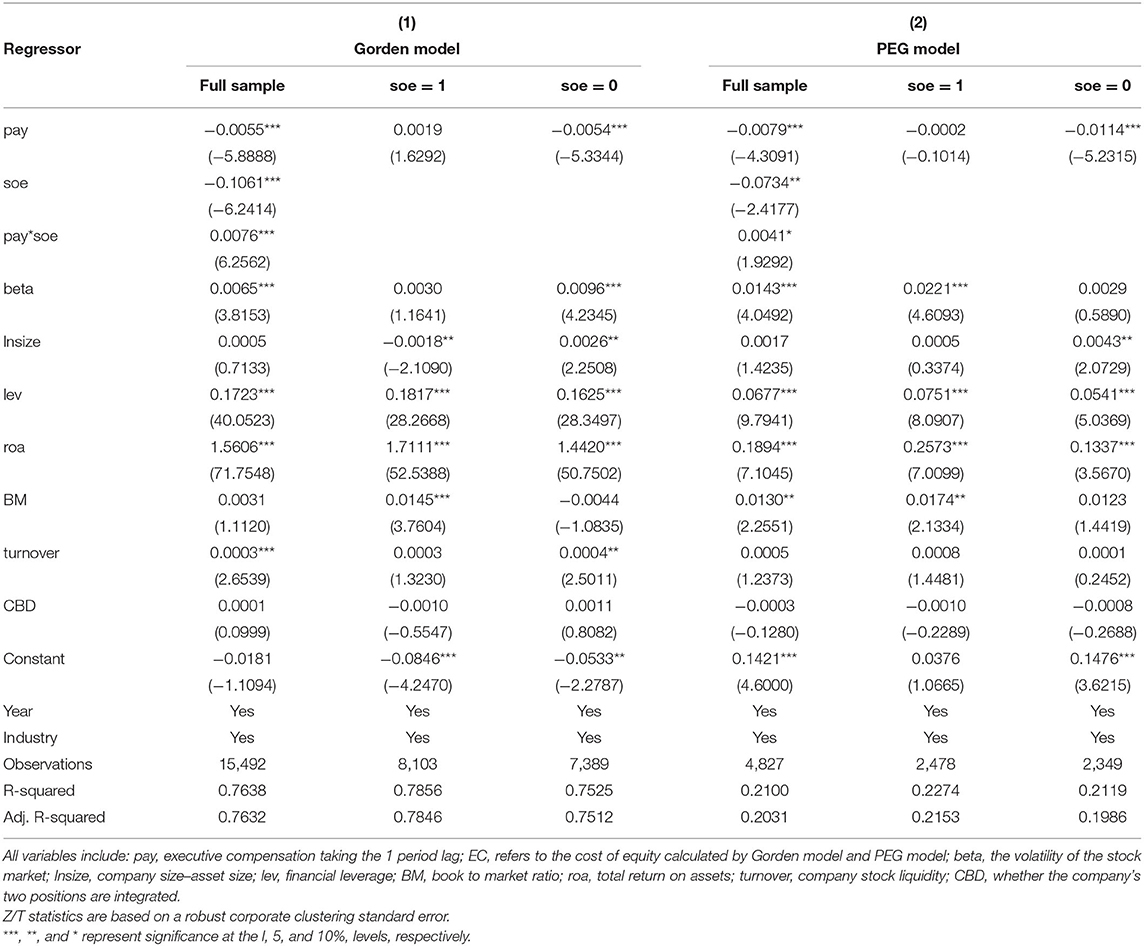

The Moderating Effect of Property Rights

Since the 1980s, China's economic transformation has greatly promoted the vitality of entrepreneurship and private enterprises. Against the background of China's special property rights system, enterprise system innovation not only enhances the competitiveness of enterprises, but also serves as the driving force of a country's sustainable economic growth. China's SOEs, especially the central SOEs, should be the major drivers of social innovation due to their strong financial capacity and policy support. However, the amount of R&D investment and number of patent applications among SOEs are significantly lower than those of non-SOEs, indicating that China has not yet established an effective innovation incentive mechanism in SOEs. As financial decision makers, senior executives have a major influence on corporate financial activities. Therefore, it is necessary to discuss the specific effects of property rights on executive incentive systems and the cost of equity, which can help leaders design an innovative executive incentive system among SOEs.

To further test Hypothesis 2 (the moderating effect of property rights on the relationship between executive incentives and equity cost), we offer the following model:

In columns 1 and 4 of Table 6, we first added the index of property rights, soe, and the interaction term between executive pay and property rights, pay*soe, to the regressions. As we can see, all coefficients of pay are significant and negative at the 1% level, indicating that executive incentives still reduce corporate equity cost after controlling for the effect of property rights. This supports our basic conclusion. Also, pay*soe is significantly and positively correlated with equity cost in both models. A one-standard-deviation increase in pay*soe increases equity cost by 0.0076 in Column 1, whereas it increases equity cost by 0.0041 in Column 4. The results suggest that property rights tend to weaken the negative effect of executive incentives on equity cost, supporting Hypothesis 2.

Furthermore, we classified the full sample into SOEs and private companies according to the final controllers, soe. Columns 2, 3, 5, and 6 of Table 6 show the comparison results between two sub-samples. The coefficients of executive compensation (pay) are significant and negative at the 1% level for the private-enterprise group, but negative and non-significant for the SOE group. This indicates that the effect of executive incentives on equity cost in private enterprises is more obvious. It may be explained by the special nature of China's SOEs, executives' direct appointment by the government and compensation systems that are more regulated by the government. However, private enterprises are not constrained by political tasks, and their development is more in line with the practical logic of the market and corporate governance. Although the development of China's current manager market is relatively slow, the role of the manager market is being reflected in private enterprises in recent years, and the efficiency of listed private enterprises is often higher than that of the SOEs.

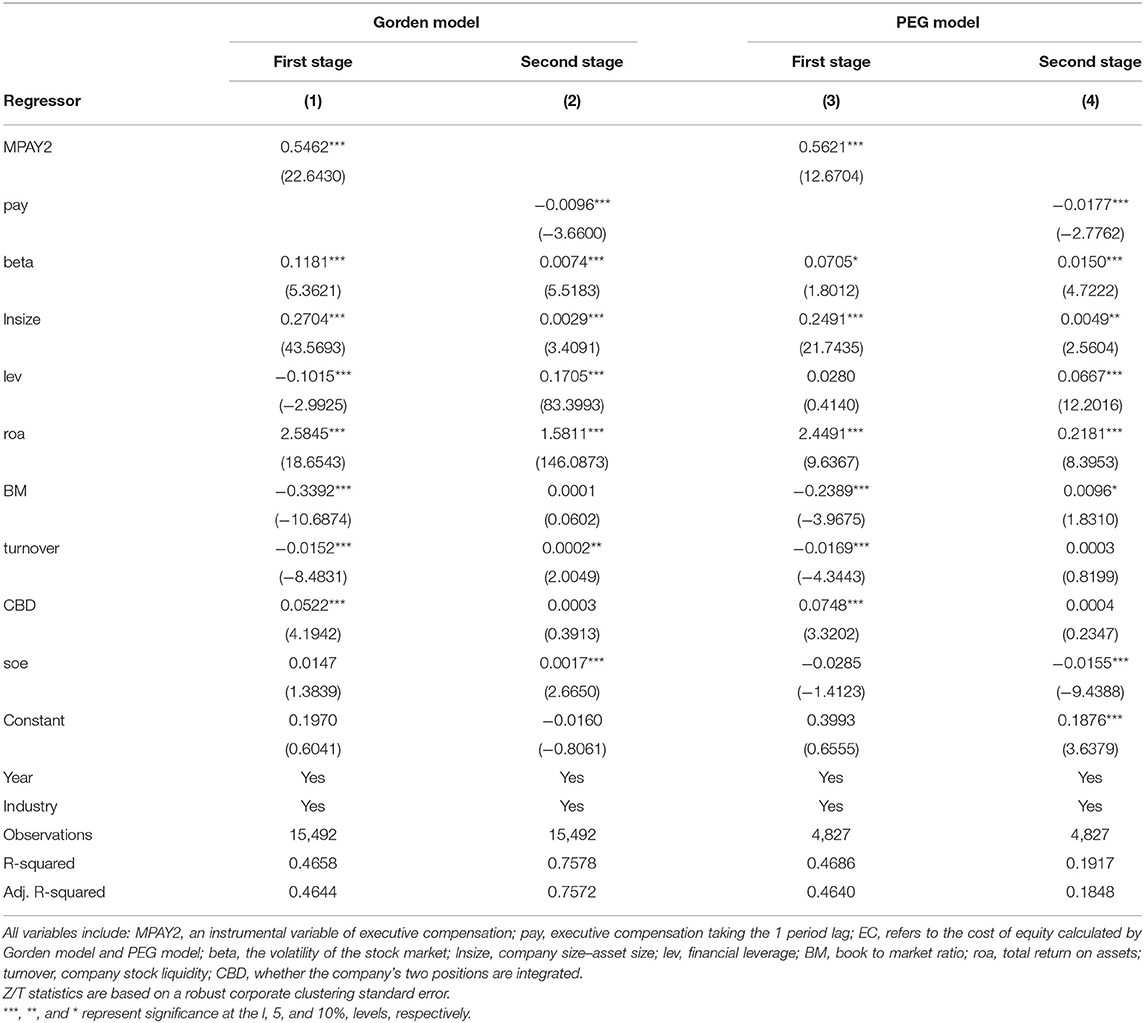

Endogeneity Problem

To eliminate the endogeneity problem caused by omitted variables, this study used the two-stage least squares method (2SLS). We regard the median of executive salary in the same industry in the same year, MPAY2, as an instrumental variable of executive compensation to conduct the 2SLS regression. The results are shown in Table 7.

In Table 7, MPAY2 is significantly and positively correlated with executive compensation in columns 1 and 3. A one-standard-deviation increase in MPAY2 increases executive compensation by 0.5462 in Column 1, whereas it increases executive compensation by 0.5621 in Column 3. This indicates that the instrumental variable is highly correlated with executive compensation. The adjusted R2-values of 0.4644 and 0.4640 indicate that MPAY2, as the instrumental variable, has good explanatory power. Furthermore, columns 2 and 4 show the results of the second-stage regression. The coefficients for executive compensation are still significant and negative at the 1% level, indicating that higher executive compensation is likely to reduce the company's equity cost. This indicates that our conclusions are robust.

Robustness Tests

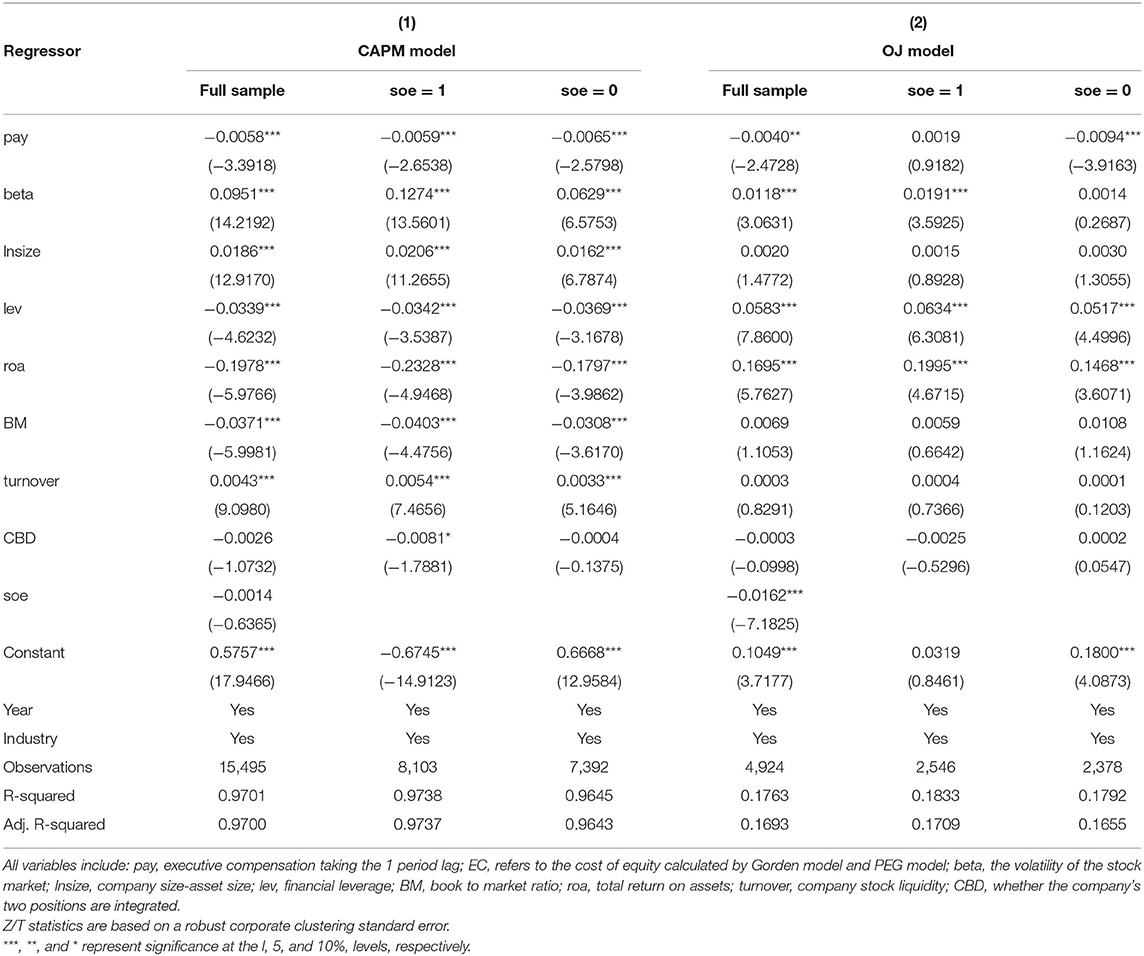

Alternative Dependent Variable: CAPM, OJ

To better verify the impact of executive compensation on the cost of equity, we used the CAPM model and the OJ model to remeasure equity cost. As can be seen from Table 8, the coefficients on executive compensation and equity cost are significant and negative at the 1 and 5% levels, respectively. Our conclusion is still valid.

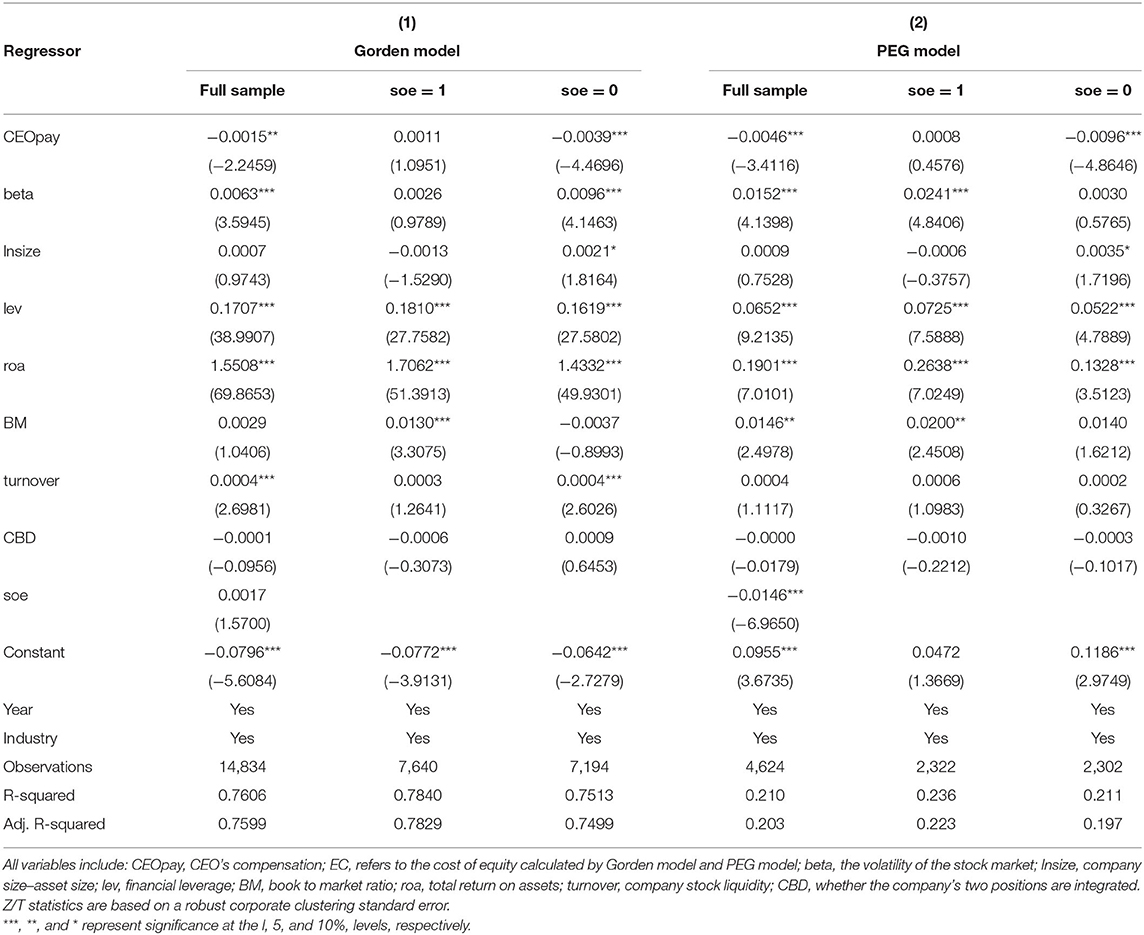

Alternative Independent Variable: CEOpay

The general manager (CEO) plays an important role in the senior management team of Chinese listed companies. CEOs are regarded as valuable organizational human capital. Efficient corporate human capital can bring great benefits to the company. Therefore, we take the logarithm of the personal salary of the general manager and CEO, CEOpay, as an alternative to executive compensation pay. Table 9 shows that the coefficients on CEOpay are significant and negative at the 5 and 1% levels, respectively. This suggests that the negative effect of the CEO's compensation incentive system on equity cost is still significant, and more so in private enterprises. Our basic conclusions remain.

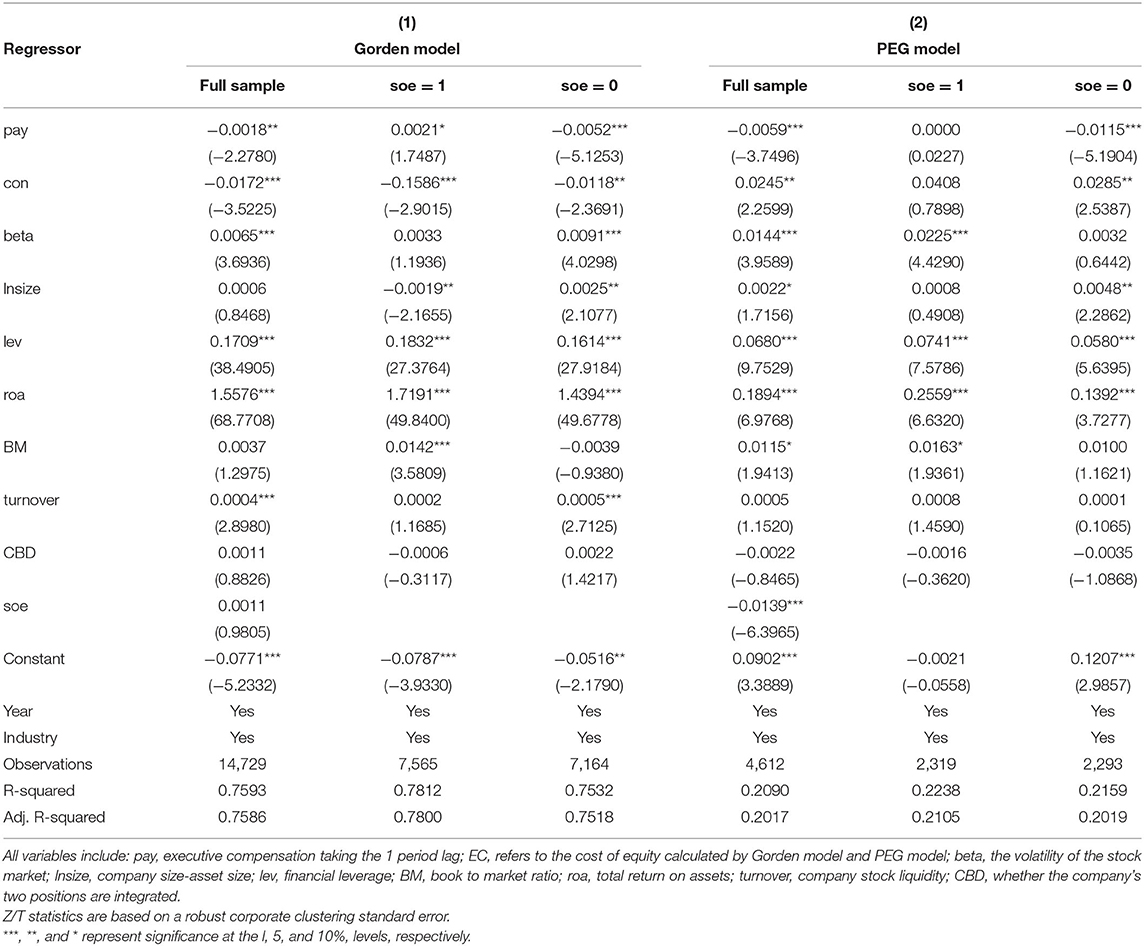

Considering the Effect of Executive Shareholdings

Considering the effect of executive shareholdings, we added the index of executive shareholdings, con, to the regression. The results in Table 10 show that the negative effect of executive compensation is still significant after controlling for the effect of executive shareholdings, further supporting our basic conclusion.

Sample Selection

To eliminate the impact of the new accounting standards in 2007, we reselected data from 2008 to 2018 as the sample period and re-ran the regression. The conclusions are unchanged.

Alternative Dependent Variable: Historically Annual Closing Price

We substituted the historically annual closing price for the latest closing price to measure equity cost in the OJ and PEG models and re-ran the models. Our results are still robust.

Discussion

Our research empirically supports hypotheses 1 and 2. The results confirm that higher executive compensation reduces a company's equity cost to a certain extent, thus supporting Hypothesis 1. Higher executive compensation tends to mitigate the contradiction between executives and shareholders. Moreover, Hypothesis 2 is also supported through our observation of the more significant effect of executive incentives on equity cost in private enterprises. Private enterprises are not constrained by political tasks, and their development is more in line with the practical logic of the market.

Entrepreneurship is the inner impulse of entrepreneurs to pursue innovation, and it has a significant impact on corporate behavior and financial decisions, promoting the differentiation of enterprises. The hard work by enterprise executives, especially founders, in the process of enterprise establishment and development make them less likely to engage in negative self-interested behaviors, such as slacking off, thus alleviating the agency problem. Entrepreneurs with high professional identity tend to show better innovation performance and return on assets. Our research proves that the innovation of the executive incentive system is conducive to the creation of a favorable environment for institutional innovation, which helps give full play to entrepreneurship, thus reducing corporate costs.

Executive incentive system innovation can more effectively stimulate the entrepreneurial spirit and improve the level of corporate innovation. The amount of R&D investment and the number of patent applications among non-SOEs are significantly higher than those of SOEs, indicating that China has not yet established an effective innovation incentive mechanism for SOEs. As the final decision makers on various financial policies, senior executives have a decisive influence on corporate financial activities. Therefore, it is of great practical significance to conduct a research an innovation-oriented incentive system for senior executives among Chinese enterprises, especially SOEs.

Conclusion

Using 15,492 firm-year observations from China's Shanghai and Shenzhen A-share listed companies for the period between 2005 and 2018, we constructed various models, including the Gorden model, the PEG model, the CAPM model, and the OJ model, to measure corporate equity cost. We investigated the effects of executive compensation incentives on the cost of equity, and further explore the effects of China's special property rights system on this relationship.

This study is particularly significant because it proves that executive incentive systems and corporate governance mechanisms in China's SOEs are neither complete nor efficient. It is necessary to introduce more innovative competition factors in the manager market, give full play to the role of executive compensation incentives, and integrate the executive incentives and capital cost of the company. When these are closely linked, research can better reflect the most basic economic significance of a company's financial management, actively promoting the innovation of executive incentives systems in SOEs. Consequently, the operating efficiency of state-owned assets, such as SOEs and large enterprises, will be improved.

In corporate governance practice, achieving a positive interaction between the investor protection and the management's abilities is always the main thrust of corporate governance. A company's scientific and efficient executive incentive system must incorporate managers' human capital and investors' interests. Only dynamic and real-time constraints and incentives for corporate executives can be combined organically, creating firm value while maximizing investors' interests. The company must be fully aware of the effects of executive personal characteristics on corporate innovation and other financial decisions. Also, the company should establish an innovative executive incentive mechanism to motivate executives' efficiency, improve firm value, reduce equity cost, and promote corporate innovation. Therefore, the innovation of executive incentive mechanisms is an inevitable choice to promote enterprises' competitiveness and creativity, and it is an important measure to optimize the urban economic structure and achieve high-quality economic growth in China. The interaction between system innovation, enterprise entrepreneurship, and financial behavior should be the ultimate goal of sustainable development and value maximization among enterprises.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

JW: collected the data and designed the research. JD: analyzed the data and empirical results. JW and JD: wrote the manuscript. All authors contributed to the article and approved the submitted version.

Funding

This study was supported by the Young Innovative Talents of Guangdong Provincial Department of Education (Humanities and Social Sciences; 2016WQNCX095), the 13th Five-Year Plan Youth Project of the Guangzhou Philosophy and Social Science Development (2018GZQN43), the Talent Research Start-Up Foundation of Guangdong University of Foreign Studies (299-X5221053), and the 13th Five-Year Plan Discipline Co-construction Project of the Guangdong Philosophy and Social Science Development (Study on the Influence of Endowment Insurance Payment Policy on Corporate Investment and Financing Behavior in Post-epidemic Era).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

Abudy, M. M., Amiram, D., Rozenbaum, O., and Shust, E. (2020). Do executive compensation contracts maximize firm value? Indications from a quasi-natural experiment. J. Bank. Financ. 114:105787. doi: 10.1016/j.jbankfin.2020.105787

Adhikari, H. P., Bulmash, S. B., Krolikowski, M. W., and Sah, N. B. (2015). Dynamics of CEO compensation: old is gold. Quart. Rev. Econ. Financ. 57, 191–206. doi: 10.1016/j.qref.2015.01.007

Aghion, P., Van Reenen, J., and Zingales, L. (2013). Innovation and institutional ownership. Am. Econ. Rev. 103, 277–304. doi: 10.1257/aer.103.1.277

Ahmed, S., Judge, A., and Mahmud, S. E. (2018). Does derivatives use reduce the cost of equity? Int. Rev. Financ. Anal. 60, 1–16. doi: 10.1016/j.irfa.2018.09.004

Bebchuk, L. A., Cremers, K. J. M., and Peyer, U. C. (2011). The CEO pay slice. J. Financ. Econ. 102, 199–221. doi: 10.1016/j.jfineco.2011.05.006

Berle, A., and Means, G. (1932). The Modern Corporation and Private Property. New York, NY: Commerce Clearing House.

Bertay, A. C., and Uras, B. R. (2020). Leverage, bank employee compensation and institutions. J. Bank. Financ. 111:105701. doi: 10.1016/j.jbankfin.2019.105701

Biener, C., Eling, M., Landmann, A., and Pradhan, S. (2018). Can group incentives alleviate moral hazard? The role of pro-social preferences. Europ. Econ. Rev. 101, 230–249. doi: 10.1016/j.euroecorev.2017.10.004

Borochin, P., and Knopf, J. D. (2021). Do managers seek control and entrenchment? J. Corporate Financ. 67:101806. doi: 10.1016/j.jcorpfin.2020.101806

Bosma, N., Content, J., Sanders, M., and Stam, E. (2018). Institutions, entrepreneurship, and economic growth in Europe. Small Bus. Econ. 51, 483–499. doi: 10.1007/s11187-018-0012-x

Boubakri, N., Guedhami, O., Mishra, D., and Saffar, W. (2012). Political connections and the cost of equity capital. J. Corporate Financ. 18, 541–559. doi: 10.1016/j.jcorpfin.2012.02.005

Carter, M. E., Choi, J., and Sedatole, K. L. (2021). The effect of supplier industry competition on pay-for-performance incentive intensity. J. Account. Econ. 71:101389. doi: 10.1016/j.jacceco.2021.101389

Castro, P., Keasey, K., Amor-Tapia, B., Tascon, M. T., and Vallascas, F. (2020). Does debt concentration depend on the risk-taking incentives in CEO compensation? J. Corporate Financ. 64:101684. doi: 10.1016/j.jcorpfin.2020.101684

Chen, J., Cesari, A. D., Hill, P., and Ozkan, N. (2018). Initial compensation contracts for new executives and financial distress risk: an empirical investigation of UK firms. J. Corporate Financ. 48, 292–313. doi: 10.1016/j.jcorpfin.2017.11.002

Chen, K. C. W., Chen, Z. H., and John Wei, K. C. (2003). Disclosure, corporate governance, and the cost of equity capital: evidence from Asia's emerging markets. SSRN Electron. J. doi: 10.2139/ssrn.422000

Chen, K. C. W., Chen, Z. H., and John Wei, K. C. (2009). Legal protection of investors, corporate governance, and the cost of equity capital. J. Corporate Financ. 15, 273–289. doi: 10.1016/j.jcorpfin.2009.01.001

Chen, S. S., Li, W. Y., and Wu, D. L. (2015). XBRL, corporate governance and cost of equity – the whole perspective of financial information value chain. Account. Res. 3, 64–71. Available online at: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=KJYJ201503009&DbName=CJFQ2015

Chen, Z. H., Huang, Y., and John Wei, K. C. (2013). Executive pay disparity and the cost of equity capital. J. Financ. Quant. Anal. 48, 849–885. doi: 10.1017/S0022109013000306

Chesney, M., Stromberg, J., Wagner, A. F., and Wolff, V. (2020). Managerial incentives to take asset risk. J. Corporate Financ. 65:101758. doi: 10.1016/j.jcorpfin.2020.101758

Chowdhury, H., Hodgson, A., and Pathan, S. (2020). Do external labour market incentives constrain bad news hoarding? The CEO's industry tournament and crash risk reduction. J. Corporate Financ. 65:101774. doi: 10.1016/j.jcorpfin.2020.101774

Chu, T., Haw, I., Ho, S. S. M., and Zhang, X. (2020). Labor protection, ownership concentration, and cost of equity capital: international evidence. Rev. Quant. Financ. Account. 54, 1351–1387. doi: 10.1007/s11156-019-00828-1

Collins, D., and Huang, H. (2011). Management entrenchment and the cost of equity capital. J. Bus. Res. 64, 356–362. doi: 10.1016/j.jbusres.2010.02.013

Core, J. E., Guay, W., and Larcker, D. F. (2008). The power of the pen and executive compensation. J. Financ. Econ. 88, 1–25. doi: 10.1016/j.jfineco.2007.05.001

Denis, D. K., and McConnell, J. J. (2003). International corporate governance. J. Financ. Quant. Anal. 38, 1–36. doi: 10.2307/4126762

Dyreng, S. D., Hanlon, M., and Maydew, E. L. (2010). The effects of executives on corporate tax avoidance. Account. Rev. 85, 1163–1189. doi: 10.2308/accr.2010.85.4.1163

Easton, P. (2004). PE ratios, PEG ratios, and estimating the implied expected rate of return on equity capital. Account. Rev. 79, 73–95. doi: 10.2308/accr.2004.79.1.73

Eisfeldt, A., and Papanikolaou, D. (2013). Organization capital and the cross-section of expected returns. J. Financ. 68, 1365–1406. doi: 10.1111/jofi.12034

Fama, E. F., and French, K. R. (1993). Common risk factors in the returns on bonds and stocks. J. Financ. Econ. 33, 3–56. doi: 10.1016/0304-405X(93)90023-5

Fang, Y., Hu, M., and Yang, Q. (2018). Do executives benefit from shareholder disputes? Evidence from multiple large shareholders in Chinese listed firms. J. Corporate Financ. 51, 275–315. doi: 10.1016/j.jcorpfin.2018.06.008

Frydman, C. (2007). The evolution of the market for corporate executives across the twentieth century. J. Econ. Hist. 67, 488–492. doi: 10.1017/S0022050707220182

Gan, H., Park, M. S., and Suh, S. (2020). Non-financial performance measures, CEO compensation, and firms' future value. J. Bus. Res. 110, 213–227. doi: 10.1016/j.jbusres.2020.01.002

Gao, M., Leung, H., and Qiu, B. (2021). Organization capital and executive performance incentives. J. Bank. Financ. 123:106017. doi: 10.1016/j.jbankfin.2020.106017

Gaver, J. J., and Gaver, K. M. (1998). The relation between nonrecurring accounting transactions and CEO cash compensation. Account. Rev. 73, 235–253. doi: 10.1111/j.1911-3846.1998.tb00559.x

Gebhardt, W. R., Lee, C. M. C., and Swaminathan, B. (2001). Toward an implied cost of capital. J. Account. Res. 39, 135–176. doi: 10.1111/1475-679X.00007

Gilje, E. P., Gormley, T. A., and Levit, D. (2020). Who's paying attention? Measuring common ownership and its impact on managerial incentives. J. Financ. Econ. 137, 152–178. doi: 10.1016/j.jfineco.2019.12.006

Gorden, J. R., and Gorden, M. J. (1997). The finite horizon expected return model. Financ. Anal. J. 53, 52–61. doi: 10.2469/faj.v53.n3.2084

Graham, J. R., Li, S., and Qiu, J. P. (2012). Managerial attributes and executive compensation. Rev. Financ. Stud. 25, 144–186. doi: 10.1093/rfs/hhr076

Guan, J., Gao, Z., Tan, J., Sun, W., and Shi, F. (2021). Does the mixed ownership reform work? Influence of board chair on performance of state-owned enterprises. J. Bus. Res. 122, 51–59. doi: 10.1016/j.jbusres.2020.08.038

Gupta, A., Raman, K., and Shang, C. G. (2018). Social capital and the cost of equity. J. Bank. Financ. 87, 102–117. doi: 10.1016/j.jbankfin.2017.10.002

Hasan, M. M., Hossain, M., Cheung, A., and Habib, A. (2015). Corporate life cycle and cost of equity capital. J. Contemp. Account. Econ. 11, 46–60. doi: 10.1016/j.jcae.2014.12.002

He, C., Lu, J., and Qian, H. (2019). Entrepreneurship in China. Small Bus. Econ. 52, 563–572. doi: 10.1007/s11187-017-9972-5

Hirshleifer, D. A., Low, A., and Teoh, S. H. (2012). Are overconfident CEOs better innovators? J. Financ. 67, 1457–1498. doi: 10.1111/j.1540-6261.2012.01753.x

Hoi, C. K. S., Wu, Q., and Zhang, H. (2019). Does social capital mitigate agency problems? Evidence from Chief Executive Officer (CEO) compensation. J. Financ. Econ. 133, 498–519. doi: 10.1016/j.jfineco.2019.02.009

Hou, K. W., van Dijk, M. A., and Zhang, Y. L. (2012). The implied cost of capital: a new approach. J. Account. Econ. 53, 504–526. doi: 10.1016/j.jacceco.2011.12.001

Howell, A. (2019). Ethnic entrepreneurship, initial financing, and business performance in China. Small Bus. Econ. 52, 697–712. doi: 10.1007/s11187-017-9980-5

Husser, J., and Paulet, E. (2021). “Impact of non-financial disclosure scores on the cost of equity capital: evidence from European data in the light of the subprime crisis,” in Ethics and Sustainability in Accounting and Finance. Vol. 2, ed K. T. Çaliyurt (Singapore: Springer), 63–84. doi: 10.1007/978-981-15-1928-4_4

Jackson, S. B., Lopez, T. J., and Reitenga, A. L. (2008). Accounting fundamental and CEO bonus compensation. J. Account. Public Policy 27, 374–393. doi: 10.1016/j.jaccpubpol.2008.07.006

James, D. (2013). Boards, CEO entrenchment, and the cost of capital. J. Financ. Econ. 110, 680–695. doi: 10.1016/j.jfineco.2013.08.009

Jensen, M. C., and Meckling, W. H. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. J. Financ. Econ. 3, 305–360. doi: 10.1016/0304-405X(76)90026-X

Jensen, M. C., and Murphy, K. J. (1990). Performance pay and top-management incentives. J. Polit. Econ. 98, 225–264.

Kabir, R., Li, H., and Veld-Merkoulova, Y. V. (2013). Executive compensation and the cost of debt. J. Bank. Financ. 37, 2893–2907. doi: 10.1016/j.jbankfin.2013.04.020

Kong, D., Wang, Y., and Zhang, J. (2020). Efficiency wages as gift exchange: evidence from corporate innovation in China. J. Corporate Financ. 65:101725. doi: 10.1016/j.jcorpfin.2020.101725

La Porta, R., Lopez-de-Silanes, F., and Shleifer, A. (2000). Investor protection and corporate governance. J. Financ. Econ. 58, 3–27. doi: 10.1016/S0304-405X(00)00065-9

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., and Vishny, R. W. (1997). Legal determinants of external finance. J. Financ. 52, 1131–1150. doi: 10.1111/j.1540-6261.1997.tb02727.x

Leone, A. J., Wu, J. S., and Zimmerman, J. L. (2006). Asymmetric sensitivity of CEO cash compensation to stock returns. J. Account. Econ. 42, 167–192. doi: 10.1016/j.jacceco.2006.04.001

Luong, T. S., Qiu, B., and Wu, Y. A. (2021). Does it pay to be socially connected with Wall Street brokerages? Evidence from cost of equity. J. Corporate Financ. 68:101939. doi: 10.1016/j.jcorpfin.2021.101939

Mishra, D. R. (2014). The dark side of CEO ability: CEO general managerial skills and cost of equity capital. J. Corporate Financ. 29, 390–409. doi: 10.1016/j.jcorpfin.2014.10.003

Murphy, K. J., and Zabojnik, J. (2004). CEO pay and appointments: a market-based explanation for recent trends. Am. Econ. Rev. Papers Proce. 94, 192–196. doi: 10.1257/0002828041302262

Ng, A. C., and Rezaee, Z. (2015). Business sustainability performance and cost of equity capital. J. Corporate Financ. 34, 128–149. doi: 10.1016/j.jcorpfin.2015.08.003

Ohlson, J. A., and Juettner-Narouth, B. E. (2005). Expected EPS and EPS growth as determinants of value. Rev. Account. Study 10, 349–365. doi: 10.1007/s11142-005-1535-3

Page, T. B. (2018). CEO attributes, compensation, and firm value: evidence from a structural estimation. J. Financ. Econ. 128, 378–401. doi: 10.1016/j.jfineco.2018.02.006

Pástor, L., Sinha, M., and Swaminathan, B. (2008). Estimating the intertemporal risk–return tradeoff using the implied cost of capital. J. Financ. 63, 2859–2897. doi: 10.1111/j.1540-6261.2008.01415.x

Pfister, B., Schwaiger, M., and Morath, T. (2020). Corporate reputation and the future cost of equity. Bus. Res. 13, 343–384. doi: 10.1007/s40685-019-0092-8

Ren, S. G., Cheng, Y., Hu, Y., and Yin, C. (2021), Feeling right at home: hometown CEOs firm innovation. J. Corporate Financ. 66:101815. doi: 10.1016/j.jcorpfin.2020.101815

Rjiba, H., Saadi, S., Boubaker, S., and Ding, X. S. (2021). Annual report readability and the cost of equity capital. J. Corporate Financ. 67:101902. doi: 10.1016/j.jcorpfin.2021.101902

Sharpe, W. F. (1964). Capital asset prices: a theory of market equilibrium under conditions of risk. J. Financ. 19, 425–442. doi: 10.1111/j.1540-6261.1964.tb02865.x

Shen, C. H., and Zhang, H. (2020). What's good for you is good for me: the effect of CEO inside debt on the cost of equity. J. Corporate Financ. 64:101699. doi: 10.1016/j.jcorpfin.2020.101699

Shen, W., Gentry, R. J., and Tosi, J.r. H. L. (2010). The impact of pay on CEO turnover: a test of two perspectives. J. Bus. Res. 63, 729–734. doi: 10.1016/j.jbusres.2009.05.008

Shleifer, A., and Vishny, R. W. (1997). A survey of corporate governance. J. Financ. 5, 737–783. doi: 10.1111/j.1540-6261.1997.tb04820.x

Skaife, H. A., Collins, D. W., and Lafond, R. (2004). Corporate governance and the cost of equity capital. SSRN Electron. J. doi: 10.2139/ssrn.639681

Szarzec, K., Dombi, Á., and Matuszak, P. (2021). State-owned enterprises and economic growth: evidence from the post-Lehman period. Econ. Model. 99:105490. doi: 10.1016/j.econmod.2021.03.009

Wang, P., Zou, Y., and Huang, L. F. (2014). Core reconstruction of executive compensation incentive: capital cost constraint view. China Indust. Econ. 5, 109–121. Available online at: https://kns.cnki.net/kcms/detail/detail.aspx?FileName=GGYY201405010&DbName=CJFQ2014

Wruck, K. H., and Wu, Y. (2021). The relation between CEO equity incentives and the quality of accounting disclosures: new evidence. J. Corporate Financ. 67:101895. doi: 10.1016/j.jcorpfin.2021.101895

Keywords: institutional innovation, academic education, cost of equity, entrepreneurial spirit, innovative ideas

Citation: Wang J and Deng J (2021) Research on the Effect of Executive Incentive Institutional Innovation on the Cost of Equity—Evidence From Chinese Listed Companies. Front. Psychol. 12:686955. doi: 10.3389/fpsyg.2021.686955

Received: 28 March 2021; Accepted: 07 May 2021;

Published: 08 June 2021.

Edited by:

Mu-Yen Chen, National Cheng Kung University, TaiwanReviewed by:

Jiunn-Woei Lian, National Taichung University of Science and Technology, TaiwanChin-Shan Wu, Tunghai University, Taiwan

Copyright © 2021 Wang and Deng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jie Deng, jiedeng0905@163.com

Jin Wang

Jin Wang Jie Deng

Jie Deng